Northern Ireland Assembly Commission Annual Report and Accounts for the year ended 31 March 2021

NI Assembly Commission 2020-21 Resource Accounts.pdf (1.74 mb)

Laid before the Northern Ireland Assembly by the Department of Finance under

section 10(4) of the Government Resources and Accounts Act (Northern Ireland) 2001

06 July 2021

CONTENTS

The Performance Report

The Accountability Report:

The Financial Statements:

- Statement of Comprehensive Net Expenditure

- Statement of Financial Position

- Statement of Cash Flows

- Statement of Changes in Taxpayers’ Equity

- Notes to the accounts

PERFORMANCE REPORT - Performance Overview

This overview is intended to provide a summary of the performance of the Northern Ireland Assembly Commission (the Commission) for the reporting year. It is aimed at giving sufficient information to users of the Annual Report and Accounts so that they may gain an understanding of the organisation, its purpose, the key risks it faces and how it has performed during the year.

Statutory basis for the Commission

The Commission is the corporate body which provides the Northern Ireland Assembly (the Assembly), or ensures that the Assembly is provided with the property, staff and services required for the Assembly’s purposes. The Commission is established under section 40 of the Northern Ireland Act 1998.

The Commission comprises the Speaker and five other members of the Assembly who are responsible for representing the interests of the Assembly and its elected Members. The Commission has appointed a Clerk/Chief Executive in accordance with schedule 5 of the Northern Ireland Act 1998, and other staff of the Assembly.

The Commission is independent of the Northern Ireland Executive. The Commission considers and makes decisions on a wide range of issues to do with the running of the Assembly, the provision of accommodation and the delivery of supporting services in Parliament Buildings.

Principal Activities

Although funded from the Northern Ireland Block Grant, the Commission is not answerable to a Northern Ireland Executive Minister. Similarly, the Commission does not contribute to the Northern Ireland Executive’s (the Executive’s) Programme for Government nor does it develop Public Service Agreement targets.

The Commission’s performance targets and the associated outputs are those that are developed internally to continually enhance the delivery of services to the Assembly. The Commission has a Corporate Strategy 2018-23 (the Corporate Strategy) which guides its work.

Key Aims and Objectives

The Corporate Strategy has a strategic focus. It sets out an ambitious and innovative approach to the improvements and developments that will be prioritised by the Commission in support of the Assembly. It also outlines a small number of Aims and objectives that capture the wide variety of interdependent roles and responsibilities of the Secretariat. The Corporate Strategy assists in determining and allocating resources, whilst ensuring value for money.

The Corporate Strategy is influenced by four common elements:

- People: Every business area relies upon the commitment, skills and expertise of our people;

- Culture: Every business area is influenced by the principles which underpin the support of a legislature, including accountability and political sensitivity;

- Engagement: Every business area is impacted by the fact that the Assembly is elected to represent the public; and

- Services: Every business area should continually seek better and more efficient ways to meet the needs of our customers while providing value for the public purse.

The Corporate Strategy sets out an overarching vision of “Excellence, expertise and innovation in support of the Northern Ireland Assembly as a legislature which is accessible to the public it represents.” This vision is distilled into four Strategic Aims:

- Investing in the development, expertise, and well-being of our people.

- Building excellence and innovation in our services.

- Strengthening engagement with the public.

- Developing a confident legislature with a strong parliamentary culture.

The Corporate Strategy recognises that while staff have different roles, they are working towards shared and common goals. No matter what their individual responsibilities are, as one team they will demonstrate:

- Professionalism in everything we do;

- Respect for each other, Members and the public; and

- Impartiality and integrity in all our work.

The Corporate Strategy seeks to deliver:

- High levels of satisfaction among Members, stakeholders and visitors;

- Enhanced understanding of the role and the work of the Assembly; and

- Skilled and motivated people.

While the Corporate Strategy establishes an overarching framework for the delivery of objectives, the corporate planning process translates the Strategic Aims of the Corporate Strategy into corporate and annual plans with a series of actions, targets and milestones assigned to each action.

In addition to the Corporate Strategy, a Corporate Plan for 2019-23 (the Corporate Plan) has been developed that sets out the key projects and priorities the Commission intends to deliver up to March 2023 to underpin the Corporate Strategy. A detailed Annual Plan for

2020-21 was developed from the Corporate Plan to establish specific and measurable targets for 2020-21.

Principal risks and uncertainties

The Annual Report and Resource Accounts have been prepared in the context of the resumption of normal Assembly business in January 2021 and the impacts of the COVID- 19 pandemic during 2020-21.

The Commission has effectively and rigorously monitored and implemented the Coronavirus Regulations and guidance issued by the Executive to manage the risk of COVID-19 infection across all of its operations. While established risk management processes have been used, significant additional measures have also been put in place to enable the Assembly to carry out all its business despite the prevailing public health situation. These measures included the development of business area risk assessments. Where this operating environment has a direct impact on the delivery of corporate targets, this has been considered in the Corporate Risk Register.

The principal risks to the Commission are identified and managed through a risk management regime. The principal responsibility for the management of risk falls to the Secretariat Management Group (SMG) through a comprehensive Risk Management Strategy. Further details on the role and composition of SMG is provided in the Management Structures section within the Director’s Report.

SMG is responsible for both the corporate planning process and the implementation of the Risk Management Strategy. Therefore, the ongoing corporate planning process and the administration of the Risk Management Strategy provide a strong emphasis on the identification and management of risks.

The Risk Management Strategy is reviewed annually by SMG. Further details on the Commission’s capacity to handle risk, the risk and control framework within which the Commission operates and a review of the effectiveness of the system of internal control are provided in the Governance Statement.

Chief Executive’s Performance Overview

I would like to thank staff for their commitment, dedication and sheer hard work to deliver continuous, consistently high-quality services to the Assembly during this extremely challenging year.

The swift resumption of normal Assembly business following the formation of the Executive on 11 January 2020 was shortly followed by the onset of the COVID-19 pandemic. Like all parts of society, this presented challenges to the Commission as it supported the work of the Assembly.

The Commission ensured strict adherence to all Coronavirus Regulations and guidance issued by the Executive. This included facilitating the remote participation in Assembly business by Members as well as a comprehensive programme of home-working for staff where it was possible to do so.

The development of the Corporate Plan recognised that once the Assembly resumed its normal business, a number of planned activities would have to be paused in order to support the Assembly. While this, alongside the onset of the COVID-19 pandemic, was considered as part of the development of the Annual Plan 2020-21, the impact and duration of COVID-19 could not have been foreseen and therefore had a significant impact on the nature of, and activities that, could be delivered during the year.

Of the 39 targets set out in the Annual Plan 2020-21, 21 (53.9%) were fully achieved and 13 (33.3%) were partially achieved. During the year, 5 of the targets (12.8%) were not achieved.

Responding to COVID-19 required significant effort in its own right and a large number of additional projects had to be undertaken in order to protect the health and safety of staff and building users during the year and to enable Assembly and Commission business to continue virtually uninterrupted throughout the pandemic. While these were not contained in the Annual Plan 2020-21, they were nevertheless vital to the smooth running of the organisation and staff are to be congratulated for the innovation, dedication and long hours that were put in to deliver these.

The Commission’s budget for 2020-21 was scrutinised by the Audit Committee on 4 March 2020 and then voted on by the Assembly on 16 March 2020. The Assembly resolved that the Commission’s Resource DEL budget for 2020-21 should be £44.847 million and £1.093 million Capital DEL.

This budget represented a significant increase from the 2019-20 budget of £36.148 million for Resource DEL and £1.000 million for Capital DEL. The increase in Resource DEL reflected the resumption of normal Assembly business and the fact that the salaries payable to Members increased from the reduced levels that were payable under the Assembly Members (Salaries and Expenses) (Present period when there is no Executive) Determination (Northern Ireland) 2018 upon resumption of normal business in January 2020. The increase also took account of a planned programme of recruitment of staff to fill the vacancies that had occurred during the period when the Assembly was not carrying out its normal business.

