Committee for Finance and Personnel Report (2007-2011 Mandate)

Report on the Executive's Draft Budget 2011 - 15 Volume 2

Report-on-Draft-Executive-Budget-Vol-2.pdf (13.57 mb)

Session 2010/2011

Third Report

Committee for Finance and Personnel

Report on the Executive's Draft Budget 2011-15

Volume 2

Memoranda and Correspondence

Ordered by The Committee for Finance and Personnel to be printed 16 February 2011

Committee for Finance and Personnel

Report: NIA 44/09/10R

Membership and Powers

Powers

The Committee for Finance and Personnel is a Statutory Departmental Committee established in accordance with paragraphs 8 and 9 of the Belfast Agreement, Section 29 of the Northern Ireland Act 1998 and under Assembly Standing Order 48. The Committee has a scrutiny, policy development and consultation role with respect to the Department of Finance and Personnel and has a role in the initiation of legislation.

The Committee has the power to;

- consider and advise on Departmental budgets and annual plans in the context of the overall budget allocation;

- approve relevant secondary legislation and take the Committee Stage of primary legislation;

- call for persons and papers;

- initiate inquiries and make reports; and

- consider and advise on matters brought to the Committee by the Minister of Finance and Personnel.

Membership

The Committee has eleven members, including a Chairperson and Deputy Chairperson, with a quorum of five members. The membership of the Committee during the current mandate has been as follows:

- Mr Daithí McKay (Chairperson)1

- Mr David McNarry (Deputy Chairperson)2

- Dr Stephen Farry

- Mr Paul Frew3

- Mr Paul Girvan4

- Mr Simon Hamilton

- Ms Jennifer McCann

- Mr Mitchel McLaughlin

- Mr Adrian McQuillan

- Mr Declan O'Loan

- Ms Dawn Purvis

1. Mr Daithí McKay replaced Ms Jennifer McCann as Chairperson on 19 January 2011, having replaced Mr Fra McCann on the Committee on 13 September 2010. Ms McCann replaced Mr Mitchel McLaughlin as Chairperson on 9 September 2009.

2. Mr David McNarry was appointed Deputy Chairperson on 12 April 2010 having replaced Mr Roy Beggs on the Committee on 29 September 2008.

3. Mr Paul Frew joined the Committee on 13 September 2010; Mr Ian Paisley Jr left the Committee on 21 June 2010 having replaced Mr Mervyn Storey on 30 June 2008.

4. Mr Paul Girvan replaced Mr Jonathan Craig on 13 September 2010; Mr Jonathan Craig had been appointed as a member of the Committee on 13 April 2010. Mr Peter Weir left the Committee on 12 April 2010. Mr Peter Weir had replaced Mr Simon Hamilton as Deputy Chairperson on 4 July 2009. Mr Simon Hamilton replaced Mr Mervyn Storey as Deputy Chairperson on 10 June 2008.

Table of Contents

List of Abbreviations and Acronyms used in the Report

Appendix 4

Memoranda and Correspondence from Assembly Committees

Appendix 5

Memoranda and Correspondence from the Department of Finance and Personnel

List of Abbreviations and Acronyms used in the Report

ACNI Arts Council Northern Ireland

A&E Accident and Emergency

ALB Arm's Length Body

AME Annually Managed Expenditure

AMU Assets Management Unit

ASB Aggregated Schools Budget

BBA British Bankers' Association

CART Capital Assets Realisation Taskforce

CBI Confederation of British Industry Northern Ireland

CDO Collateralised Debt Obligations

CEF Construction Employers Federation

CFG Central Finance Group

CFP Committee for Finance and Personnel

CIF Construction Industry Forum

CSR Comprehensive Spending Review

DARD Department of Agriculture and Rural Development

DCAL Department of Culture, Arts and Leisure

DE Department of Education

DEL Departmental Expenditure Limits

DEL Department for Employment and Learning

DETI Department of Enterprise, Trade and Investment

DFP Department of Finance and Personnel

DHSSPS Department of Health, Social Services and Public Safety

DLA Disability Living Allowance

DoE Department of the Environment

DoJ Department of Justice

DRD Department for Regional Development

DSD Department for Social Development

DWP Department of Work and Pensions

EDP Efficiency Delivery Plan

EIB European Investment Bank

E&LB Education and Library Board

EQIA Equality Impact Assessments

ERINI Economic Research Institute of Northern Ireland

ESRI Economic and Social Research Institute

ESS Enterprise Shared Services

ETI Enterprise, Trade and Investment

EU European Union

EYF End of Year Flexibility

FDI Foreign Direct Investment

FSB Federation of Small Businesses

FSME Free School Meal Entitlement

FTE Full time equivalent

GB Great Britain

GP General Practitioner

GDP Gross Domestic Product

GVA Gross Value Added

HE Higher Education

HLIA High Level Impact Assessment

HM Her Majesty's

HMT Her Majesty's Treasury

HR Human Resources

ICT Information Communication Technology

ICTU Irish Congress of Trade Unions

IFS Institute for Fiscal Studies

IMF International Monetary Fund

IoD Institute of Directors

ISNI Investment Strategy for Northern Ireland

LPS Land and Property Services

JESSICA Joint European Support for Sustainable Investment in City Area

MAC Metropolitan Arts Centre

MLA Member of the Legislative Assembly

NAMA National Assets Management Agency

NGO Non-Governmental Organisation

NI Northern Ireland

NIAO Northern Ireland Audit Office

NICMA Northern Ireland Childminding Association

NICS Northern Ireland Civil Service

NICVA Northern Ireland Council for Voluntary Action

NIFHA Northern Ireland Federation of Housing Associations

NIHE Northern Ireland Housing Executive

NILGA Northern Ireland Local Government Association

NIMFG Northern Ireland Manufacturing Focus Group

NIPSA Northern Ireland Public Service Alliance

NITA Northern Ireland Theatre Association

NIW Northern Ireland Water

OCA Office Cost Allowance

OFMDFM Office of the First Minister and deputy First Minister

PAC Public Accounts Committee

PEDU Performance and Efficiency Delivery Unit

PfG Programme for Government

PFI Private Finance Initiative

PMS Presbyterian Mutual Society

PPP Public Private Partnerships

PRONI Public Record Office of Northern Ireland

PSA Public Service Agreement

PSE UK Poverty and Social Exclusion in the UK Project

PSNI Police Service of Northern Ireland

PSO Public Service Obligations

PwC PricewaterhouseCoopers

QUB Queen's University, Belfast

RoI Republic of Ireland

RRI Reinvestment and Reform Initiative

SCS Senior Civil Service

SEN Special Educational Needs

SHDP Social Housing Development Programme

SIB Strategic Investment Board

SME Small and Medium-sized Enterprises

SOU Special Olympics Ulster

SROI Social Return on Investment

SSRB Senior Salaries Review Body

STAR Skills, Training and Reinvestment

UK United Kingdom

USA United States of America

Appendix 4

Memoranda and Correspondence from Assembly Committees

Public Accounts Committee

Public Accounts Committee

Room 371

Parliament Buildings

BELFAST

BT4 3XX

Tel: (028) 9052 1208

Fax: (028) 9052 0366

E: pac.committee@niassembly.gov.uk

Aoibhinn.Treanor@niassembly.gov.uk

Mr Kieran Donnelly

Comptroller & Auditor General

Northern Ireland Audit Office

106 University Street

Belfast

BT7 1EU 22 December 2010

Dear Kieran,

At its meeting on 16 December the Public Accounts Committee (PAC) considered a letter to you from the Audit Committee Chairperson concerning the efficiencies that can be made by the Audit Office (NIAO).

Now more than ever, all public bodies must robustly manage all funding to ensure that value for money can be demonstrated.

In the case of the NIAO this must be balanced against its ability to support the process of parliamentary accountability. The Audit Office's independence of Government enables it and by extension PAC and the Assembly to perform full and incisive scrutiny of public spending. As Mr Craig notes, this role is even more important in the current financial climate.

The Public Accounts Committee therefore supports unequivocally the Audit Committee's commitment to ensuring that the NIAO has all the resources necessary to carry out this function.

The Committee endorses the Audit Committee's conclusion that the NIAO should seek to reduce its budget by at least 10% in cash terms by 2014-15, having noted your advice that these savings represent the maximum reduction that could be made while maintaining the same quality and extent of service to the Assembly that has been offered in recent years.

This correspondence is copied to the Committee for Finance and Personnel for information and for the attention of the Finance Minister.

