Report on the Horse Racing (Amendment) Bill

Committee for Agriculture, Environment and Rural Affairs

Session: Session currently unavailable

Date: 14 October 2021

Reference: NIA 119/17-22

Report on the Horse Racing (Amendment) Bill.pdf (601.13 kb)

To accompany the full report (available below) the Committee has also produced a

'Summary Bill Report'.

This report is the property of the Committee for Agriculture, Environment and Rural Affairs.

Neither the report nor its contents should be disclosed to any person unless such disclosure is authorised by the Committee.

Ordered by the Committee for Agriculture, Environment and Rural Affairs to be printed on 14 October 2021.

Report Number: NIA 119/17-22

Mandate 2017-22

Contents

- Powers and Membership

- Executive Summary

- Introduction

- Background and Context

- The Horse Racing Fund

- Impact on NI Racecourses since 2019

- The Horse Racing (Amendment) Bill

- Committee Consideration of the Bill

- Committee Deliberations

- Clause-by-Clause Considerations

- Wider Policy Issues and Recommendations

- References

- Appendices

1. Powers and Membership

The Committee for Agriculture, Environment and Rural Affairs is a Statutory Departmental Committee established in accordance with paragraphs 8 and 9 of Strand One of the Belfast Agreement 1998 and under Assembly Standing Order 48.

The Committee has a scrutiny, policy development and consultation role with respect to the Department for Agriculture, Environment and Rural Affairs and has a role in the initiation of legislation.

The Committee has power to:

- consider and advise on Departmental budgets and annual plans in the context of the overall budget allocation;

- consider subordinate legislation and take the Committee Stage of primary legislation;

- call for persons and papers;

- initiate inquiries and make reports; and

- consider and advise on matters brought to the Committee by the Minister for Agriculture, Environment and Rural Affairs

The Committee has nine members, including a Chairperson and Deputy Chairperson, and a quorum of five. The membership of the Committee is:

Mr Declan McAleer MLA (Chairperson)

Mr Philip McGuigan MLA (Deputy Chairperson)

Ms Clare Bailey MLA

Mrs Rosemary Barton MLA

Mr John Blair MLA

Mr Maurice Bradley MLA (to 20 September 2021)

Mr Harry Harvey MLA

Mr William Irwin MLA

Mr Patsy McGlone MLA

2. Executive Summary

1. This report sets out the Committee for Agriculture, Environment and Rural Affairs' (AERA) scrutiny of the Horse Racing (Amendment) Bill ("the Bill") that was referred to it for Committee Stage on 27 April 2021.

2. The Bill is largely technical in nature and proposes several amendments to the Horse Racing (Northern Ireland) Order 1990 that sets out the legislative basis for the management of the Horse Racing Fund ("the Fund").

3. As explained in the body of the report, allocations from the Fund have been made to support activities at Down Royal and Downpatrick horse racecourses over the past three decades.

4. However, as a result of specificities in the 1990 Order the current operators at Down Royal have been prevented from making applications to the Fund since 2019, and this has also had a knock-on effect for Downpatrick racecourse.

5. The Bill seeks to mitigate the legal technicalities in the 1990 Order and ostensibly provides a framework by which allocations from the Fund can be resumed.

6. The Committee engaged with a small number of key stakeholders in its call-for-evidence on the Bill and following evaluation of the information received, has highlighted a number of wider policy issues that should be addressed via recommendations made at the end of this report.

7. In summary, the Committee is content with the Bill as drafted and recommends that the Assembly agree to its passage.

3. Introduction

8. This report outlines the work undertaken by the AERA Committee to scrutinise the Horse Racing (Amendment) Bill that passed Second Stage in April 2021 and the Committee's recommendations to support Members of the Legislative Assembly (MLAs) in their considerations of this legislation.

9. It provides an overview of:

- Contextual information relating to horse racing in NI

- Background to, and explanation of, the Horse Racing Fund

- The financial impact on Down Royal and Downpatrick racecourses in recent years, including the consequences of being unable to apply for Fund allocations

- A synopsis of the salient aspects of the Bill and reason(s) for its introduction

- The call-for-evidence activities undertaken by the Committee to help inform its considerations

- The Committee's deliberations on how effective the Bill may be in meeting its objectives

- The clause-by-clause scrutiny of the Bill as introduced

- Recommendations made by the Committee to facilitate wider policy development

4. Background and Context

Horse racing in NI

10. Horse racing refers to the breeding and training of thoroughbred horses and their participation in professional sport via races that are held at designated courses. It is a long-established and popular pastime with a vibrant support base across Great Britain and Ireland. Large meetings attract thousands of spectators with the Grand National, Epsom Derby and the Punchestown Festival being some of the biggest events in the sporting calendar.

11. It is also a significant generator of economic activity, with approximately €90 million placed in on-site bets at Irish racecourses in 2019 and in excess of €250 million via online betting each year.