During the reporting period, the Commission’s budget was revised to meet an increase in costs that resulted from the publication by the Commission of the Assembly Members (Salaries and Expenses) (Amendment) Determination (Northern Ireland) 2020 on 27 August 2020. This Determination, which followed the conferral by the Assembly of the function of making Determinations in respect of Members’ allowances to the Commission on 30 June 2020, amended the provisions of the Assembly Members (Salaries and Expenses) Determination (Northern Ireland) 2016 (the 2016 Determination) mainly in relation to the terms and conditions of employment for Members’ staff.

The impact of COVID-19 for much of the year meant that the substantial planned programme of recruitment could not proceed as quickly as anticipated. In addition, the interruption to supplies and suppliers during the year meant that a number of initiatives and projects could not be completed.

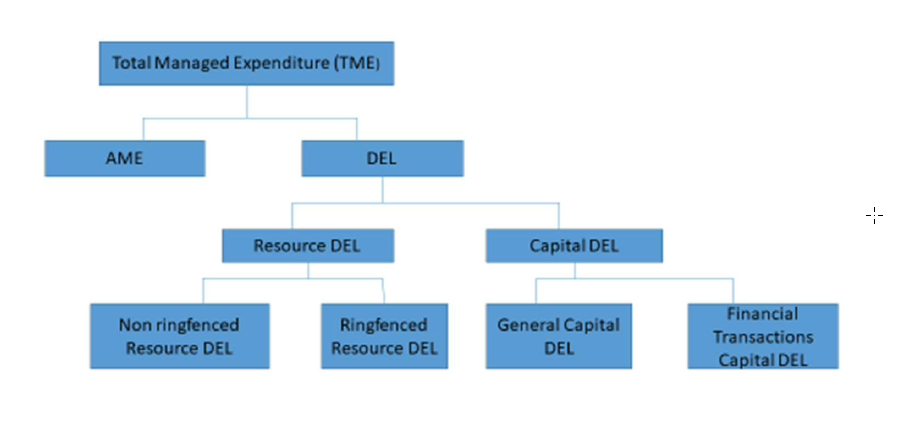

The combined impact of these factors was that Commission’s final Resource DEL budget position for 2020-21, as recorded in the Spring Supplementary Estimate (SSE) position, was £45.081 million with £0.970 million for Capital DEL. The SSE position for Annually Managed Expenditure (AME) was £2.700 million.

As set out in the Statement of Outturn against Assembly Supply - note 1, the final outturn for Resource DEL for the Commission was £42.160 million; £2.921 million less than the SSE position of £45.081 million. The outturn for AME was £0.408 million; £2.292 million less than the SSE position of £2.700 million. The outturn for Capital DEL was £0.929; £0.041 million less than the Capital DEL allocation of £0.970 million.

The effectiveness and initiative of the staff in dealing with the resumption of Assembly business and dealing with the uncertainties and complexities of the COVID-19 pandemic has been outstanding.

Performance Summary – Targets

The work of the Commission is guided and directed by the Strategic Aims contained within the Corporate Strategy and by the high level and strategic actions contained in the Corporate Plan.

The Annual Plan 2020-21 set out the detailed activities the Assembly Commission intended to progress during 2020-21 to deliver the Corporate Plan, but the context in which the Annual Plan 2020-21 was developed is important.

The Assembly resumed normal business on 11 January 2020 so re-establishing and supporting the work of Assembly plenary and committees was an overriding priority for 2020-21. In addition, at the beginning of 2020-21, it became clear that COVID-19 was going to have a significant impact on the nature of the activities that could be delivered during the year. Responding to COVID-19 required significant effort in its own right and consequences such as social distancing, home working and the closure of Parliament Buildings to visitors and for events all had implications for how the Commission delivered its services to the Assembly.

The Annual Plan 2020-21 did not seek to encapsulate all of the important activities and tasks that were required to ensure the smooth operation of the Assembly on a daily basis. These activities and task represented our “business as usual” and were guided by objectives and service standards at a business area level.

A large number of significant, additional projects had to be undertaken during the year to deliver Assembly business throughout the pandemic. While these additional actions and projects were not contained in the Annual Plan 2020-21, they were nevertheless vital to the smooth running of the organisation and the Commission is extremely grateful to staff and contractors for the delivery of these.

The Annual Plan 2020-21 contained 39 targets of which 21 were fully achieved, 13 were partially achieved and 5 were not achieved. This performance is summarised in the table below.

| Target Status | Targets Status (Number) | Target Status (%) |

|---|---|---|

|

Fully Achieved |

21 |

53.9 |

|

Partially Achieved |

13 |

33.3 |

|

Not Achieved |

5 |

12.8 |

The targets that were delivered during 2020-21 covered a wide range of important activities against all four Corporate Strategy Strategic Aims. For example, despite the challenges posed by COVID-19:

- New approaches to virtual working, recruitment and selection, internal communications and health and well-being were implemented.

- Effective plans were put in place to ensure that the highest quality of service to the Assembly would be delivered during the final year of the Assembly mandate in 2021-22;

- Work progressed on proposals to improve the physical working environment for all users of Parliament Buildings; and

- Considerable progress was made on a long-standing target to establish a Youth Assembly.

For those targets that were partially achieved, the impact of COVID-19 restrictions and the Commission’s adherence to the Executive’s Regulations and guidance on working from home had an inevitable impact. However, for many of these targets, significant progress was made during 2020-21 with an expectation that the remaining elements will be delivered in 2021-22.

The impact of the resumption of Assembly business, the consequent impact on the allocation of staffing resources and the delays to recruitment caused by COVID-19 contributed to the delay in meeting 4 of the 5 targets that were not achieved. However, that impact was envisaged when the Annual Plan 2020-21 was devised and these targets have been carried forward to 2021-22. For the remaining target that was not achieved, a later than anticipated appointment of an external supplier via a procurement exercise contributed to this delay but considerable progress has been made on this target in the early stages of 2021-22.

Performance Summary – Financial Performance

The Commission’s main areas of spend during 2020-21 continued to be the costs of the salaries paid to staff, the payments to Members either by way of salary or through the system of allowances payable to Members and the administration running costs that are needed to maintain Parliament Buildings and deliver the wide range of services required by the Assembly.

The financial impact arising from COVID-19 (or, indeed, from the UK’s exit from the EU) was minimal in both 2019-20 and 2020-21 and related to the provision of additional laptop computers and equipment to facilitate remote participation in Assembly and committee business, an enhanced cleaning regime, the installation of screens and protective barriers and the acquisition of sanitiser, face coverings and associated equipment was incurred. The funding for this expenditure came from the amounts voted to the Commission through the Main Estimates and the SSE. The Commission did not avail of any additional COVID-19 funding.

The final total outturn for the year was £42.621 million against an allocation of £47.836 million when compared to the SSE position. The Capital outturn was £0.929 million against a SSE allocation of £0.970 million. This is summarised in the table overleaf.

The outturn for the Net Cash Requirement (excluding Capital) was £39.389 million, against an SSE allocation of £42.461 million. This is shown in the Statement of Outturn against Assembly Supply.

| Outturn £'000 | SSE £'000 | Under/(over) £'000 | Under/(Over) % | |

|---|---|---|---|---|

|

Income |

(145) |

(149) |

(4) |

2.7% |

|

Resource DEL |

42,305 |

45,230 |

2,925 |

6.5% |

|

AME |

408 |

2,700 |

2,292 |

84.9% |

|

Non-budget notional costs |

53 |

55 |

2 |

3.6% |

|

Net Resources |

42,621 |

47,836 |

5,215 |

10.9% |

|

|

|

|

|

|

|

Capital |

929 |

970 |

41 |

4.2% |

The above variances arose across a Under / (Over)number of expenditure categories. The Commission’s budget, as reported in the SSE, is not split by expenditure type but the Commission further analyses its overall budget into a number of broad expenditure categories for internal budgetary purposes. The breakdown of outturn by category is set out in the table below and, for comparison purposes, a breakdown of the SSE position is provided for each category.

| Expenditure Category | Outturn £'000s | SSE £'000s | Performance Against SSE Under / (Over) £'000s | Performance Against SSE Under / (Over) % |

|---|---|---|---|---|

|

Income |

(145) |

(149) |

(4) |

2.7% |

|

Secretariat Salaries |

19,017 |

19,368 |

351 |

1.8% |

|

Admin Costs |

4,561 |

4,933 |

372 |

7.5% |

|

Members' Salaries |

6,668 |

6,672 |

4 |

0.1% |

|

Members' Other Costs |

47 |

49 |

2 |

4.1% |

|

Members' Travel |

282 |

293 |

11 |

3.8% |

|

Constituency Costs (incl. staff) |

8,074 |

9,900 |

1,826 |

18.4% |

|

Party Allowance |

631 |

725 |

94 |

13.0% |

|

Depreciation & Impairment |

3,025 |

3,290 |

265 |

8.1% |

|

Total Resource DEL |

42,160 |

45,081 |

2,921 |

6.5% |

|

AME – Members' Pension Finance Costs |

400 |

2,700 |

2,300 |

85.2% |

|

AME – Provisions Other |

8 |

- |

(8) |

(100.0%) |

|

Notional Costs – Audit Fee |

53 |

55 |

2 |

3.6% |

|

Net Resources |

42,621 |

47,836 |

5,215 |

10.9% |

|

|

|

|

|

|

|

Capital |

929 |

970 |

41 |

4.2% |

Further analysis is provided for items where the variation between the Outturn and the SSE position is greater than ±£0.250 million or the percentage difference is greater than ±5.00%.