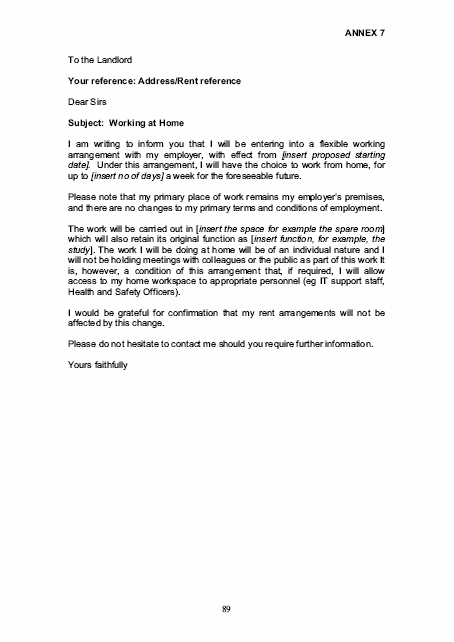

Yours sincerely,

![]()

Paul Maskey

Chairperson

Public Accounts Committee

Committee for Regional Development

Committee for Regional Development

Committee Office Room 435

Parliament Buildings

Ballymiscaw

Stormont

Belfast

BT4 3XX

Tel: 02890 521821

Fax: 02890 525927

Email committee.regionaldevelopment@niassembly.gov.uk

Ms Jennifer McCann MLA

Chairperson

Committee for Finance and Personnel

Parliament Buildings

Ballymiscaw

Stormont

Belfast

BT4 3XX 6 January 2011

Timetable for consideration of the Draft Budget and publication of departmental information

Dear Jennifer,

1. At the Committee meeting of 6 January 2011, the Committee for Regional Development decided to write to you to request more time to consider the Northern Ireland Draft Budget for 2011-2015.

2. Following publication of the Draft Budget and the Finance Minister's statement to the Assembly, the Regional Development Committee wrote to a number of its key stakeholders requesting written and oral briefing on the impact for their organisations of both the Executive's Draft Budget document and the information to be published on the Department for Regional Development's spending and savings plans and its plans for public consultation and consideration of equality impacts. The deadline given by the Committee for receipt of written papers from stakeholders was Friday 7 January 2011, with oral evidence sessions planned for 12 January 2011. This would allow the Regional Development Committee one week to consider the briefing received and to formulate a response to your Committee's call for input by your deadline of 21 January 2011.

3. As, at the time of writing, the Department for Regional Development has not published its detailed spending and savings plans, and stakeholders are not in a position to provide comment in any meaningful way on the impact for their organisations of the draft Budget or DRD's spending and savings plans. In turn, the Committee will have no adequate time to consider DRD's detailed plans, or the impact they may have on stakeholder organisations.

4. The Finance and Personnel Committee timeframe, as it currently stands, does not allow the Regional Development Committee adequate time to make an informed response to your Committee or to the coordinated report on the Draft Budget. It is also doubtful whether there is enough time for the Committee to formulate an informed view to represent during the proposed take note debate on the Draft Budget, indicatively timed for 25 January 2011.

5. Indeed Members were concerned, in the absence of detailed information published across all departments, that it could prove very difficult for anyone, be they stakeholders, members of the public, voluntary and community sector organisations, or business and trade union organisations, to make a detailed response to the public consultation by the closing date of 9 February 2011.

6. Members understand that the timetable for finalisation of the Budget is very tight this year, and that this is largely outside the control of the Finance and Personnel Committee. However the Members of the Regional Development were keen to:

a. Request more time for consideration of the detailed departmental spending and savings plans;

b. Reiterate its previously expressed view that adequate time is needed to make an informed response by the Assembly committees, and that this time should reflect the important role of the committees in the Assembly process of developing the Draft Budget and finalising the Executive's Final Budget.

7. A response as soon as possible would be appreciated. In the interim, the Regional Development Committee will continue to prioritise scrutiny of the Draft Budget and will, as far as it is possible, strive to meet your Committee's timetable and to play its full part in the Assembly's consideration of budget and financial matters.

Yours sincerely,

Fred Cobain, MLA

Committee Chairperson

Committee for Enterprise, Trade & Investment

Committee for Enterprise, Trade & Investment,

Room 375

Parliament Buildings

http://archive.niassembly.gov.uk/index_election2.htm

Tel: 028 9052 1230

Fax: 028 9052 1355

To: Shane McAteer

Clerk to the Committee for Finance and Personnel

From: Jim McManus

Clerk to the Committee for Enterprise, Trade & Investment.

Date: 14 January 2011

Subject: Skills, Training and Reinvestment

At the meeting of 13 January, the Committee for Enterprise, Trade and Investment considered your correspondence of 6 January in relation to Skills, Training and Investment initiative.

Members were content for the Committee for Finance and Personnel to undertake more work in relation to the initiative, with input from the Enterprise, Trade and Investment and Employment and Learning Committees, where appropriate.

Committee for Social Development

Committee for Social Development

Room 412,

Parliament Buildings,

Stormont,

Belfast BT4 3XX

Tel: 028 9052 1864

Mob:078 2514 1294

peter.mccallion@niassembly.gov.uk

To: Shane McAteer

Clerk to the Committee for Finance and Personnel

From: Peter McCallion

Date: 18 January 2011

Subject: Confederation of British Industry's Northern Ireland "Time for Action NI –

Delivering public services in a time of austerity"

At its meeting of 13 January 2011, the Committee for Social Development noted correspondence from the Department in relation to the Confederation of British Industry's Northern Ireland Report entitled "Time for Action NI – Delivering public services in a time of austerity".

The Committee agreed to forward the response to the Committee for Finance and Personnel for information.

Enc.

Committee for Social Development -

response to CBI report

Stephen McMurray

Stephen McMurray

Director of Financial Management

Lighthouse Building

4th Floor

1 Cromac Place

Gasworks Business Park

Ormeau Road

Belfast BT7 2JB

Tel: 02890 829016

Fax: 02890 829516

Email: Stephen.McMurray@dsdni.gov.uk

Clerk to Committee for Social Development

Mr Peter McCallion

Room 412

Parliament Buildings

BELFAST

BT4 3XX 22 December 2010

Dear Peter

Re: Social Development Committee Update on Confederation of British Industry Northern Ireland

1.0 At its meeting of 2 December 2010 the Committee noted correspondence dated 22 November 2010 from the Committee for Finance and Personnel on the Confederation of British Industry's Northern Ireland Report entitled "Time for Action NI – Delivering public services in a time of austerity." In respect to this the Committee requested an update on revenue-generating activities identified in the report, including the social rent-alignment process and the possible mutualisation of the Northern Ireland Housing Executive.

2.0 The Confederation of British Industry's Northern Ireland Report entitled "Time for Action NI – "Delivering public services in a time of austerity" refers to the following potential revenue generating activities relevant to housing:

2.1 Modest rent increases for Northern Ireland Housing Executive tenants;

The report suggests raising income through modest rent increases to invest in improving the thermal comfort of social housing stock. The report does not quantify what is regarded as modest rent increases and as Housing Executive rents have historically been increased on an annual basis this does not represent an additional revenue generating activity. The Committee letter also refers to rent realignment which is an option the Department is considering. To determine the practicalities of this option the Department is in the process of tendering for research into rent setting policies which will update and expand upon the work undertaken by Glasgow University in 2007. This research will inform the Departments views on the future rent setting policies across the social rented sector and the potential for a rent realignment process.

2.2 Mutualisation of part of the Northern Ireland Housing Executive;

The Department has started a review of the Housing Executive. The Review will examine the housing and other functions of the Housing Executive in detail, providing a comprehensive assessment of their contribution to housing and other Departmental and Government policy objectives. This will take account of other organisational structures in the housing policy sector and make recommendations about remit, role and responsibility to achieve best results. It will consider reports into Housing in Northern Ireland produced over the last three years.

The Review will also examine the efficiency and effectiveness of the Housing Executive's operations, including the appropriateness of existing structures. It will identify opportunities and make recommendations for improving performance and delivery of housing policy and objectives.

An interim report on the review is due by the end of March 2011. The review will assess the options for the future structure of the Housing Executive.

2.3 Accessing alternative sources of debt finance/capital;

Housing Associations have already successfully secured significant funding through bonds with the European Investment Bank and the Housing Finance Corporation. This additional funding will complement the Grant already available to Housing Associations delivering the Social Housing Development Programme in effect allowing more units to be delivered with less subsidy.

The Department has previously considered the options available to the Northern Ireland Housing Executive for borrowing funds. The Department of Finance & Personnel (DFP) has pointed out that Resource Accounting Rules under which the Department must operate dictate that the Housing Executive is regarded as a Public Corporation. HM Treasury guidance (Public Expenditure Survey (2002) 10, paragraph 25) states that Public Corporations can only take on long term borrowing through a departmental voted loan or through the National Loans Fund. Long term borrowing from the private sector will not be allowed by Public Corporations. The Department's Housing Division had recently looked at the possibility of the Housing Executive borrowing from the European Investment Bank, however this was subsequently rejected by the Department of Finance and Personnel for the reasons explained above.