12. There are two designated horse racecourses in NI:

- Down Royal Racecourse located near Lisburn, County Down

- Downpatrick Racecourse, Downpatrick, County Down

13. Horse racing is governed on an all-island basis and Horse Racing Ireland is the responsible body for the organisation, promotion and development of both horse breeding and horse racing industries.

14. There is a dedicated member from NI on the Horse Racing Ireland board to ensure that the interests and needs of the local sector are represented in strategic planning and implementation of its work programme.

Activity at Down Royal and Downpatrick

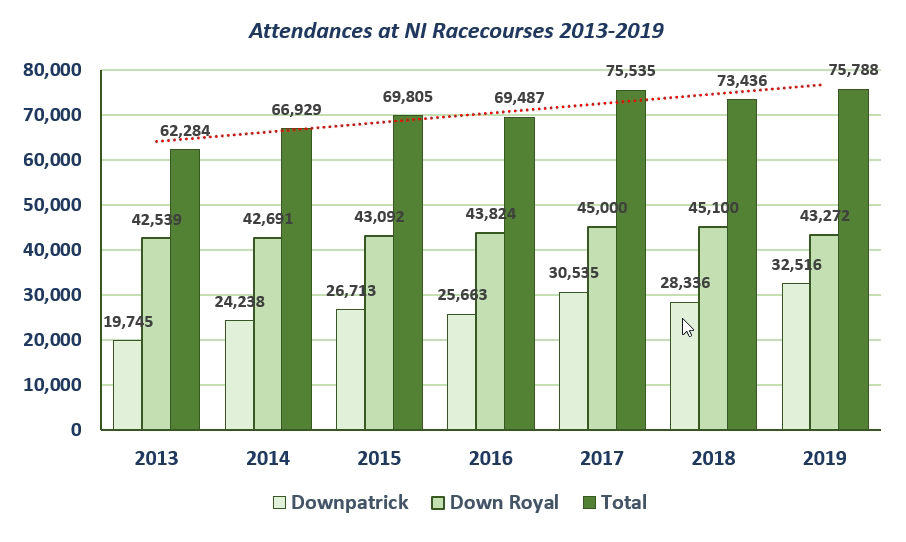

15. Whilst the two NI racecourses are relatively small compared to more high-profile sites such as Leopardstown, Galway and Punchestown, they nevertheless have a strong, dedicated fan base and attendance figures have remained healthy, and grown slightly, over the past number of years:

Economic Activity

16. A review published in 2019 by Deloitte evaluated the economic benefits of the equine sector in NI and estimated that the industry, as a whole, generates expenditure of between £170 million and £212 million per annum.

17. The report projected that events held at the two local racecourses (along with other, smaller point-point sites) account for £9 million in economic activity annually, but found that less than half of the on-site spend at Down Royal and Downpatrick is retained by the racecourses themselves as revenue is shared with catering services and betting outlets. Racecourses only retain entirely the price of racegoer admission tickets, the revenue from which is used to offset operating costs and facilitate site maintenance.

18. The review highlighted the importance of race events to businesses in the vicinity of Down Royal and Downpatrick as racegoers generate significant income for the hospitality, food and drink, transport and accommodation sectors.

19. It is projected that events held at the two local racecourses account for approximately £4.5 million in revenue for the local economy in "off-site" spending.

5. The Horse Racing Fund

20. The Horse Racing (Northern Ireland) Order 1990 provides the legislative basis for the operation of the Horse Racing Fund ("the Fund"), that is overseen and managed by the Department for Agriculture, Environment and Rural Affairs (DAERA).

21. The Fund comprises a source of income for local horse racecourses to assist with their operating costs. It is financed via annual levies made to bookkeepers operating in NI on the basis that a proportion of their income is inextricably linked to local race events.

22. The current annual charges are as follows:

- Bookmaker's licence fee: £99 (on-course bookkeepers)

- Bookmaking Office licence charge: £1,123 (off-course bookkeepers)

23. The total annual income to the Fund is approximately £350,000.

24. Since 1990 payments have been made on an annual basis from the Fund to Downpatrick and Down Royal to assist with prize money for races, costs associated with technical and personnel services on race days and interventions to ensure the safety of spectators at race meetings or the proper conduct of racing.

25. The model of subsidising the operating expenses of racecourses via charges on bookkeepers is commonplace across Europe. It was first introduced in Great Britain in 1961 to offset a decline in race day revenue (gate receipts), following the introduction of legislation which meant that people wishing to place a bet on a horse race no longer needed to physically attend a racecourse.

26. Historically, both NI racecourses received a small amount of government assistance and after the passage of the Horse Racing and Betting (Northern Ireland) Order 1976 the Fund was established to support activities at Down Royal.

27. The 1990 Order extended scope of payments from the Fund to Downpatrick.

6. Impact on NI Racecourses Since 2019

28. The 1990 Order specifically names the "Governor and Freeman of the Corporation of Horse Breeders, (the Corporation)" as the beneficiary operator of Down Royal.

29. The Corporation is no longer the operator at Down Royal which was taken over by a private entity in early 2019. Therefore, the current operator has been unable to apply for Fund allocations since 2019 due to it not being specifically named as an operator in the 1990 Order.