For Secretariat Salaries, the SSE position was submitted in late November 2020 in the expectation that further progress could be made to deliver the Commission’s programme of planned recruitment to fill vacant posts across the Secretariat. However, the significant COVID-19 restrictions that came into place after Christmas 2020 and, in effect, lasted until the end of the reporting period meant that there was a shortfall in anticipated expenditure of £0.351 million (1.8% of the SSE position).

Admin Costs cover the running costs that are typically incurred in Parliament Buildings in providing services to the Assembly. These costs were £0.372 million (7.5%) below the estimated made when constructing the SSE. This underspend was largely generated by less progress and less expenditure on Private Members’ Bills and on lower than expected recruitment-related costs.

The most significant variance arose in respect of Constituency Costs (incl. staff). This category of costs includes the range of allowances payable to Members to run constituency offices and employ staff. During the year, the Commission published the Assembly Members (Salaries and Expenses) (Amendment) Determination (Northern Ireland) 2020. This Determination improved the terms and conditions of employment and salaries for Members’ support staff, which had remained frozen since 2016 and enabled Members to engage additional staffing support.

Due to COVID-19, Members were unable to undertake the anticipated levels of recruitment resulting in an under-utilisation of staffing allowances. In addition, the closure and subsequent cautious re-opening of Members’ constituency offices meant that a significant underspend of £1.826 million (18.4%) arose.

Party Allowance covers the costs incurred by the Commission when making payments to political parties represented in the Assembly under the Financial Assistance for Political Parties Scheme 2016. These payments are made to parties to enable them to provide assistant to their Members to carry out their Assembly duties but, during the year, the assistance that is available was not fully utilised by £0.094 million (13.0% ).

For Members' Pension Finance Costs in AME, a variance of £2.300 million (85.2% of the SSE position) arose due to a credit recorded in the current year relating to Past Service Cost (with a consequent impact of £2.100 million). This credit was a result of further information on the McCloud remedy which is likely to restrict the Members who will be within the scope of the remedy (see 'Commission Pensions' for further information). For Provisions Other (also in AME), an additional £0.008 million was provided for in respect of a contractual matter. This was not anticipated when the SSE was prepared.

Policy on payment of suppliers

The Commission is committed to prompt payment of bills for goods and services. The current policy is to comply with the Confederation of British Industry’s Prompt Payers’ Code. Unless otherwise explicitly stated in a contract payment is due within 30 days after delivery of the invoice or the goods or services, whichever is latest.

During 2020-21 the Commission paid 97.7% of bills, without queries, within this standard (2019-20; 98.7%).

In addition to this the Commission has sought to comply with Department of Finance’s (DoF’s) initiative to pay all supplier invoices within a suggested target of 10 days. During 2020-21, 91.5% of invoices were paid within 10 days of being received (2019-20; 95.2%).

The Commission made no payment of interest under the Late Payment of Commercial Debts (Interest) Act 1988 during the year ended 31 March 2021.

Trend data

Given that the Assembly only resumed normal business on 11 January 2020 after a three- year hiatus in its activities and the atypical nature of 2020-21 due to COVID-19, trend data for performance targets is not included. The last broadly comparable year for parliamentary activity was 2016-17 when the Commission had a different corporate planning regime.

Summary financial trend data is provided but this does not reflect a steady state operating environment for the five years that are shown. As noted above, the activity levels for 2020-21 have been affected by COVID-19 and led to a decrease in expenditure as opposed to an increase in expenditure. Also, the fact that the Assembly was not operating as normal for all of the 2017-18 and 2018-19 financial years and for the majority of the 2019-20 financial year, means that trend data is of limited utility.

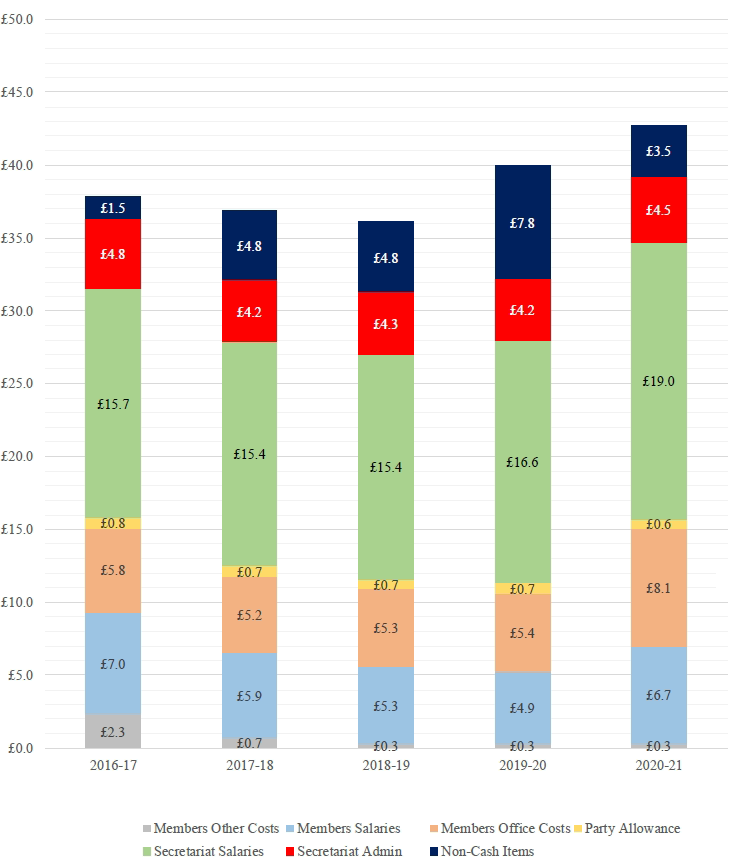

Chart 1 overleaf shows the Commission’s gross expenditure for the past five years. This expenditure includes all items included in the Statement of Comprehensive Net Expenditure, but excluding any net gain or loss on the actuarial valuation of the Assembly Members’ Pension Scheme, on the revaluation of Property, Plant and Equipment or the net gain or loss on revaluation of Intangibles.

Chart 1 - Gross expenditure by type (£m) 2016-2017 to 2020-2021

Non-Cash Items includes depreciation, impairment of assets, notional costs, provisions and Members’ Pension Finance costs. See Note 5 to the Accounts. 2016-17 also includes a Prior Period Adjustment in relation to Members’ Pensions.

| Financial Year | Members Other Costs | Members Salaries | Members Office Costs | Party Allowance | Secretariat Salaries | Secretariat Admin | Non-Cash Items |

|---|---|---|---|---|---|---|---|

|

2016-2017 |

£2.3m |

£7.0m |

£5.8m |

£0.8m |

£15.7m |

£4.8m |

£1.5m |

|

2017-2018 |

£0.7 |

£5.9m |

£5.2m |

£0.7m |

£15.4m |

£4.2m |

£4.8m |

|

2018-2019 |

£0.3m |

£5.3m |

£5.3m |

£0.7m |

£15.4m |

£4.3m |

£4.8m |

|

2019-2020 |

£0.3m |

£4.9m |

£5.4m |

£0.7m |

£16.6m |

£4.2m |

£7.8m |

|

2020-2021 |

£0.3m |

£6.7m |

£8.1m |

£0.6m |

£19.0m |

£4.5m |

£3.5m |

Signed: Lesley Hogg Accounting Officer Clerk/Chief Executive

Date: 24 June 2021

ACCOUNTABILITY REPORT

Corporate Governance Report

The purpose of the Corporate Governance Report is to explain the composition and organisation of the Commission’s governance structures and outline how these structures support the achievement of the Commission’s objectives.

