Committee for Finance and Personnel Report (2007-2011 Mandate)

Report on the Review of 2010-11 Spending Plans for Northern Ireland Departments

Report-on-the-Review-of-2010-11-Spending-Plans.pdf (4.57 mb)

Session 2009/2010

Second Report

Committee for Finance and Personnel

Report on the Review of

2010-11 Spending Plans

for Northern Ireland Departments

Together with the Minutes of Proceedings of the Committee

Relating to the Report, Written Submissions, Memoranda and the Minutes of Evidence

Ordered by The Committee for Finance and Personnel to be printed 3 March 2010

Committee for Finance and Personnel

Report: NIA 41/09/10R

Membership and Powers

Powers

The Committee for Finance and Personnel is a Statutory Departmental Committee established in accordance with paragraphs 8 and 9 of the Belfast Agreement, Section 29 of the Northern Ireland Act 1998 and under Assembly Standing Order 48. The Committee has a scrutiny, policy development and consultation role with respect to the Department of Finance and Personnel and has a role in the initiation of legislation.

The Committee has the power to;

- consider and advise on Departmental budgets and annual plans in the context of the overall budget allocation;

- approve relevant secondary legislation and take the Committee Stage of primary legislation;

- call for persons and papers;

- initiate inquiries and make reports; and

- consider and advise on matters brought to the Committee by the Minister of Finance and Personnel.

Membership

The Committee has eleven members, including a Chairperson and Deputy Chairperson, with a quorum of five members.

The membership of the Committee since its establishment on 9 May 2007 has been as follows:

Ms Jennifer McCann (Chairperson)

Mr Peter Weir (Deputy Chairperson)

Dr Stephen Farry

Mr Simon Hamilton

Mr Fra McCann

Mr Mitchel McLaughlin

Mr David McNarry**

Mr Adrian McQuillan

Mr Declan O’Loan

Mr Ian Paisley Jnr*

Ms Dawn Purvis

* Mr Ian Paisley Jnr replaced Mr Mervyn Storey on the Committee on 30 June 2008

** Mr David McNarry replaced Mr Roy Beggs on 29 September 2008

Table of Contents

List of abbreviations and acronyms used in the Report

Executive Summary

Key Conclusions and Recommendations

Introduction

Background

The Committee’s Approach

Consideration of the Evidence

Review Methodology and Evidence Base

Review Process and Departmental Committee Responses

Agriculture and Rural Development

Culture, Arts and Leisure

Education

Employment and Learning

Environment

Enterprise, Trade and Investment

Finance and Personnel

Health, Social Services and Public Safety

Office of the First Minister and deputy First Minster

Regional Development

Social Development

Other Evidence Received

Key Issues Going Forward

Appendix 1

Minutes of Proceedings Relating to the Report 31

Appendix 2

Minutes of Evidence 51

Appendix 3

Statutory Committee Submissions 125

Appendix 4

Ministerial Statement and Assembly Debate 167

Appendix 5

Memoranda and Papers from Department of Finance and Personnel 207

Appendix 6

Written Submissions 253

Appendix 7

Committee for Finance and Personnel Correspondence 299

List of Abbreviations and Acronyms used in the Report

BTB Bovine Tuberculosis

CAFRE College of Agriculture and Rural Enterprise

CBI NI Confederation of British Industry Northern Ireland

CFG Central Finance Group

CFP Committee for Finance and Personnel

CiNI Children in Northern Ireland

CSR Comprehensive Spending Review

DARD Department of Agriculture and Rural Development

DCAL Department of Culture, Arts and Leisure

DE Department of Education

DEL Department for Employment and Learning

DETI Department of Enterprise, Trade and Investment

DFP Department of Finance and Personnel

DHSSPS Department of Health, Social Services and Public Safety

DOE Department of the Environment

DRD Department for Regional Development

DSD Department for Social Development

EQIA Equality Impact Assessment

ERINI Economic Research Institute of Northern Ireland

ESR Economic and Social Rights

EU European Union

EYF End Year Flexibility

FE Further Education

IFRS Internation Financial Reporting Standards

LPIS Land Parcel Improvement Project

LPS Land and Property Services

GRO General Records Office

NI Northern Ireland

NIAO Northern Ireland Audit Office

NICS Northern Ireland Civil Service

NIEA Northern Ireland Environment Agency

NITB Northern Ireland Tourist Board

OFMDFM Office of the First Minister and deputy First Minister

PfG Programme for Government

PFI Private Finance Initiative

PSA Public Service Agreements

QUB Queen’s University, Belfast

RPA Review of Public Administration

SCS Senior Civil Service

SEN Special Educational Needs

SME Small and Medium Sized Enterprise

SSO Shared Services Organisation

UGC Ulster Gliding Club

UK United Kingdom

List of Abbreviations and Acronyms used in the Report

Executive Summary

In December 2009 the Northern Ireland Executive decided to undertake a review of departmental spending plans for 2010-11. This decision was taken in light of a range of identified public expenditure pressures totalling £367m. This report is a co-ordinated response on behalf of the Assembly’s statutory committees to the Review of 2010-11 Spending Plans for Northern Ireland Departments.

The Budget 2008-11 set the allocations for Northern Ireland departments for a three-year period, with an intention that emerging pressures would be addressed as far as possible through the quarterly in-year monitoring round process. In his statement to the Assembly on 12 January 2010 announcing the review, the Minister of Finance and Personnel confirmed that the pressures for 2010-11 are of a scale that cannot be managed through in-year monitoring, and pro-active measures are therefore necessary.

In its scrutiny of the revised expenditure proposals, the Committee received briefings from Department of Finance and Personnel officials on both departmental and strategic finance issues. An oral hearing was also held with the Minister of Finance and Personnel. Despite being unable to undertake public consultation as a consequence of the limited time available to complete the report, the Committee received submissions relating to the revised expenditure proposals from a number of organisations. The Committee also received responses from the other Assembly statutory committees and led a “take note" debate in plenary, which gave all Assembly members the opportunity to debate the plans more fully.

The Committee has identified a number of key findings and recommendations from the evidence and would ask that these, together with the issues raised by the other statutory committees, are taken into consideration by the Executive in finalising the revised Budget for 2010-11.

A particular criticism of this “mini-budget" process has been the lack of detailed information to enable substantive input from the Assembly and the wider public on the proposed reprioritisation of spending allocations between departments. This report therefore aims to identify measures which can help to improve engagement on budgetary issues going forward.

Key Conclusions and Recommendations

1. The Committee recognises that the Executive has limited options available for addressing the additional public expenditure pressures that will arise in 2010-11 and, in principle, endorses the strategic approach of targeted, rather than pro rata, savings in order to minimise the impact on the delivery of frontline public services and Programme for Government targets. (Paragraph 12)

2. The Committee considers that the Review consultation document should have included supporting information to explain the rationale behind the targeted percentage savings for each department, as this would have added transparency to the process and enabled the scrutiny committees and the wider Assembly to make informed judgements on the basis and parameters of the Review proposals. (Paragraph 15)

3. The Committee notes that seven of the eleven Assembly statutory committees have expressed varying levels of dissatisfaction with shortcomings in the information provided by departments on their revised spending proposals for 2010-11, which range from a complete absence of briefing to insufficient detail and lateness of information. The Committee is strongly critical of those departments which failed to engage properly with their departmental committees on their proposed spending plans. (Paragraph 21)

4. The Committee wishes to remind Ministers and senior departmental officials of the legal provisions for consultation with the Assembly on public expenditure proposals, as contained in the Belfast Agreement/Good Friday Agreement, the Northern Ireland Act 1998, and in Assembly Standing Orders. (Paragraph 21)