30. Downpatrick has also been impacted as a consequence of there being specifically named beneficiaries in the 1990 Order as DAERA temporarily declined Fund applications from Downpatrick in 2019 as it sought clarity on whether continued payment to one racecourse could contravene state aid regulations.

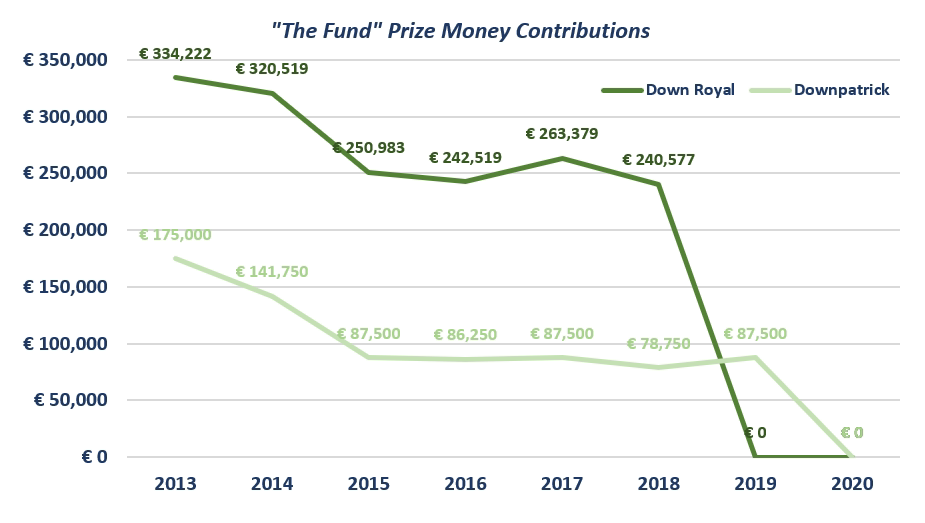

31. Allocations from the Fund have been predominantly used to contribute to the prize monies available at Downpatrick and Down Royal, with Fund payments comprising approximately 11% and 16% of the prize money respectively at each venue between 2016 and 2019.

32. The chart below shows the total allocation from the Fund that was used towards prize money contributions at both courses since 2013:

33. This clearly shows the profound impact that the loss of income via Fund allocations has had, particularly on Down Royal racecourse. In the absence of this revenue, Down Royal has had to seek additional support from private sponsors in order to bolster and maintain its overall prize money pot – in 2019 contributions from sponsors accounted for 18% of annual prize money at the course, compared to an average of just over 1% in the three previous years.

34. Allocations from the Fund are also used at Down Royal and Downpatrick to facilitate site maintenance and make building improvements to ensure the safety of spectators.

7. The Horse Racing (Amendment) Bill

35. The Horse Racing (Amendment) Bill was introduced to the Assembly by the Minister for DAERA in April 2021.

36. The Bill is largely technical in nature and has been introduced ostensibly as a result of nuances within the 1990 Order that governs the allocation of payments from the Fund.

37. It seeks to address the current situation whereby Down Royal racecourse cannot access Fund payments by redefining in law the named operators of the racecourses. This will facilitate the resumption of payments from the Fund.

38. The Bill comprises six Clauses and has the overarching policy aims:

- Amend the named operator of Down Royal racecourse in the Horse Racing (Northern Ireland) Order 1990

- Facilitate Fund payments to both Down Royal and Downpatrick racecourses

- Provide a legal framework to bring about future amendments to named beneficiaries more easily

- Make other minor changes to the wording of the 1990 Order

39. Clause 1 proposes to amend the 1990 Order by omitting references to obsolete ownership titles and to insert a generic definition of a "horse racecourse operator" that will cover the current operators at both Down Royal and Downpatrick. It also provides for a process whereby DAERA can bring about changes to named beneficiaries more easily, through a resolution of the Assembly. This may help to avoid any delay or suspension of Fund payments in the future.

40. Clause 2 amends Article 3 of the 1990 Order to take account of the amendments made by Clause 1. It also requires the operators to submit a statement of their proposed budget and expenditure plans for the following year to DAERA on or before 31 October of each year and amends the 1990 Order to allow an operator to submit future expenditure plans to DAERA individually or along with another racecourse.

41. Clause 3 makes minor and consequential amendments to the 1990 Order to replace references to "the Corporation" and "the Company" with appropriate references to a "horse racecourse operator". This clause also omits Article 11 and paragraphs 5 and 6 of Schedule 1 to the Order, which concerned rules and bye-laws of the Corporation and are no longer required

42. Clauses 4-6 are supporting and explanatory and do not contain any substantive policy effect.

Transitional Amendment to the Bill

43. On 5 July 2021 DAERA wrote to the Committee outlining a need to include an amendment in the Bill.

44. Article 3(4) of the 1990 Order (as amended by the Bill) states:

45. "Each horse racecourse operator shall on or before 31st October each year submit to the Department a statement of the proposed budget and expenditure plans of the horse racecourse operator for the year commencing 1st January next following."