Directors’ Report

The Commission and the Accounting Officer

The statutory basis for the Commission is provided in the Performance Report: Overview.

The Speaker is chairperson of the Commission. The membership of the Commission and the percentage attendance at meetings is given below:

| Role | Name | Percentage of Meetings attended |

|---|---|---|

|

Chairperson |

Alex Maskey MLA |

100% |

|

Member |

Keith Buchanan MLA |

100% |

|

Member |

John O’Dowd MLA |

100% |

|

Member |

Dolores Kelly MLA |

100% |

|

Member |

Robbie Butler MLA |

100% |

|

Member |

John Blair MLA |

100% |

Eleven meetings were held during the year.

The work of the Commission is detailed in the Governance Statement.

As Clerk to the Assembly, Lesley Hogg is the principal adviser to the Assembly. As well as advising the Speaker and office holders on procedural matters, and the Commission on corporate matters, she is Chief Executive of the Commission and Accounting Officer for the Commission’s resources.

The Management Structure

The Commission has a two-tier management structure. While the Commission has the legislative authority to provide the Assembly with the wide range of services needed by it, the day-to-day delivery of those services is achieved through a formal delegation to the Clerk/Chief Executive. A copy of the letter of delegation is attached at Annex A.

The work of all Commission staff is organised and monitored by SMG. SMG is chaired by the Clerk/Chief Executive and comprises the Director of Corporate Services, the Director of Legal, Governance and Research Services and the Director of Parliamentary Services.

SMG has responsibility for the delivery of the work of the Commission. This includes responsibility for ensuring effective corporate governance in the Commission and ensuring that staff are equipped to fulfil their role in supporting Members in carrying out their Assembly functions. SMG meets monthly to consider progress on strategic and key management issues.

Membership of SMG (Twelve meetings held):

| Role | Name | Percentage of Meetings attended |

|---|---|---|

|

Clerk/Chief Executive |

Lesley Hogg |

100% |

|

Director of Corporate Services |

Richard Stewart |

100% |

|

Director of Legal Governance & Research Services |

Tara Caul |

100% |

|

Director of Parliamentary Services |

Gareth McGrath |

100% |

For the purposes of this report, corporate governance arrangements have been applied to SMG, which is charged with the delivery of the services on behalf of the Commission.

The Remuneration and Staff Report within this Annual Report and Accounts contains information about the salary and pension entitlements of Commission Members and SMG. Claims for reimbursement of expenses are published quarterly on the Assembly website.

The appointments of Directors to SMG are held on a continuing basis.

Register of interests

Commission Members are appointed to the Commission by the Assembly from its membership. The Assembly’s Standing Order 69 (1) requires that a Register of Members’ interests be established, published and made available for public inspection. Following the Assembly election on 2 March 2017, a Register of Members’ Interests for the sixth Assembly mandate was established. This Register is continuously updated. View the latest version of the Register of Members' interests.

A Register of Interests is also maintained for SMG. This Register is continually updated by SMG members and reviewed formally on an annual basis. The last review was undertaken in March 2021. View the latest version of the SMG Register of Interests.

Pensions liabilities

Note 1.13 to the Accounts and the Remuneration and Staff Report provide details of the pensions liabilities of the Commission.

Auditors

The Commission’s financial statements are audited by the Comptroller and Auditor General, whose certificate and report is available in the Accounts. The notional cost of the work performed by the Northern Ireland Audit Office (NIAO) for 2020-21 was £53,500 (Commission audit, £45,000 and Assembly Members’ Pension Scheme audit, £8,500) (2019-20; £43,500 (Commission audit, £37,500 and Assembly Members’ Pension Scheme, £6,000)) and related solely to audit services.

The Commission participates in the biennial National Fraud Initiative. The Comptroller and Auditor General also has statutory powers to undertake the biennial data matching exercises for the National Fraud Initiative. The cost of this work performed by the NIAO for 2020-21 was £2,499 (2019-20; £Nil).

Disclosure to Auditors

So far as the Accounting Officer is aware, there is no relevant audit information of which the Commission’s auditors are unaware and she has taken all reasonable steps to make herself aware of any relevant audit information and to establish that the Commission’s auditors are aware of that information.

Personal Data Related Incidents

During 2020-21, the Commission reported no personal data incidents to the Information Commissioner’s Office.

Communication with staff

During the year, a variety of actions were undertaken to ensure good internal communications. A new Internal Communications Officer took up post and has introduced a range of new initiatives including a new staff newsletter, a Chief Executive’s monthly note to staff, the redesign of elements of the Commission’s intranet site and the publication of a range of staff-led content.

Regular communication with staff took place as part of the Commission’s response to the COVID-19 pandemic. This communication sought to keep staff fully aware of the infection-control precautions that were in place in Parliament Buildings.

In addition, the Internal Communications Group continued to provide advice and guidance on internal communications matters and presented recommendations to SMG following a staff survey that was undertaken in late-2019. The Commission’s HR Office continued to advise staff on wellbeing issues.

Charitable donations

The Commission did not make any charitable donations in the year.

Complaints

The Commission has a Complaints Policy and Procedure and welcomes feedback from the public. The Commission uses this feedback to help improve the services that it provides. The Commission does not provide statutory services to the public so the nature of its complaints handling differs from other entities within the public sector.

The Complaints Policy and Procedure therefore covers complaints from members of the public relating to the delivery of services in Parliament Buildings. The Complaints Policy and Procedure does not cover complaints from members of staff relating to their employment or from contractors providing services to the Commission. Separate procedures are available in both cases. View full details of the Commission’s Complaints Policy and Procedure.

Under the Complaints Policy and Procedure, a complainant can contact the Commission by email, post or by telephone. The receipt of a complaint will be acknowledged, an investigation into the circumstances surrounding the complaint will be undertaken and the results of that investigation including any remedial actions that are required will be communicated to the complainant. This process will normally be completed within 20 working days of the receipt of the complaint.

A central complaints register is held by the Commission and appropriate details relating to the detail of each complaint are held on this register. During 2020-21, the Commission received two (2019-20; One) complaints, of which one was upheld. The complaint that was not upheld was later dealt with under the Commission’s Equality Scheme and again was not upheld. The complaints did not have an impact on the policies and procedures of the Commission.

Events after the Reporting Period

There are no events after the reporting period that require disclosure.

Statement of Accounting Officer’s Responsibilities

Under the Government Resource and Accounts Act (Northern Ireland) 2001, DoF has directed the Commission to prepare for each financial year resource accounts detailing the resources acquired, held or disposed of during the year and the use of resources by the Commission during the year.

The accounts are prepared on an accruals basis and must give a true and fair view of the state of affairs of the Commission and of its Statement of Comprehensive Net Expenditure, Statement of Financial Position, Statement of Cash Flows and Statement of Changes in Taxpayers’ Equity for the financial year.

In preparing the accounts, the Accounting Officer is required to comply with the requirements of the Government Financial Reporting Manual and in particular to:

- observe the Accounts Direction issued by DoF, including the relevant accounting and disclosure requirements, and apply suitable accounting policies on a consistent basis;

- make judgements and estimates on a reasonable basis;

- state whether applicable accounting standards as set out in the Government Financial Reporting Manual have been followed, and disclose and explain any material departures in the accounts;

- prepare the accounts on a going concern basis; and

- confirm that the Annual Report and Accounts as a whole is fair, balanced and understandable and take personal responsibility for the Annual Report and Accounts and the judgements required for determining that is fair, balanced and understandable.

DoF has appointed me, as Accounting Officer of the Commission. The responsibilities of an Accounting Officer, including responsibility for the propriety and regularity of the public finances for which the Accounting Officer is answerable, for keeping proper records and for safeguarding the Commission’s assets, are set out in the Accounting Officers’ Memorandum issued by DoF and published in Managing Public Money Northern Ireland.

