Committee for Finance and Personnel Report (2007-2011 Mandate)

Report on the Inquiry into the Scrutiny of the Northern Ireland Executive’s Budget and Expenditure

Report-on-Scrutiny-of-Executives-Budget.pdf (1.07 mb)

Session 2008/2009

First Report

Committee for Finance and personnel

Report on the Inquiry into the

Scrutiny of the Northern Ireland

Executive’s Budget and Expenditure

Stage 1: Submission to the Review of the Northern Ireland Executive’s Budget Process

TOGETHER WITH THE MINUTES OF PROCEEDINGS, MEMORANDA

AND WRITTEN SUBMISSIONS RELATING TO THE REPORT

Ordered by the Committee for Finance and Personnel to be printed 22 October 2008

Report: 15/08/09R (Committee for Finance and Personnel)

This document is available in a range of alternative formats.

For more information please contact the

Northern Ireland Assembly, Printed Paper Office,

Parliament Buildings, Stormont, Belfast, BT4 3XX

Tel: 028 9052 1078

Membership and Powers

Powers

The Committee for Finance and Personnel is a Statutory Departmental Committee established in accordance with paragraphs 8 and 9 of the Belfast Agreement, Section 29 of the Northern Ireland Act 1998 and under Assembly Standing Order 46. The Committee has a scrutiny, policy development and consultation role with respect to the Department of Finance and Personnel and has a role in the initiation of legislation.

The Committee has the power to:

- consider and advise on Departmental budgets and annual plans in the context of the overall budget allocation;

- approve relevant secondary legislation and take the Committee Stage of primary legislation;

- call for persons and papers;

- initiate inquiries and make reports; and

- consider and advise on matters brought to the Committee by the Minister of Finance and Personnel.

Membership

The Committee has eleven members, including a Chairperson and Deputy Chairperson, with a quorum of five members.

The membership of the Committee since its establishment on 9 May 2007 has been as follows:

Mr Mitchel McLaughlin (Chairperson)

Mr Simon Hamilton (Deputy Chairperson)

Dr Stephen Farry Mr Declan O’Loan

Mr Fra McCann Mr Ian Paisley Jnr*

Ms Jennifer McCann Ms Dawn Purvis

Mr David McNarry** Mr Peter Weir

Mr Adrian McQuillan

* Mr Ian Paisley Jnr replaced Mr Mervyn Storey on 30 June 2008.

* * Mr David McNarry replaced Mr Roy Beggs on 29 September 2008.

Inquiry Terms of Reference

Terms of Reference

The Committee for Finance and Personnel will undertake the following three-stage exercise aimed at maximising the Assembly’s contribution to the NI Executive budget process and enhancing the role of Assembly statutory committees and members in budget and financial scrutiny:

Stage 1

1. To contribute to the ongoing Review of the NI Executive Budget Process by the Department of Finance and Personnel (DFP) by

a) examining the budget scrutiny processes in other applicable legislatures, for the purpose of identifying lessons for NI;

b) co-ordinating the views of the Assembly’s statutory committees on the strengths and weaknesses of the 2007 Budget process; and

c) reporting on the outcome of (a) and (b) to DFP by end of October 2008.

2. To consider and respond to the findings from DFP’s Review.

Stage 2

3. Following confirmation of the Executive’s future budget process, to review the resources available for assisting Assembly statutory committees and members in undertaking budget and financial scrutiny and to put forward a set of practical recommendations for enhancing the capacity of the Assembly in this regard.

Stage 3

4. To review the processes for the in-year monitoring of departmental expenditure by the Assembly and its statutory committees, with a view to making recommendations to further improve the operation of the processes and to facilitate more effective scrutiny. This review to take place after the end of the current financial year, when the statutory committees and their respective departments will have experience of operating the recently introduced format for monitoring round information.

Table of Contents

Inquiry Terms of Reference

List of Abbreviations used in the Report

Executive Summary

Key Recommendations

Overview of Stage 1 of the Inquiry

Background

Issues from Committee for Finance and Personnel Response

Issues from other Statutory Committee Responses

Next Steps

Appendix 1 – Terms of Reference for Department of Finance and Personnel’s Review of the Northern Ireland Executive Budget Process

Appendix 2 – Northern Ireland Assembly Research Papers

Comparative Analysis: Budget Scrutiny in Northern Ireland and Other Legislatures

The Scottish Parliament Finance Committee’s Review of the Budget Process:

Points on Interest for Northern Ireland 35

Appendix 3 – Written Submissions

1. Committee for Culture, Arts and Leisure

2. Committee for Education

3. Committee for Employment and Learning

4. Committee for Enterprise, Trade and Investment

5. Committee for the Environment

6. Committee for Finance and Personnel

7. Committee for Health, Social Services, and Public Safety

8. Committee for the Office of the First Minister and deputy First Minister

9. Committee for Regional Development

10. Committee for Social Development

Appendix 4 – Minutes of Proceedings (extracts)

2 July 2008

10 September 2008

15 October 2008

22 October 2008 (unapproved)

List of Abbreviations used in the Report

| AER | Annual Evaluation Report |

| BEL | Budget Expenditure Lines |

| CAL | Committee for Culture, Arts and Leisure |

| CFP | Committee for Finance and Personnel |

| CIPFA | The Chartered Institute of Public Finance and Accountancy |

| CSG | Consultative Steering Group |

| CSR | Comprehensive Spending Review |

| DEL | Department for Employment and Learning |

| DFP | Department of Finance and Personnel |

| DPR | Departmental Position Reports |

| DRD | Department for Regional Development |

| EDF | Executive Programme Funds |

| EPR | Executives Position Report |

| FIAG | Financial Issues Advisory Group |

| GDP | Gross Domestic Product |

| HLIA | High Level Impact Assessment |

| HMT | Her Majesty’s Treasury |

| ISNI | Investment Strategy Northern Ireland |

| MEGs | Main Expenditure Groups |

| MLA | Member of the Legislative Assembly |

| MSP | Member of the Scottish Parliament |

| NI | Northern Ireland |

| OECD | Organisation for Economic Co-operation and Development |

| OFMdFM | Office of the First and deputy First Minister |

| PDC | Public Dividend Capital |

| PfG | Programme for Government |

| PFI | Private Finance Initiative |

| PKF | Parnell Kerr Foster |

| PPP | Public Private Partnership |

| PSA | Public Service Agreements |

| RoI | Republic of Ireland |

| RoS | Registers of Scotland |

| RRI | Reinvestment and Reform Initiative |

| SPAs | Spending Programme Areas |

| SPIC | Scottish Parliament Information Centre |

| SPS | Scottish Prison Service |

| SWBG | Scottish Women’s Budget Group |

| UK | United Kingdom |

| USA | United States of America |

| WCF | Welsh Consolidated Fund |

Executive Summary

The scrutiny of public expenditure is a vital parliamentary function, which has been a significant feature of business in the Northern Ireland Assembly in both the current and previous mandate. This report contains the output from the first stage of a three-stage ‘Inquiry into the Role of the Northern Ireland Assembly in Scrutinising the Executive’s Budget and Expenditure’, which the Committee for Finance and Personnel commenced in July 2008. The overarching aim of the Inquiry is to maximise the Assembly’s contribution to the Northern Ireland budget process and enhance the role of Assembly statutory committees and members in budget and financial scrutiny.

The Committee framed the terms of reference for its Inquiry to complement and contribute to a parallel ‘Review of the NI Executive Budget Process’ which the Department of Finance and Personnel (DFP) commenced in May 2008. The Committee’s work would focus on the internal arrangements within the Assembly and between the Assembly and the Executive; whereas the DFP Review would be wider in scope and would involve engaging a range of key stakeholders. Stage 1 of the Committee Inquiry would contribute to the DFP Review by identifying potential lessons from the budget scrutiny process in other applicable legislatures and by co-ordinating the views of the Assembly’s statutory committees on the strengths and weaknesses of the 2007 budget process.