46. Given that the Bill was introduced in April 2021 it would not have been possible for the Assembly to ensure adequate scrutiny and give Royal Assent before October 2021.

47. Therefore, in the context of Article 3(4) Down Royal would have only been eligible to apply for Fund payments in October 2022 at the earliest, with an allocation being made in January 2023 (if approved).

48. In order to mitigate any further prolongation of the inability to access Fund payments, DAERA requested the inclusion of a technical clause that would establish transitional arrangements for 2022 calendar year only. This will enable horse racecourse operators to submit their financial statements two weeks after the Bill is given Royal Assent, if they have not done so before end of October 2021.

49. The wording of the technical clause put forward by DAERA is as follows:

"4A Transitional provision

(1) This section applies where a horse racecourse operator has not submitted a statement under Article 3(4) of the 1990 Order for the year beginning on 1 January 2022.

(2) The horse racecourse operator must before the end of the period of two weeks beginning on the day after the day on which this Act receives Royal Assent submit to the Department of Agriculture, Environment and Rural Affairs a statement of the proposed budget and expenditure plans for the horse racecourse operator for the period beginning on the day after the last day for submission of the statement and ending on 31 December 2022.

(3) References in the 1990 Order to a statement submitted under Article 3(4) of the 1990 Order include statements submitted under subsection (2).

(4) In this section, "horse racecourse operator" has the meaning given by Article 2(2) of the 1990 Order."

8. Committee Consideration of the Bill

Bill Timeline

50. The Bill was introduced by the AERA Minister and completed First Stage on 13 April 2021.

51. At its meeting of 15 April 2021, the Committee considered correspondence from the Minister pertaining to the Bill seeking the Committee's support in facilitating expeditious scrutiny to address the issue of outstanding payments from the Fund to Down Royal.

52. At its meeting on 22 April 2021 the Committee received oral evidence from DAERA officials on the outcome of its consultation and its policy position.

53. The Bill passed Second Stage on Monday 26 April 2021.

54. On 6 May 2021 the Committee reviewed a report prepared by the Examiner of Statutory Rules relating to the Delegated Powers contained in the Bill – there was no issue of concern reported. It also agreed to submit a motion to the Assembly seeking an extension of Committee Stage to January 2022 in order to facilitate time to carry out effective scrutiny.

55. The Committee's motion was approved by the Assembly on 17 May 2021 that, in accordance with Standing Order 33(4), Committee Stage would be extended to 28 January 2022.

56. On 16 June 2021 the Committee received an oral briefing from the Assembly's Research and Information Service (RaISe) on a briefing paper that had been commissioned to support the Committee's consideration of the Bill. A plan for the Committee Stage and proposals for a call-for-evidence and views was agreed.

57. The Committee's call-for-evidence template was launched via the Citizen Space platform on 25 June 2021 with a closing date of 20 August 2021.

58. Officials from DAERA attended the Committee on 16 September 2021 to provide an oral briefing as part of the Committee's evidence on the key aims and aspects of the Bill and the rationale for the proposed transitional amendment (please see below).

59. On 23 September 2021 Members were provided with a briefing regarding the headline messages arising from the responses to its call-for-evidence and the Committee also received oral briefings from senior management at both Down Royal and Downpatrick racecourses as to the importance of Fund payments to their operations.

Research and Information Service (RaISe)

60. The Committee commissioned a Bill Paper from RaISe to assess the key aspects of the legislation, compare models of allocating charges on bookkeepers to support racecourse operating expenses in other jurisdictions and to explore any other policy considerations.

61. Some of the key issues arising from the RaISe assessment of the Bill included:

- Potential consideration of changing the flat-rate levy on bookkeepers in NI in favour of a proportionate charge on their profits, as is the case in England

- Widening the scope of the Fund to include other forms of racecourses, particularly greyhound and point-to-point racing sites

- Whether the current operation of the Fund is compliant with the six principles outlined in the UK-European Union Trade and Co-operation Agreement (TCA) relating to the administration of state-aid subsidies

- Under what future circumstances DAERA would consider changing the definition of a horse racecourse operator (Clause 1 of the Bill)

- Why DAERA felt it was necessary to amend the provisions in the Bill to specifically set out that the racecourses can submit financial plans separately or jointly?

- If there is any potential issue with the proposed omission of the Irish Turf Club, which ceased to exist in 2018, as a potential named beneficiary to payments from the Fund

Response from DAERA

62. Following its consideration of the RaISe briefing, the AERA Committee wrote to DAERA seeking clarity on these issues and a response was provided on 8 July 2021.

63. With regards to the potential for widening the scope of the operability of the Fund to include other types of race course and amending the model of levying fees on bookkeepers, DAERA advised that it is currently unable to bring forward any legal framework on these issues as the Department for Communities retains responsibility for the relevant legislation (Betting, Gaming, Lotteries & Amusements Order 1985).