As the Accounting Officer, I have taken all the steps that I ought to have taken to make myself aware of any relevant audit information and to establish that Commission’s auditors are aware of that information. So far as I am aware, there is no relevant audit information of which the auditors are unaware.

Governance Statement

Scope of Responsibility

As Accounting Officer, I have responsibility for maintaining a sound system of corporate governance that supports the achievement of the policies, aims and objectives of the Commission, whilst safeguarding the public funds and assets for which I am personally responsible, in accordance with the responsibilities assigned to me in Managing Public Money Northern Ireland.

This includes ensuring that the arrangements for delegation are robust and promote good management, supported by staff with an appropriate balance of skills and experience.

Appropriate management systems and procedures are also essential to support service delivery.

Governance Framework

Corporate governance is the way in which an organisation is directed, controlled and led. The underpinning framework consists not only of the formal systems and processes, but also of organisational culture and values. It defines relationships, distributes responsibility, determines the rules and procedures by which objectives are set, monitored and achieved and ensures accountability is clearly defined.

The Commission complies with all relevant requirements of the “Corporate Governance in Central Government Departments: Code of Good Practice (NI)” which was issued by the Department of Finance and Personnel (DFP) (now DoF) in April 2013. The Commission is not a Government Department so not all of the provisions in the Code and guidance are appropriate or relevant.

The Commission has a two-tier management structure. The Commission is the corporate body, which under section 40 of the Northern Ireland Act 1998 has the statutory authority to provide the Assembly with the wide range of services it needs. Members are appointed to the Commission by the Assembly. The day-to-day delivery of these services is achieved through delegation to me in my role as Clerk/Chief Executive. I have responsibility to ensure arrangements for delegation to SMG are robust. These delegations offer clarification on the roles and responsibilities of the Commission, the Accounting Officer and Directors.

While the details of the structure and statutory authority of the Commission are provided, for the purposes of this statement, the corporate governance arrangements, including the requirement to review effectiveness, has been applied to the senior management team charged with the delivery of services on behalf of the Commission. Commission Members are not deemed to be Non-Executive members.

The Corporate Governance Role of the Commission

When the Assembly is in session, the Commission customarily meets monthly. I attend Commission meetings with Directors, along with the Non-Executive Chairperson of the Secretariat Audit and Risk Committee (SARC). The Chairperson of SARC also has an annual meeting with the Commission in the absence of officials.

It is the Assembly, through the annual Budget Act, that appropriates funds directly from the Consolidated Fund to the Commission (in the same way as occurs for Northern Ireland Departments).

While under Standing Order 69 (1) there is a requirement that a Register of Members’ Interests is established and published for public inspection, this does not deal specifically with conflicts of interest. Therefore, this is a standing agenda item at each Commission meeting.

The Corporate Governance Role of the SMG

SMG is the top-level leadership and management team within the Commission. SMG supports me in my role as Accounting Officer to discharge the obligations set out in Managing Public Money Northern Ireland. This includes advice and support on the strategic direction and overall management of staff.

As the Clerk/Chief Executive, I chair the monthly SMG meetings and am supported by the other Directors. Details of the Directors and the attendance at each meeting are given in the Directors’ Report.

SMG advises the Commission on major proposals and decisions in relation to policy, expenditure, asset management and staffing. SMG reviews progress against the aims and targets established in the Corporate Strategy and reviews progress on key operational issues. It also ensures that the appropriate management systems are in place and are operating effectively to ensure compliance with statutory and regulatory duties. This includes promoting best practice in corporate policies to ensure effective governance across the whole organisation, taking account of risks and performance.

The members of SMG are full-time employees of the Commission. The Commission has retained responsibility for matters relating to the appointment, the terms and conditions and the remuneration of any Director. There are no Non-Executive Directors appointed to SMG.

Conflicts of interests are addressed as a standing agenda item at each SMG meeting and, as such, are included in the published Minutes of each meeting.

Administrative support for SMG and the Commission is provided by the Commission/Chief Executive’s Office. Formal processes exist for providing information to SMG and the Commission, to ensure it is provided in a timely manner, to an agreed standard and in a concise format. A clearly defined approval process has also been established for the presentation of papers, with Director approval of papers prior to submission to me. This adds a further level of scrutiny as to the relevance and quality of information being provided.

In preparing papers for SMG, it is necessary to demonstrate that a number of key areas have been considered including Freedom of Information, legal, staffing, financial/tax, data protection and the equality implications of the material recommendations being presented. If appropriate, it must be demonstrated that the appropriate consultation has been undertaken in preparing the papers.

Papers must clearly set out the context of the matter being discussed, including references to any previous papers that have been presented on the matter. They must include comprehensive and relevant evidence to inform the decision making process, concluding in a series of recommendations which are directly linked to the information provided in the paper.

This process of communicating with SMG and the Commission is reviewed regularly and updated to ensure it continues to represent the information needs of SMG and the Commission.

SMG undertakes an annual self-assessment of its effectiveness. The last assessment was carried out by SMG in June 2021. Any issues arising from this or through the governance arrangements and business planning processes are discussed by SMG and an action plan is devised to address the issues as appropriate.

Principal risks and uncertainties

The Commission identifies a number of corporate risks, through the risk management process, and these are discussed further in this Governance Statement.

The Secretariat Audit and Risk Committee

The Commission established SARC to support me in my role as Accounting Officer and to support the Commission and SMG in our responsibilities for issues of risk, control and governance. SARC provides this support by reviewing the comprehensiveness of assurances in meeting the organisation’s assurance needs and reviewing the reliability and integrity of these assurances. SARC operates in accordance with DoF’s Audit and Risk Assurance Committee Handbook (NI) 2018.

SARC advises on the strategic processes for risk, control and governance and the Governance Statement, the planned activity of the Internal Audit Unit and the results of its work, the planned activity of the NIAO and the results of its work and the overall adequacy of management responses to any audit issues raised. In addition, SARC reviews the Commission’s Annual Reports and Resource Accounts, including the Governance Statement.

SARC normally meets on a quarterly basis to monitor progress on all of these matters. However, during this reporting period, SARC met on three occasions due to restrictions incurred by the COVID-19 pandemic and the associated delays in compiling the Annual Report and Accounts and completing the external audit. SARC agreed at its meeting held in October 2020 that given the circumstances, SARC was content that one further meeting would be sufficient to complete the full extent of its annual business for this reporting year.

SARC comprises two independent Non-Executive members, one of whom chairs the Committee, and a Commission member. The presence of an independent chairperson and independent member provides for a robust challenge to the corporate governance regime within the Commission.

The members of SARC during 2020-21 were:

| Role | Name | Percentage of Meetings attended(4 meetings) |

|---|---|---|

|

Independent Chairperson |

James Brooks |

100% |

|

Independent Member |

Derek Martin |

100% |

|

Commission Member (until 16 February 2021) |

Keith Buchanan MLA |

66% |

|

Commission Member (from 17 February 2021) |

John O'Dowd MLA |

N/A (no SARC meetings took place between 17 February 2021 and 31 March 2021) |

SARC’s Terms of Reference provide for another Commission Member to attend on behalf of the nominated Member, if required.

As Accounting Officer, I attend all SARC meetings, along with all Directors, the acting Head of Internal Audit, the Head of Finance and a NIAO representative.

The Minutes, Terms of Reference and Annual Reports of SARC are published on the Assembly’s website along with a Register of Interests of independent members.

Internal Audit

The Commission’s Internal Audit Unit complies with the requirements of the Public Sector Internal Audit Standards (PSIAS) as per the following definition:

“Internal Audit is an independent, objective assurance and consulting activity designed to add value and improve an organisation’s operation. It helps an organisation accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control and governance processes.”

Internal Audit continues to use four assurance rating classifications: substantial, satisfactory, limited, and unacceptable. The decision to retain the Substantial assurance rating, rather than adopt only the ratings outlined in DAO (DoF) 07/16, was considered and agreed by SARC in 2016.

