Report on the Response to the Executive's Review of the Financial Process in Northern Ireland

Session: 2011/2012

Date: 18 January 2012

Reference: NIA 28/11-15

ISBN: 978-0-339-60414-8

report-on-the-response-to-the-executives-review-of-the-financial-process-in-northern-ireland.pdf (7.96 mb)

Membership

The Committee has eleven members, including a Chairperson and Deputy Chairperson, with a quorum of five members. The membership of the Committee during the current mandate has been as follows:

Mr Conor Murphy MP (Chairperson)

Mr Dominic Bradley (Deputy Chairperson)

Mrs Judith Cochrane

Mr Leslie Cree MBE

Mr Paul Girvan

Mr David Hilditch

Mr William Humphrey

Mr Ross Hussey

Mr Paul Maskey MP *

Mr Mitchel McLaughlin

Mr Adrian McQuillan

* Mr Maskey replaced Ms Caitríona Ruane with effect from 12 September 2011.

List of Abbreviations and Acronyms used in the Report

ALB - Arm's-length Body

AME - Annually Managed Expenditure

BRG - Budget Review Group

CAL - Culture, Arts and Leisure

CFP - Committee for Finance and Personnel

CLG - Chairpersons' Liaison Group

DEL - Departmental Expenditure Limit

DFP - Department of Finance and Personnel

ETI - Enterprise, Trade and Investment

HM - Her Majesty

HSSPS - Health, Social Services and Public Safety

IMF - International Monetary Fund

MoU - Memorandum of Understanding

NDPB - Non-departmental public body

NI - Northern Ireland

NIAO - Northern Ireland Audit Office

NICS - Northern Ireland Civil Service

OECD - Organisation for Economic Co-operation and Development

OFMDFM - Office of the First Minister and deputy First Minister

PAC - Public Accounts Committee

PfG - Programme for Government

PSA - Public Service Agreement

RfRs - Requests for Resources

UK - United Kingdom

Table of Contents

List of Abbreviations and Acronyms used in the Report

Report

Key Conclusions and Recommendations

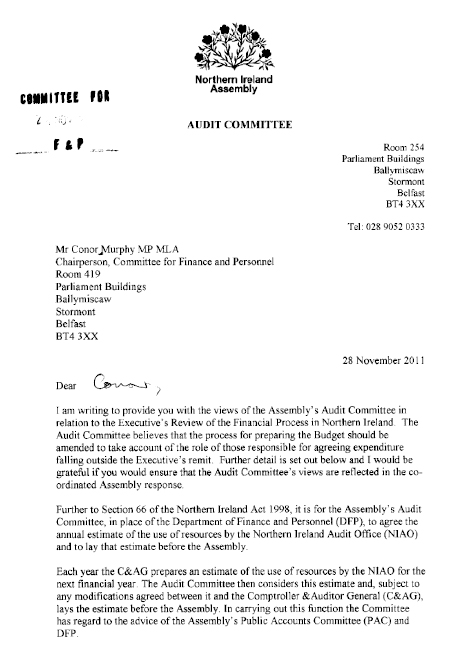

Consideration of the Review Recommendations

List of Appendices to the Report

Appendix 1

Minutes of Proceedings (Extracts)

Appendix 2

Appendix 3

Memoranda and Correspondence from DFP

Appendix 4

Written Submissions and Correspondence

Appendix 5

Executive Summary

The Northern Ireland Executive's current budget and financial process has been open to criticism in terms of being convoluted and repetitive, with a lack of transparency and read-across between the Budgets, Estimates and Accounts, which has caused frustration for Assembly Members and committees. The Committee has long called for a settled and effective budget process which affords sufficient time for meaningful engagement with Assembly Members, committees and the wider public. While recognising that the Executive's budget is developed within the context of a wider UK control and management framework, the Committee welcomed the Executive's decision to commission the Department of Finance and Personnel to undertake a review, with the aim of establishing a simplified budget process model which meets the requirements of the devolved administration.

The Department of Finance and Personnel's Review of the Financial Process in NI discussion paper was issued to all key stakeholders on 10 October 2011. The paper set out fifteen initial recommendations for discussion, related to key issues and concerns. The response set out in this Report fulfils the Committee's unique role in co-ordinating the Assembly's response to budget and financial issues. To inform the response, the Committee commissioned research on a range of issues, including the presentation of fiscal data, budget system laws and strategic budget stages; and, on the latter issue, legal advice was provided by Assembly Legal Services. The Committee also invited comments from the other applicable Assembly committees, the Chairpersons' Liaison Group and the Northern Ireland Audit Office.

The Review recommendations have been broadly welcomed by the Committee, and by other Assembly committees and stakeholders. It is recognised that addressing the misalignments between the Budget, Estimates and Accounts and bringing all non-voted expenditure in Budgets within coverage of the Estimates will go some way to enhance transparency and accountability to the Assembly. The concept of setting out an ideal Budget timetable, which affords time for the Assembly to input to an early strategic phase, was also considered important. The Committee must stress, however, that an early strategic phase is one of the most influential stages in the budget process and, as such, is an essential requirement rather than an aspiration. In the longer term, the effectiveness of this stage will also serve to increase the potential for streamlining the latter stages in the budget process.

The Committee has highlighted concerns and queries with some of the Review recommendations and would request further consultation and assurance in this regard, including: appropriate safeguards for changes to Assembly voting controls; the level of detail to be provided in respect of departmental expenditure lines; the presentation of information in the various financial publications; and consolidation of non-departmental public bodies and other arm's-length bodies within the accounting boundaries. In addition, the Committee believes that there should be firm, visible linkages between the Programme for Government and budget allocations, and is unable to endorse any recommendations to the contrary. Finally, in terms of providing for an effective early strategic phase in the budget process in particular, it is the Committee's intention to explore the merits of a "Budget Process Agreement" between the Executive and Assembly, which is underpinned in the Assembly's Standing Orders, compared to the option of statutory provision, possibly through a Committee Bill.

Key Conclusions and Recommendations

1. The Committee would wish to highlight at the outset that most of the Review recommendations have been broadly welcomed, both in the submissions received from the other Assembly committees and stakeholders and by the Committee itself. As such, the comments in this co-ordinated response tend to focus on the specific Review recommendations where particular concerns have been identified or proposals made. The Committee believes that further examination of these issues will help to elucidate the arguments in respect of the proposed reforms. In looking forward to the Department's response on these matters, the Committee would also welcome a clearer analysis of the overall cost implications of the proposed reforms. (Paragraph 7)

2. The Committee endorses the recommendation of its predecessor that "relevant financial documents, including Budgets, Estimates and Resource Accounts are simplified and harmonised to increase transparency." The Committee also concurs with the view of the Education and Regional Development committees that the implementation of Review Recommendation 1 would enhance transparency and accountability to the Assembly and that the changes will "further afford statutory committees potential for greater and more indepth scrutiny of the budgetary processes." (Paragraph 10)

3. The Committee calls on the Department of Finance and Personnel to extend consolidation beyond Executive non-departmental public bodies to include other types of arm's-length bodies, which form an important element of some departmental expenditure remits. (Paragraph 13)