5. The Committee believes that there is a need to establish firm protocols for the provision of timely and appropriate budgetary information to the statutory committees, and against which departmental performance can be measured going forward. The Committee intends to take this forward with the key stakeholders, including the other statutory committees, the Chairpersons’ Liaison Group, and with DFP on behalf of the Executive. The outcome of this exercise will also be informed by international good practice in executive-legislature relations. (Paragraph 22)

6. The Committee believes that some of the difficulties encountered in the current mini-budget process, including in terms of insufficient engagement both by departments with their Assembly committees and by the Executive with the public, could have been minimised or avoided had DFP attached greater urgency to the completion of the Review of the Executive’s Budget Process 2008-11 and the establishment of a future Budget process.(Paragraph 24)

7. The Committee calls for the urgent establishment of a formal process for Assembly scrutiny of future Executive Budgets and expenditure, which will both enable the statutory committees to plan the necessary scrutiny and will focus departments’ attention on meeting the future briefing requirements of their committees. The Committee further recommends that the detail of the future Budget process is determined in conjunction with the Assembly statutory committees and subsequently launched with an awareness programme for all Assembly Members. (Paragraph 25)

8. The Committee intends to liaise with the Assembly Committee on Procedures to examine how the Assembly’s scrutiny of the Executive’s Budget and expenditure might be underpinned by having a stronger procedural basis in Assembly Standing Orders. (Paragraph 25)

9. In terms of the proposed reprioritisation of the spending allocations between departments, the Committee for Finance and Personnel recommends that, in finalising the revised Budget 2010–11, the Minister of Finance and Personnel and the wider Executive take on board the concerns, conclusions and recommendations contained in the submissions from the Assembly statutory committees, which have been included in this report. (Paragraph 113)

10. The Committee believes that Assembly consideration of the medium-to-long-term strategic finance issues facing the Executive will also be important in terms of minimising and managing any further public expenditure pressures in the years ahead. As such, the Committee will shortly be reporting to the Assembly on the outcome of its investigation into the drive for greater public sector efficiency and effectiveness. (Paragraph 133)

Introduction

Background

1. The Budget allocations for public services in Northern Ireland (NI) for 2010-11 were set in January 2008, when the Assembly agreed the Budget for the three-year period from 2008–2011. This Budget took into consideration the strategic priorities and key plans of the Programme for Government (PfG). A stocktake of the Budget position for 2009–10 and 2010–11 was undertaken by the Executive in late 2008, in which departments were asked to review progress against their 3-year plans and identify reduced requirements, and also to identify any significant increased requirements together with proposals as to how these could be addressed, through an adjustment of existing plans and priorities.

2. In its submission to the Executive’s strategic stocktake in October 2008, the Committee for Finance and Personnel highlighted its concern at the range and amount of new emerging pressures on existing Budget allocations. At that time the Department of Finance and Personnel (DFP) sought to assure the Committee that any pressures could be managed through the in-year monitoring processes. Since then, the level of reduced requirements being declared by departments at monitoring rounds has diminished, and the Committee believes that this suggests a welcome improvement in financial management by departments. There is, however, less flexibility to address emerging pressures as the money available for redistribution is reduced, and it has been necessary for the Executive to undertake a review of the spending plans for 2010-11 for NI Departments.

3. In his statement to the Assembly on 12 January 2010 announcing the Review, the Minister of Finance and Personnel stated that, in 2010-11, the Executive faces spending pressures of £367m, mainly as a result of the further deferral of water and sewage charges, the need to reduce the level of overcommitment and the cost of the Civil Service equal pay claim. Of this, £217.1m is current expenditure and £149.9m is capital expenditure, which equates to 2.6% of planned current expenditure and 10.2% of planned capital expenditure respectively.[1] Full details of the spending pressures are laid out in Tables 1, 2 and 3 below.

Table 1: Pressures / (Easements) flowing from changes to the funding available to the Executive for 2010-11.

| Current Expenditure (£million) |

Capital Investment (£million) |

|

| Remove Opening Level of Overcommitment | 60.0 | 0.0 |

| Barnett consequentials from UK Budget 2008 & 2009 and PBR 2008 & 2009 | (86.5) | (9.1) |

| Impact of additional efficiencies confirmed in Budget 2009 | 100.0 | 22.8 |

| Balance of EYF Available from CSR 07 | (20.0) | (50.0) |

| Acceleration of capital DEL into 2008-10 | 0.0 | 38.4 |

| Shortfall in receipts | 44.0 | 53.4 |

| IFRS PFI Changes | 0.1 | (9.8) |

| Clear Line of Sight | (55.2) | 0.0 |

| Total Pressure | 42.4 | 45.7 |

Table 2: Additional Spending Pressures (and Easements)

| Current Expenditure (£million) |

Capital Investment (£million) |

|

| Deferral of Water Charges | 119.7 | 93.3 |

| Equal Pay | 64.6 | 0.0 |

| Reduced Requirements declared in Strategic Stocktake | (21.1) | (0.0) |

| Shared Services for all departments - net of amounts held centrally | 6.5 | 0.0 |

| Integrated Development Fund | 0.0 | 3.7 |

| NI Assembly costs | 5.0 | 3.4 |

| Innovation Funding | 0.0 | 3.9 |

| Total Pressure | 174.6 | 104.2 |

Table 3: Overall level of Public Expenditure Pressures for 2010-11

| Current Expenditure (£million) |

Capital Investment (£million) |

Total (£million) |

|

| Table 1 | 42.4 | 45.7 | 88.1 |

| Table 2 | 174.6 | 104.2 | 278.8 |

| Total | 217.1 | 149.9 | 366.9 |

4. During an evidence session with departmental officials on 17 February 2010, the Committee was advised that the block grant for 2010-11 is in fact increasing, although less than originally planned for. Related to this, the Committee queried why the £122.8 million of additional efficiency savings confirmed in the Budget 2009 has been included in calculating the pressures for 2010-11, given that this represented a reduction in the rate of growth rather than a reduction in the baseline for the next financial year. In response, the Department provided the information at Table 4 below, outlining the changes to the block grant since the Comprehensive Spending Review (CSR) 07. The full response from the Department is provided at Appendix 5.

Table 4: Changes to the NI Executive 2010-11 Block Grant from CSR 071.

| £ million | |

| CSR 07 outcome (aligns with Budget 2008-11 document) | 9,673.3 |

| Classification/Treatment changes | 156.2 |

| Transfers to/from other UK departments | 1.5 |

| Budget 2008 (Barnett additions) | 10.1 |

| PBR 2008 (Barnett additions) | 11.7 |

| PBR 2008 (Impact of reduced DoH capital plans)2 | (42.7) |

| PBR 2008 (Accelerated capital spend from 2010-11into 2008-09) | (9.4) |

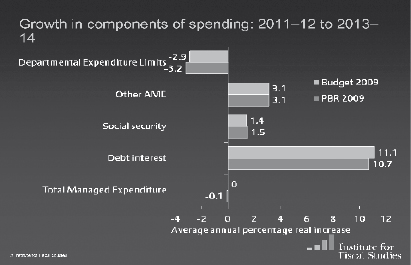

| Budget 2009 (Barnett additions) | 66.1 |

| Budget 2009 (Impact of £5 billion savings for UK departments) | (122.8) |

| PBR 2009 (Barnett additions) | 7.7 |

| Position following PBR 09 (aligns with Tables 1a and 1b in Review of 2010-11 Spending Plans Consultation Document) | 9,751.8 |

Notes:

1. Figures in brackets represent a negative.

2. This will be offset in 2010-11 by enhanced access to the Executive’s capital investment EYF stock for the same amount.