This report on Stage 1 of the Inquiry makes a range of recommendations to DFP, on behalf of the Assembly statutory committees. These include suggested improvements to the budget timetable and documentation, departmental budget submissions, and the plenary aspects of the budget process. The contributions from the committees are supplemented with research papers which highlight potential considerations for the DFP Review.

The research provided to the Committee has indicated both that the Assembly has a relatively strong committee system, including in terms of the powers of committees to undertake budget scrutiny, and that the budget scrutiny process in the first mandate compared favourably with other legislatures in terms of the opportunity for input by committees. The challenge now, therefore, is to establish a future process which builds on that which existed in the first mandate and maximises the contribution from elected representatives in the Assembly. The recommendations in this report aim to inform the ongoing DFP Review in this regard, with a view to seeing improved arrangements in place for the 2009 Budget process.

Key Recommendations

Arising from Stage 1 of its Inquiry, the Committee for Finance and Personnel makes the following recommendations to the Department of Finance and Personnel:

1. That a budget process is established which maximises the opportunity for Assembly committees to provide early input. The future process should include a stage similar to the Departmental Position Report/Executive’s Position Report stage of the process in the first mandate, which should be timetabled to ensure completion before the Assembly goes into summer recess. (Paragraph 6)

2. That a set timetable is agreed to determine when departments will provide information to committees. (Paragraph 7)

3. That there would be benefit, in terms of transparency and scrutiny, from fuller and more standardised information on departments’ bids and their outcomes being published as part of the draft Budget process. (Paragraph 7)

4. That, in addition to information on bids for additional resources, there is a case for departments also providing their committees with a critical evaluation of the programmes and resources within their existing baselines, including how these support PfG priorities. (Paragraph 8)

5. That DFP should follow through on the recommendation in the PKF Review of Forecasting and Monitoring, published in June 2007, that the planning and budgeting process should move away from the existing incremental approach and towards a system which provides a transparent link between inputs and outputs. (Paragraph 8)

6. That supporting documents, such as departmental Efficiency Delivery Plans and Investment Delivery Plans, should be published alongside the draft Budget, PfG and ISNI documents and that these should be rigorous in detailing how and when the planned efficiencies and capital investments are to be achieved. (Paragraph 9)

7. That there should be a closer alignment between the PfG and the Budget documents; in particular a more visible linkage between PfG priorities and goals, PSA objectives and the allocations, departmental objectives and spending areas in budgets. (Paragraph 10)

8. That in the interests of transparency, the draft Budget and ISNI documents should include information on the extent to which the overall capital investment will be based on anticipated PFI, the extent to which the capital allocations for individual departments will draw on RRI borrowing, together with accumulated debt under RRI and the projected level of loan charges during 2008-11. The Committee calls for this recommendation to be acted on in respect of future draft Budget and ISNI documents. (Paragraph 11)

9. That consideration should be given to streamlining the plenary aspects of the budget process to avoid repetition of debate, once the Assembly has approved the Budget. (Paragraph 12)

10. That, as part of its Review of the NI Executive Budget Process, DFP also takes on board the conclusions and recommendations contained in the attached responses from the other statutory committees to the questions posed by DFP on the 2007 budget process. (Paragraph 13)

Overview of Stage 1 of the Inquiry

Background

1. In July 2008 the Committee for Finance and Personnel agreed a terms of reference for an ‘Inquiry into the Role of the NI Assembly in Scrutinising the Executive’s Budget and Expenditure’. This would aim to maximise the Assembly’s contribution to the NI Executive budget process and enhance the role of Assembly statutory committees and members in budget and financial scrutiny. The Inquiry would have an inward focus on processes within the Assembly and between the Assembly and the Executive. It would also run in tandem with a wider DFP Review of the NI Executive Budget Process (Appendix 1). The Committee agreed that, given the internal focus of the Inquiry and the fact that DFP would be engaging with key stakeholders as part of its Review, the Committee would not seek external evidence from the public at this stage. Rather, the Committee decided to frame the terms of reference for its Inquiry to contribute to and complement the wider DFP Review.

2. Stage 1 of the Committee’s Inquiry will contribute to the ongoing DFP Review of the NI Executive Budget Process by:

a) examining the budget scrutiny processes in other applicable legislatures, for the purpose of identifying lessons for NI;

b) co-ordinating the views of the Assembly’s statutory committees on the strengths and weaknesses of the 2007 budget process; and

c) reporting on the outcome of (a) and (b) to DFP by the end of October 2008.

3. The output from Stage 1 of the Inquiry, which was agreed by the Committee at its meeting on 22 October, is attached. As part of its deliberations, the Committee commissioned two papers from Assembly Research which are attached as Appendix 2. The first of the two research papers provides a comparative analysis of budget scrutiny in NI and other legislatures and highlights potential considerations for the ongoing DFP Review. The second research paper examines the ongoing review of the budget process in Scotland by the Scottish Parliament Finance Committee. Whilst the Scottish review has not been concluded, the research paper draws out some emerging themes which will help to inform DFP’s Review of the process in NI. In commending both research papers to DFP for consideration, the Committee particularly recommends that the Department, in finalising its Review, takes account of any applicable findings and recommendations from the review of the budget process in Scotland.

4. To facilitate statutory committee consideration of the strengths and weaknesses of the 2007 budget process, DFP provided twelve questions for each committee to answer. The Committee for Finance and Personnel’s full response to these questions is at Appendix 3. The Committee also co-ordinated the views of the other statutory committees and these have been included in full at Appendix 3.

Committee for Finance and Personnel Response

5. The key issues arising from the Committee for Finance and Personnel’s response (Appendix 3) are as follows:

Budget Timetable

6. The Committee considers that the ability of statutory committees to influence budget decisions is greatest at the early stages of the budget cycle, a theme which is also emerging from the evidence to the Scottish Parliament Finance Committee’s Review of the Budget Process in Scotland. The Committee therefore recommends that a budget process is established which maximises the opportunity for Assembly committees to provide early input. The future process should include a stage similar to the Departmental Position Report/Executive’s Position Report stage of the process in the first mandate, which should be timetabled to ensure completion before the Assembly goes into summer recess.

Departmental Budget Submissions

7. The Committee would recommend that a set timetable is agreed to determine when departments will provide information to committees. The Committee also reiterates the recommendation in its Report on the Executive’s Draft Budget 2008-2011, ‘that there would be benefit, in terms of transparency and scrutiny, from fuller and more standardised information on departments’ bids and their outcomes being published as part of the draft Budget process.’

8. The Committee considers that, in addition to information on bids for additional resources, there is a case for departments also providing their committees with a critical evaluation of the programmes and resources within their existing baselines, including how these support PfG priorities. Related to this, the Committee calls on DFP to follow through on the recommendation in the PKF Review of Forecasting and Monitoring, published in June 2007, that the planning and budgeting process should move away from the existing incremental approach and towards a system which provides a transparent link between inputs and outputs.

9. The Committee believes that supporting documents, such as departmental Efficiency Delivery Plans and Investment Delivery Plans, should be published alongside the draft Budget, PfG and ISNI documents and that these should be rigorous in detailing how and when the planned efficiencies and capital investments are to be achieved.

Budget/Programme for Government Links

10. In its Report on the Executive’s Draft Budget 2008 - 2011, the Committee recommended that there should be a closer alignment between the PfG and the Budget documents; in particular a more visible linkage between PfG priorities and goals, PSA objectives and the allocations, departmental objectives and spending areas in budgets. This is a theme emerging from the other statutory committee responses and, indeed, the Committee notes that the evidence to the ongoing Review of the Budget Process in Scotland is also suggesting the need for greater transparency and clarity in the linkage between spending and outcomes.

Capital Allocations in ISNI

11. In particular, the Committee considered that there was insufficient detail in the draft Budget document (and in ISNI) on the financing of the planned capital investment. The Committee recommended that in the interests of transparency, the draft Budget and ISNI documents should include information on the extent to which the overall capital investment will be based on anticipated PFI, the extent to which the capital allocations for individual departments will draw on RRI borrowing, together with accumulated debt under RRI and the projected level of loan charges during 2008-11. The Committee calls for this recommendation to be acted on in respect of future draft Budget and ISNI documents.