4. Following up on the recommendation of its predecessor in 2008 that the benefits of Account NI should be rolled out to non-departmental public bodies and other arm's-length bodies as far as is practical, the Committee calls on the Department to set out the business case for the fuller integration of these bodies within the Account NI system as part of the proposed consolidation process. (Paragraph 16)

5. While strongly supportive of the aim of Review Recommendation 2, the Committee sees benefit in the consolidation of non-departmental public bodies within the accounting boundaries being informed by the outcome of the review of arm's-length bodies which the Executive's Budget Review Group is leading. This would help to avoid the inefficient use of time and resources by departments and non-departmental public bodies in preparing for consolidation now only for the body to be wound up at a later stage. Members would therefore urge the Minister to press for the review of arm's-length bodies to be concluded expeditiously. (Paragraph 19)

6. Accepting that additional misalignments are likely to be identified going forward, the Committee is supportive of Review Recommendation 3 and looks forward to considering details of such additional misalignments and the related assessments of the impact of any proposed further changes. (Paragraph 22)

7. In recognising that the proposals to bring all non-voted expenditure and income in Budgets within the coverage of Estimates will aid transparency and scrutiny and align with international best practice, the Committee welcomes Review Recommendation 4. (Paragraph 25)

8. Given the risks attaching to Review Recommendation 5, that the Assembly votes "Net"controls in the Estimates and Budget Act, the Committee's support for this proposal is subject to further detail and assurance from the Department of Finance and Personnel to satisfy members that the "appropriate safeguards" will indeed be established so that firm control is maintained over the use of income by departments. The Committee also considers that the proposed changes would increase the need for systematic in-year scrutiny of departmental income generation by the respective Assembly committees and that formal arrangements would have to be put in place to facilitate this, including provision of the necessary information by departments. (Paragraph 32)

9. The Committee agrees that the level of detail currently provided in departmental expenditure plans often does not provide meaningful information on key areas of public spending, and welcomes any proposals that will simplify and harmonise information, increase transparency and ensure that expenditure is more readily scrutinised. While there was also general support for the thrust of Review Recommendation 6 from other Assembly committees, it was noted that further consultation will be required with the Assembly on the level of the breakdown proposed. (Paragraph 34)

10. The Committee firmly believes that there should be clear, visible linkages between Budget allocations and the Programme for Government, and is unable to endorse Review Recommendation 7. In noting the difficulties cited by the Department of Finance and Personnel in linking spending to priorities and outcomes, the Committee is mindful of previous evidence from the Department which runs contrary to the current proposal that "performance outcomes and the delivery of the Programme for Government should not be directly attributable to allocations in budgets", including the advice that the Account NI system had the capability to map expenditure to outputs and outcomes. The Committee, therefore, reiterates the call by its predecessor that work is undertaken to exploit the Account NI system to its full potential in this regard. (Paragraph 42)

11. The Committee has long called for better read-across between the published financial documents which accompany the different stages of the budget process and members welcome any moves towards this end. In noting that the NI Audit Office intends to discuss the presentation of the Estimates further with the Department of Finance and Personnel, the Committee recommends that these discussions also consider how the Resource Accounts may be further improved from the example provided in the discussion paper, particularly in terms of being user friendly and supporting Assembly scrutiny. Members look forward to being apprised of any subsequent proposals in this regard. (Paragraph 46)

12. The Committee endorses the view of its predecessor that budget allocations should be driven by priorities, not the other way around. In this regard, it supports the recommendation that the Budget should be developed in the context of a Programme for Government agreed by the Executive. Moreover, the Committee considers that it is not simply "desirable" but is in fact essential that a draft Programme for Government is developed prior to, or at least in tandem with, a draft Budget and wishes to see this reflected in any agreed Budget framework. (Paragraph 50)

13. The Committee welcomes the proposal in Review Recommendation 10 to include an early strategic phase and sufficient time for consultation with Assembly committees and other stakeholders within a Budget timetable. However, given that an early strategic phase is one of the most informative and influential stages in the Budget process, members are firmly of the view that it is a requirement, rather than an ideal which will just take place "if circumstances and time permits". In noting that the discussion paper itself states that "even if the Westminster Spending Review outcome and the NI Block allocation is not yet known, this early strategic phase could still take place in order to inform the later stages of the Budget", the Committee believes it essential that the caveat is removed from this Review recommendation. (Paragraph 55)

14. The Committee concurs with those committees that welcomed the principle of setting out an ideal Budget timetable, and notes that Assembly research indicates that elements included in the timetable proposed in Review Recommendation 11 are in line with international best practice. (Paragraph 57)

15. The Committee recommends that consideration is given to following the approach of the Scottish Government in undertaking public consultation at the formative pre-draft budget stage, which could either remove or reduce the time required for public consultation once the draft Budget has been agreed by the Executive. This Department of Finance and Personnel-led public consultation could be scheduled to align with Assembly committees' engagement with departments, so that the outcome of the public consultation is available to inform the Committee's co-ordinated report and the Take Note debate at the pre-draft budget stage. (Paragraph 59)

16. The Committee would reiterate the findings from its predecessor that it is not appropriate for Assembly committees to lead the consultation on departmental expenditure plans as inferred in the discussion document, particularly as they do not have the authority to act on the outcome of such consultation. (Paragraph 61)

17. It is the Committee's intention to further explore the merits of the Budget Process Agreement, proposed in Review Recommendation 12, as compared to the potentially more robust option of statutory provision, which would have a particular focus on facilitating a pre-draft budget scrutiny stage and would possibly take the form of a Committee Bill. Considerations around both options will be set out in a discussion paper on which views will be sought from all relevant stakeholders. While the general principle behind Review Recommendation 12, in terms of formalising the budget process, was welcomed by a number of the other committees who responded to the discussion paper, the majority have indicated that they wish to await the outcome of the Committee's work in this regard before making any final decisions. (Paragraph 67)

18. In terms of Review Recommendations 13 and 14, the Committee agrees with the Department of Finance and Personnel position that the latter stages of the current budget process are convoluted and repetitive. The potential to streamline the process exists, but only in the context of a reformed budget process which provides unequivocally for a formal pre-draft budget phase, affording the Assembly and its committees an opportunity to influence budgetary matters at an early stage. The Committee will therefore wish to consider this matter further once a reformed process has been developed and trialled. (Paragraph 70)

19. The Committee supports Review Recommendation 15, that the Rates Order should be debated alongside the expenditure plans for the next financial year, as set out in the Budget Bill, and believes that an integrated approach to considering revenue and spending plans will further underpin Assembly scrutiny. (Paragraph 74)