A three-year Internal Audit Strategy covering the three financial years from 2020-21 to 2022-23 was agreed by SMG in April 2020. The Internal Audit Strategy enhances the strategic focus of Internal Audit coverage while continuing to provide assurance over routine business activity. By dedicating audit resources to priority areas, while ensuring cyclical coverage of business areas, systems and processes, enhanced assurance can be provided to the Clerk/Chief Executive, SMG and SARC on the framework of risk management, internal control and corporate governance.

The Internal Audit Strategy includes a three-year Strategic Plan and a detailed 2020-21 Internal Audit Plan, which were informed by the methodology set out in the Internal Audit Strategy, including reviews of the Corporate and Directorate Risk Registers, the Corporate Plan, previous audit coverage, and detailed discussions with the Accounting Officer and Directors.

Progress against the plan was monitored throughout the year and performance was reported to SMG and SARC, with in-year revisions to the plan agreed by the Accounting Officer and presented to SARC. In response to the COVID-19 pandemic, remote working was employed for the majority of the year. Delivery of the plan was unaffected and it was delivered as envisaged. Detailed reports on the findings from individual audits, together with associated recommendations for control enhancement, were prepared and presented to senior managers and SARC for consideration.

The audits completed comprised areas from each Directorate of the Secretariat. As per the requirements of the PSIAS, this enabled the acting Head of Internal Audit to give an overall opinion to the Accounting Officer representing the system of risk management, control and governance across the organisation. Formal monitoring of the implementation of audit recommendations continued for each Directorate with progress on each recommendation formally reported to SARC.

In 2020-21, twelve final reports were issued. Six reviews resulted in substantial assurance, five provided satisfactory assurance, and one resulted in the provision of limited assurance. All of the recommendations made during the year were accepted by management and follow-up activity has further contributed to the assurance provided. Of the five follow-up reviews carried out, four have resulted in the provision of substantial assurance; the remaining follow-up review concerned recommendations made as part of a scoping review and was not assurance based, however controls were successfully implemented by management to address the three issues raised as part of the scoping review.

Limited assurance was provided in respect of the review of Broadcasting Infrastructure. This report was issued on 25 June 2020 and was also highlighted in last year’s Governance Statement, where it was noted that the report raised a significant issue relating to risk associated with the resilience of the broadcasting infrastructure and Internal Audit’s inability to provide assurance over measures to prevent its operational failure in the short-term. The report acknowledged that this was a legacy issue which management was aware of and had included in the Corporate Risk Register. Mitigation measures had been identified and included in the Corporate Plan, as it would have been imprudent to make the significant investment required during the period when the Assembly was not carrying out its normal business. These measures include a refresh of Assembly broadcasting infrastructure, along with other measures to reduce the risk of operational failure.

Over the course of the year, progress has been made on this planned work to improve the resilience of the broadcasting infrastructure and the 2021-22 Internal Audit plan includes follow-up work in this regard. As was the case in 2019-20, the acting Head of Internal Audit advised that it did not have a material impact on the overall level of assurance for 2020-21.

Based on the results of the above programme of Internal Audits and associated follow-up activity, the acting Head of Internal Audit reported an overall satisfactory level of assurance for 2020-21.

An External Quality Assessment review of the Internal Audit Unit was carried out in 2020. The report concluded that the Unit demonstrates general conformance with the UK Public Sector Internal Audit Standards and includes three recommendations to promote full conformance, and a number of “added value” recommendations to promote the Unit’s continuous development. Implementation of the recommendations will be monitored by senior management and SARC.

Members’ Expenses

In response to significant concerns regarding a number of provisions of the 2016 Determination particularly as they related to the terms and conditions of employment for Members’ support staff, the Commission sought the Assembly’s agreement to confer the function of determining the allowances payable to Members on the Commission. The Assembly conferred that function on the Commission on 30 June 2020 and, on 27 August 2020, the Commission published the Assembly Members (Salaries and Expenses) (Amendment) Determination (Northern Ireland) 2020 (the 2020 Determination).

The 2020 Determination amended the 2016 Determination to enhance the terms and conditions of employment for Members’ support staff and to increase the range of basic items that Members can purchase to continue to deliver services to constituents. This Determination had an effective date of 1 April 2020 for the overwhelming majority of its provisions.

The tenure of the Independent Financial Review Panel (the Panel) ended in July 2016. The motion that was brought to the Assembly on 30 June 2020 to confer the function on the Commission to determine allowances payable to Members did not amend the process for determining Members’ salaries or pensions. This function remains with the Panel.

However, the Commission intends to change the remit and scope of the Panel to focus solely on Members’ salaries and pensions and brought forward a Bill (the Assembly Members (Remuneration Board) Bill) to give effect to that change. The Bill had its First Stage on 14 December 2020 but the Second Stage has not yet progressed.

View full details of all Determinations.

Payments made to Members under the provisions of the 2016 Determination as amended by the 2020 Determination are subject to regular reviews for compliance, either by the on- going compliance testing carried out by the Commission’s Finance Office, or through the annual review by Internal Audit. During the reporting period any issues of non- compliance or inadmissible expenditure that were highlighted as a result of these reviews were dealt with through the established administrative processes as prescribed in the 2016 Determination.

These principles are also applied to payments made to political parties under the Financial Assistance for Political Parties Scheme 2016, which are also reviewed by an independent external auditor each year.

External Audit

The Comptroller and Auditor General for Northern Ireland is responsible for auditing the Commission’s Annual Report and Accounts. The purpose of the external audit is to form an opinion on the truth and fairness and regularity of the figures disclosed in the accounts.

As part of the external audit process, weaknesses in the effectiveness of the system of internal control may be identified in the NIAO’s Report to those Charged with Governance. The report also provides a commentary on the observations for each significant risk as recognised by the NIAO and where appropriate, makes recommendations for the enhancement of controls. The implementation of audit recommendations is monitored quarterly and reported to SARC.

Strategic Planning and Performance Management

Details of performance against the Strategic Aims and targets set in the Annual Plan 2020-21 are summarised in the Performance Summary – Targets section of the Performance Report.

Internal Control Environment

Systems of internal control are designed to continuously identify and prioritise the principal risks to the achievement of the Commission’s policies, aims and objectives. The systems also evaluate the likelihood of those risks being realised, assess the impact should they be realised, and seek to manage them efficiently, effectively and economically.

Generally, the systems of internal control seek to manage risk to a reasonable level rather than to eliminate all risk. It can therefore only provide reasonable and not absolute assurance of effectiveness. These arrangements were in place throughout the year. Risks and internal controls are reviewed routinely by management and are tested as part of the ongoing Internal Audit programme.

Personal Data Related Incidents

In 2020-21, the Commission reported no (2019-20; One) personal data incidents to the Information Commissioner’s Office.

Risk Management

The Commission’s risk management arrangements comply with generally accepted best practice principles and relevant guidance.

A Risk Management Strategy and associated policies and procedures were in place across the Commission during the reporting period. The Risk Management Strategy includes a detailed analysis of risk appetite and continues to define the Commission’s approach to risk management. The Strategy is reviewed annually by SMG to ensure that it remains adequate and appropriate.

The Risk Management Strategy was reviewed in May 2020 when SMG considered a number of updates to the guidance issued by HM Treasury in its ‘Orange Book – Management of Risk – Principles and Concepts’, which was published in 2020.

SMG agreed a number of enhancements and points of clarification to the existing Risk Management Strategy, including a minor amendment to the definition of risk. However, SMG agreed that the risk appetite and classification of risk as stated in the Risk Management Strategy remained appropriate but some additional examples of risk categories within the classifications were added by way of clarification. SMG also agreed that the annual Risk Management Self-Assessment could be further enhanced, by using a number of the questions included in the Orange Book, to assist in assessing how the risk management principles are being applied throughout the Secretariat.

SMG again considered the Risk Management Strategy at a meeting on 30 April 2021 when it was agreed that clarification would be provided on the need for a risk culture that embraces openness and transparency. SMG also agreed that as the Risk Management Strategy was now well embedded, with only minor amendments required over the past two years, the review of the Risk Management Strategy and the Commission’s risk appetite would take place on a biennial basis, and that any new or revised risk management guidance published, which affected the Strategy, would be considered by SMG by exception.