The ability of the Housing Executive to access additional private finance is dependent on the future structure of the organisation which is to be part of the current review. Currently the Housing Executive has approximately £750m of loans outstanding from the consolidated fund and any future change to their structure will have to take account of these. Any potential large scale sale of the Housing Executive stock needs to take account of how these loans will be repaid. DFP has previously considered an approach to HM Treasury about writing off the loans as part of a future stock transfer but concluded that due to the impact of a write off on the NI Block it was not viable option. To service any additional borrowing the Housing Executive would require a considerable increase in rental income or increased deficit funding from the public purse. These are just some of the functions that need to be considered in the assessment of the future structure of the Executive.

2.4 Sales of surplus or underutilised land/property.

2.41 Northern Ireland Housing Executive Land

The Housing Executive currently has in excess of £28m of surplus land being actively marketed for sale. Offers totalling £23m for the various lots have been received but are largely dependent on planning approval being granted. For this reason they predict that actual receipts from these sites will be limited.

The Housing Executive also hold a significant amount of land which is not currently being marketed for sale for specific reasons such as future housing need. Given the difficulties being experienced with the existing land for sale it may not be that this sites would realise receipts in the near future. However, the potential for sale will be exhausted in going forward.

2.42 Northern Ireland Housing Executive Commercial properties

The Housing Executive has 431 commercial properties generally comprising shops/small commercial units. Strategic Investment Board had started to look at the potential for the commercial units to be sold off but never progressed this to a formal proposal because of the economic crisis and perceived lack of interest. Again this matter will be actively assessed going forward.

2.43 Northern Ireland Housing Executive Head office

Strategic Investment Board completed an Economic Appraisal in late 2008 to assess the viability of the sale and leaseback of the Executive's Housing Centre. At that time Strategic Investment Board predicted a receipt of between £16m to £20m depending on the type of lease being negotiated. When the economic appraisal was submitted to DFP their conclusion was that "in the absence of any decision to the contrary, the Housing Centre is expected to be occupied by the Housing Executive, in some form, for the foreseeable future. Therefore, at this time, it is not surplus to requirements or underutilised. There does not appear to be an obvious business need for the proposed transaction, other than the opportunity to raise further capital receipts in the short term, and it restricts flexibility to react in line with future business requirement. As it stands, the Value for Money of the preferred option is not been clearly established and it has not been confirmed as being affordable." It is not known if a similar capital receipt could be realised from such a transaction in the current market or if DFP will be of the same opinion on the Value for Money and affordability of this proposal. However, the department again believes that this is an option that requires active consideration going forward.

3.0 Urban Regeneration Assets

The other revenue activities applicable to this Department are in respect of Urban Regeneration as follows.

3.1 Asset Sales and strategies

The Department has identified that the former Newtownlands holdings is surplus to requirements and has developed a disposal strategy to sell the assets.

3.2 Alternative Sources of debt finance/capital

Finding appropriate mechanisms to generate the funding needed to support regeneration has been a longstanding issue – an issue that has now come to the fore due to the combined effects of the credit crunch, the downturn in the property market and increasing constraints on public spending. It is understandable that these recent developments have reignited interest in imaginative new ways of funding infrastructure requirements.

In examining alternative funding sources we have considered three particular types of investment to be important:

- Maximising the level of public spending into the most disadvantaged areas;

- Levering additional resources from private investment when and where market conditions are appropriate; and

- The development of community finance infrastructure.

We therefore intend to work with relevant stakeholders and partner Departments to explore the feasibility of mechanisms that exploit:

- Community Financing options such as Urban Patient Capital Funds and Asset Transfer Units;

- European financing options such as JESSICA (Joint European Support for Sustainable Investment in City Areas);

- Tax based financing options such as Tax Incremental Financing districts/Accelerated Development Zones; and

- Joint venture financing options such as Local Asset Backed Vehicles and Regional Infrastructure Funds.

It should be emphasised that the application and use of these instruments will clearly depend on economic and development conditions across the region.

Yours sincerely

Stephen McMurray

cc: Michael McKernan

Margaret Sisk

Billy Crawford

Gareth McKinty

Joann Hanna

Committee for Employment and Learning - Departmental Proposals

Draft Budget 2011-15:

Budget Settlement and Proposals to Reduce Expenditure for tthe Department for Employment and Learning

10 January 2011

Budget Settlement and Proposals to Reduce Expenditure for the Department for Employment and Learning

Introduction

1. The Northern Ireland Executive's 'Draft Budget 2011-15' was announced by the Minister for Finance and Personnel on 15 December 2010. The Executive's Draft Budget provides proposed departmental Current expenditure and Capital investment allocations for the four year Budget period. To allow Ministers time to make decisions on priorities, the proposed allocations were presented at an overall departmental level. The announcement of the Draft Budget triggered the public consultation period, the closing date for which is 9 February, 2011. A copy of the Executive's 'Draft Budget 2011-15' can be accessed on the Budget website: www.northernireland.gov.uk/budget2010.

2. Clearly, Budget 2010 takes place in a very difficult fiscal environment. This presents us with the challenge of making resource savings in order to fund business-critical services over the forthcoming Budget 2010 period, covering the financial years from 2011-12 to 2014-15.

3. The purpose of this paper is to set out the impact of the Draft Budget for the Department for Employment and Learning's (DEL) over the period 2011-15. The public consultation period on the department's budget settlement and proposals to reduce expenditure runs in tandem with the public consultation on the Executive's Draft Budget.

Consultation Arrangements

4. The department has already taken a number of steps to engage with key stakeholders, setting out the challenges for the department's own finances and the anticipated impact of a Budget settlement.

5. The department has consulted with the Assembly Committee for Employment and Learning in developing its spending proposals.

6. Over the forthcoming weeks the department will continue to engage with the Committee for Employment and Learning. In addition, we are publishing this document on our website www.delni.gov.uk. We have also taken steps to inform our staff of the likely departmental implications of the Draft Budget settlement. In addition, business areas across the department will continue to update their key stakeholders of the likely impacts of the Draft Budget on the services which they deliver as part of their ongoing engagement.

7. We are interested in hearing views on any aspects of this document and the budget settlement and proposals to reduce expenditure contained within it. We encourage all interested parties to make their responses as soon as possible before the consultation closing date of 9 February 2011.

8. If this document is not in a format which suits your needs, please let us know. Contact details can be found below.

Contact Details

9. Should you wish to make comments in relation to any of the issues contained within this document, the address for consultation responses is as follows:

Trevor Connolly

Finance Director

Adelaide House

39/49 Adelaide Street

Belfast

BT 2 8FD

Telephone: 028 90257810

E-mail: DEL.BudgetConsultation@delni.gov.uk

Comments should be sent to arrive no later than 9 February 2011.

10. In order to promote environmental sustainability respondents will not receive an acknowledgement letter. A list of respondents will be placed on the department's website along with copies of responses (in full or in part). If you do not wish your response or name to be published on the website, please make this clear in your response to us.

Department for Employment and Learning (DEL)

Introduction

1. This paper sets out the outcome of the proposed budget settlement for the Department for Employment and Learning (DEL), and assesses its implications in the context of increasing inescapable demands on the services provided by the Department and the targeted reductions in expenditure imposed by the Department of Finance and Personnel (DFP) for the period 2011-12 to 2014-15.

2. The department's overall aim is "to promote learning and skills, to prepare people for work and to support the economy". It is responsible for further and higher education, training and skills and employment programmes. In pursuing its aim the department's key objectives are:

- to promote economic, social and personal development through high quality learning, research and skills training; and

- to help people into employment and promote good working practices.

3. It seeks to achieve these through four key areas of activity:

- enhancing the provision of learning and skills, including entrepreneurship, enterprise, management and leadership;

- increasing the level of research and development, creativity and innovation in the Northern Ireland economy;

- helping individuals to acquire jobs, including self employment, and improving the linkages between employment programmes and skills development; and

- the development and maintenance of the framework of employment rights and responsibilities.

Key Issues / Challenges over period 2011 -15

4. The Department faces the following key issues and challenges over the Budget 2010 period:

- DEL's cash funding is reduced by £53m over the Budget 2010 period, increasing to a reduction of over £124m when inflation at 2% pa is included;

- the above reductions exclude the pressures being exerted on the Department's budget in its response to the economic downturn, and from the increase in the numbers unemployed, welfare reform, higher demand for student support and cessation of funding for innovation and research;

- when these are taken into account the Department has a funding deficit of £40m and £31m in years 20011-12 and 2012-13 respectively after delivering savings of £40/72/108/144m across the four years of the budget settlement period;

- this real reduction in funding and the deficit above is impacting at a time when our services are most needed to assist increasing numbers of unemployed adults back to work, to support our young people to improve their skills and find work and to help industry to climb out of the downturn through improving its skills base; the Department's plans seek to protect capacity in these essential services as far as possible;

- but we do have to acknowledge that as a result of the budget settlement we will struggle to deliver parity in our services to the unemployed with the rest of the UK;

- the implementation of our proposed skills strategy will be severely restricted by a lack of resources;

- the Further Education (FE) sector will continue to struggle to sustain capacity and financial balance;

- important and successful initiatives in innovation, knowledge transfer and research and development will need to be curtailed;

- given the need for the Employment Service and training capacity to be maintained as far as possible, it is inevitable that in line with decisions elsewhere Higher Education (HE) must bear a significant proportion of the necessary reductions in expenditure; and

- in addition, student fees will need to increase if capacity and service quality in that sector is to be maintained.