Introduction and Background

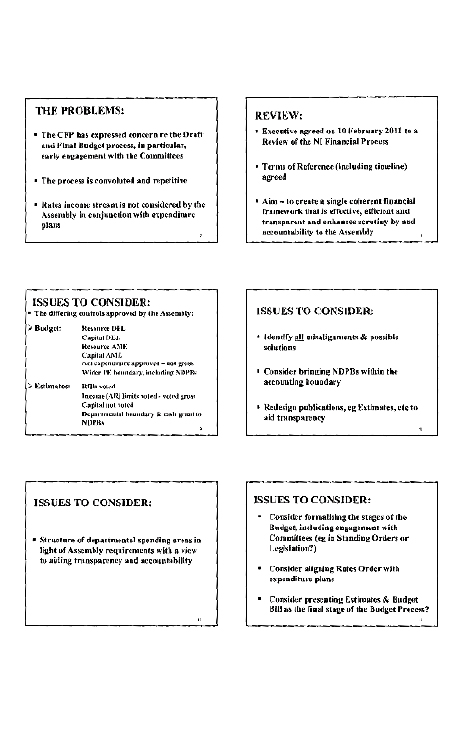

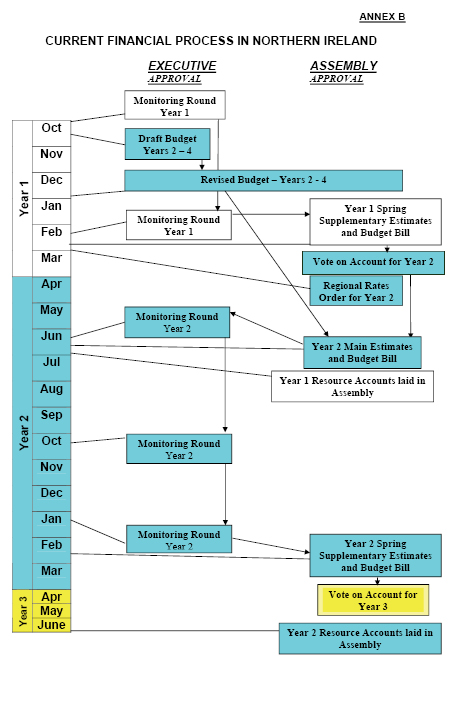

1. In February 2011, the NI Executive agreed a Terms of Reference for a Review of the Financial Process in NI, to be taken forward by the Department of Finance and Personnel (DFP). Aimed at bringing forward a streamlined financial framework that is more efficient, transparent, open to scrutiny by and accountability to the Assembly, the strategic aims of the review are:

- "To align the Budget, the Estimates and the Accounts as far as practicable to improve transparency; and

- To synchronise the presentation of the Budget, the Estimates/departmental expenditure plans, the Budget Bills, the Rates legislation and the Accounts in order to create a single co-ordinated public revenue and expenditure process."[1]

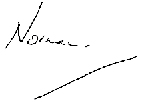

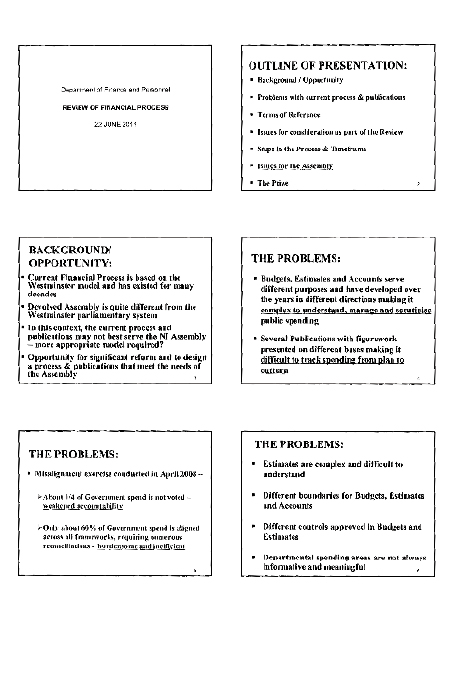

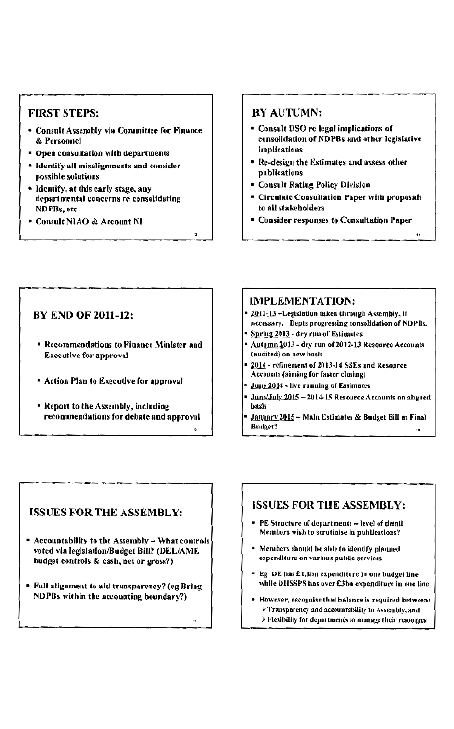

2. The Committee received an initial presentation from DFP officials on 22 June 2011 which outlined the difficulties with the current financial process and related publications, and issues which would be considered within the Review. The presentation highlighted a range of matters for consideration by the Assembly, including: the controls that should be voted by the Assembly; the level of detail to be included in publications; presentation of the Main Estimates and related Budget Bill as the final stage of the Budget process; and the possibility of incorporating the Budget process in Assembly Standing Orders or in legislation.[2] A subsequent evidence session was held on 21 September 2011, when the Committee received an update on the progress of the Review. The Official Report of the evidence session is provided at Appendix 2. Members were advised that a discussion paper setting out initial recommendations would be brought forward for consideration by key stakeholders. The paper was subsequently issued on 10 October 2011.

The Committee's Approach

3. Early in this Assembly mandate, the Committee considered and endorsed recommendations made by its predecessor in its Report on the Executive's Draft Budget 2011-15[3] and the Third Report on the Inquiry into the Role of the Assembly in Scrutinising the Executive's Budget and Expenditure.[4] The recommendations sought to facilitate and strengthen the role of the Assembly in scrutinising the Executive's budgets and expenditure, and were developed in consultation with other committees in the last mandate. In particular, the recommendations aimed to:

- establish a regularised budget process, with a key pre-draft budget scrutiny stage;

- improve the provision of financial information to committees and allow sufficient time for scrutiny; and

- strengthen the support for committees and members in financial scrutiny.

The Committee has been mindful of these recommendations and the work of its predecessor in its consideration of the proposals put forward in the Review discussion paper.

4. As a first step to increasing awareness of the public expenditure system and support for Members and committees in financial scrutiny, the Committee hosted an "Overview of the Public Expenditure System" workshop on 18 October 2011, to which all Assembly Members and committee secretariat staff were invited. At the event, DFP officials provide an overview of the public expenditure system, to assist both individual Members and committees in budget scrutiny. Given that the discussion paper had been issued directly to Members as key stakeholders, a short briefing on the Review of the Financial Process was also provided.

5. In line with convention from the previous mandate, the Committee has continued with the approach of co-ordinating the Assembly's response to budget and financial issues. To inform this Report, comments on the discussion paper were invited from applicable Assembly committees and the Chairpersons' Liaison Group (CLG). The responses from the other committees have been referenced below, with the full submissions included at Appendix 4. The Committee would wish to draw attention to the point made by CLG in respect of the complexity of the issues under consideration and the potential difficulties that committees may face in responding to such issues, and notes the suggestion that "perhaps DFP could have found alternative ways to interact with committees and take their views other than in writing."