64. However, DAERA confirmed that it will progress preparatory, scoping work to develop a potential policy position on these matters and that it is committed to undertaking a comprehensive review of the management of the Fund, in accordance with any future changes brought forward by the Department for Communities in respect of licences charged to bookkeepers operating in NI.

65. DAERA confirmed that it is satisfied that the Fund constitutes a subsidy under the definition of the UK-EU TCA and that it has a "reasonable degree of compatibility" with the six Subsidy Control principles. It was highlighted that the Fund complies with all of the principles with the exception of the rule which states that "Subsidies should be an appropriate policy instrument to achieve a public policy objective and that objective cannot be achieved through other less distortive means." However, DAERA assured the Committee that it is content that the Fund will achieve compliance to a high level of defensibility once the Bill receives Royal Assent and payments can resume to both named beneficiaries.

66. In relation to other issues, DAERA outlined the following:

- The delegated power to bring about a future change to the definition of a horse racecourse operator would only be used to change the name of the operator at the two existing locations where Fund payments are made to (Down Royal and Downpatrick). This will avoid the need for any further primary legislation to make a relatively straightforward amendment and any such request would be subject to draft affirmative procedure approval via the Assembly

- The wording in the 1990 Order is ambiguous regarding the ability of operators to submit financial statements independently or jointly. In practice this has varied over the years with separate and joint statements being laid with DAERA. The new provision in the Bill provides flexibility and clarity with regards the process of submitting financial statements

- DAERA clarified that, in its experience, the provision of the 1990 Order that allowed the Irish Turf Club to request Fund payments for "prize money" paid upfront, has not been used. Further, the Irish Horse Regulatory Board, which subsumed the functions of the Irish Turf Club when it was dissolved in 2018, has not sought to avail of this provision. Therefore, what is effectively a redundant element of the 1990 Order has been removed

Call-for-Evidence June to August 2021

67. The AERA Committee facilitated a call-for-evidence on the Bill that was made accessible to stakeholders and members of the public from 25 June to 20 August 2021.

68. The call-for-evidence template asked the following questions:

Question 1: The Bill Objectives

The primary objectives of the Horse Racing (Amendment) Bill are to:

- Amend the named operator of Down Royal racecourse in the Horse Racing (Northern Ireland) Order 1990

- Facilitate Fund payments to both Down Royal and Downpatrick racecourses

- Provide a legal framework to bring about future amendments to named beneficiaries more easily

- Make other minor changes to the wording of the 1990 Order

a) Do you agree with the objectives of the Bill?

b) Please tell us your views on the overall objectives

Question 2: Amendment of Named Beneficiaries

Clause 1 of the Bill will amend the 1990 Order by omitting references to specifically named owners and inserting a new definition of a "horse racecourse operator" that will cover the current operators at both Down Royal and Downpatrick.

a) Do you agree with this amendment?

b) Please tell us your views on the amendment in Clause 1

Question 3: Future Changes to Named Beneficiaries

The Bill sets out a process to bring about changes to named beneficiaries of horse racecourses more easily, through a resolution of the Assembly. This may help to avoid any delay or suspension of Fund payments in the future.

a) Do you agree that future changes to named beneficiaries should be made through a resolution of the Assembly?

b) Please tell us your views on this proposal

Question 4: Submission of Financial Statements

Clause 2 of the Bill will amend the 1990 Order to allow a racecourse to submit future budget and expenditure plans to the Department individually or along with another racecourse.

a) Do you agree with this amendment?

b) Please tell us your views on this amendment

Question 5: Additional Information

a) Are there any other measures not included in the Bill that you think should be included and why?

b) Do you have any other comments you would like to make or is there anything else that the Committee should be aware of when considering the Bill?

Responses to Call-for-Evidence Template

69. The Committee received a total of 8 responses to its call-for-evidence from the following entities:

- Downpatrick Race Club

- Down Royal Racecourse Limited

- Equine Council for Northern Ireland

- Irish Harness Racing Association

- Lisburn and Castlereagh District Council

- North West Bookmakers (Ladbrokes)

- Run with Passion Limited

- The Northern Ireland Turf Guardians Association

70. The key themes arising from the returns are outlined below:

- The Bill Objectives

71. The vast majority of respondents, 75%, were broadly positive about the Bill and agreed with its overarching objective to facilitate resumption of payments from the Fund to Down Royal and Downpatrick racecourses. Returnees reflected that these payments are essential in order to ensure the long-term sustainability of the courses and to support their ability to host high-profile events that facilitate important income for the local economy:

"Down Royal Race Course attracted 45,000 visitors to the Lisburn Castlereagh City area in 2019 and it was expected to exceed this in 2020 prior to Covid-19. It is therefore considered a valuable asset to the tourism industry. Local accommodation providers, attractions and restaurants all benefit from the visitors who come to the race course.