Budget 2011-15 Allocations

5. The overall draft expenditure allocation for DEL is set out below:-

Table 1 – Draft Budget Settlement for DEL

| £m | |||||

| 2010-11 | 2011-12 | 2012-13 | 2013-14 | 2014-15 | |

| Current Expenditure: | |||||

| Proposed Allocation | 798.9 | 775.4 | 767.4 | 785.6 | 813.8 |

| Year-on-year % change | -2.9% | -1.0% | 2.4% | 3.6% | |

| Capital Investment: | |||||

| Proposed Allocation | 37.6 | 41.2 | 32.3 | 18.5 | 28.3 |

| Year-on-year % change | 9.6% | -21.6% | -42.7% | 53.0% | |

6. Over the four year period the Department will seek to sustain its current level of activity, subject to the service implications of the proposals to reduce expenditure set out below.

Current Expenditure

7. The proposed current expenditure settlement for DEL is as follows:

| 10-11 Baseline (£m) |

11-12 (£m) |

12-13 (£m) |

13-14 (£m) |

14-15 (£m) |

|

| Resources Available | 798.9 | 775.40 | 767.40 | 785.60 | 813.80 |

| Funding Change from 10-11 baseline | (23.5) | (31.5) | (13.3) | 14.9 | |

| % change from 10-11 baseline | (2.9%) | (3.9%) | (1.7%) | 1.9% |

8. This table shows that the proposed allocation for DEL in 2011-12 is some £24m less than that provided in 2010-11, some £32m less in 2012-13 and some £13m less in 2013-14. The allocation improves at the end of the period showing an increase of some £15m over the 2010-11 baseline. But in overall terms there is a cash reduction of some £53m over the four year period.

9. There are two important considerations in assessing these figures in money terms.

- Firstly, they are in cash terms. Hence the impact of inflation effectively increases the above % change. The year on year effects of a 2% inflationary rise are as follows:

| 11-12 | 12-13 | 13-14 | 14-15 | |

| % change from 10-11 baseline @ 2% | (4.9%) | (5.9%) | (3.7%) | (0.1%) |

- Secondly, the allocation includes the Barnett consequentials for the increase in the cost of the student loan subsidy associated with the fees changes in England. This amounted to £0/5/20/36m over the 4 year period to 2014-15. This is a ring fenced sum which must be used for the cost of the loan subsidy and the resources will need to be returned to the Treasury if they are not utilised.

10. If these resources are stripped out to provide for a like for like comparison with the 10-11 baseline, the results are as follows:

| 10-11 Baseline (£m) | 11-12 (£m) | 12-13 (£m) | 13-14 (£m) | 14-15 (£m) | |

| Proposed Allocation | 798.9 | 775.40 | 767.40 | 785.60 | 813.80 |

| Less ringfenced loan subsidy | 0.00 | 5.10 | 20.40 | 36.40 | |

| Net like for like comparison | 798.9 | 775.40 | 762.30 | 765.20 | 777.40 |

| £ Change from 10-11 baseline | (23.5) | (36.6) | (33.7) | (21.5) | |

| % change from 10-11 baseline | (2.9%) | (4.6%) | (4.2%) | (2.7%) | |

| Real term change @ 2% | (4.9%) | (6.6%) | (6.2%) | (4.7%) |

11. This shows a different picture than that provided at paragraph 2 above. There is a cash reduction compared to the 10-11 baseline in each year of the Budget 2010 period ranging from some £22-37m per year and a real terms reduction of some 5-7%. (assuming 2% inflation). Overall, after making this adjustment the cash reduction over the 4 year period amounts to some £115m.

Resource Requirements

12. The Department's resource requirements are not only determined by the cost of existing services, but by the cost of any inescapable requirements it faces and the resource consequences of any new developments it wishes to pursue.

13. The Department faces a number of inescapable demands over which it has limited control and little, if any, discretion over its response. For example:

- the unemployment register is anticipated to rise further as a result of the economic downturn; this will place an additional demand on the Employment Service which will have to be resourced;

- UK government policy with regard to welfare reform will also place an additional and unavoidable demand on the Employment Service as a result of the migration of those currently in receipt of Incapacity Benefit to Employment Support Allowance or Job Seekers Allowance, and other changes to the arrangements for lone parents;

- the Department's budget for student support is already under severe pressure and these pressures will continue over the Budget 2010 period and will need to be properly resourced;

- resources will also need to be set aside for services which are currently funded by time limited monies such as the Funding for Innovation, which cease in March 2011; these include knowledge transfer and research activities in the Higher and Further Education sectors;

- recurrent provision also needs to be made available for the Assured Skills programme which has been funded on a time limited pilot basis to date; and

- although our financial strategy will be to bear down on pay and price inflation increases payable to our providers, we must recognise that some increases in costs will be inevitable as we progress through the Budget 2010 period.

14. Taking these issues into account our resource requirements for the Budget 2010 period compared to the resources available are as follows:

| 11-12 (£m) | 12-13 (£m) | 13-14 (£m) | 14-15 (£m) | |

| Baseline 2010-11 | 799 | 799 | 799 | 799 |

| Increased demand for Employment Service | 14 | 20 | 16 | 18 |

| Student Support Pressure | 21 | 25 | 32 | 41 |

| Innovation and Research | 13 | 11 | 8 | 7 |

| Assured Skills | 3 | 3 | 3 | 3 |

| Pay and Price Pressures | 5 | 7 | 28 | 50 |

| Total Requirement | 855 | 865 | 886 | 918 |

| Less Resources Available | 775 | 762 | 765 | 777 |

| Deficit | (80) | (103) | (121) | (141) |

15. This table demonstrates that if our cost and service pressures are to be met the Department faces a deficit of some £80m next year rising to some £141m by 2014-15. These deficits can only be met by reducing expenditure (either by improving efficiency or reducing services) or by generating additional income.

Options to Reduce Expenditure or Generate Additional Income

16. The Department was tasked by DFP earlier in the year to identify areas to reduce expenditure by some 5% year on year. This amounted to a target of reduced expenditure as follows:

| 11-12 (£m) | 12-13 (£m) | 13-14 (£m) | 14-15 (£m) | |

| 5% cash releasing reductions | 40 | 72 | 108 | 144 |

17. If these reductions in expenditure are delivered the impact on our resource requirements is as follows:

| 11-12 (£m) | 12-13 (£m) | 13-14 (£m) | 14-15 (£m) | |

| Target reduced expenditure | 40 | 72 | 108 | 144 |

| Total additional requirement | (80) | (103) | (121) | (141) |

| Total | (40) | (31) | (13) | +3 |

18. The table above shows that, even after achieving the target reductions, the Department continues to face a deficit of £40m and £31m in years one and two respectively. The position improves slightly in year 3 and particularly in year 4, but this is critically dependent on the target reductions being met. Given the scale, these will become increasingly difficult to deliver as we move through the Budget 2010 period - £144m by 2014-15 is an 18% reduction on the existing baseline.

Strategy for Reducing Expenditure

19. The Department's strategy for delivering the necessary reductions in expenditure focuses on:

- squeezing out unnecessary bureaucracy, concentrating resource on front line services;

- bearing down on pay and price inflation;

- recognising the public benefit of investment, but seeking greater contributions from service users and beneficiaries; and

- seeking improvements in efficiency from HE sector in particular, given the generous funding it has been allocated over the last 5 years.

20. Details are provided below:

| 11-12 £m |

12-13 £m |

13-14 £m |

14-15 £m |

Notes | |

| Proposed Budgetary | |||||

| Reductions | 8.5 | 8.5 | 8.5 | 8.5 | (1) |

| 10-11 Savings carried | |||||

| Forward | 3.0 | 3.0 | 3.0 | 3.0 | (2) |

| Pay and Price Restraint | 12.0 | 22.5 | 34.0 | 46.0 | (3) |

| Staffing efficiencies | 0.0 | 2.0 | 3.0 | 5.0 | (4) |

| Employment Relations | |||||

| and European Division | 0.5 | 0.5 | 0.5 | 0.5 | (5) |

| Further Education | 4.0 | 4.0 | 4.0 | 4.0 | (6) |

| Employment Service | 2.0 | 4.0 | 4.0 | 4.0 | (7) |

| Skills and Industry | 2.5 | 5.0 | 5.0 | 5.0 | (8) |

| Higher Education | 7.5 | 22.5 | 46.0 | 68.0 | (9) |

| Total Reduction | 40.0 | 72.0 | 108.0 | 144.0 | (10) |

Notes

(1) This represents a general tightening of budgetary provision across spending areas through improving efficiency and squeezing discretionary spending areas. It will not impact directly on existing services but it will reduce the Department's flexibility in responding to new and as yet unforeseen demands over the period.