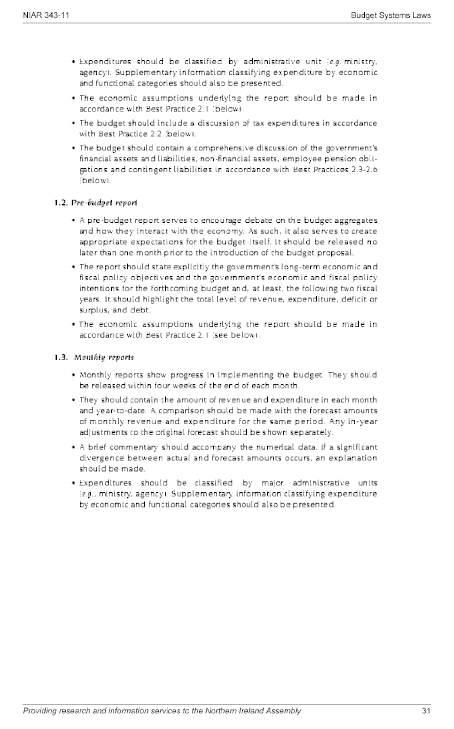

6. To assist its deliberations on the proposals arising from the Review, the Committee commissioned research on a range of budget and financial matters, including the presentation of fiscal data, budget systems laws and strategic budget stages. The Committee agreed that the recommendations made in the Research and Information Service briefing paper, DFP's Review of Financial Process: considerations for improving the budget process,[5] should be taken forward in parallel with the Executive's Review. Assembly Research also undertook a critical analysis of the recommendations put forward in the DFP discussion paper. The Research and Information Service briefing papers are provided at Appendix 5.

Consideration of the Review Recommendations

7. The Committee would wish to highlight at the outset that most of the Review recommendations have been broadly welcomed, both in the submissions received from the other Assembly committees and stakeholders and by the Committee itself. As such, the comments in this co-ordinated response tend to focus on the specific Review recommendations where particular concerns have been identified or proposals made. The Committee believes that further examination of these issues will help to elucidate the arguments in respect of the proposed reforms. In looking forward to the Department's response on these matters, the Committee would also welcome a clearer analysis of the overall cost implications of the proposed reforms.

8. The following commentary considers the Review recommendations individually and sets out a Committee position in each case.

|

Review Recommendation 1: Assembly controls should change to reflect the alignment of Budget, Estimates and Accounting boundaries. The concept of Requests and Resources (RfRs) should be abolished and the Assembly should instead vote, as applicable, each department's: Resource DEL Capital DEL Resource AME Capital AME Net Cash Requirement |

9. The DFP discussion paper notes that there are a number of ways in which the Budget, Estimates and Accounts are misaligned, estimating that only about 60% of expenditure is aligned across these frameworks. It states that

"Budget high level controls are net Resource DEL and AME and net Capital DEL and AME while Estimate/legislative controls are currently by Requests for Resources (RfRs) for net resource plus the accruing resources (total of operating and non-operating) while capital is not voted, except within the cash requirement."[6]

As a consequence, departments budget against one set of controls within the Budget, but account for spend against different controls set in the Estimates. To align the controls, DFP proposes that each department's budgetary controls are authorised by the Assembly, together with its overall cash requirement. This would "simplify the process for budgeting, voting and accounting for departmental spend within the same limits", and would also serve to increase transparency and accountability to the Assembly.

10. In regard to this issue, the Committee endorses the recommendation of its predecessor that "relevant financial documents, including Budgets, Estimates and Resource Accounts are simplified and harmonised to increase transparency."[7] The Committee also concurs with the view of the Education and Regional Development committees that the implementation of Review Recommendation 1 would enhance transparency and accountability to the Assembly and that the changes will "further afford statutory committees potential for greater and more indepth scrutiny of the budgetary processes."[8]

Review Recommendation 2: NDPBs are consolidated within the Estimates and Accounting boundaries in order to improve the alignment and transparency. |

11. A further misalignment between the Budgets, Estimates and Accounts occurs in respect of non-departmental public bodies (NDPBs). While the full spend and income of the majority of NDPBs is included in the Budget, only the cash grant-in-aid for Executive NDPBs is in the Estimates or the Resource Accounts.[9] DFP considers that this is one of the primary reasons for misalignment between the Budget and Estimates, and therefore recommends that NDPBs are brought within the Estimates and Accounting boundaries. The discussion paper stresses that the distinctive characteristics of NDPBs will remain unchanged and they would "continue to be separate corporate identities with statutory responsibilities and independent in their executive decision-making in line with their responsibilities." The Committee sees this as an important assurance, given the need to ensure that consolidation does not inadvertently undermine the function of the NDPB model.

12. The NI Audit Office (NIAO) notes a potential benefit of such a change would be closer working between departments and their NDPBs, greater integration of financial reporting and increased accountability and financial monitoring. The Committee also notes that accountability to the Assembly for NDPB funding and expenditure would be improved and that a sponsor department could be called to account for overspending by an NDPB, which is not the case at present. The proposed change should also enhance the transparency of the flow of resources from departments to their NDPBs.

13. While there are potential benefits to the proposal, a number of issues have also been raised. While generally supportive of the recommendation, the Committee for Culture, Arts and Leisure (CAL) is concerned that it relates only to Executive NDPBs. It points out that 80% of the CAL Department's budget is managed by arm's-length bodies (ALBs), which do not all have NDPB status. The CAL Committee therefore requested clarification on whether consideration has been given to including all ALBs within the proposals rather than just those defined as Executive NDPBs. Similarly, while not opposed to the principle of the recommendation, the Regional Development Committee cites NI Water as "an example whereby the constituted organisation and the application of NDPB budgetary and accounting values are in conflict." In circumstances such as these, that Committee considers that "application of appropriate budgetary and governance processes must be addressed in the first instance rather than encouraging closer alignment of NDPB budget processes." Given the concerns raised by some of the other Assembly statutory committees, the Committee calls on DFP to extend consolidation beyond Executive NDPB's to include other types of ALBs, which form an important element of some departmental expenditure remits.

14. The DFP discussion paper itself also points out a number of practical issues regarding the consolidation of NDPBs into the accounting boundaries, primarily in respect of the closing and laying of accounts and the administrative burden for NDPBs and departments, particularly in the early years of any changes. It also notes that there could be implications for NIAO in ensuring that the accounts of consolidated NDPBs are audited in time for faster closing; NIAO states that it will consider these resource implications as part of its future corporate planning process. DFP considers that

"the problems are not insurmountable with careful planning and…the benefit of alignment between Budgets, Estimates and Accounts would outweigh any short term difficulties."

15. Assembly research has noted that there may be additional administrative costs in respect of consolidation, when departments and NDPBs may already be facing budgetary pressures. In addition, NIAO has highlighted a number of other risks associated with the proposed changes. From its perspective, there would be concerns regarding the quality of financial management and reporting, which may have a knock-on effect on the audit process. It also notes that the Account NI system "does not currently offer a full consolidation solution; many NDPBs do not use this system and in some cases the financial systems in use currently require upgrade." In this respect, the Committee notes that, in response to the Executive's Draft Budget 2008-11, its predecessor called for consideration to be given to the potential for extending the scope of shared services (including Account NI) beyond the NI Civil Service (NICS) to the wider public sector, including NDPBs.[10] In its response, the Department assured the previous Committee, as far back as March 2008, that:

"Whilst Account NI's initial focus is on the migration and stabilisation of the NICS departments to the new Account NI service, both the Contractor and the Authority (DFP/NICS) would be keen to pursue opportunities to provide this service to other public sector bodies."[11]

16. Following up on the recommendation of its predecessor in 2008 that the benefits of Account NI should be rolled out to NDPBs and other ALBs as far as is practical, the Committee calls on the Department to set out the business case for the fuller integration of these bodies within the Account NI system as part of the proposed consolidation process.