Plenary Process

12. The Committee considers that the focus for improving the plenary aspects of the budget process may need to be on the Supply Resolution debates and the plenary stages of the associated Budget Bills. In particular, consideration should be given to streamlining the plenary aspects of the budget process to avoid repetition of debate, once the Assembly has approved the Budget. This point was highlighted in the comparative research which the Committee commissioned.

Other Statutory Committee Responses

13. The responses from the other statutory committees on the strengths and weaknesses of the 2007 budget process are at Appendix 3. The key issues emerging from the responses, many of which reflect the aforementioned recommendations from this Committee, are summarised below. The Committee recommends that, as part of its Review of the NI Executive Budget Process, DFP also takes on board the conclusions and recommendations contained in the attached responses from the other statutory committees to the questions posed by DFP on the 2007 budget process.

Budget Timetable

14. The timetable for statutory committee scrutiny and public consultation on the Draft Budget was too short, though this was to a large extent unavoidable. In the year prior to the setting of a 3-year Budget, there needs to be intensive and early engagement (well before summer recess) on emerging priorities and departmental positions.

15. Committees should also be engaged annually on any review of PfG priorities (taking account of progress against PfG targets and the changing policy and financial environment) and subsequently in considering proposals for significant changes in budgetary allocations. It was considered that the publication of an annual report illustrating spend and delivery would greatly improve budget scrutiny. A similar theme, in terms of outcomes being assessed as a basis for going forward, was also highlighted in the comparative research provided to the Committee for Finance and Personnel.

Departmental Budget Submissions

16. There was a general difficulty in obtaining detailed information to enable sufficient scrutiny and prioritisation. Without information on costs it is impossible to determine where spending could be scaled back. The late finalisation of efficiency delivery plans and difficulties in identifying funding for cross-cutting priorities also posed problems. The Committee for Regional Development received bids in the DFP pro forma format and found this to be useful. There was a call for Departmental Position Reports to be reintroduced to provide advance appraisal and a basis for subsequent committee scrutiny.

Budget/Programme for Government Links

17. There is considerable room for improvement in the clarification, simplification and harmonisation of the terminology in the PfG, ISNI and Budget documents. The departmental objectives used to organise the Budget are at a different level to those in the PSAs. Aligning PSAs more closely with Budget documents would allow an assessment of what is to be achieved with the allocated funding and enhance Committee scrutiny. As PfG outcomes were not costed, it was difficult to assess the adequacy of bids. One Committee suggested a preliminary Assembly debate on the priorities in the draft PfG before commencement of the Budget process.

Bid Prioritisation

18. Whilst prioritisation of bids is considered essential, there was limited scope for manoeuvre once inescapable bids had been accounted for. Some bids were classified as ‘inescapable’ and others as ‘committed.’ It was unclear which had higher priority.

Impact of Committee Views

19. There was little evidence of issues raised by committees being addressed in the revised Budget and subsequently a call is made for a formal feedback mechanism to address post-budget scrutiny (e.g. Departmental statements to the Assembly after the Budget has been passed).

Capital Allocations in ISNI

20. The period beyond the second year of the Budget and ISNI is only indicative. This is a less than optimal method of planning large capital infrastructure projects and makes it harder to achieve value-for-money as the market is not as well prepared as it might be. Given the importance of infrastructure investment in tackling social need, details of the geographical distribution of investment should be published with the ISNI. The important link between ISNI and capital realisations was also emphasised.

Cross-departmental Proposals

21. Consideration should be given to a system of financial incentives and penalties for the delivery of cross-departmental priorities. The large number of cross-cutting PSAs make it difficult for committees to monitor performance and relate it to the Budget. A more robust system is needed to identify measures to deliver cross-cutting priorities and for monitoring the level of funding allocated to them. The Committee for the Environment expressed concern at the lack of cross-departmental working in practice and the low priority placed on cross-cutting objectives by individual departments.

Public/Stakeholder Consultation Responses

22. Oral evidence from key stakeholders was useful for highlighting probable impact on services. However more time was needed to facilitate more appropriate stakeholder engagement.

Plenary Process

23. The Ministerial Statement on the Draft Budget is embargoed until the statement commences which does not give members an opportunity to contribute fully.

High Level Impact Assessments (HLIAs)

24. Whilst several committees did not see the outcome of the HLIAs, some who did expressed concern at the lack of quantifiable or challengeable information.

Committee Role

25. There may be a need for specialist resources to provide standing or ad hoc technical advice to support committees’ challenge and scrutiny functions (an issue which the Committee for Finance and Personnel will consider during the next stage of its ongoing Inquiry).

Draft/ Revised Budget Documents

26. More information may be helpful for stakeholders in the public consultation. It should be clearer how changes in resources relate to changes in priorities and new interventions being supported by Budget allocations should be explicit.

Next Steps

27. Following a briefing from DFP officials on 12 November 2008, the Committee for Finance and Personnel will consider and respond to the findings from DFP’s Review. Once the Executive’s future budget process has been confirmed, the Committee will undertake Stage 2 of its Inquiry: ‘to review the resources available for assisting Assembly statutory committees and members in undertaking budget and financial scrutiny and to put forward a set of practical recommendations for enhancing the capacity of the Assembly in this regard.’

Appendix 1

Terms of Reference for Department of Finance and Personnel’s Review of the Northern Ireland Executive Budget Process

Terms of Reference for DFP Review

DFP Review of NI Executive Budget Process

Terms Of Reference

Background

1. Upon the restoration of devolution, in May 2007, the incoming Finance Minister assumed responsibility for a Budget process that had started a considerable time before, under the oversight of direct rule Ministers. However in the period between May and October the Finance Minister was able to draw up spending proposals for the next three years, in consultation with his Ministerial colleagues that were approved by the Executive as basis for public consultation between October and January. In January a final set of Budget proposals were approved by the Executive and Assembly.

2. While this reflected a successful outcome for the first Budget process conducted under the new Executive and Assembly, the Finance Minister has concluded that it would be valuable to review the processes (as distinct from the outcomes) followed during this first exercise to ensure that he and his officials in DFP can make improvements where appropriate before the next local Budget exercise is carried out, most likely in 2009.

3. In light of the fact that there will not be a national Spending Review in 2008, and hence that there will be limited, if any, additional resources available for allocation in 2009-10, the Executive agreed on 13 March 2008 that there should not be a substantive local Budget process this year, but instead a strategic stocktake of the position in the autumn. This provides some time and capacity within DFP to undertake the above review of the Budget process followed last year.

Objectives

4. The overall objective of the review is to consider the arrangements for future Budget processes; to seek to further improve and embed the linkages between spending allocations, and the Programme for Government (PfG) and to establish stronger and more explicit linkages between the allocation of funding to Departments and the delivery of outcomes approved by the Executive. The review will also look at future arrangements for direct public engagement, in the context where elected representatives in the Assembly now have a direct input to the Budget process, and ultimate responsibility for approving the Budget outcome.

5. The review will consider and make recommendations in the following areas:

- Linkage between Budget process and Programme for Government;

- Management of capital investment proposals;

- Engagement by departments with Statutory Committees of the Assembly;

- Supporting evidence to be provided by departments for the Budget process and in particular the content of spending proposals;

- Scope for greater cross-departmental co-operation in the funding of services;

- Consultation on draft proposals, including consultation with the statutory Committees of the Assembly; and,

- The integration of Statutory Equality and Anti-Poverty considerations within the Budget process.

Methodology

6. The review will seek the views of Departments and key stakeholders regarding the strengths and weaknesses of the most recent process. The Finance and Personnel Committee, in particular, has indicated a keenness to be involved at an early stage in improving the Budget process. Although evidence will be sought from a range of sources the main input will be from structured interviews. It will also be important that the review considers the approach to the Budget process in the rest of the UK, focusing on the parallel devolved administrations in Scotland and Wales.

Output

7. The output of the review will be a report by DFP officials to the Finance Minister setting out an assessment of the process as well as recommendations for improvement.

8. It is intended the review will report by autumn 2008 in time to inform the preparation for the 2009 Budget process. A proposed timetable of the key milestones is attached in Annex A.