(2) In June 2010 HM Treasury imposed reductions of £128m across the NI Block. The Department's share of this reduction amounted to some £6m which has been removed from the 2010-11 budget. £3m of these are available to carry forward from 2011-12 onwards.

(3) In order to avoid reductions in service provision and jobs the Department will seek to contain costs by bearing down on annual pay and price uplifts across its own cost structures and its service providers. This will be effected initially in the Department by the Executive's freeze on annual cost of living increases for all of those Departmental staff earning over £21,000 for two years. External providers and arms length bodies will be expected to exercise similar disciplines in containing costs.

(4) In addition to pay restraint, the Department will seek to achieve a 10% improvement in staff efficiency over the period whilst maintaining service quality. This should release some £5m by end of year 4.

(5) This small saving will be effected through a number of small scale budgetary adjustments of the divisions overall budget providing, for example, for improved efficiency in the Labour Relations Agency and managing down discretionary spend.

(6) Maintaining capacity in the FE sector throughout the period will be critical to maintaining an acceptable response to the economic downturn. But given the overall financial position the FE sector cannot be fully protected from reductions in expenditure. It expected however that this modest reduction will be delivered through a further 3% improvement in efficiency by the sector. This is on the back of efficiencies of some 20% delivered over the last few years.

(7) The aim will be to maintain as far as possible existing capacity in the Employment Service and its provision for those out of work. But given the overall position some reductions are unavoidable. The reduction will be delivered through improved targeting of resources to measures which are deemed most effective in enhancing individuals' opportunities to return to work.

(8) Enhancing skills levels in the economy are essential if the recognised productivity gap in the local economy is to be addressed and NI plc is to be supported in attracting foreign investment and maintaining a competitive position in the global economy. But again, a reduction in this budget is unavoidable. This will be effected by reducing the support infrastructure associated with the current arrangements, withdrawing funding for adult apprenticeships and encouraging employers to bear a greater proportion of the costs associated with delivery of other current adult programmes. Support for young people including the training guarantees for 16-17 year olds will be maintained at current levels.

(9) Given the need for the Employment Service and training capacity to be maintained as far as possible, if these services are to cope with the increasing demands they will face as a result of the economic downturn, it is inevitable that in line with decisions elsewhere HE must bear a significant proportion of the necessary reductions in expenditure. By the end of the period it is estimated that funding to the sector will need to reduce by at least £68m. A significant proportion of this will be delivered by a 22% real terms operational efficiency with the balance being delivered either by reductions in capacity, or by better targeting of existing support for students and additional income from fees. Final decisions on these matters have yet to be taken.

(10) Achieving the required reductions of £40/72/108/144m over the four year period leaves unresolved the deficit in funding of some £40m in 11-12 and £31m in 12-13 identified in paragraph 17 above. This is an issue of very significant concern to the Department and it continues to examine how it might close this funding gap. As part of this process it will wish to examine the degree to which some of the inescapable additional demands giving rise to the deficit can be reduced and to assess the service implications of this. But the room to manoeuvre is extremely limited as a significant proportion of the costs are already in the system. Even if these could be pared back by some 50% there would remain an unfunded gap of some £15-20m in each of the years 2011-12 and 2012-13.

21. If the funding gap identified above remains unresolved there will be a number of adverse impacts on services currently financed or delivered by the Department.

- provision to support people back to work will be spread more thinly over increasing numbers of unemployed people. Although we will have no choice but to implement the migration of people currently on Incapacity Benefit to job related programmes, very few individuals would progress to a work focussed interview and no additional provision would be available in the Steps to Work programme for them. Clients would be left waiting for excessive periods and little done to improve their employability;

- unlike in the rest of the UK we will not be able to bring forward the trigger point for intervention from 18 to 12 months for the over 25 age group, with real risks of this group becoming long term unemployed;

- generally our resources would have to be restricted to individuals who are required to participate in employment programmes as a condition of their benefits, leaving voluntary clients unsupported;

- funding for the 300 additional post graduate places financed in the last Programme for Government would be withdrawn in mid stream;

- funding to support knowledge transfer and innovation activity in the HE sector would be withdrawn and activity would cease. Further reductions in block funding to the sector would have to be contemplated threatening widening participation initiatives; and

- similarly no resources would be available to sustain activities in the FE sector currently financed by Funding for Innovation.

Capital Expenditure

22. The capital expenditure allocation will enable DEL to:

- fund the contractually committed elements in respect of the PFI contracts at Belfast Metropolitan College and South Eastern Regional College;

- fund the ongoing development works at the Springvale E3 campus of Belfast Metropolitan College;

- provide support to the FE sector in respect of Health and Safety and Minor works; and

- fund the development of teaching and research infrastructure at both the universities and the two university colleges.

Equality & Good Relations

23. Virtually all of the Department's budget allocation underpins sustainable development and increases economic activity. Despite the difficulties the budget as a whole will impact positively on well-being and on poverty within the region and foster good relations among the community. Preliminary equality impact assessments of individual measures have been completed. A high level impact assessment of the savings proposals is currently being finalised and will be published on the Department's website as soon as possible.

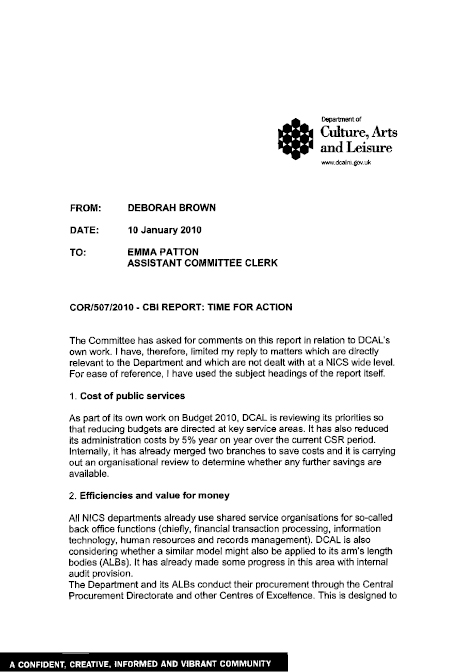

Committee for CAL - response to CBI report

Committee for Culture, Arts and Leisure

Room 344

Parliament Buildings

Ballymiscaw

Stormont

Belfast BT4 3XX

Tel: +44 (0)28 9052 1602

Fax: +44 (0)28 9052 1355

To: Shane McAteer

Clerk, Committee for Finance and Personnel

From: Lucia Wilson

Committee Clerk

Date: 21 January 2011

Subject: CBI Report: Time for Action

At its meeting of 20 January 2011 the Committee for Culture, Arts and Leisure considered correspondence from the Department for Culture, Arts and Leisure regarding the 'CBI Report: Time for Action'.

The Committee agreed to forward you the paper in response to your correspondence from 22 November 2010.

Lucia Wilson

Clerk

Committee for Culture, Arts and Leisure

Committee for CAL - response to CBI report

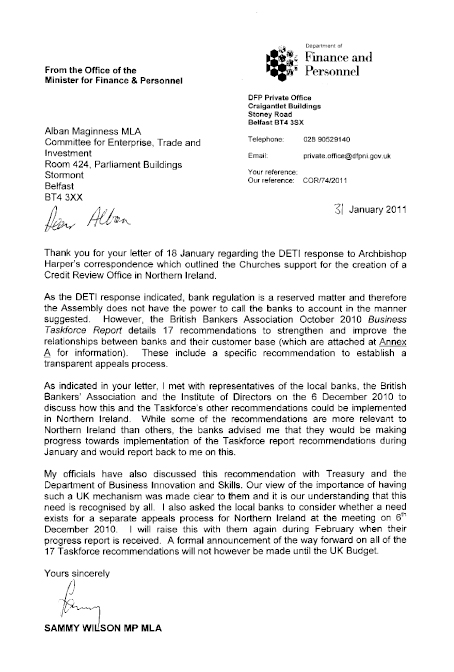

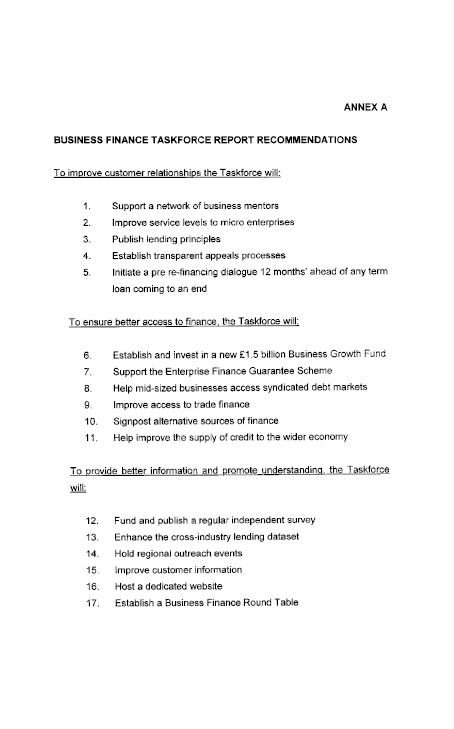

Committee for ETI - Priorities for sustainable growth

Committee for Enterprise, Trade & Investment

Room 375

Parliament Buildings

Tel: +44 (0) 28 9052 1614

Fax: +44 (0) 28 9052 1355

To: Cathie White

Clerk to the Committee for the Office of the First Minister & deputy First Minister