As the only grade-1 horse racing course in N. Ireland it is imperative that this establishment is supported. The loss of the Horse Racing Funding has already had a detrimental impact to the core business and if not reinstated this loss will continue to impede the operation and its ability to support the funding of Grade-1 horse racing in the North of Ireland." – Lisburn and Castlereagh District Council

72. A number of respondents who were broadly supportive of the Bill's objectives suggested that its scope, and the operability of the Fund, should be expanded as follows:

- Other forms of competitive racing outlet, such as greyhound tracks, should be able to access the Fund. This would improve the competitiveness of greyhound tracks in NI against those in ROI which are eligible for government support (this is not currently the case in NI)

- Additional entities, such as the Irish Harness Racing Association, should have the opportunity to bid for Fund payments in order to support the sport of horse racing

- Consideration should be made to changing the management of the Fund from DAERA to Sport NI (an Arm's Length Body of the Department for Communities)

73. Two respondents replied negatively to the Bill and highlighted a number of concerns, including:

- One organisation disputed the presentation of the Bill as a straightforward, technical piece of legislation and considered that it undermines the express intent of the 1976 and 1990 Orders which specifically identified Downpatrick and Down Royal as suitable beneficiaries as "non-profit making" entities

- Given that the current operator of Down Royal is a commercial entity it was considered that they should not be eligible to receive Fund payments which could be used to bolster the profits of a private enterprise

- The Bill's presentation to the Assembly was rushed in order to facilitate passage before the end of the current Mandate, without adequate scrutiny and consultation

- It is questionable whether the Bill complies with the UK's state subsidiary control regime

- Horse racecourses have a number of potential income streams including media payments, corporate sponsorship, loans etc. and therefore should not be reliant on payments made from the Fund

- The annual levy placed on off-course bookkeepers that is used to resource the Fund is disproportionate to the level of income that local betting shops actually generate from events at Down Royal and Downpatrick which account for approximately 0.15%-0.4% of their total turnover

- Amendment of Named Beneficiaries

74. Most respondents were supportive of the change that will be facilitated by Clause 1 of the Bill to include the definition of a "horse racecourse operator" as this will enable the resumption of payments to Downpatrick and Down Royal racecourses.

75. Two organisations articulated a negative view of this change, which reflected their overarching concerns about the Bill as a whole.

- Future Changes to Named Beneficiaries

76. Stakeholders were asked to consider the proposal that any future changes to the named beneficiaries of Fund payments could be brought about via secondary legislation passed through the Assembly.

77. The majority of respondents (63%) were supportive of this as it was considered that it would mitigate the chance of Fund payments being suspended in the future and that it would avoid delays as passage of secondary legislation is usually more expeditious than bringing forward a primary Bill.

"Future changes to named beneficiaries being made through a resolution of the Assembly would help to avoid any delay or suspension to the Fund in the future"– Down Royal Racecourse Limited

- Submission of Financial Statements

78. The purpose of Clause 2 in the Bill is to provide flexibility for Fund claimants to submit financial statements to DAERA either individually or collectively.

79. There was a mixed response from stakeholders when asked "Do you agree with this amendment?", with returns as follows:

- Yes: 3 (37.5%)

- No: 2 (25%)

- Unsure: 3 (37.5%)

80. Two organisations were unclear as to the rationale for this amendment and it was highlighted that any legislative change with regards submission of financial statements should be made solely to improve the governance and accountability regarding the use of public monies.

81. Both Down Royal and Downpatrick disagreed with the proposed amendment and indicated that they wish to submit financial statements separately as they have done so for the past number of years.

- Additional Information

82. Respondents were provided with the opportunity to highlight anything not currently included in the Bill and to make comments on their overall view and opinion on the legislation as drafted.

83. Broadly, it was recognised that allocations from the Fund to Downpatrick and Down Royal are essential components of the racecourses' income and that facilitating resumption of payments is necessary in order to ensure the long-term viability and sustainability of horseracing activities in NI that has a wider economic benefit, particularly in the County Down area.

84. However, there were a number of suggestions made with regards the scope and management of the Fund and, more widely, the licence fee charges made on bookkeepers in NI:

- It was suggested that it would be prudent for DAERA to undertake a strategic review of the operation of the Fund and to consider specifically:

- Broadening the scope of the Fund to allow entities other than horse racecourses to apply, for example greyhound tracks, and other organisations seeking to maximise and promote horseracing activities more generally

- Reviewing the most appropriate body to administer the Fund and whether this should rest with a government Department or Arm's Length Body

- Assessment of the application process to include for what purpose(s) Fund payments can be used, what criteria is used to authorise payment and an audit process to ensure that monies sought from the Fund are used only for the applied-for purpose. It may also be prudent to facilitate public disclosure of annual fund applications and the rationale for approving, or declining, these

- A number of respondents strongly articulated the need for a comprehensive review of the charges made in respect of on-course and off-course bookkeepers to ensure that these are fair, proportionate and reflective of modern gambling activity.

For example, there are different models that could be considered with regards licence fee charges rather than imposition of an annual fee, such as levying charges based on revenue/profit accrual.