5. In his statement to the Assembly, the Minister outlined the Executive’s proposal that a targeted approach to managing these pressures is adopted, rather than a pro rata cut from each departmental budget. To complement the consultation document setting out the high level proposals, and to enable Assembly committees to review the position for their respective department, Ministers were asked to publish details of implications for individual departments on their websites, to include how savings are to be made and the improvements in services that will be delivered in 2010-11.

6. The Minister requested that the Committee for Finance and Personnel produce a co-ordinated report on the Review of 2010-11 Spending Plans on behalf of all departmental scrutiny committees, to be completed by the end of February 2010 or as soon as possible thereafter. The Official Report (Hansard transcript) of the Minister’s statement is at Appendix 4, and the consultation document is available at the link below.[2]

The Committee’s Approach

7. The Committee takes evidence from DFP officials on budgetary matters on an ongoing basis. In addition to scrutinising the quarterly monitoring rounds on both a DFP and a cross-departmental basis, this includes briefings on strategic and cross-cutting public finance issues as well as evidence on Budget Bills and both the main and spring supplementary estimates. Since November 2009, the Committee has also been undertaking an in-depth investigation into public sector efficiency savings. During its consideration of this report on 24 February 2010, the Committee agreed that the outcome of its scrutiny of efficiencies and other strategic financial issues will be reported to the Assembly separately before summer recess 2010. This report therefore addresses the Review of 2010-11 Spending Plans as a discrete piece of work.

8. The Committee agreed a timetable for gathering evidence on the revised spending proposals and preparing its report within the limited time available to it. The Committee took evidence from DFP officials on the implications of the proposals at a departmental level, and also on strategic financial issues. Members also held an oral hearing with the Minister of Finance and Personnel on 11 February 2010. With regard to input from other Assembly statutory committees, the Committee wrote on 14 January 2010 to invite submissions on their respective departments’ positions by 5 February 2010. For lengthy submissions, committees were asked to provide a summary highlighting key findings, conclusions or recommendations which have been included below, with the full response provided at Appendix 3.

9. The limited timescale for consideration of the issues and completion of the report precluded the Committee from undertaking a wider consultation on the Executive’s proposals. Nonetheless, the following organisations wrote to the Committee or offered submissions on the consultation document which accompanied the Minister’s statement on the Review: Economic Research Institute of Northern Ireland (ERINI); Confederation of British Industry (CBI); the Ulster Gliding Club Ltd (UGC); Children in Northern Ireland (CiNI); Queen’s University Belfast (QUB) School of Law / Human Rights Centre and The Stroke Association NI. These are included at Appendix 6.

10. Finally, to provide all Members with the opportunity to debate the proposals for the Review of 2010-11 Spending Plans, and to inform this report, the Committee tabled a motion for a “take note" debate, which took place on Tuesday 9 February 2010. The Hansard transcript of that debate is at Appendix 4.

Consideration of the Evidence

Review Methodology and Evidence Base

11. In his statement to the Assembly on 12 January 2010 and in his subsequent evidence to the Committee on 11 February 2010, the Minister of Finance and Personnel provided a detailed account of the rationale for undertaking the Review of 2010-11 Spending Plans. The Minister stated that he initiated a review of the spending position for 2010-11 in the summer of 2009, when it became evident that emerging pressures could not be managed in the context of the in-year monitoring process.

12. During the evidence session with the Committee, the Minister confirmed that the Executive had examined a range of alternatives to achieving the required savings for 2010-11. The Executive agreed to a targeted approach to reducing existing budget allocations to departments and, in doing so, sought to protect the delivery of front line public services in particular. The Committee recognises that the Executive has limited options available for addressing the additional public expenditure pressures that will arise in 2010-11 and, in principle, endorses the strategic approach of targeted, rather than pro rata, savings in order to minimise the impact on the delivery of frontline public services and Programme for Government targets. An opinion was expressed by some members that a wider ranging mechanism of prioritisation to address the additional public expenditure pressures should have been conducted.

13. That said, the Committee has, on a number of occasions during evidence sessions with both DFP officials and the Minister, and in written correspondence with the Department, sought to determine the precise methodology which has given rise to the specific percentage savings proposed for individual departments. As noted later in the report, the Committee for Health, Social Services and Public Safety has also queried the methodology which has underpinned the Review. In addition, the Finance and Personnel Committee sought to establish what evidence exists to support the proposed percentages savings across departments. Several stakeholder submissions to the Committee have raised related concerns that the Review has not been accompanied by accessible and transparent information. These concerns are outlined later in the report.

14. From the DFP responses, it is difficult to identify precise supporting evidence for the proposed percentage savings by departments, although a number of factors were taken into account, including:

- consideration of information from Central Finance Group’s (CFG) ongoing contact with departments;

- input on how hypothetical savings of x% of current expenditure and y% of capital expenditure might be achieved by individual departments;[3] and

- bilateral discussions between the Finance Minister and individual Ministers, together with collective discussions at Executive level.

The Committee recognises that, by its very nature, the methodology will include an element of subjectivity. The Committee is concerned, however, that while the methodology appears to have been inclusive at all stages and the proposed percentage savings should therefore have been an agreed position, it appears from the submissions from Assembly committees, detailed below, that not all departments have engaged fully in this process.

15. From the Review consultation document, the Committee notes that, in reprioritising the spending allocations between departments, the Review “took into consideration a broad range of factors including the potential impact on the delivery of priority frontline services as well as the implications for the Executive’s top priority of growing the economy". The consultation document also explains that “other key issues included evidence of inefficiency and levels of underspend in previous years as well as the growth in available resources under Budget 2008-11 and the extent of any contractual commitments".[4] Whilst welcoming this broad approach, the Committee considers that the Review consultation document should have included supporting information to explain the rationale behind the targeted percentage savings for each department, as this would have added transparency to the process and enabled the scrutiny committees and the wider Assembly to make informed judgements on the basis and parameters of the Review proposals.

Review Process and Departmental Committee Responses

16. As alluded to above, the Committee for Finance and Personnel invited the Assembly’s other statutory committees to make written submissions on the outcome of their considerations of the revised spending proposals for 2010-11 from their respective departments. The individual committee submissions are summarised below. To facilitate the statutory committees in fulfilling their scrutiny function, there was an expectation that departments would engage with their committees on the proposals fully and promptly, especially given the time constraints for completing the exercise. Indeed, the consultation document indicated that the departments would provide further details of the revised 2010-11 budget allocations for individual business areas on their websites, and stated that:

“This should include details of the progress made by each department in delivering PfG targets since April 2008 as well as the proposed measures to be taken to deliver additional savings whilst at the same time minimising the impact on the delivery of priority frontline public services. In addition, departments have been asked to set out the improvements in public services they intend to deliver in 2010-11 with the revised budget allocations and summary details of the implications in respect of Equality, Good Relations and Anti-Poverty".[5]

17. At its meeting on 17 February 2010, the Committee considered the key themes from the submissions from the other statutory committees on their respective departmental positions. Members noted significant differences in the level of detail in the responses received. It should be noted that some committees had meaningful engagement with their department; for example, during the “take note" debate on 9 February 2010, the Chairperson of the Environment Committee commended that Department for the level of detail provided, while the Chairperson of the Committee for Enterprise, Trade and Investment referred to a “frank and open" discussion with departmental officials. The Committee for Finance and Personnel also commends DFP for the level of engagement on both departmental and strategic budgetary issues. The return from the Committee for Employment and Learning did not indicate that it was dissatisfied with the level of engagement with its Department and included a copy of the briefing which it had received.