17. The DFP discussion paper makes reference to the Review of ALBs which is being led by the Executive's Budget Review Group (BRG), noting that this "will consider options for abolition, merger or integration within departmental structures." There is no indication, however, as to whether DFP considers that this process should be completed in advance of departments and NDPBs proceeding with consolidation as recommended. When the Committee sought an update on the Review of ALBs in September 2011 it subsequently received advice via the Committee for the Office of the First Minister and deputy First Minister (OFMDFM) stating that:

"The responses received from departments on the Review of Arm's Length Bodies are being analysed. Following this, the First Minister and deputy First Minister intend to bring a paper to a future meeting of the Budget Review Group (BRG) and the views of the Group will inform the recommendations which they, as joint chairs of BRG, ultimately bring to the Executive."[12]

18. The Committee notes that, while the review and rationalisation of ALBs is incorporated in the priority to deliver high quality and efficient public services within the draft Programme for Government (PfG) 2011-15, no timescale for completion has been specified. As such, at its meeting on 11 January 2012, the Committee agreed to seek a further update from OFMDFM on progress in concluding this review.

19. In its submission, the Public Accounts Committee (PAC) cautioned that it will be costly to proceed with consolidations using the current structure, if reorganisations that require further realignment occur within a short time. NIAO also stated that"it is important that any restructuring or machinery of government changes take place before commencing consolidation." In agreeing with these concerns, while strongly supportive of the aim of Review Recommendation 2, the Committee sees benefit in the consolidation of NDPBs within the accounting boundaries being informed by the outcome of the review of ALBs which the Executive's Budget Review Group is leading. This would help to avoid the inefficient use of time and resources by departments and NDPBs in preparing for consolidation now only for the body to be wound up at a later stage. Members would therefore urge the Minister to press for the review of ALBs to be concluded expeditiously.

Review Recommendation 3: DFP should continue to work with departments to find solutions, where possible, to all other misalignments between Budgets, Estimates and Accounts. |

20. The DFP discussion paper notes that a number of other misalignments will remain even after the consolidation of NDPBs as proposed by Review Recommendation 2, including, for example, notional charges and capital grants to the private sector. On this latter point, members note that Assembly research points out that the International Monetary Fund's (IMF) code of good practices on fiscal transparency states that:

"Government relationships with the private sector should be conducted in an open manner, following clear rules and procedures."[13]

21. In evidence to the Committee, DFP officials indicated that they would wish to eliminate all misalignments; if that is not achievable, they will be reduced as far as possible.

22. Accepting that additional misalignments are likely to be identified going forward, the Committee is supportive of Review Recommendation 3 and looks forward to considering details of such additional misalignments and the related assessments of the impact of any proposed further changes.

Review Recommendation 4: All non-voted expenditure and income within Budgets (e.g. Consolidated Fund Standing Services) is brought within the coverage of Estimates in the Part II Subhead Detail |

23. At present, not all expenditure included in the Budgets or Accounts is voted in the Estimates. The DFP discussion paper states that the reason for this is that "separate standing legislative authority already exists for this expenditure and, therefore, further annual authorisation by the Assembly is not correct or necessary." It therefore proposes to include non-voted spend within the Estimates so that it aligns with the Budget.

24. During an evidence session with DFP officials, members were concerned to learn that, under existing arrangements, approximately 25% of all expenditure is not voted. Departmental officials advised that this is related in part to capital spend and also to NDPB expenditure as discussed at paragraphs 11 to 19 above. In this regard, members are aware from Assembly research that the IMF code of good practices on fiscal transparency states that "the budget documentation, including the final accounts, and other published fiscal reports should cover all budgetary and extra-budgetary activities of the central government."[14]

25. In recognising that the proposals to bring all non-voted expenditure and income in Budgets within the coverage of Estimates will aid transparency and scrutiny and align with international best practice, the Committee welcomes Review Recommendation 4.

Review Recommendation 5: The Assembly votes 'Net' controls in the Estimates and Budget Act in line with budgetary controls, with details of income shown in the Estimates and appropriate safeguards in place so that firm control is maintained over the use of income by departments. |

26. The DFP discussion paper notes that, under the current process,

"Budgets are approved by the Assembly net of any departmental income that is classified as being within Budgets. However, departments can only retain the income (and related cash) if the Assembly has approved, through the Estimates process and the related Budget Act, the use of the income on related services – the Assembly , therefore places limits on both net resources and on income (accruing resources) – thereby voting 'Gross' spend."[15]

27. The discussion paper therefore proposes that Estimates and the Budget Act are instead voted on a "net" basis. In evidence to the Committee, DFP officials recognised that a consequence of this measure would be weakened accountability for the Assembly; however, DFP argues that measures could be put in place to mitigate against this, such as:

- the provision of gross data, including details regarding resource and capital income, in the Estimate for information purposes only; and

- listing the types of income that could be retained and used to finance services within a department in the Estimates and the related Budget Act. In this way, Departments would be unable to generate income from a source not approved by the Assembly. While a limit on income would no longer be set, formal Assembly and legislative control on the types of income would rest with the Assembly.

28. In the briefing paper, Presenting fiscal data: gross or net?, Assembly research found that international best practice is for data to be reported on a gross basis.[16] In response, DFP officials contended that best practice guidance such as that by the Organisation for Economic Co-operation and Development (OECD) and the IMF relates more to fiscal policy management for national governments. It does not apply in the context of a devolved administration where the vast majority of funding is allocated by HM Treasury, which also imposes the rules relating to public expenditure.[17]

29. At present, a department can only use income it generates up to the level approved by the Assembly. Income received in excess of this limit must be returned to the Consolidated Fund. Members note that the proposed changes would mean that a department would be able to keep any income it generates, provided it is within the ambit of the department and within the net voted limit. In NIAO's opinion, the proposal

"runs contrary to the tighter controls proposed at Recommendation 1. Whilst there are potential benefits to the proposed change, there are also some risks which could arise from an increased focus on income generation and reduced control by the Assembly."

30. In follow up correspondence with the Committee, NIAO also advised that, if Review Recommendation 5 is accepted "it is imperative that DFP introduce administrative controls over income generation by departments … Furthermore, it is important that appropriate controls over virement of income are in place as a safeguard."[18]

31. The Committee notes that one of the risks highlighted by Assembly research is that departments may increase charges rather than seeking to improve the efficiency of service delivery. Similarly, in recognising that departments may increase the focus on income generation, PAC stated that "it is important they continue to seek best value for money in any income generation activities they undertake."

32. Given the risks attaching to Review Recommendation 5, that the Assembly votes "Net"controls in the Estimates and Budget Act, the Committee's support for this proposal is subject to further detail and assurance from DFP to satisfy members that the "appropriate safeguards" will indeed be established so that firm control is maintained over the use of income by departments. The Committee also considers that the proposed changes would increase the need for systematic in-year scrutiny of departmental income generation by the respective Assembly committees and that formal arrangements would have to be put in place to facilitate this, including provision of the necessary information by departments.