Review Team

9. The Review Team will be comprised of a small number of officials in Central Expenditure Division working under the direction of DFP senior management.

Department of Finance and Personnel

May 2008

Annex A

Draft Timetable for the 2007 Budget Review

| Key Milestones | Target Date |

| Gather evidence on Budget process in other regions focusing on Scottish, Welsh and Irish systems | End of July |

| Gather evidence on the strengths and weaknesses of 2007 Budget process from: Assembly Committees; Departments; and, key stakeholders | End of August |

| Produce a draft report for consideration by the Finance Minister | End of October |

| Report to the Executive | End of November |

Appendix 2

Northern Ireland Assembly Research Papers

Research and Library Services

Research Paper

28/08/08

Comparative Analysis: Budget Scrutiny in Northern Ireland And Other Legislatures

Jodie Carson

Research Officer

Research Papers are compiled for the benefit of Members of The Assembly and their personal staff. Authors are available to discuss the contents of these papers with Members and their staff but cannot advise members of the general public.

Introduction

This paper carries out a comparative analysis of budget scrutiny processes in Northern Ireland, Scotland and Wales . It is intended to provide the necessary background to assist the Committee for Finance and Personnel in its contribution to the Department of Finance and Personnel’s Review of the NI Executive Budget Process. The paper begins by highlighting the role of the legislature and committees in ensuring effective budget scrutiny. The scrutiny processes of the devolved administrations are then compared and a number of other considerations presented.

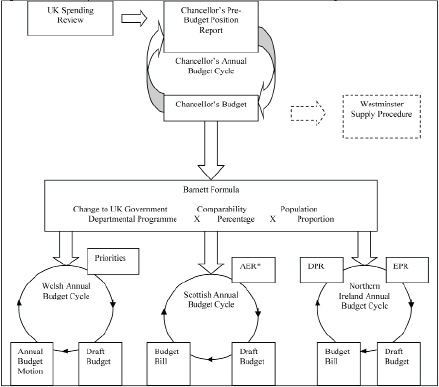

Background: The UK Budget Framework

Government funding in the UK devolved administrations continues to be determined by central Spending Reviews. However, the allocation of public expenditure across services is under the control of the devolved administrations. The relationship between the Chancellor’s Budget and those of the devolved administrations is depicted below:

Figure 1: Relationship between Chancellor’s and devolved administrations’ Budgets

* This stage in the Scottish Budget Process occurs during spending years only

1. Legislature / Committee Involvement: International Comparisons

Before examining the budget and scrutiny processes of the devolved administrations in more detail, this section considers the extent and duration of legislature / committee involvement in other regions. This provides a context within which to consider the processes in Northern Ireland, Scotland and Wales.

1.1 The Role Of The Legislature In Scrutiny

Legislative participation is becoming increasingly recognised as an essential component of effective budget scrutiny. Accordingly, there has been a recent resurgence in the influence of national legislatures therein. The role of a legislature in a budget process is to scrutinise and authorise revenues and expenditures, and to ensure the budget is properly implemented. If legislative participation is effective, it ensures essential checks, enhances openness, facilitates public debate, and provides a platform for wider input. In practice, a legislature’s engagement in the budget process depends upon two factors: its powers of amendment, and the extent to which these are exercised:

1.1.1 Powers Of Amendment

The scope for legislature involvement is fundamentally dependent upon its powers of amendment. These are usually contained in a country’s written constitution; however they might also be based on convention / parliamentary rules or determined by ordinary legislation.

Generally, greater powers of amendment enable more legislature influence. The extent (and effect) of legislature engagement in budget processes varies; whereas some legislatures actually formulate the budget, others approve executive budget proposals without changes. The figure below describes the different types of legislature involvement:

Figure 2: A Typology of the Budget Policy Impact of Legislatures

Budget-Making Legislatures have the capacity to amend or reject the budget proposal of the executive, and the capacity to formulate and substitute a budget of their own.

Budget-Influencing Legislatures have the capacity to amend or reject the budget proposal of the executive, but lack the capacity to formulate and substitute a budget of their own.

Legislatures With Little Or No Budgetary Effect lack the capacity to amend or reject the budget proposal of the executive, and to formulate and substitute a budget of their own. They confine themselves to assenting to the budget as it is placed before them.

Source: Wehner, J, Back from the Sidelines? World Bank 2004

In practice, the first category of legislatures, ‘budget-making’, is rare, (the United States is one example - congress determines its own budget policy and ascertains departmental spending and taxation measures accordingly). The majority of legislatures tend to approve the Executive’s budget after making only minor changes. Known as ‘Budget-influencing legislatures’, these include Scandinavia, Republic of Korea, most of continental Europe and Latin America.

At the other end of the spectrum are legislatures with little or no budgetary effect; where the draft budget is generally approved without changes. In these Westminster-type parliaments any successful amendment to the budget is perceived as a vote of no confidence in the government. Examples include Australia, Britain, and New Zealand. Figure 3 summarises the powers of amendment in OECD countries:

Figure 3 Formal Legislative Powers to Amend the Budget in OECD countries

| Rights | Number (%) | Countries |

|---|---|---|

| Unlimited powers to amend the budget | 17 (56.7) | Austria, Belgium, Denmark, Finland, Germany, Hungary, Iceland, Italy, Luxembourg, Netherlands, New Zealand, Norway, Portugal, Slovakia, Sweden, Switzerland, USA |

| Amendment powers, but no power to change totals | 3 (10) | Czech Republic, Mexico, Poland |

| Powers to decrease proposed expenditure / revenues | 2 (6.7) | Canada, United Kingdom |

| No amendment powers | 1 (3.3) | Greece |

| Other | 7 (23.3) | Australia, France, Ireland, Japan, South Korea, Spain, Turkey |

| Total | 30 (100) |

Source: OECD, Budget Practices and Procedures Survey, (2007)

1.1.2 The Extent to Which Powers are Exercised

This is the second determinant of legislature involvement:

Figure 4 Does the Legislature Generally Approve the Budget Presented by Government?

| Country | No changes | Minor changes | Significant changes |

|---|---|---|---|

| Australia |

X

|

||

| Austria |

X

|

||

| Canada |

X

|

||

| Czech Republic |

X

|

||

| Denmark |

X

|

||

| Finland |

X

|

||

| France |

X

|

||

| Germany |

X

|

||

| Greece |

X

|

||

| Hungary |

X

|

||

| Iceland |

X

|

||

| Ireland |

X

|

||

| Italy |

X

|

||

| Japan |

X

|

||

| Korea (Republic of) |

X

|

||

| Mexico |

X

|

||

| The Netherlands |

X

|

||

| New Zealand |

X

|

||

| Norway |

X

|

||

| Poland |

X

|

||

| Portugal |

X

|

||

| Spain |

X

|

||

| Sweden |

X

|

||

| Switzerland |

X

|

||

| Turkey |

X

|

||

| United Kingdom |

X

|

||

| United States |

X

|

||

| Total (%) |

6 (22%)

|

17 (63%)

|

4 (15%)

|

Source: OECD, The OECD Budgeting Database, 2002

1.1.3 The Duration of Legislature Involvement

Generally, the more time allocated to scrutiny, the greater the legislatures’ potential influence. This varies considerably between countries; in the US, Congress spends at least eight months debating the Budget, whereas other legislatures only have one month. The international experience suggests that a national legislature requires a minimum of 3-4 months for effective consideration of the Budget.

1.2 The Role of Committees In Scrutiny

Assemblies can be divided into two categories on the basis of the extent of committee engagement; ‘working assemblies’ are committee-orientated, whereas ‘talking assemblies’ are chamber-orientated. The House of Commons is an example of a talking assembly, whereas the American Congress is better defined as a working assembly.

A committee orientated (or ‘working’) system is defined as encompassing inter alia three functions :

- Consideration of bills and financial proposals;

- Scrutiny of government administration and past expenditure;

- Investigation of matters of general public concern.