18. In contrast, neither the Health, Social Services and Public Safety Committee nor the Regional Development Committee were in a position to comment on their departments’ proposals as these had not been provided to them. In the case of the committees for Education and Social Development only limited or headline information had been provided, which those committees did not consider enabled them to comment fully on the proposals. The Committee for Agriculture and Rural Development noted that the late receipt of papers in advance of an evidence session did not afford that Committee the opportunity to fully scrutinise the Department’s position. In its return, the Committee for the Office of the First Minister and the deputy First Minster also emphasised concern over the continual late receipt of financial papers from its Department. Finally, the Committee for Culture, Arts and Leisure expressed concern at the undue delay by the Department of Culture, Arts and Leisure (DCAL)in publishing its proposals on the departmental website. This Committee also considered that there was insufficient provision for the public to comment on the proposals and a lack of detail and transparency in the information that was eventually made available to the public on the DCAL website.

19. In addition to the aforementioned concerns raised by individual statutory committees, the Chairpersons’ Liaison Group expressed serious concerns that “the lack of detailed information provided by departments and the short timescale within which committees were required to consider the draft 2010-11 Spending Plans did not enable committees to effectively carry out their scrutiny role." The Liaison Group is awaiting sight of this report before considering possible courses of action in this regard.

20. The Committee is aware that DFP engages with the other departments on an ongoing basis in terms of financial issues. Furthermore, in his evidence to the Committee on 11 February 2010, the Minister stated that, during November and perhaps even before then, officials in DFP were in discussions with departmental finance officers in relation to the review of 2010-11 spending plans. The Minister also confirmed that he had discussed the worst-case scenario with each Minister and that the figures used during these discussions were in excess of those agreed by the Executive on 17 December 2009, with the exception of two departments. Given this dialogue, the Committee considers that departments would have had knowledge of the requirements of the review of spending plans for some time, and the Executive’s decision of 17 December 2009 would not have come as a surprise.

21. The Committee notes that seven of the eleven Assembly statutory committees have expressed varying levels of dissatisfaction with shortcomings in the information provided by departments on their revised spending proposals for 2010-11, which range from a complete absence of briefing to insufficient detail and lateness of information. Given the level of concern raised by Assembly statutory committees, the Committee is strongly critical of those departments which failed to engage properly with their departmental committees on their proposed spending plans. Such failure on the part of departments stymies the committees and the wider Assembly in carrying out their challenge function. In this regard, the Committee wishes to remind Ministers and senior departmental officials of the legal provisions for consultation with the Assembly on public expenditure proposals, as contained in the Belfast Agreement/Good Friday Agreement, the Northern Ireland Act 1998, and in Assembly Standing Orders.

22. The effective scrutiny of public expenditure is a key function of the Assembly, which must be respected by departments. As such, the Committee believes that there is a need to establish firm protocols for the provision of timely and appropriate budgetary information to the statutory committees, and against which departmental performance can be measured going forward. The Committee intends to take this forward with the key stakeholders, including the other statutory committees, the Chairpersons’ Liaison Group, and with DFP on behalf of the Executive. The outcome of this exercise will also be informed by international good practice in executive-legislature relations.

23. As the Committee highlighted during the “take note" debate, the requirement for this mini-budget process and the difficulties arising from the truncated timetable, underscores the need to establish a formal budget process going forward. The extremely tight time constraints have also prevented both the Department from undertaking a wider public consultation on the proposals and the committees from engaging with stakeholders. This shortcoming was highlighted in correspondence to the Committee from Children in NI and, as detailed later, in its submission, the QUB School of Law outlined the requirement in international law to have participation in budget decisions and concluded that the Review consultation document “falls short of good practice for consultations".

24. In December 2007, when it published its Report on the Executive’s Draft Budget 2008-11, the Committee called for the future budget process and timetable to be settled early in 2008, to enable Assembly statutory committees to schedule the necessary scrutiny into their work programmes and thereby provide departments with notice in terms of the future briefing requirements of committees. Subsequently, in its Submission to the Review of the Executive’s Budget Process, in October 2008, the Committee reiterated its call for the establishment of a future budget process, which maximises the contribution from elected representatives in the Assembly. In this regard, the Committee anxiously awaits the outcome from DFP’s Review of the Executive’s Budget Process 2008-11, which was due for completion by the end of 2008, and which should inform the establishment of an effective process for determining future budgets, once the Review of 2010-11 Spending Plans has been concluded. The Committee believes that some of the difficulties encountered in the current mini-budget process, including in terms of insufficient engagement both by departments with their Assembly committees and by the Executive with the public, could have been minimised or avoided had DFP attached greater urgency to the completion of the Review of the Executive’s Budget Process 2008-11 and the establishment of a future Budget process.

25. Therefore, the Committee calls for the urgent establishment of a formal process for Assembly scrutiny of future Executive Budgets and expenditure, which will both enable the statutory committees to plan the necessary scrutiny and will focus departments’ attention on meeting the future briefing requirements of their committees. The Committee further recommends that the detail of the future Budget process is determined in conjunction with the Assembly statutory committees and subsequently launched with an awareness programme for all Assembly Members. The Committee intends to take the lead in co-ordinating this awareness programme in conjunction with DFP and, as part of its ongoing Inquiry into the role of the NI Assembly in scrutinising the Executive’s Budget and Expenditure, will also be reviewing the resources available for assisting Assembly statutory committees and members in undertaking budget and financial scrutiny, with a view to putting forward a set of practical recommendations for enhancing the capacity of the Assembly in this regard. Also, the Committee intends to liaise with the Assembly Committee on Procedures to examine how the Assembly’s scrutiny of the Executive’s Budget and expenditure might be underpinned by having a stronger procedural basis in Assembly Standing Orders.

26. The response from each statutory committee is set out below. In addition, some of the committees provided fuller submissions and/or details of their departments’ proposals and these are included at Appendix 3.

Committee for Agriculture and Rural Development

27. The Committee received a presentation on the Review of 2010–11 Spending Plans as it applied to the Department on 26 January 2010 in plenary session.

28. The Committee notes that the Executive decision for the Department of Agriculture and Rural Development (DARD) is that the Department has been set a target to save £6.3m on current expenditure and £3.4m on capital investment.

29. The Committee is concerned, however, that the Department appears to have targeted the softer options of research and education to cover the majority of these additional pressures, including the sale of land. The Committee is aware that the Department is undertaking a review of its estate and would place on record its opposition to the Department asset-stripping prime public property in order to pay for its mistakes.

30. The Department is also concerned that the pressures now facing them will begin to have a significant impact on their Public Service Agreement (PSA) targets within the Programme for Government.

31. The Department has identified a number of other significant areas that will result in increased pressures during 2010–11. These are as follows:

(a) Crossnacreevy

The over-evaluation of the Crossnacreevy site by the Department has resulted in a negative capital investment budget of £174m. The Committee has long held the view that this valuation was totally inaccurate and unsubstantiated by the Department. Whilst the £200m receipt identified by the Department in their accounts may be covered by slippage of other departmental programmes, the Committee is of the view this represents a major loss to the NI economy.

(b) EU Disallowances

The Department is facing disallowances arising from non compliance with EU regulations governing their EU area based payments schemes. A disallowance of £30m has been proposed for the 2004 – 2006 scheme years, with an additional £30m in respect of 2007 and 2008.

(c) Rolled-Up Modulation Match Funding

The Committee was astonished to learn that the Department had failed to insert a budget requirement in respect of Axis 3 of the Northern Ireland Rural Development Programme. Applications to the programme have been approved and the Department now needs to bid for £5m to meet in year commitments.

The Department is bidding to secure these monies from rolled up modulation match funding, totaling some £27m, apparently being held by DFP. The Department has duly bid for £5m for the next financial year but rates its chances of being successful in its bid at approximately 40%.

The Committee for Agriculture and Rural Development would support this bid on the basis that rural businesses are already making their element of the project ventures. Another injection of £5m into the rural economy would be a significant economic driver.