Review Recommendation 6: Spending Areas in Departmental Expenditure Plans should be restructured in such a way as to be meaningful and informative to the reader and indicative of the range of services delivered by the Department. Spending Areas should be used in all publications. |

33. The DFP discussion document considers that "the reader should readily understand, at an acceptable level of detail, how much public funding is being spent on each main service in a department".[19] In many instances, however, this is not the case. The document specifically refers to the position in respect of the departments of Education and Health, Social Services and Public Safety (HSSPS), with some lines of expenditure of up to £3 billion. To improve transparency and accountability, a more meaningful level of information should be provided. The Department notes, however, that related issues must be taken into consideration in this regard; for example, movements between spending area/expenditure lines requires Executive approval at monitoring rounds, but departments must be able to have sufficient flexibility to manage budgets and emerging pressures. The Review discussion document therefore argues that it is important to strike a balance "between achieving an acceptable level of detail in the expenditure lines and preserving the ability of departments to manage their budgets without having to constantly revert to the Executive".[20]

34. The Committee agrees that the level of detail currently provided in departmental expenditure plans often does not provide meaningful information on key areas of public spending, and welcomes any proposals that will simplify and harmonise information, increase transparency and ensure that expenditure is more readily scrutinised. While there was also general support for the thrust of Review Recommendation 6 from other Assembly committees, it was noted that further consultation will be required with the Assembly on the level of the breakdown proposed. On this latter point, the Committee for Regional Development suggest that this should be taken forward by DFP via CLG and CFP.

Review Recommendation 7: Performance outcomes and the delivery of the Programme for Government should not be directly attributable to allocations in budgets but should be monitored and delivered regardless of budget inputs. |

35. The DFP discussion paper notes that the PfG and its Public Service Agreement (PSA) targets are becoming more high-level and cross cutting and, as a result, it is difficult to map them meaningfully to particular spending areas. To disaggregate budgets to this level "may not be possible or practical or an efficient use of resources". It also contends that any department could link a bid to a PSA as they are so high level and that "in effect, to meet bids because they are linked to a PSA target could encourage inefficiencies in that spending area". The proposal from the Department is that, while PSA targets and outcomes should be monitored and departments held accountable, "performance should not have any direct link to funding inputs".

36. The Committee notes that this position appears to represent a shift in DFP thinking in this regard; the Review of the NI Executive Budget 2008-11 Process, completed by DFP in March 2010, included the following recommendations:

- "Recommendation 1: An exercise should be conducted at the start of the next Budget process to seek to determine the level of public expenditure underpinning actions to deliver each Public Service Agreement in the Programme for Government (PfG).

- Recommendation 7: Every departmental spending proposal should clearly state the impact on the respective PSA target, if successful."

The predecessor Committee welcomed both of these recommendations, but believed that the latter should be extended to also cover the reporting stage to "enable performance to be tracked at a departmental level in terms of inputs, outputs and outcomes."[21]

37. Members are also mindful that the Review discussion paper was published before the Executive had prepared its draft PfG 2011-15, which is currently out to public consultation. It is noted that the draft PfG does not contain accompanying PSAs similar to the previous PfG and that the majority of the "Key Commitments" set out in the draft PfG are attributable to a single Department, each with attached milestones/outputs to be achieved up until 2015. While the Executive's approach to delivery and reporting on PfG 2011-15 has yet to be announced, the Committee would welcome clarification on whether there is now an opportunity to adopt a system of reporting performance outcomes which would address some of the difficulties of mapping meaningfully to particular spending areas, as cited in the Review discussion paper.

38. The Committee notes that, in his statement to the Assembly on 17 January 2012 on the 2011-12 January Monitoring Round, the Finance Minister advised that his officials would be undertaking a comparison of departments' current financial positions and their original allocations in the Budget 2011-15. The Minister stated that this "will provide the Executive with an opportunity to review departmental allocations for 2013-14 and 2014-15 in light of the PfG priorities."[22] In the Committee's opinion, the Minister's statement suggests that a link can therefore be drawn between budget allocations and PfG priorities.

39. Almost all of the Assembly committees that responded to the discussion paper commented specifically on this recommendation. The majority expressed concern with the recommendation and were of the view that there should be strong links between spending and priorities, and that mechanisms should be in place to enable effective scrutiny in this regard. The Regional Development Committee had a slightly different view and, while it considered that budget allocations should not be totally disassociated from the PfG, was "content…that a closer alignment of budget allocations to individual departmental corporate plans is a more appropriate level and would endorse any progress towards this."

40. Committees also considered it important that the linkages should enable performance and outcomes to be measured against inputs, with the CAL and Enterprise, Trade and Investment (ETI) committees, in particular, advocating a move towards a more outcome-based approach. Assembly research has indicated that many countries currently use forms of outcome-based budgeting, and points to a project undertaken by the Scottish Government to develop a methodology to align resources to outcomes. It is the intention of the Committee to take further evidence in this regard. In the meantime, members would also point out that the lack of linkage between objectives and spending allocations hinders Assembly statutory committees in fulfilling their function of advising on departmental budgets. For instance, without linkage committees cannot identify the funding that is being channelled to objectives that are not being delivered. If they were in a position to do so, they could advise on whether spending in the particular areas should be cut out altogether, or increased, to enable non-achievement to be addressed.

41. It should also be noted that the predecessor Committee, in considering an outputs and outcomes approach, queried with DFP whether the existing financial systems in departments and Account NI were sufficiently aligned with PSA targets and indicators to provide information on inputs, outputs and outcomes. In its response, the Department confirmed that the Account NI system is capable of this, as it "allows departments to 'map' expenditure and report the record level of detail and which budget allocations are held on the Resource Budget Management … system".[23] It was considered that the mapping and provision of such information would support Assembly scrutiny; and presumably the integration of Executive NDPBs within the Account NI system, discussed under Review Recommendation 2, would also provide committees with a more complete picture.

42. The Committee firmly believes that there should be clear, visible linkages between Budget allocations and the PfG, and is unable to endorse Review Recommendation 7. In noting the difficulties cited by DFP in linking spending to priorities and outcomes, the Committee is mindful of previous evidence from DFP which runs contrary to the current proposal that "performance outcomes and the delivery of the Programme for Government should not be directly attributable to allocations in budgets", including the advice that the Account NI system had the capability to map expenditure to outputs and outcomes. The Committee, therefore, reiterates the call by its predecessor that work is undertaken to exploit the Account NI system to its full potential in this regard.

Review Recommendation 8: The Estimates and Resource Accounts should be revised as shown in Annexes D and E. |

43. The discussion paper notes that, in addition to alignment of the Budget, Estimates and Accounts, improved presentation of information is required to increase transparency and read-across among the different related publications. It is proposed that the Estimates are redesigned to include expenditure that is currently not voted as part of the Estimates process.[24] [25]The format of Resource Accounts will also be revised to better align with the presentation of the Estimates.[26]

44. In its submission, NIAO considers that, in terms of improving transparency, it is as important to improve the presentation of information within the published documents as it is to reduce and correct misalignment between the various frameworks. The example of the revised Resource Accounts attached to the DFP discussion paper is still complex, not readily understood or meaningful to many readers. In NIAO's opinion "there is the opportunity to review the format of the resource accounts with a view to making them more meaningful to the reader."