The Risk Management Strategy notes that risk management is not a process for avoiding risk but instead can act as a tool to encourage the organisation to take on activities that have a higher level of risk, because the risks have been identified, are being managed and that the exposure to risk is both understood and acceptable.

The Risk Management Framework includes the Risk Management Strategy, Corporate and Directorate Risk Registers, Assurance Statements, the activities of SARC, risk-based audit delivered by the Internal Audit team and external audit, and the annual Governance Statement. In delivering the Risk Management Strategy, SMG has sought to ensure that a strong risk management culture is embedded across the entire organisation, which is assisted by a process of regular and ongoing monitoring and reporting of risk.

SMG has ownership of the Corporate Risk Register. The Corporate Risk Register is presented quarterly to SARC and biannually to the Commission. It is reviewed and approved by SMG on a quarterly basis. As at the reporting date, three corporate risks were identified.

These are:

- Major Incident / Breakdown / Security Incident / Pandemic;

- Errors or omissions in equality, governance or regulatory requirements; and

- Shortage of staff, skills and knowledge and / or staff engagement.

Risks are identified and assessed using a 5 x 5 matrix of impact and probability, with appropriate Red, Amber, Green colour coding being applied to each risk. The risk appetite is assessed for each risk, using one of the five identified levels. The risk owner documents the root causes of the risk and appropriate responses to address the risk. The adequacy of controls is then reviewed and the degree of acceptance of any gaps in controls and any further actions that are required to improve control are determined.

The quarterly review by SMG ensures that SMG can evaluate the nature and extent of corporate risks and ensures the risks are being managed efficiently. An additional review was undertaken by SMG in May 2020, to ensure that all risk responses, in the context of the COVID-19 pandemic, were recorded on an on-going basis. In addition, the Commission used the risk register templates issued by the Health and Safety Executive Northern Ireland to record its risk response to the COVID-19 pandemic.

Directorate and business area risk registers (where appropriate) are maintained. The Risk Management Strategy includes a monthly review of Directorate risk registers by each Director and Heads of Business. These monthly review meetings are attended by the Governance Officer.

Assurance Stewardship Statements are prepared every six months by each Director. The Statements are submitted to me and are subsequently considered by SARC. These Statements confirm if the management of risks in respective areas have been effectively managed, and provide a narrative on how this assurance has been achieved.

If controls have been inappropriate or ineffective in managing the risk, a narrative must also be provided on any remedial actions that may be required. The Statements also require risk owners to provide a commentary on other governance issues, such as the control of expenditure, information management practices, fraud and bribery prevention measures and the implementation of internal and external audit recommendations.

The Stewardship Statements were prepared as at the end of September 2020 and the end of March 2021 and all Directors confirmed that they were satisfied that controls were in place and that these controls were appropriate.

As in previous years, a number of self-assessments were completed to consider the risks associated with fraud, bribery, corruption, risk management and cyber security. These included Fraud and Bribery Self-Assessment Checklists, the Bribery Risk Assessment and Action Plan, Risk Management Self-Assessment checklists and Action Plan, and the National Audit Office Cyber security and information risk guidance for Audit Committees, Checklist and Action Plan.

SMG agreed that due to the near full compliance with these assessments, they should be carried out on a biennial basis but the Action Plans for these self-assessments will continue to be monitored quarterly and presented to SARC.

Anti-fraud and Anti-Bribery Issues

The Fraud Prevention and Anti-Bribery Policy and associated Response Plan are reviewed on a biennial basis. A review was carried out in May 2020 to ensure that they continue to represent best practice and reflect all appropriate legislative changes. No further changes were made to the policy or response plan. An online, mandatory training programme in

support of the Policy and Response Plan was made available to all staff in late 2020. There were no reported incidents of suspected fraud during the reporting period.

The Commission also participates in the biennial National Fraud Initiative exercise, which is an effective data matching exercise to compare data from across a range of public sector organisations to identify potentially fraudulent claims. This exercise was completed during October 2020. The Commission reported 349 matches across all of the datasets uploaded (for payroll and creditors). The analysis of the matches is ongoing.

Budget Position and Authority

The Assembly passed the Budget Act (Northern Ireland) 2021 in March 2021 which authorised the cash and use of resources for the Commission for the 2020-21 year. The Budget Act (Northern Ireland) 2021 also authorised a Vote on Account to authorise the Commission’s access to cash and use of resources for the early months of the 2021-22 financial year. This was followed by the 2021-22 Main Estimates and the associated Budget (No. 2) Bill in June 2021 which authorises the cash and resource balance for the remainder of 2021-22.

General

Over the last year, progress on recruiting staff to fill the large number of vacant posts that had accrued during the 3-year political hiatus, was impacted significantly by the COVID- 19 pandemic. Key vacancies were filled on a temporary basis by engaging agency workers. The Coronavirus Regulations and guidance that were put in place by the Executive meant that work practices and procedural processes were adapted to ensure that the work of the Assembly could continue.

As Accounting Officer, my assessment of the current corporate governance arrangements is that they comply with the best practice principles, as contained within the “Corporate Governance in Central Government Departments: Code of Good Practice (NI) 2013” as issued by DFP under the DAO (DFP) (now DoF) 06/13. While recognising the fact that the Commission is not a Government Department, many of the principles can be applied. However, the application may not always be straightforward and where alternative governance arrangements are deemed to be more appropriate, deviation from the code has been explained for the purposes of this statement.

Signed: Lesley Hogg Accounting Officer Clerk/Chief Executive

Date: 24 June 2021

Remuneration and Staff Report

The purpose of the Remuneration and Staff report is to set out the Commission’s remuneration policy for senior management, reporting on how this policy has been implemented and what has been paid to senior management. This report explains the provisions for Commission Members as set by the relevant determination, therefore providing the users of the Annual Report and Resource Accounts with information on those individuals who are central in terms of accountability. The report also provides information on overall staff numbers and associated costs for the reporting period.

Remuneration Policy

Commission Members

The salaries and pensions of all Members (including those Members elected to serve as members of the Commission) during 2020-21, were set by the 2016 Determination, and the Assembly Members (Pensions) Determination (Northern Ireland) 2016. These Determinations were made by the Panel which was established by the Assembly Members (Independent Financial Review and Standards) Act (Northern Ireland) 2011, to make determinations in relation to salaries, allowances and pensions payable to Members.

Non- Executive Directors

The Commission has established SARC to consider and advise the Accounting Officer on all matters of governance, audit and internal controls. SARC comprises two independent Non-Executive members, one of whom chairs the Committee, and a Commission Member. The Non-Executive members are paid a daily rate as established and reviewed by the Commission. The Commission Member receives no additional remuneration for undertaking this particular role.

Senior Management

Section 40 of the Northern Ireland Act 1998 states that “The Commission shall provide the Assembly, or ensure that the Assembly is provided, with the property, staff and services required for the Assembly’s purposes”. The Commission has the legal authority to appoint the staff of the Secretariat and to set the remuneration of staff.

The pay award for all staff including its senior managers is normally based on an incremental uplift on all pay scales. A one year pay award was made from 1 August 2020 which included the following distinct elements:

- a 3% consolidated pay increase on all pay scales;

- a one-step progression for staff who were not at the maximum point of their pay scale at 1 August 2020 and whose performance met the required standard;

- and an increase from 18 to 26 weeks in the period for which Occupational Maternity Pay is paid at full salary.

Service Contracts

Staff are appointed on merit on the basis of a fair and open competition. Staff are normally appointed on a permanent basis. Early termination, other than for misconduct, may result in the individual receiving compensation as set out in the Commission’s staff policies and procedures.

Appointments to senior management positions are made by the Commission on the basis of fair and open competition and the Commission has set its own policies and procedures in this regard.

The following sections provide details of the remuneration and pension interests of the Commission, the most senior officials within the Assembly Secretariat and the Non- Executive members of SARC.