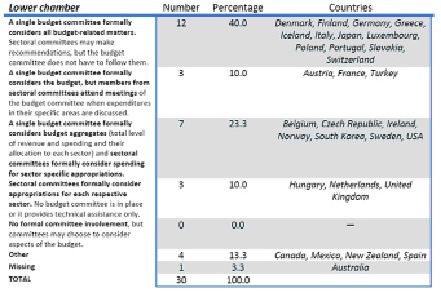

The importance of effective committee systems in the budget process is becoming increasingly acknowledged. Some legislatures have a separate finance or budget committee dedicated to this purpose; the rationale for this is the avoidance of ‘selfish’ scrutiny by the Subject Committees. Figure 5 summarises the different budget-related committee systems in OECD countries:

Figure 5: What is the committee structure for dealing with the Budget?

Source: http://webnet4.oecd.org/budgeting/Budgeting.aspx

1.3 Determinants of Effective Budget Scrutiny

The literature suggests that the effectiveness of committees in the Budget process depends on the following factors :

- The location of amendment powers, i.e. whether committees have powers of amendment

- Time allocated to committee debate relative to total time available for Budget consideration;

- Committee involvement, i.e. which committees are involved in the budgetary process and the relationship between them

- Access to independent research capacity and analysis by specialised research staff enables effective scrutiny

- Access to departmental information should be timely and should comprise that on the implementation and impact of the current Budget and the development of future Budgets.

2. Comparative Analysis - Northern Ireland, Scotland and Wales

This section presents information on the comparative practices of budget scrutiny in Northern Ireland and the other UK devolved administrations. The Republic of Ireland (ROI) is excluded from the analysis since the relatively weak budgetary powers held by the Dail render it less applicable. Parliamentary involvement in the Irish budget is limited; the Cabinet’s proposals cannot be amended and committees’ scrutiny is limited – the most influential committee is the Public Accounts Committee, which is concerned ex post budget execution rather than the ex ante budget .

Accordingly the comparative analysis is restricted to a consideration of budget scrutiny in Northern Ireland, Scotland and Wales.

2.1. The Budget in Northern Ireland

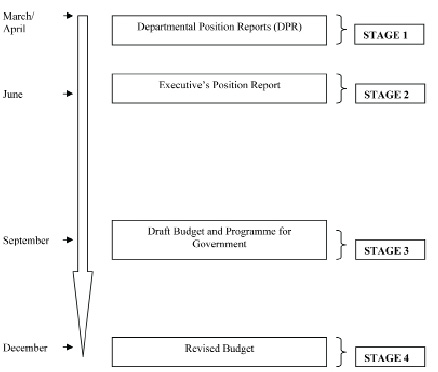

The Budget process in Northern Ireland consists of four stages; it is summarised in the diagram below:

Figure 6: The ‘Normal’ NI Budget Process

2.1.1 The Role of Committees During the Budget Process

The role and remit of committees within the Northern Ireland Assembly are set out in the Belfast Agreement; the Northern Ireland Act 1988; and the Standing Orders of the Northern Ireland Assembly. Statutory Committees have a statutory duty to scrutinise the departmental budgets as set out in paragraph 9 of Strand One to the Belfast Agreement :

“(Committees) will have a scrutiny, policy development and consultation role with respect to the Department with which each is associated, and will have a role in initiation of legislation.”

Amongst the powers granted to committees are those to:

“…consider and advise on Departmental budgets and Annual Plans in the context of the overall budget allocation...”

The committees are involved at various stages:

- Departmental Position Reports (DPR) mark the first stage of the process, which occurs in March / April. Committees have an opportunity to receive an oral or written briefing from their department and consult upon the DPR. Following the period of consultation, committees provide feedback to their department, who then submit DPRs to DFP in April.

- The Executive’s Position Report (EPR) is issued jointly by DFP and OFMDFM in June. The EPR summarises each department’s position report and allows for consultation with committees, etc. in advance of the preparation of the Draft Budget and Programme for Government. This is the stage to reflect upon the relative priority attached to different policies and programmes, and the scope for reducing services or improving them through efficiency improvements. The committees are briefed by departmental officials once again, and consult as they see fit. CFP coordinates committees’ responses to the EPR and submits these to DFP in August.

- The Draft Budget and Draft Programme for Government (PfG) are produced in September. The PfG provides an overview of the strategic issues to be addressed by the Executive and determines resource allocation decisions. At this stage the Executive consults with committees and the general public on both documents. CFP coordinates committee responses, initiates a ‘take note’ debate in the Assembly in mid-November and publishes a report at the end of November.

- The Revised Budget is introduced by the Minister of Finance and Personnel in mid-December. Once this is agreed by the Assembly the scope for committee involvement is more limited:

- The Budget Bill No. 1 incorporates Spring Supplementary Estimates and Vote on Account, and is introduced in the Assembly in February. There is limited opportunity for any amendments at this stage; the bill must reflect the figures agreed in the Revised Budget and mirrored in the Main Estimates/Supply Resolution.

- The Budget Bill No. 2 incorporates the Main Estimates and Supply Resolution, and is introduced in the Assembly in June. Again, there is limited scope for amendment. Both bills may proceed by accelerated passage subject to the provisions of Standing Order 40 (2); this provides that accelerated passage is acceptable if the Chairperson of CFP (or someone acting on his/her behalf) can confirm that they are content that sufficient consultation has taken place.

Committees have additional scope for budget scrutiny at quarterly monitoring rounds and in assessing progress in the achievement of PfG targets and Public Service Agreements (PSAs). They are also afforded the opportunity to scrutinise departmental bids for Executive Programme Funds (EDFs) and particular business areas within their respective department.

The Committee for Finance and Personnel is specifically responsible for coordinating budget scrutiny by the Assembly. The following specific steps were taken to facilitate scrutiny of Draft Budget 2008-11 :

- Provision of an information seminar for MLAs and officials on the ‘Assembly’s Role in the Annual Budget Process’

- Commissioning the views of the other Assembly statutory committees on the draft budget allocations for their respective departments;

- Receiving a briefing on the draft Budget by the Minister;

- Taking evidence from DFP officials on strategic and cross-cutting budgetary issues;

- Tabling a motion for a ‘take note’ debate in plenary on the Draft Budget;

- Publishing a coordinated report on the draft Budget on behalf of all the Assembly statutory committees.

2.1.2 Perceived Shortcomings of the Most Recent Process

In its “Report on the Executive’s Draft Budget 2008-11”, the Committee for Finance and Personnel (CFP) highlighted a number of perceived shortcomings with the recent budget process. Associated recommendations are outlined below:

- “The Committee echoes the call, made by a number of the Assembly statutory committees, for a closer alignment between the revised Budget and the revised PfG …. a more visible linkage is required between PfG priorities and goals, PSA objectives and the allocations, departmental objectives and spending areas in the Budget”.

- “The Committee considers that there would be benefit, in terms of transparency and scrutiny, from fuller and more standardised information on departments’ bids and their outcomes. ..as part of the draft Budget process.”

- “The Committee considers that the future budget process and timetable needs to be settled early in 2008 to enable the Assembly statutory committees to schedule the necessary scrutiny into their work programmes.”

2.2. The Budget in Wales

The Budget process in Wales was recently amended by the Government of Wales Act, 2006. This section outlines the stages of the process, per the original Act, and highlights the key implications of the new legislation.

2.2.1 The Budget Process under the Government of Wales Act 1998

The Budget process provided for by the 1998 Government of Wales Act was designed to enable the Assembly to distribute block grant resources according to spending priorities. This was achieved by plenary voting to approve the Budget proposed by the Finance Minister. The three stages of the process were as follows :

- Stage One – Consultation on spending priorities. Per Standing Order 21.2, Subject Committees were invited to submit their views on expenditure priorities for the forthcoming budget period.

- Stage Two – Draft Budget. Standing Order 21.3 required the Finance Minister to lay a draft budget (consisting of proposed allocations for the budget period) before the Assembly prior to 15 November and to table a take note motion.

- Stage Three – Final Budget. Per Standing Order 21.4, the Finance Minister was obliged to lay a final budget before the Assembly prior to 10 December and table a motion that it be adopted by the Assembly. A supplementary budget could be tabled prior to the end of the financial year, identifying any changes to the final budget .