45. As just one specific example of an area where the Resource Accounts format could be improved, the Committee would highlight section 2.1 of the illustrative Resource Accounts appended to the Review discussion paper. While this sets out details of Administration and Programme Outturn for the given year, it does not provide for a breakdown of the prior-year figures in this regard, which would assist committees in scrutinising departmental administrative expenditure in particular. Members note that this relates to an issue identified by the predecessor Committee when it raised concern around the decision to abolish the programme of administrative cost controls in the Executive's Budget 2011-15 and instead delegate responsibility in this area from DFP centrally to individual departments. The predecessor Committee saw risks in this in terms of reducing the level of transparency and safeguards available for protecting expenditure on frontline services and considered that statutory committees should have a focus on departmental administrative expenditure going forward. Provision of the necessary comparative information is therefore one example of an area where the format of Resource Accounts should be improved.

46. The Committee has long called for better read-across between the published financial documents which accompany the different stages of the budget process and members welcome any moves towards this end. In noting that NIAO intends to discuss the presentation of the Estimates further with DFP, the Committee recommends that these discussions also consider how the Resource Accounts may be further improved from the example provided in the discussion paper, particularly in terms of being user friendly and supporting Assembly scrutiny. Members look forward to being apprised of any subsequent proposals in this regard.

Review Recommendation 9: That the Budget should be developed in the context of a Programme for Government agreed by the Executive. |

47. The DFP discussion paper refers to concerns expressed by the previous Committee for Finance and Personnel and Assembly members about the development of budgets in the absence of a Programme for Government. It notes that

"the need for the formulation of a Programme for Government prior to or at least, in tandem, with the development of a Budget is an opinion that has been expressed repeatedly in many forums."[27]

48. Members note from Assembly research that this proposal would better align the Budget process to international good practice. In addition, it is noted that this requirement is already included within legislation at Section 64(1) of the Northern Ireland Act 1998 and Paragraph 20 of Strand 1 of the Belfast/Good Friday Agreement. Assembly research pointed out, however, that that the recommendation is somewhat qualified, as DFP has stated that the development of a budget after, or in parallel with, a PfG is "desirable",[28] not a necessity.

49. In its response, the Regional Development Committee stated that it "would accept that a strict development of PfG and budgets in parallel might not be absolutely possible". It goes on to say, however, that the interrelationship between the two requires that they are developed in close proximity to one another. For its part the Audit Committee also saw the proposal in Review Recommendation 9 as a sensible approach; however, it pointed out that Executive budgets include expenditure that falls outside PfG, including expenditure for the purpose of holding the Executive and its departments to account. The Audit Committee considered that

"removing the NIAO from DFP and the Executive's remit underlines and strengthens the NIAO's independence in holding departments, executive agencies and other public bodies to account for their use of public money."

50. The Education Committee indicated strong support for this recommendation, and further recommended that it be extended to "place a requirement on departments to publish an Implementation Plan which is linked to the PfG." A number of statutory committees had previously indicated support for a similar recommendation in the DFP Review of the NI Executive Budget 2008-11 Process, which stated that "the PfG should be developed to a timetable slightly in advance of the Budget." The Committee endorses the view of its predecessor that budget allocations should be driven by priorities, not the other way around. In this regard, it supports the recommendation that the Budget should be developed in the context of a PfG agreed by the Executive. Moreover, the Committee considers that it is not simply "desirable" but is in fact essential that a draft PfG is developed prior to, or at least in tandem with, a draft Budget and wishes to see this reflected in any agreed Budget framework.

Review Recommendation 10: That, if circumstances and time permits, the Budget timetable should include an early strategic phase, allow sufficient time for consultation by Committees and with the public and be strictly adhered to by all concerned. |

51. The DFP discussion paper states that "where circumstances and time permit it should be possible, and desirable, to include an early strategic stage in the Budget timetable". It makes reference to external factors which have influenced the previous two budget processes: devolution in May 2007 which resulted in the development of the 2008-11 Budget in a short timespan; and the 2010 Westminster election which gave rise to a change of government and a later-than-usual Spending Review announcement in October 2010, thereby constricting the Budget process. Notwithstanding this, it goes on to say that

"Even if the Westminster Spending Review outcome and the NI Block allocation is not yet known, this early strategic phase could still take place in order to inform the later stages of the Budget".

52. The discussion paper specifies that, at this stage, each committee should:

- "identify and challenge pressures facing departments";

- "rank priorities for expenditure in order against the PfG"; and

- "identify plans to meet any pressures within the current or a reduced funding envelope."

It is also proposed that the Committee for Finance and Personnel would fulfil its conventional function of leading on this phase and producing a report on behalf of the Assembly. This report could be used to inform a "Take Note" debate, which would enable the Assembly to debate spending priorities and potential revenue raising measures in advance of the development of the Executive's draft Budget.

53. The Committee is mindful of the concerns raised by statutory committees about the lack of engagement with their respective departments during previous budget and financial processes. In its response to the DFP Review of the NI Executive Budget 2008-11 Process, the previous Committee considered that "greater influence can be brought to bear on spending plans at the earlier stages in the process", and was therefore supportive of recommendations in that review relating to early engagement with both Assembly committees and key stakeholders.[29]

54. While there was general support for Review Recommendation 10 and, in particular, the inclusion of an early strategic phase to allow consultation with committees, the majority of those committees who responded to the discussion paper expressed grave concern that this is heavily qualified by the phrase "if circumstances and time permits." The CAL Committee pointed out that this caveat in fact contradicts the assertion that that a Budget timetable will be "strictly adhered to by all concerned".

55. The Committee welcomes the proposal in Review Recommendation 10 to include an early strategic phase and sufficient time for consultation with Assembly committees and other stakeholders within a Budget timetable. However, given that an early strategic phase is one of the most informative and influential stages in the Budget process, members are firmly of the view that it is a requirement, rather than an ideal which will just take place "if circumstances and time permits". In noting that the discussion paper itself states that "even if the Westminster Spending Review outcome and the NI Block allocation is not yet known, this early strategic phase could still take place in order to inform the later stages of the Budget",[30] the Committee believes it essential that the caveat is removed from this Review recommendation.

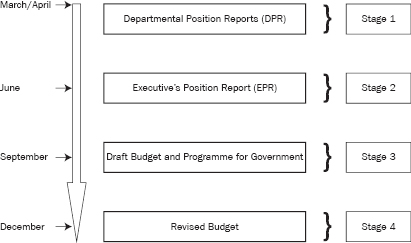

Review Recommendation 11: An 'ideal Budget timetable would be (presuming the development of a Programme for Government prior to or slightly in advance of the Budget):

|

56. The discussion paper proposes a timetable which would see the final Budget agreed by the Executive and approved by the Assembly by the end of December. The timetable incorporates an early strategic phase prior to the publication of a draft Budget, and also allows time for consultation on the draft Budget. Completion of the process by the end of December would allow departments sufficient time to plan and allocate their budgets in advance of the new financial year.