Further, it was suggested that licence fees should be reflective of the income generated for bookkeepers by races at Downpatrick and Down Royal. Currently the fees charged to off-site bookkeepers comprise approximately 97% of the total annual Fund contribution, while less than 0.5% of off-site bookkeeper annual revenue is attributable to local race activity.

Oral Evidence Sessions

85. Officials from DAERA provided oral evidence to the Committee on 16 September 2021 regarding the salient aspects of the Bill, its overarching aims and rationale for introduction.

86. The fundamental purpose of the Bill, which is to reinstate the ability of DAERA to issue payments from the Fund to racecourses in County Down, was reiterated. The technical problem with having specifically named Fund beneficiaries in the 1990 Order was discussed and that the purpose of the Bill is to insert a "generic" definition of a horse racecourse operator that will mitigate any delay of Fund allocations should there be changes in ownership in the future.

87. Members sought clarity from officials regarding DAERA's position on allocating Funds to a private, commercial entity (the incumbent owner of Down Royal) and whether it had any concerns in this regard.

88. The Committee was advised that DAERA considers that Fund payments should not be restricted to any particular type of corporate entity, whether it be profit-making, voluntary or charitable, because, as outlined in the 1990 Order, the purpose of the Fund is to support the continued operations at the two racecourses in County Down: so long as applications for Fund payments are justifiable in this regard, allocations can be made to the operator.

89. The prospect of widening the Fund scope to enable other entities to apply for allocations, such as greyhound racetracks and other organisations that seek to promote the sport of horse racing, was discussed, as was the issue of licence fees currently charged to on and off-site bookkeepers.

90. DAERA officials advised that the Minister recognises and acknowledges the inherent limitations with the operability of the Fund, resultant from the narrow scope of the 1990 Order, and that DAERA is committed to undertaking a fundamental, strategic review of the Fund in the long-term.

91. The Committee heard that this piece of work will require engagement with the Department for Communities, given the fact that it has authority for complementary legislation covering the definition of a licenced bookkeeper, and that it would be prudent to conduct a strategic review of the Fund in accordance with any future changes introduced by the Department for Communities in respect of licence fee charges.

92. This would preclude piecemeal policy development and ensure that, in the long-term, the operation of the Fund is modernised, fair and reflective of local racing and gambling activity.

93. Representatives from Down Royal attended the Committee on 23 September 2021 and briefed Members on their consideration of the Bill. It was explained that the incumbent operators, Merrion Property Group, purchased the site in 2006 and facilitated a leasing arrangement with the previous operator, the Corporation, until assuming operational responsibility in 2019.

94. Since 2019 the operators have been unable to apply for allocations from the Fund which has presented challenges for financial viability and activity at the course.

95. In order to offset the loss of income from Fund payments, the operators have taken out loans and increased sponsorship. This has enabled them to invest over £500,000 on the site to undertake necessary repairs and upgrade the facilities to enable delivery of a full racing calendar.

96. However, the Committee heard that this is not sustainable and that resumption of Fund allocations is essential in order to ensure that Down Royal can bolster its prize-money to facilitate premium "Grade 1" events which attract significant interest and spectator activity.

97. The current operators signalled that they intend to commit to this level of prize-money perennially, should it be able to access Fund payments, and that continued provision of these marquee races would boost economic prosperity and employment in the local area.

98. The Committee was advised of the achievements at Down Royal in terms of increased attendance numbers, brokering of new deals and delivery of a full race programme, in the context of Covid-19 and the absence of Fund payments, which has provided significant financial challenges.

99. However, it was reiterated that Fund allocations are essential to the business model and income streams at Down Royal to ensure it can attract top-level racing events in the long-term.

100. The senior management team from Downpatrick also provided oral evidence on 23 September 2021. They explained that the 1990 Order in their view is good legislation and that the Fund has provided a crucial means of financial support to the activities at Downpatrick over the years.

101. The owners of Downpatrick operate on a "not-for-profit" basis and therefore the temporary inability to access payments from 2019 has placed significant financial strain on the operators and they have been unable to undertake some necessary repairs and maintenance works as a result.

102. It was explained that the racecourse is currently in the midst of judicial review proceedings against DAERA with respect to the decision to decline Downpatrick's applications to the Fund from 2019 and that this may preclude their ability to discuss the Bill in full.

103. The different activities at Down Royal and Downpatrick were discussed, with Downpatrick providing a different option for spectators in terms of national hunt events and races more associated with "a typical racecourse."

104. The owners explained that in the context of increasingly stringent Health and Safety regulations that additional upkeep and maintenance of the site was necessary and Fund allocations were essential to facilitate this.

105. As a result, the representatives from Downpatrick explained that they supported the introduction of the Bill and its overarching aim to facilitate resumption of Fund payments.

9. Committee Deliberations

106. The Committee undertook deliberations on the Horse Racing (Amendment) Bill on 7 October 2021, supported by representatives from the DAERA Bill team and a Clerk from the Bill Office.

107. Broadly, Members welcomed the introduction of the Bill and agreed with its overarching purpose which is to remedy the current situation whereby the operator at Down Royal racecourse is precluded from applying from Fund payments, due to the nuances of the 1990 Order.