Invest to Save Proposals

32. The Department has proposed bids in three areas. These are as follows:

(a) Land Parcel Improvement (LPIS) Project

The LPIS project aims to support the drive to better compliance with EC area and scheme regulations, and reduce the risk of Commission disallowance. Non-compliance with the scheme rules can result in significant levels of disallowance being placed against the Managing Authority, with the Department currently facing up to £60m disallowance. The project will improve IT systems and will involve a significant amount of cross departmental working with DFP’s Land and Property Services Division. The overall cost is around £14m, and payback will be achieved in 2 years.

The Committee for Agriculture and Rural Development supports this bid on the basis that it will alleviate significant future disallowance bids.

(b) College of Agriculture and Rural Enterprise (CAFRE) Enniskillen Campus Improvements

Construction of new facilities and to ensure compliance with disability legislation at a cost of £1m will enable CAFRE to disengage from the Necarne estate. There are net forecast savings of £0.16m per year, which gives payback of the initial investment of 7 years.

The Committee for Agriculture and Rural Development is supportive of this action.

(c) Badger Prevalence Study

The objective of the study is to provide a measure of bovine tuberculosis (BTB) in badgers in order to give a solid scientific basis about where to target future interventions and provide baseline data to compare against the results of any intervention. The cost of the study is £2.5m over 2 years.

The Committee for Agriculture and Rural Development is opposed to this bid.

33. There was a consensus within the Committee that the Department is heading towards a severe financial crisis, given the extreme levels of financial pressures that it faces. Indeed, during the evidence session with the Department, the Deputy Secretary argued that the Revised Expenditure Plan was a means of avoiding bankruptcy.

34. The very unfortunate aspect to this is that it will be the wider NI community that will have to bear the brunt for the financial mis-management of the Department.

Committee for Culture, Arts and Leisure

35. The Culture, Arts and Leisure Committee took evidence from departmental officials on the proposed revised budget for 2010-11 at its meeting on Thursday 28 January 2010.

36. The Committee was disappointed that, in terms of percentage cuts to existing budgets, DCAL had the highest cuts of all the departments. The Committee is of the view that DCAL is sometimes regarded as a “soft target" in terms of budgetary cuts because the impact of its business areas is not fully understood or recognised.

37. The Committee makes the point that investment in DCAL business areas contributes to key areas of economic growth such as the creative industries and cultural tourism. These kinds of activities have the potential to generate jobs and attract tourists to this region.

38. The Committee took evidence from Sport NI on how the proposed cuts will affect its ability to deliver key projects and programmes on the ground. The Committee is concerned that if the cuts to Sport NI’s budget are realised, opportunities for young people and adults to participate in sport and physical activity will be lessened. There is a particular concern that these cuts will negatively impact on people living in socially deprived areas in terms of their ability to pursue sport and physical activity, which is key to improving health and well being.

39. In terms of public consultation and public access to the proposed changes to the Department’s budget, the Committee had a number of concerns. On 12 January, the Finance Minister announced the proposed savings to the 2010-11 budget to the House. In his statement he said that he had asked Executive colleagues to publish details of the implications for their individual departments on their departmental websites.

40. However, DCAL did not publish this information on its website until 25 January, almost two weeks later. This would seem to be an undue delay given the importance of the issue. The document provided on the DCAL website was entitled “DCAL 2010-2011 Budget consultation". However, no information was provided as to how members of the public should make their views known to the Department and there was no closing date for the consultation period.

41. The Committee also noted that the figures provided on the Department’s website only gave details of the headline cuts to various spending areas. It did not provide details of the final proposed budgets after internal re-allocations between business areas had been made. This information was provided to the Committee, and it is the Committee’s view that the same information should have been available to the public through the Department’s website.

42. The Committee understands that the main form of consultation on the revised budget is to be through the Assembly committees. However, this does not mean that the public should not be provided with transparent information about the process and how they make known their views.

Committee for Education

43. Introduction - The Committee for Education receives regular (normally monthly) briefings from Department of Education (DE) senior officials on the education budget. At its 18 November 2009 meeting, the Committee questioned officials how the then £33 million resource pressures and £70 million capital requirement for 2010-11 would be addressed, together with further expected additional efficiencies from the Executive’s Spending Plans for 2010/11. The Committee heard that, in the absence of any additional capital funding, DE will not release any further capital projects and cease work on bringing new projects into the process.

44. The Committee received a letter dated 14 January 2010 (included at Appendix 3) from the Minister of Education setting out the Executive’s draft proposals for 2010-11 Spending Plans amounting to savings of £51.7 million (2.6%) current expenditure and £22 million (11.5%) capital expenditure for the education budget. The letter highlighted that there are other pressures on the 2010-11 education budget of some £40 million current expenditure.

45. At the Committee’s request, the Minister of Education attended the 3 February 2010 Committee meeting. The Minister stressed:

- the need to reduce bureaucracy and streamline delivery of administration in education; with the delay in establishing the Education and Skills Authority, a Convergence Delivery Plan has been produced to maintain the momentum of reform and deliver the 50% management saving (430 posts) through “invest to save", generating £20 million annual saving;

- with 70% of the education budget being salary costs, the need to protect as far as possible frontline services ; and

- the need for an equality impact assessment (EQIA) of proposed spending reductions.

46. The question and answer session raised various points on these issues, with the Committee highlighting to the Minister that the primary role of the Committee was to scrutinise the Minister’s proposals to address proposed savings and pressures and it was not in a position to consider and give its view on:

(a) the five areas for potential reductions identified by the Minister as the Committee has not been provided with sufficient information on the nature of the spend in these areas and, in particular, the impact of potential reductions;

(b) the Convergence Delivery Plan, as the Committee has yet to see the Plan despite its earlier requests to be briefed on the Plan;

(c) the Minister’s review of the capital programme, as the Committee has not been provided with the criteria to be used in the review or any outcomes, despite its earlier requests for this; and

(d) any other measures the Minister may be considering to deliver additional savings, as the Committee has not been informed on this and no information has been posted on the DE website.

47. Through its recent scrutiny of the Special Educational Needs (SEN) & Inclusion Review Policy Proposals the Committee was able to comment on £24.3 million that is currently allocated in the 2010-11 baseline for SEN Review. The Committee understands that this is for teacher training and capacity building, with presumably a large proportion of it to implement the new SEN and Inclusion Review policy proposals - bearing in mind the baseline allocation for this area in 2009-10 was £1 million. Given that key stakeholders and the Committee have serious concerns with a number of the Department’s consultation policy proposals, the Committee raised the issue of the timing of such a significant spend bearing in mind that officials said that more detailed proposals will also need to be developed for consultation. The Committee concludes that a substantial proportion of the £24.3 million could be utilised to address pressures in the 2010-11 budget on the basis that the resources would (subject to the outcomes of the consultations) be a priority and would be required in subsequent years.

48. The Committee has not commented on other areas of spend proposed in the 2010-11 education budget, primarily because it was not in a position to fully assess the impact which potential reductions in spend would have on services, in particular on frontline classroom services.

Committee for Employment and Learning

49. At its meeting on 27 January 2010 the Committee for Employment and Learning was briefed by departmental officials on details of the impact of the Review of 2010-11 Spending Plans on the budget of the Department for Employment and Learning (DEL). A copy of the briefing paper is attached at Appendix 3.

50. The Department has put a positive slant on the spending cuts by emphasising that they are to be made from what is termed “growth" – increased budget allocation – rather than from a baseline budget projection, and confirms that it will still be able to deliver on PSA targets and PfG key goals.