In terms of Budget presentation, documents showed allocations across a series of Main Expenditure Groups (MEGs) which broadly corresponded to Ministerial Portfolios. MEGs were then delineated into Spending Programme Areas (SPAs) and these were further sub-divided into Budget Expenditure Lines (BELs). These delineations did not strictly operate as control totals; Standing Orders 21.6 and 21.7 stipulated that only changes to the Main Expenditure Groups required the approval of the Assembly in plenary.

With regards to Budget scrutiny, Standing Order 21 required committees to undertaken specific functions at pre-determined points in the cycle. The main role of committees was the expression of priorities in May/June and consideration of the Draft Budget in October/November . Following completion of the Draft Budget stage, Standing Orders required no further input from Subject Committees. However, under Standing Order 9.7(ii), Subject Committees were required to “keep under review the expenditure and administration connected with” policies within their portfolio.

2.2.2 Changes Arising from the Government of Wales Act 2006

Budget scrutiny under the 1998 Act was constrained by the fact that committees, and their operation, were required to reflect Ministerial portfolios. Furthermore, committees ability to effectively scrutinise was considered to be compromised by difficulties in ‘reading across’ from the beginning (the Assembly budget) to the end (National Assembly of Wales Resource Accounts). In 2006, a Welsh Assembly School Funding Committee report recommended that :

“To improve transparency and budget scrutiny, the Assembly Government should make arrangements to permit relevant committees to scrutinise the local government finance budget…”

The Government of Wales Act 2006 provided the National Assembly with the means to adapt Standing Orders to enable the implementation of the committee’s recommendation . Under the 2006 Act, the reconstituted Welsh Assembly no longer has executive functions; these are conferred directly on Ministers. Part 5 of the 2006 Act made Ministers accountable to the Assembly for the exercise of executive functions ….requires them to obtain Assembly approval for the use of resources.

To facilitate the new arrangements, the act created a Welsh Consolidated Fund (WCF), which is a bank account held with the Paymaster General. The block grant from the Secretary of State is paid into the WCF and amounts may only be issued if the Assembly has passed a budget motion to that effect .

2.2.3 Key Implications for Budget Scrutiny

The budget motion requirement of the 2006 Act and the creation of the WCF strengthened the role of Assembly members in relation to the Budget; essentially they have enhanced powers of amendments. From the 2007-08 financial year onwards, Members authorise the drawdown and use of resources for purposes outlines in the resolution. This is a considerable transition from their previous role (per the 1998 Act) of adopting allocations proposed by the Government .

Another amendment which is intended to improve scrutiny is the fact that the 2006 Act requires Budget motions to be submitted in a form that is comparable with the eventual resource outturn; they must set out:

- The amount of resources which may be used in the financial year for the services and purposes set out in the motion;

- The amount of accruing resources that may be retained to be used on the services / purposes specified (rather than being paid into the WCF);

- The amount which may be paid out of the WCF in the financial year for the services and purposes specified.

In terms of committees’ involvement, Standing Order 12.1 of the third Assembly states that :

“There must be scrutiny committees with power within their remit to examine the expenditure, administration and policy of the government and associated public bodies.”

The Business Committee is responsible for determining titles of / remits for committees and ensuring that:

“…every area of responsibility of the government and associated public bodies is subject to the scrutiny of a scrutiny committee”

The role of the Finance Committee is to consider, and report on:

- Any report or document laid before the Assembly containing proposals for the use of resources, including budget motions and supplementary budget motions;

- The estimates of income and expenses prepared by the Ombudsman;

- The use of resources and payments out of the WCF.

Additionally, the Finance Committee may choose to comment on the timetable for the consideration of budget proposals / motions.

The Scrutiny and Finance Committees have the opportunity to input at the draft budget stage of the Budget process. There is no opportunity for plenary debate until the Finance Committee has produced its report on the Draft Budget (within 4 weeks of introduction). Subject committees can consider the draft budget and make related recommendations to the Finance Committee (within 2 weeks). In its report, the Finance Committee may recommend (net zero) changes to the Draft Budget

The Assembly must then consider (within 2 weeks) a take note debate. Amendments to the motion may only be tabled if they are net zero proposals. An annual budget motion is then tabled on or before the 3 December. It is not possible to table any amendments at this stage; Members’ options are limited to abstaining, or voting to support or oppose the motion to authorise the budget as it stands.

2.3 The Budget in Scotland

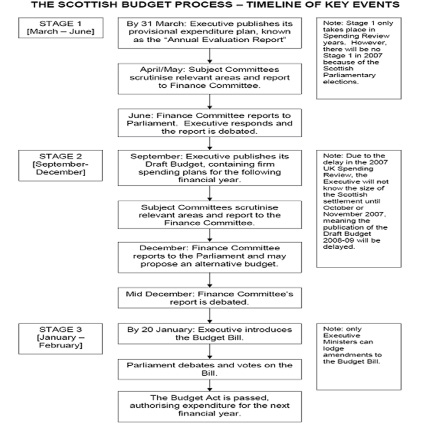

The budget process in Scotland originates from the recommendations of the Financial Issues Advisory Group (FIAG) . The process is based on a two year cycle, centred around the biennial spending review. In spending review years, the process is a three stage one; however in non-spending review years (when there are limited amendments to the budget) the first stage is omitted.

The three-stage process is as follows (and is summarised in Figure 4 below):

- Stage One – Annual Evaluation Report (AER). The AER (which, as stated above, only occurs in spending review years ) focuses on strategic issues and provisional spending plans. The document includes a performance report which shows progress against targets from the previous spending review. This is a consultation document to which committees, the public and outside bodies are invited to respond. The Finance Committee co-ordinates the responses and produces a report which is debated in June.

- Stage Two – Draft Budget. Responses received in Stage One are considered and spending plans prepared accordingly. The Draft Budget is published in September / October . Once again, parliamentary committees are consulted for their opinion; Subject Committees assess whether or not the relevant recommendations, (per Stage One), have been incorporated and report their findings to the Finance Committee. The Finance Committee can propose changes to the Budget at this stage (this may contain proposals for an alternative budget– provided that the changes have a zero net effect on expenditure levels). Parliament then debates a motion tabled by the Finance Committee on its report.

- Stage Three – Budget Bill. The final stage of the process provides parliamentary authority for spending in Scotland for the following financial year. The Budget Bill must be introduced by 20 January each year and the has three stages in itself (as with other Scottish legislation), however given the level of scrutiny at stages 1 and 2 of the process it is passed more quickly than other bills. Only members of the Scottish Government can propose changes to the Budget Bill. Despite this, Parliament can vote down the Bill in its entirety at Stages 1 or 3 of the Bill process. If the Budget Act is not in place by the end of the financial year, the Public Finance and Accountability Act allows for expenditure to continue at the same rate as the previous year for previously approved projects

The timings of the different stages of the Scottish budget process are occasionally affected by proceedings at Westminster. Stage 1 of the Budget Process did not occur in 2007, despite it being a Spending Review Year, due to the postponement of the 2006 Comprehensive Spending Review until 2007 and the clash with Parliamentary elections. The delayed publication of the UK Spending Review also meant that the Scottish Spending Review and Draft Budget were not published until published on 14 November 2007.

Figure 7: The Scottish Budget Process Summarised

Source: http://www.scottish.parliament.uk/s3/committees/finance/budget/documents/TimelineOfKeyEvents1.pdf

2.3.1 The Role of Committees and the Parliament in Financial Scrutiny

Post devolution, committees gained a remit to consider financial proposals and administration of the Scottish Executive which relate to or affect any competent matter. Resultantly, subject Committees are responsible for scrutinising the relevant section of the AER and for scrutinising the draft budget.