Remuneration (including salary) and pension entitlements for Commission Members (audited)

| Assembly Commission Members | Salary £ | Benefits in kind (to nearest £100) | Pension Benefits* (to nearest £1000) | Total (to nearest £1000) | ||||

|---|---|---|---|---|---|---|---|---|

|

|

2020-21 |

2019-20 |

2020-21 |

2019-20 |

2020-21 |

2019-20 |

2020-21 |

2019-20 |

|

Alex Maskey MLA |

38,000 |

12,208 |

- |

- |

12,000 |

2,000 |

50,000 |

14,000 |

|

Keith Buchanan MLA |

6,000 |

1,081 |

- |

- |

2,000 |

- |

8,000 |

1,000 |

|

John O’Dowd MLA |

6,000 |

1,290 |

- |

- |

2,000 |

1,000 |

8,000 |

2,000 |

|

Dolores Kelly MLA |

6,000 |

1,290 |

- |

- |

2,000 |

- |

8,000 |

1,000 |

|

Robert Butler MLA |

6,000 |

1,290 |

- |

- |

2,000 |

- |

8,000 |

1,000 |

|

John Blair MLA |

6,000 |

1,081 |

- |

- |

2,000 |

- |

8,000 |

1,000 |

* The value of pension benefits accrued during the year is calculated as (the real increase in pension multiplied by 20) plus (the real increase in any lump sum) less (the contributions made by the individual). The real increase excludes increases due to inflation and any increase or decrease due to a transfer of pension rights.

The above figures only relate to the remuneration received by Commission Members in respect of their position as officeholders.

Remuneration SARC Members (audited)

| Single total figure of remuneration | ||||||

|---|---|---|---|---|---|---|

| SARC | Fees £ | Benefits in kind (to nearest £100) | Total (to nearest £1000 | |||

|

|

2020-21 |

2019-20 |

2020-21 |

2019-20 |

2020-21 |

2019-20 |

|

James Brooks – Chairperson |

1,640 |

2,442 |

- |

- |

2,000 |

2,000 |

|

Derek Martin – Independent Member |

1,560 |

856 |

- |

- |

2,000 |

1,000 |

Remuneration (including salary) and pension entitlements for Secretariat staff (audited)

| Single total figure of remuneration | ||||||||

|---|---|---|---|---|---|---|---|---|

| Secretariat Officials | Salary £’000 | Benefits in kind (to nearest £100) | Pension Benefits* (to nearest £1000) | Total £’000 | ||||

|

|

2020-21 |

2019-20 |

2020-21 |

2019-20 |

2020-21 |

2019-20 |

2020-21 |

2019-20 |

|

Lesley Hogg |

135-140 |

130-135 |

- |

- |

59,000 |

51,000 |

195-200 |

285-290 |

|

Gareth McGrath Director of Parliamentary Services |

90-95 |

90-95 |

- |

- |

42,000 |

35,000 |

135-140 |

125-130 |

|

Richard Stewart |

90-95 |

90-95 |

- |

- |

56,000 |

30,000 |

150-155 |

120-125 |

|

Tara Caul |

90-95 |

85-90 |

- |

- |

27,000 |

44,000 |

120-125 |

130-135 |

|

Band of Highest Paid Director’s |

140-145 |

135-140 |

||||||

|

Median |

£33,665 |

£35,805 |

||||||

|

Ratio |

4.23 |

3.84 |

||||||

*The value of pension benefits accrued during the year is calculated as (the real increase in pension multiplied by 20) plus (the real increase in any lump sum) less (the

contributions made by the individual). The real increases exclude increases due to inflation and any increase or decrease due to a transfer of pension rights.

**Total remuneration includes salary, non-consolidated performance-related pay, and benefits-in-kind. It does not include severance payments, employer pension contributions and the cash equivalent transfer value of pensions.

Hutton Fair Pay Review Disclosure (audited)

Reporting bodies are required to disclose the relationship between the remuneration of the highest paid Director in their organisation and the median remuneration of the organisation’s workforce.

The reported figure for the banded remuneration of the highest paid Director under the Hutton Fair Pay Review Disclosure was 4.23 times (2019-20; 3.84) the median remuneration of the workforce, which was £33,665 (2019-20; £35,805). The decrease in the median salary is due to a change in the grade of the median employee, partly offset by the pay rise awarded during the year. In 2020-21, no (2019-20; 0) employees received remuneration in excess of the highest-paid Director. The remuneration range for 2020- 21 was £19,044 to £140,307 (2019-20; £17,931 to £136,220).

Total remuneration includes salary, non-consolidated performance-related pay and benefits-in-kind. It does not include employer pension contributions and the cash equivalent transfer value of pensions.

Salary

‘Salary’ for Secretariat staff includes gross salary, overtime, any other allowance to the extent that it is subject to UK taxation and any ex gratia payments.

This report is based on payments made by the Commission and thus recorded in these accounts. In respect of Members of the Commission (including the Speaker), ‘salary’ represents the additional salary payable for being a Member of the Commission or the Speaker over and above the salary payable as a Member.

The 2016 Determination provides for salaries to be paid in respect of certain offices within the Assembly where the salary is higher than the salary payable to Members of the Assembly generally. The 2016 Determination sets out the total salary payable to Members generally and for each officeholder.

The additional amount paid for holding the office of Commission Member was £6,000 (2019-20; £4,800 from 1 April 2019, £6,000 from 11 January 2020). For the Speaker, the additional amount paid for holding office was £38,000 (2019-20; £19,960 from 1 April 2019, £38,000 from 11 January 2020). The salary figures reported here do not include the salary for a Member generally of £51,000 (2019-20; £50,500).

Benefits in kind

The monetary value of benefits in kind covers any benefits provided by the employer and treated by HM Revenue & Customs as a taxable emolument.

Pensions Benefits for Assembly Commission Members (audited)

| Assembly Commission Members | Accrued pension at age 65 as at 31/03/21 £'000 | Real increase in pension at age 65 £'000 | CETV at 31/03/21 (or end date) £'000 | CETV at 31/03/20 (or start date) £'000 | Real increase in CETV £'000 |

|---|---|---|---|---|---|

|

Alex Maskey MLA |

0-5 |

0-2.5 |

45 |

33 |

9 |

|

Keith Buchanan MLA |

0-5 |

0-2.5 |

2 |

- |

1 |

|

John O’Dowd MLA |

0-5 |

0-2.5 |

74 |

70 |

1 |

|

Dolores Kelly MLA |

0-5 |

0-2.5 |

16 |

14 |

2 |

|

Robert Butler MLA |

0-5 |

0-2.5 |

2 |

- |

1 |

|

John Blair MLA |

0-5 |

0-2.5 |

2 |

- |

1 |

*The calculation of the starting pension for the 2020-21 CETV was based on the pensionable salary used in the 2020-21 annual benefit statement and was therefore greater than the closing pension for the 31 March 2020 CETV.

Commission pensions

Pension benefits for Commission Members are provided by the Assembly Members’ Pension Scheme (Northern Ireland) 2016 (AMPS). In 2011, the Assembly passed the Assembly Members (Independent Financial Review and Standards) Act (Northern Ireland) 2011 establishing a Panel to make determinations in relation to the salaries, allowances and pensions payable to Members of the Assembly. In April 2016, the Panel issued the Assembly Members (Pensions) Determination (Northern Ireland) 2016 which introduced a Career Average Revalued Earnings scheme for new and existing members. The scheme is named the Assembly Members’ Pension Scheme (Northern Ireland) 2016.

Assembly Members aged 55 or over on 1 April 2015 and in continuous service between 1 April 2015 and 6 May 2016 will retain their Final Salary pension arrangements under transitional protection until 6 May 2021. The McCloud judgement found that the transitional protection offered to members of the Judiciary and Firefighters Schemes when their schemes were reformed was discriminatory on grounds of age. In light of this decision, the government has agreed to provide remedy to eligible members across the main public sector schemes. This judgement could have an impact on Members who missed out on the Transitional Protection policy in the AMPS because of their age but the applicability and approach to the McCloud judgement in this scheme is still under consideration.

As Commission Members are Members of the Legislative Assembly, they also accrue an MLA’s pension under AMPS (details of which are not included in this report). Pension benefits for Commission Members under transitional protection arrangements are provided on a “contribution factor” basis, which takes account of service as a Commission Member. The contribution factor is the relationship between salary as a Commission Member and salary as a Member for each year of service as a Commission Member.

Pension benefits as a Commission Member are based on the accrual rate (1/50th or 1/40th) multiplied by the cumulative contribution factors and the relevant final salary as a Member. Pension benefits for all other Members are provided on a career average (CARE) basis.