Peter Hall

Clerk to the Committee for Employment and Learning

John Simmons

Clerk to the Committee for Education

Shane McAteer

Clerk to the Committee for Finance and Personnel

Roisin Kelly

Clerk to the Committee for Regional Development

From: Jim McManus

Clerk to the Committee for Enterprise, Trade and Investment

Date: 24 January 2011

Subject: NI Executive Economic Strategy – Priorities for Sustainable Growth:

Consultation Document

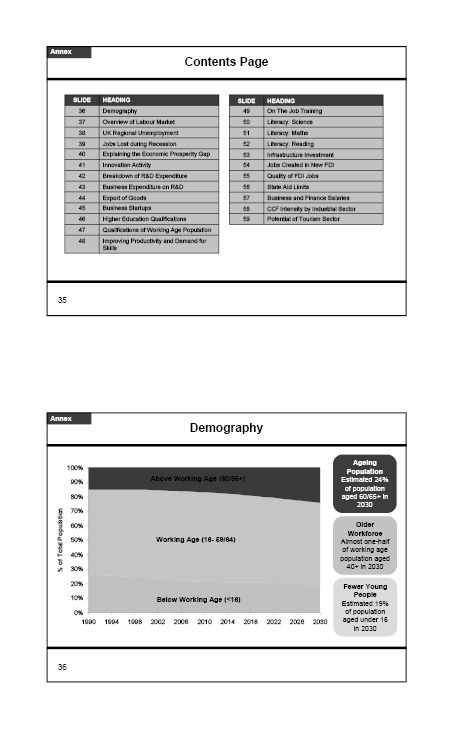

1. At its meeting on the 20 January, the Committee for Enterprise, Trade & Investment considered the Executive's consultation on Priorities for Sustainable Growth.

2. This is one part of formulating a new economic strategy for NI. The responses from this consultation will be considered with another consultation based on the outcome of the UK Government's review on rebalancing the NI economy.

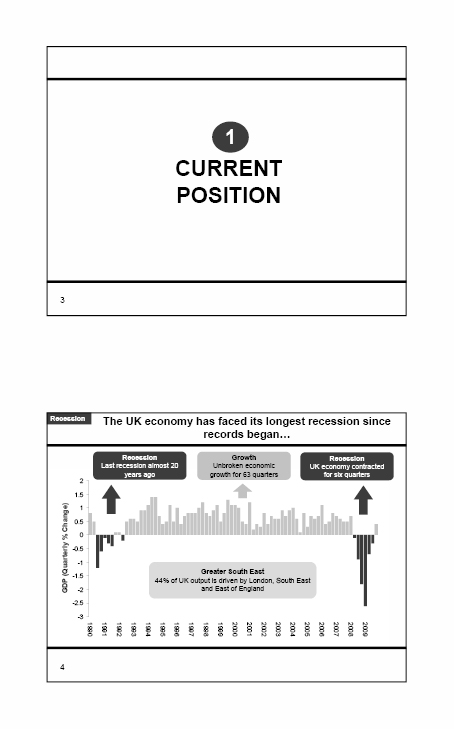

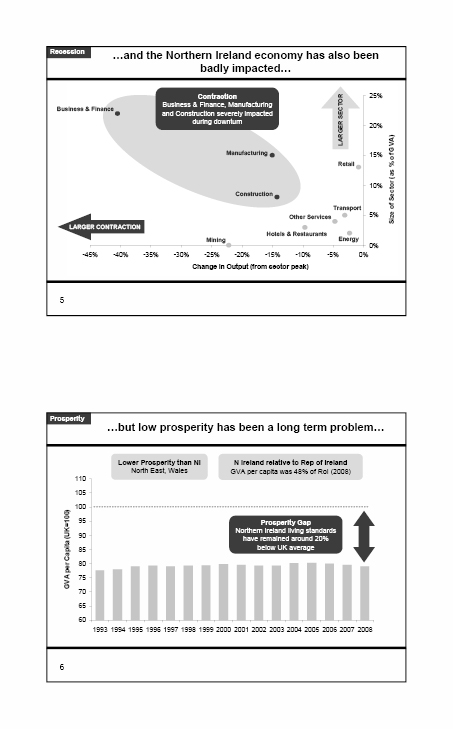

3. The consultation focuses on 3 key issues:

1. Performance of the NI economy over the past 10 years and the impact of the recession.

2. Where the Executive wants the economy to be by the year 2020 and the overall strategic priorities for the Executive.

3. Key issues relating to the actions that need to be taken by NI Departments in order to deliver the priorities.

4. The Committee agreed to forward the consultation document[1] to other relevant committees for their views. I would be grateful for your respective committees' views by Friday, 12 February.

Please feel free to contact me if you have any questions.

[1] http://www.detini.gov.uk/northern_ireland_economic_strategy_-_initial_consultation_paper__priorities_for_sustainable_growth_and_prosperity.pdf

Audit Committee - Annex to submission

Audit Committee

Northern Ireland Audit Office – Proposed Estimate for 2011-12

Memorandum for The Audit Committee of the Northern Ireland Assembly

Introduction

1. The Office's most recent estimate, which was for 2010-11, was approved by the committee in March 2010 and set out a net resource requirement of £9.0million which, in itself, represented a decrease in real terms of 3% from the previous year.

2. As a result of the government's comprehensive spending review there is considerable pressure on all areas of government to generate savings and our Office is determined to play its part in making those savings.

3. Therefore in planning our estimate for 2011-12 we have thoroughly examined all areas of our expenditure to identify where further savings can be generated and also take advantage of the efficiencies that we have achieved in previous years.

4. The proposals set out below ensure that the Office identifies the maximum reduction in its estimate whilst still being able to maintain the same quality and extent of service to the Assembly that it has offered in recent years.

Proposed savings

5. Our proposed savings would:

- Make an adjustment to our estimate in 2010-11 of £600,000 thereby reducing our budget to £8.4 million for the current year and amounting to a 7% cut in our estimate immediately.

- In 2011-12 we would propose to reduce our budget by a further 4% in cash terms – therefore our estimate in 2011-12 would be more than 10% lower in cash terms than our original estimate in 2010-11.

- We would follow these reductions by further reductions (in cash terms) of 3% in 2012-13 and 1% in 2013-14.

- Overall by the third year of the plan our savings would amount to a reduction of 13.5% in our net resource requirement in cash terms and around 19% after allowing for inflation.

6. We are able to make these savings by a number of means:

- Over the last number of years we have benefitted from significant cumulative savings that have been generated from changes to the way we do our work. This means that we are now able to take advantage of those savings by reducing our estimate by a large amount immediately;

- We intend to reduce our outsourcing requirements significantly by ensuring the optimal use of our staff at peak times and continuing to build our in-house capability in key areas;

- There will be reduced recruitment during the period. Only essential vacant posts will be filled and we will suspend our graduate trainee accountant programme for a time to help reduce overall numbers; and

- We anticipate a two year pay freeze for staff during the period.

7. Our projected spending over the period of the plan will therefore be:

| 2010-11 Estimate £m |

2011-12 Forecast £m |

2012-13 Estimate £m |

2013-14 Estimate £m |

|

| Staff (permanent) | 7.7 | 7.4 | 7.4 | 7.4 |

| Staff (temporary) | 0.5 | 0.2 | 0.1 | 0.0 |

| Consultancy | 0.3 | 0.2 | 0.1 | 0.1 |

| Contracted out audit | 1.4 | 1.3 | 1.3 | 1.3 |

| Other costs | 2.0 | 1.5* | 1.8 | 1.5 |

| Gross resource requirement | 11.9 | 10.6 | 10.7 | 10.3 |

| Income | (2.9) | (2.2) | (2.5) | (2.2) |

| Net resource requirement | 9.0 | 8.4** | 8.2 | 8.1 |

| Supplementary estimate | (0.6) | |||

| Revised estimate | 8.4 |

* Other costs include £300,000 in 2010-11 and in 2012-13 for our costs incurred in the National Fraud Initiative. This is only carried out biannually and leads to some fluctuation between years.

** The net resource requirement in 2011-12 includes £0.4m of resources transferred to us from the National Audit Office following the transfer of policing and justice audits. This funding transfers directly from the GB exchequer and puts no additional pressure on the NI block. In order to compare the net resource requirement of 2010-11 to later years, £0.4m should be deducted from the net resource requirements for each year from 2011-12 onwards.