51. The spending reductions total £28.7m, £19.7m to be made from current revenue expenditure and £9.0m from the capital expenditure budget. Both the current expenditure and the capital cuts will be made primarily from the Higher Education sector, with £12.8m (65% of the total £19.7m) from current expenditure and £8.1m (90% of the total £9m) from capital expenditure. There are no planned cuts for Further Education but this is dependent on £10m being realised as capital receipts.

52. Members raised the following concerns:

Current expenditure

- The Committee is acutely aware of the importance of the delivery of skills and training, and, in particular, the value of apprenticeships. Members expressed concern that budget cuts of £6.0m would impact on the Programme-led Apprenticeships scheme but received assurances from officials that the remaining increase in funding (£17.4m) would protect training services.

Capital expenditure

- The Strategic Capital Investment Fund for universities and university colleges has been reduced from £14.0m to £5.9m. Members were concerned as to how this will impact on the future expansion plans of the universities, which have recently been outlined to the Committee. Officials made it clear that this funding was the only area of the Higher Education budget which had not yet been formally committed, and on that basis, members accepted that it would have a lesser immediate effect on the development of Higher Education.

- Members considered correspondence from the Vice-Chancellor of the University of Ulster challenging the basis on which the Executive is reviewing spending and outlining the implications for the University. Members agreed that this letter should be forwarded to the Minister for comment and voiced concerns that the Department had not consulted adequately with the management of the universities.

- Members welcomed the lack of cuts planned for the Further Education (FE) sector but expressed concern that this was critically dependent on the planned capital receipts of £10.0m being fully realised. Officials outlined the possible impact on on-going FE projects which would have to be scaled back.

Committee for the Environment

53. At its meeting on 28 January 2010 the Environment Committee received a briefing on the Department of the Environment’s (DOE) revised spending plans for 2010-11.

54. The Department has been required by the Executive to make savings of £3.9m on the current budget and £0.2m on the capital budget.

55. This is in addition to a number of other pressures totalling £11.38m resulting predominantly from the shortfall in the planning fees and planning reform (£7m), equal pay pressures (£2.4m), RPA admin pressures (£1.2m) and other internal pressures (£0.73m). In all, this adds up to a total of £15.3m; 11.3% of the Department’s 2010-11 baseline budget.

56. The Department intends to address the funding pressures by pro-active management measures that will include:

- the cessation of low priority activities;

- reductions in consultancy spend;

- reductions in other departmental running costs;

- realigning Planning Service’s operating costs with future fee income and DPF funding; and

- review of Corporate Service functions across the Department.

The £0.2m capital reduction will be met from the Strategic Waste Infrastructure Funding.

57. The Committee acknowledged that the Department is facing significant financial pressures.

58. Members welcomed the Department’s commitment to reduce consultancy spend and to reduce its running costs and review Corporate Service functions across the Department. Members were advised that because of the “upfront" costs involved in rapidly addressing staff numbers, the Department would be focusing any savings in relation to staff costs on not filling vacancies.

59. Members also welcomed the Department’s decision to realign Planning Service operating costs and urged them to expedite the process. Having established that this would involve relocating staff rather than making them redundant, members felt that, as planning receipts have now been in rapid decline since 2007, this process should and could have commenced sooner. Failing to react to this issue quickly has resulted in greater pressure on the non-core services of the Department which are now having to bear the brunt of the cost cuts.

60. The Committee accepted the approach of allocating pressures across each business area along with the proposal to exclude Local Government even though this would result in greater pressures on the other areas. However Members expressed concern about the proposed deferral of contracts and grant funding for the following reasons:

- It is unlikely that the non-government organisations affected by cuts would have the opportunity to relocate staff and this decision, unlike the one to realign Planning Service, could lead to redundancies and the loss of expertise from the sector or the region.

- Some of the non-government organisations affected by this decision deliver or contribute to statutory environmental protection obligations by levering in significant amounts of private money as well as direct action. Cutting their funding to meet current pressures may not be the most cost-effective approach in the longer term if it leads to further deterioration of protected sites and/or EU infraction proceedings. A value for money approach is needed which includes ensuring that the immediate, medium and long term contributions of non-government organisations that have received grants can be objectively assessed when funding pressures arise.

61. The Department allayed some of these concerns when it indicated that it is looking at options such as phasing grants over a longer period and targeting organisations that have a variety of funding streams available to them and are not solely dependent on the Department’s funding. The Committee welcomed that the Department was liaising closely with the organisations affected but asked for a more detailed picture on which organisations will be cut so that the Committee can assess the real impact of the Department’s proposals.

62. Members questioned whether Northern Ireland Environment Agency (NIEA) will retain sufficient funds to address illegal dumping. The Department indicated it has sought to maintain staffing levels in NIEA enforcement but accepts there is always scope to improve enforcement activities.

63. The Committee also stressed the importance of using powers afforded by the Northern Ireland Audit Office (NIAO) to “data-match" information across government departments and ensure that receipts for any breaches for which the Department of the Environment has responsibility are maximised.

Committee for Enterprise, Trade and Investment

Summary of Key Spending Plan Adjustments

64. The Department of Enterprise, Trade and Investment (DETI) has identified that £200.6 million (71%) of DETI’s budget is contractually committed. The Department considers this to be a little higher than what it considers normal (65%). The available headroom from which savings can be made amounts to £35 million current expenditure and £37 million capital investment.

65. The Executive agreed to DETI savings of £4.6 million (2.2%) current and £6.6 million (8.2%) capital based on opening 2010-11 budget allocations.

66. Savings options for current expenditure (Table 5) and for capital expenditure (Table 6) are detailed below. [More detail on savings options is included in DETI Review of 2010-11 Spending Plans ETI Committee Briefing at Appendix 3]

Table 5. – Proposed Option for Current Expenditure Savings

| Priority | Savings Options | Value £m |

EU Drawdown £m |

| 1 | IntertradeIreland | 1.6 | |

| 2 | TIL | 1.0 | |

| 3 | Economic Policy and Research | 0.6 | |

| 4 | Economic Infrastructure | 0.7 | |

| 5 | Energy Resource & Consultancy | 0.3 | |

| 6 | Tourism | 0.4 | 0.4 |

| Total | 4.6 | 0.4 |

Table 6. – Proposed Option for Capital Expenditure Savings

| Priority | Savings Options | Value £m |

EU Drawdown £m |

| 1 | Energy From Waste Projects | 0.6 | |

| 2 | Invest NI | 6.0 | |

| Total | 6.6 |

67. The most notable savings are £1.6 million from InterTradeIreland and £1.0 million from Tourism Ireland in current expenditure and £6.0 million from Invest NI in capital expenditure. Invest NI savings will probably come from expenditure reductions in land acquisition and development.

Committee Members’ Concerns relating to Spending Plan Adjustments

68. Individual Committee members expressed concerns in relation to some proposals. Concerns concentrated on InterTradeIreland, Tourism and Invest NI. There were two general concerns expressed. Firstly, in relation to 71% of DETI’s budget being already committed and secondly, in relation to lack of awareness, from the Departments evidence, of the impact that cuts will have on affected organisations.

69. Concerns expressed in relation to InterTradeIreland included:

- the risk that cuts could put the stimulation of trade at risk;

- the assertion that the economy here is based on the small and medium sized enterprise (SME) sector and the need to develop this sector across the island of Ireland.

70. Concerns expressed in relation to Tourism included:

- the need to strengthen the economy through stimulation of tourism;

- a perceived inconsistency between proposed cuts in Northern Ireland Tourist Board and Tourism Ireland and the Department’s ethos of building a dynamic economy.

71. Concerns expressed in relation to Invest NI included:

- the need to have adequate land available for business investment to take advantage of the economic upturn;

- the current level of vacant rental properties, owned by Invest NI; and

- the current level of undeveloped land owned by Invest NI and the need to balance between holding too much vacant land and being able to make land available if and when investment can be found.