The scrutiny process involves seeking written and oral evidence from Ministers, senior officials and other individuals and organisations. The Scottish Ministers report (to Parliament) the results of any public consultations on expenditure proposals. The Finance Committee is responsible for co-ordinating other committees’ responses and reporting to the Parliament. The roles of the Finance and other committees during the various stages of the budget are as follows:

2.3.1.1 Stage One

Parliament takes a strategic look at this stage, consults with the public and makes recommendations to the Executive. To ensure that Parliament is sufficiently informed, the Scottish Ministers undertake to submit a provisional expenditure plan by the 31 March each year. Committees comment on their respective allocations. This stage is essentially a matter for Parliament, however Ministers endeavour to facilitate any committee requirements for information. Subject committees submit their responses to the Finance Committee, whose report is submitted and subsequently debated in plenary.

2.3.1.2 Stage Two

At this stage, Parliament assesses whether the Executive has incorporated the input provided at stage one. The Finance Committee again co-ordinates responses on expenditure proposals and produces a report. The Finance Committee has the authority to propose an alternative budget at this stage, provided that the total spend is the same as under the existing budget. Other committees can also table motions and amendments at this stage – the Parliamentary Bureau determines which are put forward for consideration by the Parliament.

2.3.1.3 Stage Three

Given the extent of pre-legislative scrutiny, the passage of the Budget Bill is accelerated. Only a member of the Executive can propose amendments at this stage of the process. Parliament can not vote on the Budget bill until 20 days have elapsed from the date it was presented, but must do so within 30 days . Parliament votes to pass or reject the Bill in its entirety.

2.3.2 Recent Development: Alternative Proposal Powers Exercised

The Scottish Finance Committee recently exercised, for the first time, its power to propose an alternative budget. There had been a previous incidence of a substantive alternative budget proposal in the past (the proposal was that additional funding be allocated to compensating Hepatitis C victims), but this deemed to be lacking an evidence base and thus not accepted by the committee.

The recent amendment proposal was that the level of police recruitment be increased beyond that being proposed. The Finance Committee put it to the Government to determine where associated reductions in expenditure might be made. When the Budget Bill was passed by the Parliament, an extra £10 million was allocated to police recruitment and an additional £4.3 million to “address climate change” (this was not recommended by the Finance Committee). Refer to Annex 1 for further details – the letter from the Cabinet Secretary outlines the full list of changes.

2.3.3 The Ongoing Review of the Scottish Budget Process

In November 2007, the Scottish Parliament agreed that the processes of, and resources available for, financial scrutiny should be reviewed . Central to the review is a reconsideration of the provision for the Finance Committee to put forward alternative budget proposals and the capacity/resources needed to exercise this. Other specific issues under consideration include:

- The best way to organise scrutiny of the Draft Budget

- The best way to deal with any delays in future UK Spending Reviews

- The balance of responsibility between the subject and Finance committees

- Is the time currently available for scrutiny adequate?

- Would there be merit in having a “Parliamentary Budget Office”?

2.4 How Does Northern Ireland Compare?

As highlighted in Section 1.3 the literature suggests that committees’ effectiveness in the Budget process is determined by :

- The location of amendment powers, i.e. whether committees have powers of amendment

- Time allocated to committee debate relative to total time available for Budget consideration;

- Committee involvement, i.e. which committees are involved in the budgetary process and the relationship between them

- Access to independent research capacity and analysis by specialised research staff enables effective scrutiny

- Access to departmental information should be timely and should comprise that on the implementation and impact of the current Budget and the development of future Budgets.

Accordingly, the table below assesses how Northern Ireland compares in each of these areas:

Figure 8: Determinants of Effective Scrutiny: Comparative Analysis

| Factor | Comparative Position in NI |

| The location of amendment powers | Unlike in NI (and Wales), the Scottish Finance Committee can suggest an alternative budget at stage 2 of the process. In this respect, the Scottish committee has greater powers of amendment. |

| Time allocated to committee debate | The NI Draft Budget is produced in September and the CFP report must be completed by the end of November. The Committee for Finance and Personnel has recommended that: “…the future budget process and timetable needs to be settled early in 2008 to enable the Assembly statutory committees to schedule the necessary scrutiny into their work programmes.” However, the current schedule is the same as that in Scotland; the Draft Budget is introduced in September and their Finance committee reports at the end of November. In Wales, there is less time allocated to committee scrutiny of the Draft Budget; the Finance Committee produces its report within 4 weeks of introduction. Subject committees can consider the draft budget and make related recommendations to the Finance Committee (within 2 weeks). The Assembly must then consider (within 2 weeks) a take note debate and an annual budget motion is tabled on or before the 3 December. |

| Committee involvement | The Northern Ireland Assembly has a strong committee system. The remit of NI committees is broader than that of the Statutory Committees of the Scottish Parliament. Local committees have a policy development and scrutiny role linked to departments, and are charged with both ‘advising and assisting’ in the formulation of policy and ‘considering and advising’ on departmental budgets and plans . As in Scotland, the Committee for Finance and Personnel co-ordinates input from subject committees. |

| Access to independent research capacity | In Scotland, there is a budget for “external research” when the need arises. There is also a standing budget advisor and subject committees are entitled to appoint a budget advisor also. These facilities do not currently exist in Northern Ireland. (Stage 2 of the Committee for Finance and Personnel’s inquiry will consider the issue of resources available to assist in budget scrutiny) |

| Access to departmental information | The CFP’s report on Draft Budget 2008-11 highlighted the view of other committees that there: “…would be benefit, in terms of transparency and scrutiny, from fuller and more standardised information on departments’ bids and their outcomes. ..as part of the draft Budget process.” |

3. Other Considerations

3.1 Lessons From (Ongoing) Scottish Review

Professor Arthur Midwinter (Budget Advisor to the Scottish Finance Committee) responded to the consultation on the review of the Scottish budget process, recommending that parliamentary input be strengthened by developing more relevant information. He distinguished between problems occurring in Stages 1 and 2 of the budget process and outlined problems / recommendations accordingly:

Stage 1

- Stage 1 of the Scottish budget process should occur every second year and focus on the Annual Evaluation Report (AER). This stage allows performance to be assessed against past targets and a consideration of future strategic priorities.

- Strategic priorities should be based on major crosscutting issues;

- The document should show how Executive’s objectives have determined budgetary allocations

- Problem with current process: there is no direct link between budgets and outcomes

- A key objective of the Finance Committee is to scrutinise how the Executive’s objectives are met by the budgetary allocations, so the Budget should clearly demonstrate the determination of allocations;

“In an effective outcome budgetary system…it would be expected to see clear and explicit logic links between high level outcomes, intermediate outcomes, output measures, actions, input measures and budget resources .”

- Systematic linkage and alignment between resources and results are highlighted as essential in enabling effective scrutiny;

Stage 2

Stage 2 is concerned with the authorisation of (or formulation of alternatives to) the Executive’s detailed spending proposals .

- Professor Arthur Midwinter highlighted the fact that changes to the budgetary format, including the removal of certain information , made it more difficult to monitor changes. He suggests that this “makes it easier for the Executive to evade scrutiny”

Professor Midwinter is of the opinion that the Scottish Parliament has endorsed a Budget format which has reduced both the volume and transparency of budgetary information.

3.2 The Case For / Against Public Engagement in the Budget Process

There are pros and cons associated with permitting public involvement in budget scrutiny. The OECD suggests that, to ensure Budget transparency, the Executive should actively promote an understanding of the budget process by individual citizens and non-governmental organisations . Public hearings provide a structured approach to opening budget debate to experts from academia, civil society and the private sector. This transparency can also help to build trust in government .

However, critics argue that legislative deliberations should remain secret otherwise decision making will be relocated to other (private) forums, such as working groups. Nonetheless, there appears to be a lack of evidence to substantiate this claim; no legislature that has opened its proceedings to the public has subsequently reversed its decision to do so .

Public Engagement can be encouraged via passive or interactive approaches. Annex 2 outlines examples of how public engagement is encouraged / facilitated in other regions.

3.3 What does the Literature Prescribe for Strengthening Committee Involvement?

The literature suggests that the following specific reforms could be useful in strengthening committee involvement:

- Establishing a comprehensive system of financial committees;

- Introducing public hearings on the budget;

- Boosting the numbers of support staff; and

- Expanding the time for committee consideration of the draft budget in order to facilitate more in depth scrutiny

3.4 Other Potential Considerations for Northern Ireland

- Would there be merit in having an equivalent of the Scottish Stage 1 process, whereby outcomes are assessed as a basis for going forward?