Assembly Commission - Annex A

Assembly Commission Del Resources Budget Over The Csr Period

| Expenditure Description | 2010-11 Budget | 2011-12 Forecast | 2012-13 Forecast | 2013-14 Forecast | 2014-15 Forecast |

| £m | £m | £m | £m | £m | |

| Members Costs (subject to IFRP) | £16.40 | £17.40 | £16.37 | £16.37 | £16.37 |

| Party Allowance | £0.80 | £0.80 | £0.80 | £0.80 | £0.80 |

| Secretariat Costs | £26.90 | £25.45 | £25.44 | £25.33 | £25.29 |

| Non-Cash Costs | £4.30 | £3.80 | £3.59 | £3.58 | £3.57 |

| Total Resources | £48.40 | £47.45 | £46.20 | £46.08 | £46.03 |

| £47.19 | £45.98 | £44.77 | £43.56 | ||

| GDP Deflator | 1.9% | 2.3% | 2.6% | 2.6% | |

| 2010-11 Budget in real terms | £49.32 | £50.45 | £51.76 | £53.11 | |

| Total Real Cut £M | -£7.08 | ||||

| Total Real Cut % | -13.3% | ||||

| Total Cash Cut £M | -£2.37 | ||||

| Total Cash Cut % | -4.9% | ||||

Chairpersons Liaison Group

Committee for Regional Development - letter to the Speaker

Committee for Education - Final response

Committee for Education Final Response (15 February 2011)

To the Committee for Finance and Personnel on its Scrutiny of the Department of Education Draft Budget 2011–15: Draft Allocation and Savings Proposals Published on 13 January 2011

Pre Draft DE Budget Publication Scrutiny

1. The Chairperson of the Committee for Education wrote to the Minister of Education on 8 July 2010 highlighting the Committee's need for timely and detailed information on the future Education Budget in the context of Budget 2010 as follows:

'The Committee, at its meeting of 30 June, stressed the importance of Department of Education copy papers to DFP over summer recess and responses to future requests for information on the Education Budget (in the context of Budget 2010) arriving with the Committee in good time so they can be given the Committee's full consideration. I would also emphasise that it is essential for the Committee to receive full and detailed information on the impact of your options for savings/cuts.'

2. The Committee requested copies from the Department of Education (DE) of information on its savings proposals to be provided to DFP by 26 August 2010 and other detailed information through its letters on 1 & 7 July 2010 for its Committee meetings of 1 & 8 September 2010, which were dedicated sessions for scrutiny of DE draft Budget proposals. The Committee subsequently received briefing papers from DE on 25 August 2010 and 7 September 2010 on Budget 2010 – Spending proposals. The Chairperson of the Committee wrote to the Minister of Education on 2 September 2010 listing key issues raised by the Committee at its meeting of 1 September 2010 with senior Departmental officials on the DE initial Spending Proposals. These included:

'Resource Spending Proposals:

- Teachers pay and non teaching pay bill in the context of the Government's pay freeze and national pay agreements;

- Up-front redundancy costs to deliver savings;

- Cost of the extension of Free School Meals Eligibility criteria; and

- Public Private Partnership resource costs;

Capital Spending Proposals

- The approach to and relative merits of costs of different procurement options for funding major and minor works for schools – including the balance between major and minor works funding; and

- The Review of Middletown Centre for Autism building costs.'

3. The Committee continued its scrutiny of DE initial Spending Proposals at meetings on 13 October 2010 with the Association of School and College Leaders and the National Association of Head Teachers, on 17 November 2010 with representatives of E&LBs Chief Executives, and on 1 and 8 December 2010 with senior Departmental officials (examining ICT/C2K and School Transport policy in the Budget context). Departmental officials also provided briefing papers on 19 October 2010 on non-permanent teaching and non-teaching staff and actual retirees/leavers, and on 24 November 2010 provided an analysis of the Resources and Capital Spending Proposals for the Budget 2010 period.

4. Following the Executive's Draft Budget publication on 15 December 2010, the Committee Chairperson wrote to the Minister of Education on 17 December 2010 stressing the Committee's need for timely and detailed information on the Minister's forthcoming draft DE budget 2011 – 2015 as follows:

'With the Executive's agreed Draft Budget allocations now announced and with the public consultation on this closing on 9 February 2011, it is imperative that the Committee receives your revised Spending Proposals written to the Executive's Draft Budget education allocations as soon as possible please. You will appreciate that your Spending Proposals need to be at a detailed level to allow the Committee to properly scrutinise proposed allocations and formulate views to be put to you. It is important that the Committee receives the Saving Delivery Plan associated with your revised Spending Proposals. We also need clarity on your priorities reflected in your revised Spending Proposals and what the implications are of year-on-year reduced expenditure allocation proposals (where appropriate) – again at a sufficiently detailed level.'

5. The Committee met on 1 December 2010 to continue its scrutiny of the forthcoming draft DE Budget and questioned senior Departmental officials on whether or not the Department was undertaking options/scenario planning on draft Spending and Saving proposals, particularly to protect frontline school services. Some Members expressed grave concerns that the senior official responded that:

'Our Department like any other Department works under the direction and control of the Minister…' '..beyond the high level figures at block level that are available I have no figures on which to commission any work nor do I have any authority to commission any work on scenarios…'

The Committee received a further DE briefing paper on Education Workforce issues on 11 January 2011, which included a breakdown of the 15,635 education service non-permanent staff.

Post Draft DE Budget Publication Scrutiny

6. The Minister of Education's Draft Budget 2011 -15: Draft Allocations and Savings Proposals were published on the evening of the 13 January 2011 and the Minister wrote to the Committee on 14 January 2011 saying that she was 'keen to meet and engage with the Committee at the earliest opportunity to hear your view on my proposals.'

7. The Minister attended the Committee's meeting on 18 January 2011 and the Committee continued its scrutiny of the DE Draft Budget with senior Departmental officials at meetings on 25 and 26 January 2011, dedicated exclusively to scrutiny of the Draft Budget. Following the meeting with the Minister of Education, the Committee agreed to formally request from the Department as a matter of urgency, a range of information through questions in seven specific areas (noted below).

8. The Committee raised a number of key issues with the Minister and these were set out in a list attached to the Committee's letter to the Department dated 19 January, in the following terms:

(1) The Draft Resource Allocation section – paragraph 3.2 to 3.5 of pages 6-8

Paragraph 3.3 refers to 'inescapable cost pressures associated with pay increases, price inflation, meeting statutory and contractual commitments and addressing demographic impacts'. Table 2 refers to these 'Inescapable Pressures' which are the key components of the resource spending 'shortfall' or 'Gap' building to £303million in 2014-15. The Committee requests a detailed breakdown of these 'Inescapable Pressures' for each year of the 4 years of this Budget period and the basis/rationale or underlying assumptions for each element of this.

(2) The Executive's Invest to Save Fund– paragraph 3.6, page 8

Paragraph 3.6, refers to £10million available from the Executive's Invest to Save Fund for Education for each of the years 2011-12 and 2012-13 to pay for severance/redundancies and 'The Department will be seeking further provision for redundancies from the balance of the Executive's Invest to Save Fund'. The Committee requests the Department's forecast estimates/planning assumptions at this stage of the savings generated from reducing posts over each of the 4 years of this Budget period. The Committee needs to understand the 'shortfall' or 'gap' in spending requirements set out in Table 2, as this 'shortfall' determines the all-important savings proposals totals for each of the 4 years set out in Table 4.

(3) End Year Flexibility – paragraph 3.7 & 3.8, page 8

The Committee's position on End Year Flexibility is that schools should not lose the £56million. However, the Committee requests what the likely pattern of draw down of this money would have been over the 4 year budget period – from previous annual draw downs – and what is the distribution of this money between primary, post-primary and the various school sectors. The Committee wishes to understand the problem this presents for schools and requests information on the options to mitigate the impact of loss being considered by the Department eg. phasing out options. The Committee would also ask for assurance that all schools affected by this EYF issue should be treated fairly under measures taken to mitigate the impact of the loss.

(4) Draft Capital Allocation – paragraphs 3.9 to 3.12, pages 8-10

Paragraph 3.12 refers to '44% and 35% of the draft Budget allocations in 2011-12 and 2012-13 is required to meet financial commitments (or inescapable pressures)'. The Committee asks does this mean existing contractual commitments and whether the remaining % is for some 'moderate' investment in minor works and maintenance particularly to meet statutory requirements. The Committee requests clarity on this, as the Minister is proposing to reclassify £41million in 2011/12 from capital to resource – this would leave £86.4million capital resource in 2011/12, and with £56 million committed, this reduces to £30million. The Committee asks what risk does this present in terms of planned and unplanned statutory work which could arise in schools in 2011/12.