Departmental Oral Briefing Response to Committee Concerns

72. Savings in InterTradeIreland and Tourism Ireland would have been coming in any case as this has been agreed by the relevant departments in both jurisdictions. The need for this funding for InterTradeIreland has not been demonstrated.

73. The other options open to DETI were savings as follows:

- £1 million to marketing in overseas markets;

- £1 million from the NITB Tourism Innovation Fund;

- £0.5 million from Invest NI’s trade budget;

- Cease all funding in the Belfast Visitor and Convention Centre and MATRIX;

74. Land acquisitions are being prioritised by Invest NI with land still being acquired Armagh, Newry, Omagh and Strabane.

75. The number of vacant properties in Invest NI is a small portion of the complete list (DETI agreed to provide details to the Committee).

76. DETI considers committed expenditure of 71% to be high. If it was much higher (80%+) DETI would have to cease all activities and only monitor existing commitments.

77. Current stocks of development land have not reduced as much as was expected. Land is therefore available. It is considered uneconomic to sell land in the current climate.

78. The Department provided a written response to the Committee outlining the impact of savings options on Invest NI, NITB, Tourism Ireland and InterTradeIreland. [See Appendix 3].

Committee for Finance and Personnel

79. The Committee for Finance and Personnel took evidence from DFP officials at its meeting on 20 January 2010 on the implications of the Review of 2010-11 Spending Plans for the Department. In response to the Review, DFP is required to make savings of £4.1m in current expenditure and £2.1m in capital expenditure, which equates to 2.4% and 12.3% respectively. In clarifying how these figures were determined, departmental officials advised that options were developed by various business areas and considered by the Departmental Board. In considering and agreeing the options put forward, the Board took account of the potential impact on the delivery of the Department’s PfG and PSA targets. The DFP briefing paper is included at Appendix 5 of this Report, together with a table illustrating the breakdown of proposed savings across DFP business areas.

80. The Committee noted that the Department provides front line services through the General Records Office (GRO) and Land and Property Services (LPS), both of which have been protected from the proposed savings in terms of current expenditure. A reduction of £0.3m is proposed for the LPS capital budget against a baseline of £2m. Taking into account that capital expenditure in LPS is forecast at £1.6m for 2009-10, it is not anticipated that this proposed reduction will impact on service delivery. Nevertheless, DFP officials have given an assurance that this will be kept under close review.

81. The Committee recognises that the budget for LPS was set in advance of the introduction of some 43 rating reforms, and the Agency has faced significant challenges as a result. During an evidence session with LPS officials on 17 February 2010, the Committee heard that, while it is not proposed that LPS will be required to make savings in current expenditure as a result of this Review, it nonetheless faces pressures of £11.2m for 2010-11. LPS has plans in place to manage this, which will include a bid for £5m in the in-year monitoring rounds, realisation of additional income and staff reductions. The Committee is concerned that LPS has had to rely on the allocation of additional funding in the monitoring rounds in each year of the three-year Budget period to alleviate, in part, the budget shortfall. The Committee is also anxious that further staff reductions should not have a detrimental impact on service delivery and the improved performance by LPS. Given the important role of LPS with regard to revenue and benefits, the Committee considers that it is essential a firm funding base is established for LPS for future years.

82. Apart from LPS, staff reductions were proposed across a number of other business areas to achieve savings, and it is anticipated these will be achieved mainly by a process of redeployment either across the Department, or in the wider Northern Ireland Civil Service. In response to members’ queries whether this could be regarded as true savings or simply a movement of costs from one business area to another, DFP officials made clear that staff will be redeployed to fill vacancies for which budgets currently exist. The Committee noted that further savings will also be realised through the closure of the Rating Policy Division as the raft of rating reforms comes to a natural end, and staff are redeployed to fill funded vacancies in other business areas.

83. The Committee is mindful that DFP has a disproportionately high share of higher-paid senior civil servants (SCS) compared to other departments, though it recognises that this is due, in part, to the professional grades which are essential in some business areas, for example the Departmental Solicitors Office. The Committee welcomes the modest reductions that have been made to date in the number of SCS within the Department, and recommends that a review of DFP’s senior management structure is undertaken with a view to identifying where further reductions could be made in this regard.

84. The Committee noted that estimated annual recurring cost of the recently agreed Equal Pay settlement is estimated at £3m for DFP, which will be an additional pressure on the 2010-11 budget.

85. The Committee noted that the £2.8m in capital slippage for HR Connect for 2009-10 will now be required in 2010-11, and that the Department hopes to address this through the in-year monitoring process. Given that this funding is required to meet contractual commitments, members questioned DFP officials from the Shared Services Organisation (SSO) on the implications of such a bid not being met, during a briefing on 27 January 2010. In response to subsequent correspondence on this matter, the Department has advised that capital budgets for other business areas may be reduced if such a bid was not successful.

86. The decision to move the Census forward to March 2011 means that expenditure planned for 2011-12 will now be incurred in 2010-11. The Committee has been advised that the existing budget baseline is therefore not sufficient. The Census is important in that it is used to determine allocations within the Barnett formula, and also within NI. Furthermore, the Census must be undertaken to fulfil EU Regulations. In this respect, the Committee believes that additional expenditure requirements relating to the Census should be afforded priority in the 2010-11 in-year monitoring process.

87. The Committee notes that reductions of £1.2m in current expenditure and £0.3m capital expenditure are proposed for Properties Division, and is concerned that failure to maintain the estate to an adequate standard will have cost implications for future years. The Committee further notes that the Department has declared a pressure to be managed of up to £5m for essential property maintenance, in relation to developing the office estate in line with the Workplace 2010 principles. The Department is currently undertaking a review of the work required to develop the office estate and the associated cost implications, and the Committee looks forward to being appraised of the outcome of this review.

88. Finally, the Committee notes that, in responding to members’ contributions to the “take note" debate, the Minister pointed out that the £26m for Invest to Save does not represents a budgetary cut but, rather, this money will be redistributed to the departments which make successful bids. Whilst the Committee is supportive of the Invest to Save concept, it has sought clarity on a range of issues in this regard. In response to a query around the criteria for assessing bids from departments, DFP has advised that each proposal “will be assessed in terms of the quantity of projected savings versus the level of upfront cost as well as the quality of the proposal in respect of, for example, deliverability". The Committee has also enquired as to whether the successful projects will focus on short-term savings or longer-term efficiencies, and also whether provision will be made for cross-departmental bids. In terms of its own position, the Department is currently giving consideration to the feasibility of the delivery of some projects within the parameters of the Invest to Save fund, though it has pointed out that deliverability within 2010-11 is a key issue. The Committee would welcome more information which would enable it to take a considered view and lend support to any such bids, where appropriate.

Committee for Health, Social Services and Public Safety

89. The Committee for Health, Social Services and Public Safety explained that it was unable to provide a substantive reply because Minister McGimpsey had not supplied a detailed breakdown of how he intends to implement the additional savings across his Department.

90. The Committee took evidence from the Minister and his officials on 28 January 2010. The Committee also took evidence from various Trade Unions on the same date.

91. The Minister has taken the position that the Department of Health, Social Service and Public Safety (DHSSPS) should be exempt from having to make any additional savings as outlined in the “Review of 2010 -11 Spending Plans for NI Departments" i.e. £92m in revenue and £21.5m in capital funding.

92. To back up his position, the Minister stated that there was rising demand for health and social care services. He quoted that there had been a 19.3% increase in day case admissions to hospitals since 2004/05 and a 7% increase in the number of inpatient admissions. The Minister referred to a £600m spending gap between NI and the rest of the UK and that according to Prof Appleby, the health service in NI was underfunded. He noted that the Department should be receiving more money and not facing cuts.