- Should the resources available to the Assembly to assist in scrutiny be reviewed? For example, should a standing Budget Advisor be appointed? This consideration will be particularly important in the context of any potential increases in powers of amendment.

(To be considered in more detail in stage 2 of the CFP inquiry) - Is there scope (or a case) for rationalising the legislative process relating to the budget – there appears to be considerable duplication within the existing system.

- The publication of the Draft Budget occurs very soon after the completion of the EPR stage. Would there be merit in considering the feasibility of combining the DPR and EPR stages or increasing the time between EPR and Draft Budget?

ANNEX 1

ANNEX 2

2.1 A Passive Approach as adopted by the Canadian Department of Finance:

Source: http://www.oecd.org/dataoecd/24/51/39894468.pdf

2.2 HM Treasury provides an example of a more interactive approach:

Source: http://www.oecd.org/dataoecd/24/51/39894468.pdf

2.3 The Canadian Minister for Finance invited citizens’ input on-line:

Source: http://www.oecd.org/dataoecd/24/51/39894468.pdf

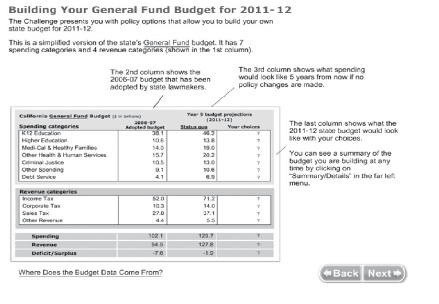

2.4 ‘Next Ten’ is an example of a non-governmental (educational website) approach:

Source: http://www.oecd.org/dataoecd/24/51/39894468.pdf

Research and Library Services

9 October 2008

The Scottish Parliament Finance Committee’s Review of the Budget Process: Points of Interest for Northern Ireland

Research Paper prepared for the Committee for Finance & Personnel

Dr Robert Barry

In November 2007, the Scottish Parliament agreed that the budget process and the resources available for financial scrutiny should be reviewed. This paper describes the current budget process in Scotland, outlines in detail the issues to be considered by the Scottish Parliament Finance Committee in its review, and summarises the key points raised to date in written submissions and oral evidence sessions. Finally, it draws this body of evidence together into a summary of key points of relevant interest to the Northern Ireland Assembly Committee for Finance and Personnel to help inform its own review of the budget process in Northern Ireland.

Library Research Papers are compiled for the benefit of Members of The Assembly and their personal staff. Authors are available to discuss the contents of these papers with Members and their staff but cannot advise members of the general public.

The Scottish Parliament Finance Committee’s Review of the Budget Process: Points of Interest for Northern Ireland

Summary

In November 2007, the Scottish Parliament agreed that the budget process and the resources available for financial scrutiny should be reviewed. The review is being led by the Finance Committee and will examine:

- the principles underpinning the way each phase of the budget process is managed;

- the timetable for scrutiny and the opportunities for evidence to be taken;

- the relationships between subject committee scrutiny and the Finance Committee’s role, including the means by which alternative spending proposals can be considered; and

- the resources available to support financial scrutiny.

This paper describes the current budget process in Scotland, outlines in detail the issues to be considered by the Scottish Parliament Finance Committee in its review, and summarises the key points raised to date in written submissions and oral evidence sessions. Finally, it draws this body of evidence together into a summary of key points of relevant interest to the Northern Ireland Assembly Committee for Finance and Personnel to help inform its own review of the budget process in Northern Ireland.

The key lessons that appear to be emerging from the Scottish Parliament’s Review are as follows:

1) There is a clear need to influence the process at an early stage, as there is less scope for revision at the later stages of the process.

2) Subject Committees should have greater involvement in the process.

3) The entire process, including the linkage between spending and outcomes and the reconciliation of different sets of published figures, requires greater transparency and clarity.

4) More resources, including training and expert advice, are needed to support Members and Committees throughout the process.

The Scottish Parliament Finance Committee’s Review of the Budget Process: Points of Interest for Northern Ireland

Introduction

In November 2007, the Scottish Parliament agreed that the budget process and the resources available for financial scrutiny should be reviewed [1] . The review is being led by the Finance Committee and will examine[2] :

- the principles underpinning the way each phase of the budget process is managed;

- the timetable for scrutiny and the opportunities for evidence to be taken;

- the relationships between subject committee scrutiny and the Finance Committee’s role, including the means by which alternative spending proposals can be considered; and

- the resources available to support financial scrutiny.

Current Budget Process

The current budget process is divided into three distinct stages, as recommended by the Financial Issues Advisory Group (FIAG) and confirmed by written agreements between the Finance Committee and the Executive. In short, the stages of the process are[3] :

- an examination of the Scottish Government’s future spending plans and priorities (Stage 1);

- detailed scrutiny of the Scottish Government’s firm spending plans for the coming financial year (Stage 2); and

- the granting of formal Parliamentary authority for spending in the coming financial year (Stage 3).

Stage 1 only takes place in a Spending Review year unless there is a Scottish Parliamentary election, as in 2007. During Stage 1:

- The Scottish Government publishes its “Annual Evaluation Report” (AER). This looks at progress against targets and some provisional spending plans.

- The Parliament’s subject committees make comments to the Finance Committee on the area for which they have responsibility (e.g. the Justice Committee scrutinises the Justice Department’s spending plans).

- The Finance Committee then makes recommendations to the Government in its Stage 1 Report.

- The report is debated by the Parliament, usually in June.

- The Scottish Government responds to the Finance Committee’s report in detail; and

- Individual Ministers respond as appropriate to subject committee reports.

- FIAG originally intended that Stage 1 of the process would take place on an annual basis. However, following the revision of the Written Agreement in 2005, it was agreed that Stage 1 would only take place in Spending Review years.

This change was made to reflect the central importance of the Spending Review cycle in setting spending plans. Spending Reviews set plans for three forward years (e.g. Spending Review 2007 set plans for 2008-09, 2009-10 and 2010-11) with the final year usually being the first year of the next Spending Review period. The change was primarily driven by recommendations from the Finance Committee and the subject committees. They pointed out that holding Stage 1 in non-Spending Review years resulted in a large amount of duplication in their work as there was little change in the figures. However, it was also based on the assumption that Spending Reviews would occur on even-numbered years (and thus not clash with Scottish elections).

The timings of the different stages of the Scottish budget process are occasionally affected by proceedings at Westminster. Stage 1 of the Budget Process did not occur in 2007, despite it being a Spending Review Year, due to the postponement of the 2006 Comprehensive Spending Review until 2007 and the clash with Parliamentary elections.

The main phases of Stage 2 are:

- The Scottish Government publishes its Draft Budget which contains firm spending plans for the following financial year, usually by 20 September.

- Subject Committees again scrutinise the area of the budget relevant to their remit and report their findings to the Finance Committee.

- At this point, subject committees can suggest alternative spending proposals to the Finance Committee (although these cannot increase the overall spend proposed by the Government);

- The Finance Committee publishes a report which can contain proposals for an alternative budget, but cannot increase the total spend proposed by the Government.

- The Parliament debates a motion lodged by the Finance Committee on its report.

The timetabling difficulties involved in Budget Process 2008-09 had an impact on Stage 2. The delay in publication of the UK CSR until October meant that the Scottish Budget: Spending Review 2007 document (which included the Draft Budget 2008-09) was not published until 14 November 2007.

The third stage of the process provides Parliamentary authority for spending in Scotland for the following financial year. The main points to note regarding Stage 3 are:

- The Scottish Government must introduce the Budget Bill by 20 January each year.

- While this is the third stage of the Budget Process, the Budget Bill also has three stages, in common with other Scottish Parliament legislation.

- As a result of the level of detailed scrutiny in Stages 1 and 2 of the budget process, the time allowed for passage of the Bill is shorter than for the passage of other bills.