(5) Extension of Free School Meal Entitlement (FSME) – paragraph 5.2, page 14

Section 5 provides the Minister's more specific priorities for protection in the Budget period, which includes the extension of eligibility of Free School Meals Entitlement and the reference to 'an additional £1million in 2011-12'. However, resource spending proposals given to the Committee in September 2010 gave an extension of FSME requirement of £21.8 in 2011-12 with some £31m costs per annum for the other 3 years of this Budget period. The Committee requests specific clarification on this – to include the specific spending proposals for the extension of FSME over the 4 year Budget period.

(6) Proposed Savings – Table 4, page 16

The Committee needs a lot more information on the impact of the proposed savings in this table and requests in particular:

- What will be the impact of £5million per annum out of the 'Home to School' budget?

- Can more effective procurement make these substantial savings in 'ICT in Schools' and what is the impact of these savings?

- What will be the re-organisation and impact of the very substantial savings in 'Professional Support for Schools'?

- How are savings going to be achieved in Arms' Length Bodies (ALBs) – in particular, the £15m in 2011-12 - and what will be the impact?

(7) Aggregated Schools Budget – paragraph 5.24, page 22

The Committee has major concerns with these saving proposals on the 'Aggregated Schools Budget' and the associated paragraph 5.24 commentary. This proposed saving amounts to £26.5m in Year 1 rising to £180m in Year 4, and in % terms this represents 18.5%, 45%, 49% and 58% of the total savings proposed by the Minister. The Minister has stressed in her recent letters to the Committee, etc that her key priority is 'to protect front line services (schools) as far as possible'. While noting the Minister's assessment that the Department of Education requires access to the additional 'possible revenue sources' [£800million] identified in the Executive's Draft Budget, some Members of the Committee asked how does this sit with these substantial direct Schools' Budget Savings proposals ? The final year proposed cut is nearly one-fifth of the Schools' Budget. Finally, paragraph 5.24 refers to putting 'in place plans across the Education Sector to reshape the school provision through rationalisation and restructuring...'. This Committee requests what are the specific plans, including details of planned actions and timescales.

9. The Committee Chairperson emphasised that it was vital that the Department's Draft Spending Plans, based on the draft DE budget document are provided to the Committee as soon as possible – the Committee wrote to the Department to this effect on 20 January 2011.

10. The Committee received a response from DE on the evening of 24 January 2011 addressing the above information requests and questions and this (together with other key DE Budget 2010 papers and the Hansard record of the Minister's session before Committee on 18 January 2011) formed the focus of the Committee's discussion with senior Departmental officials at the Committee's meetings of the 25 and 26 January 2011 (this response and other key DE papers and the Hansard record have been placed on the Committee's website available at http://archive.niassembly.gov.uk/education/2007mandate/educationbudget_07.htm).

11. The key points and concerns raised by the Committee, or some Members of the Committee, during these discussions are as follows:

The Absence of Draft DE Spending Proposals

(a) The DE response stated that Department's Draft Budget document highlights the 'main spending proposals', but when the Chairperson asked senior officials to identify these, they referred members to the Minister's additional spending proposals which are included in the Department's Draft Budget proposals:

- extension to Free School Meals Entitlement (FSME) of £1 million in 2011-12:

- £3 million in 2011-12 for the Early Years (0-6) Strategy.

Some Members concluded that it was essential to receive a breakdown of the Minister's Draft Spending Proposals for the £1.9 billion draft Education Budget now and could not accept the Department's view that 'to provide something at this stage could, in fact, be misleading for Committee Members'. The Department's view was expressed in the context that:

'At this stage it is not possible to reflect the out-workings of these changes [spending and savings changes] and update the Budget Distribution table as:

i. Work is currently on-going to disaggregate some of the draft Budget proposals across the various bodies;

ii. The £41million capital to resource reclassification is still subject to Executive approval; and

iii. My Minister is determined to increase the amount of funding available for education.' [DE letter to Committee of 24 January 2011]

Also, some Members questioned the wisdom of not setting out draft Spending Proposal Plans on the grounds that the 'Minister is determined to increase the amount of funding available for education' and said that a 'further £800 million is yet to be allocated'. These Members, while they would very much welcome additional money for education, pointed out that the Executive's Draft Budget referred to 'other possible revenue sources' and 'If any...have merit..., they will be factored into the final Budget allocations.' Other Members stressed the need for the Executive to work together to secure additional funding for departments.

Invest to Save

(b) The Committee received no information from DE on forecast estimates or planning assumptions at this stage of savings generated by reducing posts over the 4 years of the Budget period. Although some £25 million is available in 2010/11 for a Voluntary Severance Programme, no definitive take-up figures or savings generated estimate was given – there was a suggestion that a £10 million take-up might represent 200 post reductions. Some Members were very concerned about the lack of information in this area as staff costs account for 80% of the education budget. The DE papers cited this as 'clearly a critical area of work' and some Members questioned the wisdom of not considering targeting potential savings from the 11,200 non-teaching non-permanent staff and the natural wastage from retirees and leavers, bearing in mind the total education service workforce is some 60,000 staff. Again, no information was available from DE officials on any consideration of this. Officials indicated that only when areas for savings had been confirmed could the potential for savings through reductions in non-permanent staff be assessed. The current Voluntary Severance Programme is focussed on 'central management and administration and also professional development and support services'. Some Members saw the need to consider this area as a matter of urgency as clearly extensive job cuts would be necessary to deliver the magnitude of the savings proposed by the Minister in Table 4 of her Draft Budget, and in particular, with the proximity of the significant proposed savings commencing 1 April 2011. Other Members welcomed the protection of frontline services and jobs, particularly in Year 1 of the Draft DE Budget and called for additional funds from the possible additional £800 million for Years 2-4.

End Year Flexibility

(c) The Committee welcomed the Finance and Education Ministers' guarantee on 21 January 2011 to put in place arrangements to ensure that schools have access to the £56.7 million surplus which they have accumulated, and both past and future savings will be honoured. Members agreed that they would wish to see precisely what these arrangements will be and that schools receive the necessary communication on this as soon as possible. Members also expressed concern at the number and level of school deficits (some 200 schools and £10.7 million total deficit), particularly with the draft DE Budget proposal to significantly reduce the Aggregated Schools Budget.

Draft Capital Allocation

(d) The Committee expressed concern at the overall level of the proposed capital available to DE for allocations over the 4 years budget period, particularly with the substantial maintenance backlog (estimated at £300 million) and minor works backlog (estimated at £100 million). Some Members questioned and had concerns with the Minister's proposal to reclassify £41 million in 2011/12 from capital to resource, for example, this would reduce the uncommitted element in 2011/12 to £30 million and run the risk of not meeting statutory and Health and Safety requirements. While again other Members agreed with the reasoning of the Minister in proposing the move to protect jobs and frontline services. Also, at an earlier meeting, some Members questioned DE officials about whether more active consideration should be given to moving school capital projects forward by way of PPP or similar mechanisms.

Extension of Free School Meals Entitlement (FSME)

(e) Some Committee Members questioned and expressed concern with the DE initial Spending Proposals on the extension of FSME which was estimated in total to cost £21.8 million in 2011/12 and some £31 million per annum for the other 3 years of the Budget period. The Committee requested clarification on this and received, in the 24 January 2011 DE paper, significantly reduced spending proposals of £4, £4.6, £4.7 and £4.8 million for the Budget period, based on a significantly reduced estimate of 10,000 additional take-up and the figures include £0.4 million extension of primary school uniform grant. The Committee noted no additional funding has been identified to address the 'knock-on' increase on the Aggregated Schools Budget through the Age Weighted Pupil Unit (AWPU). However, some Members remained concerned that this extension of FSME has not been taken forward by the other parts of the United Kingdom and should demand exceed the 10,000 forecast, costs would increase – questioning if this extension is affordable in the context of the draft DE Budget allocations and whether the extension to Key Stage 2 pupils in September 2011 should be cancelled - while other Members welcomed the extension of free school meals as a valuable asset to low income families.

Proposed Savings Areas

(f) On the proposed savings listed in Table 4 of the Draft DE Budget, some Members had serious concerns that a lot more information is needed on the means to achieve such savings and the impact of these savings – particularly the substantial savings proposals and the impact, directly or indirectly, on front line services in schools. For example, there is very little information on how substantial savings in Arm's Length Bodies (£60 million over the 4 years) and Professional Support for schools (£105 million over the 4 years) will be delivered, particularly as significant savings are proposed for 2011/12 with no evidence of plans, consultations, or timescales. Some Members pointed to the difficulty in identifying implications of the Budget due to the complicated nature of the education structure with numerous Arms Length Bodies and over 1200 schools managing budget lines.

Some Members questioned and had concerns with the level of spending remaining for SEN capacity building, as the SEN and Inclusions Strategy is not finalised, while others agreed that such a budget line should remain open. Some Members questioned whether the proposed savings in Teacher Substitution Costs are achievable; and whether the savings proposed on Primary Principal Transfer Interviews can be taken forward as consultation on this proposal has not commenced.

Aggregated Schools Budget (ASB) Proposed Savings