93. The Minister asked the Committee to keep in mind that health and social care services are delivered by people. Salaries and associated costs are the largest part of the budget and therefore it is very difficult to make the sudden and abrupt changes required by this spending review. Budget changes means changing staff resources, facilities and locations and this can not be done quickly.

94. Minister McGimpsey noted that the heaviest usage of the health service was by people in the first and last ten years of life (i.e. the young and elderly). These are vulnerable groups and therefore a detailed EQIA will be required.

95. While the Committee has some sympathy and understanding of the pressures facing the Minister, it has and will continue to push for the Minister to provide the detailed information as soon as possible.

96. The Committee would also ask that the Minister of Finance and Personnel provides information on the methodology used to decide the level of proposed additional savings that each department should make.

97. The Committee also heard from Trade Unions and noted with interest one particular point relating to the DFP document “Review of the 2010 -11 Spending Plans for NI Departments" as detailed below –

“The Committee need to be clear as to how the baseline before reduction has developed through 2008/2009 to 2010/11. Does the baseline for 2010 – 2011 include 3% efficiencies or the larger figure (4.5%) drawn down from the Chancellor’s 2009 ‘emergency’ statement? It is not clear from the DFP paper whether the £113 million has been cut from the 2010 base before these cuts arrived."

98. The Committee for Health, Social Services and Public Safety would ask if this aspect could be clarified by the Committee for Finance and Personnel.

Committee for the Office of the First Minister and deputy First Minister

99. The Committee for the Office of the First and deputy First Minister (OFMDFM) explained that it was due to receive a briefing on the Revised Departmental Expenditure Plans 2010 – 11 at its meeting on 20 January 2010. However no papers were received from the Department. The Committee was then scheduled to receive a briefing on the plans at its meeting of 27 January 2010, and although the meeting was cancelled, no papers were received from the Department. Again the Committee was scheduled to receive a briefing on the plans at its meeting of 3 February 2010 and again no papers were received. The Committee had no opportunity to scrutinise the plans before the “take note debate" on Tuesday 9 February 2010. The papers arrived from the Department on Tuesday evening. The Committee wish to put on record its concern over the continual late receipt of financial papers from the Department as this delay restricts the ability of this Committee to fulfil its scrutiny function.

100. The Committee has concerns about when decisions will be made about the Civic Forum and when an International Relations Strategy will be developed. This Strategy will be of importance to the promotion of NI on a positive basis in Europe, North America and elsewhere.

101. The Committee notes the work that the Department has done to address the outstanding number of appeals coming before the Planning Appeals Commission, down from 2,800 to 943. However, the Committee is concerned about whether there continues to be sufficient staffing resources and funding to handle the substantial number of area plans and Article 31 inquiries.

Committee for Regional Development

102. The Committee for Regional Development, at its meeting on 3 February 2010, considered its response to the Executive’s Revised Expenditure Plans for 2010-11 and decided to make the following comment in response to your Committee’s request for input.

103. Briefing was requested for the meeting of 27 January 2010 from the Department for Regional Development (DRD) on the following issues:

- details of the revised 2010-11 budget allocations for individual business areas;

- progress made in delivering PfG targets since April 2008;

- the proposed measures to be taken to deliver additional savings whilst at the same time minimising the impact on the delivery of priority frontline public services;

- improvements in public services that it is intended will be delivered in 2010-11 with revised budget allocations; and

- details of the implications in respect of Equality, Good Relations and Anti-Poverty.

104. Unfortunately, the Department indicated on 26 January 2010 that it was not yet in a position to brief the Committee on the Department’s Revised Expenditure Plans for 2010-11. In its letter of 26 January 2010, DRD offered an alternative date of 3 February 2010. The Committee accepted this rescheduled date, although it provided Members with little time to consider the detail of the Department’s Revised Expenditure Plans. Members also offered to make themselves, or the Chairperson and Deputy Chairperson, available in advance of the meeting on Wednesday for pre-briefing. Despite these efforts, the Department remained unable to brief the Committee at the meeting of 3 February 2010.

105. In the absence of this briefing, the Committee is unable to make any comment on the Revised Expenditure Plans for 2010-2011. At the meeting of 27 January 2010, the Committee received a useful briefing from the Research Service on the role of infrastructure investment in stimulating growth during a recession. This has been published on the Assembly’s web pages and Members decided to forward it to the Committee for Finance and Personnel for information (see Appendix 3).

106. The Committee for Regional Development has always had constructive and co-operative engagements with the Department on the annual Budget and in-year monitoring, and for this reason is disappointed that it has not been possible for the Department to brief the Committee on what is a very important budgetary year. The Committee will be writing to the Minister for Regional Development, expressing its disappointment and seeking an explanation of this situation.

Committee for Social Development

107. The Committee for Social Development considered revised departmental expenditure plans at its meetings of 28 January and 4 February 2010.

108. The Committee was provided with limited written information on which to base its analysis. The Department indicated that a Ministerial briefing on the revised expenditure plans was expected to be provided in late February or early March.

109. In respect of capital expenditure reductions (£16.9m), the Committee was advised that cuts could not be allocated until a decision had been reached by the Department of Finance and Personnel in respect of the treatment of slippage associated with the Royal Exchange programme.

110. In relation to resource expenditure reductions (£13.4m), the Department advised that cuts of around 2.6% had been allocated to each of the major resource groups. The Committee questioned the validity and effectiveness of apportioning resource reductions in this way. The Department would not provide further information on the impact on individual programmes or front-line services.

111. The Department indicated that the ongoing costs of the NICS Equal Pay settlement would amount to approximately £12m in 2010-11 but did not set out how these additional costs were to be met from resource budgets.

112. Given the Committee’s dissatisfaction with the departmental response, the Committee Chairperson wrote to the Minister seeking an urgent briefing on the Equality, Good Relations and Anti-Poverty implications of the reductions in both the capital and current expenditure budget for the Department for Social Development (DSD) (see Appendix 3). The Committee for Social Development is was awaiting a response to this request.

113. In terms of the proposed reprioritisation of the spending allocations between departments, the Committee for Finance and Personnel recommends that, in finalising the revised Budget 2010–11, the Minister of Finance and Personnel and the wider Executive take on board the concerns, conclusions and recommendations contained in the submissions from the Assembly statutory committees, which have been included in this report.

Other Evidence Received

114. The Committee received correspondence from Children in Northern Ireland (CiNI), the Ulster Gliding Club Ltd (UGC) and The Stroke Association NI, which are provided at Appendix 6. In its correspondence to the Minister, copied to the Committee, CiNI notes its concern at the level of public engagement on the expenditure proposals, and seeks clarification from the Minister on how this compares to the obligations set out under Section 75 of the Northern Ireland Act 1998. CiNI also notes that proposals have not been published on all departmental websites, and meaningful consultation is therefore “impossible". CiNI has requested that the outcome of DFP’s review of the Executive’s budget process is published as a matter of urgency.

115. In its correspondence, UGC “strongly objects" to the proposed cut to DCAL’s budget for 2010-11. UGC believes that Sport NI will not remain unaffected by such a cut, which will have an adverse impact on people’s health, particularly those in lower socio-economic groups. UGC notes that the Executive is committed to improving the health of individuals and communities, and asks that the proposed cut in DCAL’s budget is reversed. Similarly, the Stroke Association NI notes its concern at the proposed cut for DHSSPS and believes it is inevitable that front line services will be affected. It states that “this lack of priority and protection for Health is extremely worrying" and calls for DHSSPS to be exempt from the proposed reductions.