108. Therefore, the Committee is supportive of Clause 1 which removes from the 1990 Order specific references to named beneficiaries and replaces these with a generic definition. It is recognised that making this change to the Order will enable the resumption of payments from the Fund to Down Royal to support appropriate activities.

109. The Committee recognises the profound financial impact that loss of Fund allocations has had, on both racecourses, and agrees that it is essential that this be remedied expeditiously in order to ensure the sustainability of activities at these sites which are of significant benefit, not only for spectators, but also the wider economy in County Down.

110. The Committee agreed to seek clarity from DAERA on the feasibility of issuing a "backdated" allocation to operators that would have likely received payments in 2019 and 2020, had this not been prohibited by the wording of the 1990 Order. DAERA officials undertook to scope if this would be possible under the Bill as drafted and what mechanisms may be available to facilitate this.

111. Notwithstanding the important issues highlighted by stakeholders in its call-for-evidence in terms of the scope and function of the Fund, the Committee considered that the primary focus of the Bill should be to avoid any further delay or disruption for the two local racecourses in terms of operating income.

112. Therefore, the Committee agreed that some of the wider issues identified with the current operation of the Fund would be better addressed via future policy development with sufficient time and scope to consider the optimal model of supporting race track activity locally, rather than through amendment of the Bill as drafted.

113. Members also agreed that the amendment under Clause 1 that will enable DAERA to bring forth any future change to named beneficiaries via secondary legislation was prudent, in order to mitigate any future delay or suspension of Fund allocations.

114. While the Committee noted the desire of both Down Royal and Downpatrick to continue to submit financial statements to DAERA independently, the Committee felt that the amendment included at Clause 2 provides clarity on the ability of operators to make submissions independently or jointly, and that this is useful.

115. There may be, due to unforeseen circumstances, a need for operators at the County Down racecourses to submit statements jointly and it would be of utility to facilitate such flexibility within the legislation.

116. Members were content with Clause 3 of the Bill that omits obsolete references to the 1990 Order pertaining to rules and bye-laws of the Corporation, and did not identify any issues with Clauses 4 to 6 which are technical and/or inconsequential.

117. In respect of the amendment proposed by DAERA to be inserted as Clause 4(A) that would introduce transitional arrangements for calendar year 2022 only, the Committee agreed that this would be prudent in order to avoid any prolongation of Down Royal's inability to apply for Fund payments.

118. The Committee noted that the timetabling associated with the introduction and passage of the Bill is unfortunate in that it would not have been possible for it to proceed before the end of October 2021, and therefore without the transitional amendment, Down Royal would have been unable to make an application for another 12 months.

119. The amendment will provide both racecourses with the opportunity to submit their financial statements, and any applications for Fund payments, within two weeks of the Bill being given Royal Assent (if they have not done so before end of October 2021), which would allow allocations to be authorised in 2022.

10. Clause-by-Clause Consideration

120. Having considered the range of evidence and information collated through its call-for-evidence and deliberations on the Bill, the Committee undertook formal clause-by-clause decision making at its meeting on 7 October 2021.

121. The Minutes of Proceedings of this date are included with the report appendices.

Clause 1 – Horse Racecourse Operators

122. The Committee was content with the Clause as drafted by the Department.

Clause 2 – Horse Racing Fund

123. The Committee was content with the Clause as drafted by the Department.

Clause 3 – Minor and Consequential Amendments

124. The Committee was content with the Clause as drafted by the Department.

Clause 4 – Interpretation

125. The Committee was content with the Clause as drafted by the Department.

New Draft Clause 4(A) – Transitional Provision

126. The Committee was content with the Clause as drafted by the Department.

Clause 5 – Commencement

127. The Committee was content with the Clause as drafted by the Department.

Clause 6 – Short Title

128. The Committee was content with the Clause as drafted by the Department.

Long Title

129. The Committee was content with the Long Title as drafted by the Department.

11. Wider Policy Issues and Recommendations

130. Following review of the issues raised by a number of stakeholders in its call-for-evidence and other information identified during the course of its scrutiny, the Committee recommends that:

- DAERA establishes, in accordance with the Department for Communities as required, a timetable for the completion of a strategic review of the operation of the Horse Racing Fund that should include:

- A review of the entities that are eligible to make applications to the Fund, and whether this should be expanded to include, for example, greyhound tracks and point-point horse racing courses

- An evaluation of the annual levies currently charged to on-and-off course bookkeepers to resource the Fund to ensure that these are proportionate and reflective of income generated by activities at local racecourses

- Consideration as to whether management of the Fund should be transferred to another entity

- The Department for Communities should set out any long-term plans to review comprehensively the system of issuing licences to bookkeepers in NI, including those entities that operate predominantly online

12. References

Deloitte, Analysis of the NI Equine Industry: Breaking New Ground, 2019

Horse Racing Ireland, The Irish Racing Factbook 2013 – 2019, Available at The Irish Racing Factbook (hri.ie)