57. The previous CFP repeatedly called for a Budget timetable to be set out which included each of the key milestones in the process. Thus, the Committee concurs with those committees that welcomed the principle of setting out an ideal Budget timetable, and notes that Assembly research indicates that elements included in the timetable proposed in Review Recommendation 11 are in line with international best practice.

58. The DFP discussion paper suggests that the early strategic phase and the Take Note debate could be led by CFP on behalf of the Assembly. By convention, the Committee has taken this role in previous budget processes, as it ensures that the Assembly's response is not disjointed, and also that consideration is given to the strategic financial position and high level cross-cutting issues. It is the Committee's opinion that this practice will continue and it will publish co-ordinated reports on behalf of all Assembly statutory committees as part of future budget processes; further consideration will also be given to how this Committee function might be codified in formal procedures. The Committee also agrees with the Agriculture Committee's assertion that timely access to relevant information is necessary to enable statutory committees to fulfil their scrutiny role effectively. The issue of information provision is considered below under Review Recommendation 12.

59. The Review discussion paper highlighted "the fact that Northern Ireland is the only jurisdiction in the UK that carries out a formal public consultation on its Budget proposals" and cited this as imposing "further constraints in terms of having to factor in sufficient time for a public consultation".[31] Members note from Assembly research that the Scottish Government did in fact consult on its budget plans but that it took the approach of early (pre-draft) engagement with the public. In this regard, the Committee recommends that consideration is given to following the approach of the Scottish Government in undertaking public consultation at the formative pre-draft budget stage, which could either remove or reduce the time required for public consultation once the draft Budget has been agreed by the Executive. This DFP-led public consultation could be scheduled to align with Assembly committees' engagement with departments, so that the outcome of the public consultation is available to inform the Committee's co-ordinated report and the Take Note debate at the pre-draft budget stage.

60. Concerns were raised by a number of committees, including Agriculture, HSSPS, ETI, Justice and Social Development, with the apparent suggestion in the discussion paper that statutory committees will lead the pre-draft Budget consultation and that this "may preclude the need for later public consultation."[32] This echoed concerns raised in response to the specific recommendations in the DFP Review of the NI Executive Budget 2008-11 Process that:

"Assembly Committees should have the lead role in the consultation on the Executive's draft Budget proposals, with responses to the Executive co-ordinated by the Committee for Finance and Personnel."[33]

61. Those committees which commented specifically on this aspect consider that it is the duty of a department to consult on its budget proposals, as with any other public policy area. Additionally, as pointed out by the HSSPS Committee, committees "have no authority in terms of allocating money." In this regard, the Committee would reiterate the findings from its predecessor that it is not appropriate for Assembly committees to lead the consultation on departmental expenditure plans as inferred in the discussion paper, particularly as they do not have the authority to act on the outcome of such consultation.

Review Recommendation 12: A Budget Process Agreement should be made between the Assembly and the Executive and the Assembly's Standing Orders should be amended to reflect this Agreement and specify Budget Procedures. |

62. The discussion paper notes that an Assembly research paper prepared for the Committee called for the formalisation of the budget process in legislation or the Assembly's Standing Orders. In respect of legislation, the discussion paper states that the Budget framework is provided in the Northern Ireland Act 1998 (the 1998 Act). Section 64 of the 1998 Act requires the Finance Minister to lay a draft budget, which has been agreed by the Executive, before the Assembly. A definitive date for this is not included, but it must be before the beginning of each financial year. DFP cautions against formalising the budget process in primary legislation for a number of reasons:

- The 1998 Act is Westminster legislation, and the ability of the Assembly to amend it is very limited;

- Unforeseeable/external factors may prevent dates which are specified in legislation from being met. It will therefore be necessary to include provisions to amend such dates which would, in DFP's opinion, "rather defeat the purpose of the original provision";

- The Executive may be deemed to be in default if deadlines were not met.

63. The discussion paper therefore proposes a two-fold approach, whereby a Budget Process Agreement would define key stages and administrative arrangement for the budget process, which could be reflected in the Assembly's Standing Orders. It considers that such an approach:

"would ensure the timetable is clear to all parties and would require adherence by all concerned and the timely publication of all documentation. This approach would also spell out the ground rules for engagement between Committees and departments and their Ministers, including full and timely engagement by all concerned, thereby underpinning the provisions of the 1998 Act and the Ministerial Code."

It also notes that that the Assembly could amend Standing Orders to provide for "accepted unavoidable slippage."

64. The issue of an agreement – or Memorandum of Understanding (MoU) – between the Executive and the Assembly was considered in the predecessor Committee's Third Report on the Inquiry into the Role of the NI Assembly in Scrutinising the Executive's Budget and Expenditure,[34] with specific regard to the provision of information. Consideration was given to recourse in the event of non-compliance with a MoU by departments and it was recommended that:

"the wording of Standing Order 42(2)is reviewed to determine if an amendment is required to clarify that CFP should have regard to wider considerations, including the views of the other appropriate committees and compliance by departments with the MoU, when deciding whether to grant accelerated passage to budget bills."

65. The concerns around lack of engagement by departments, which were raised by a majority of statutory committees in the last mandate, have been well documented by the predecessor Committee. It has already become evident, however, that some departments are still failing to meet the needs of their committees in terms of the provision of financial information. This was highlighted to the Committee in correspondence from CLG on 7 November 2011 in relation to departmental monitoring round submissions. CLG expressed major concerns regarding "the lack of sufficient detail provided in some departmental submissions to allow committees to effectively carry out their budget scrutiny obligations and the timing of receipt of submissions".[35] On 21 November 2011, in its submission on the Review, CLG again highlighted common concerns expressed by chairpersons, including "that any outcome of the review should:-

- recognise that a committee requires financial information in sufficient time to allow it to undertake proper budget and financial scrutiny; and

- that the information provided should have adequate detail to allow a committee to effectively carry out its budget scrutiny obligations."[36]

66. While the proposed Budget Process Agreement could be potentially wider in scope than the MoU previously considered, members would question whether Review Recommendation 12, as set out, is sufficiently robust. DFP argues against including dates in legislation as they may need to be amended to take account of any unforeseen or external circumstances, but in such cases Standing Orders could easily be amended (or suspended). Initial advice from the Assembly's Legal Services suggests that statutory provision, specifically to facilitate a pre-draft budget scrutiny stage, could be made which would be sufficiently flexible to allow for unforeseen or external factors as noted by DFP. In addition, Assembly research found that:

"…good practice guidance suggests…that the overall budget and financial process should be established in statute, but that some of the detail should be left in subordinate legislation, or to the Assembly's Standing orders.

In relation to Standing orders, however, there is a note of caution. Whilst good practice suggests these should be used for formalising a legislature's internal rules for organisational arrangements for budget approval and review, the Assembly should: Avoid using such regulations [i.e. Standing Orders] as substitutes for general budget procedures and restrictions that should be in law, not internal parliamentary regulations.

So, whilst Standing Orders may be used to frame how the Assembly conducts budget scrutiny internally, they should not be relied upon to establish the principal stages or timing of a future process."[37]

67. It is the Committee's intention to further explore the merits of the Budget Process Agreement, proposed in Review Recommendation 12, as compared to the potentially more robust option of statutory provision, which would have a particular focus on facilitating a pre-draft budget scrutiny stage and would possibly take the form of a Committee Bill. Considerations around both options will be set out in a discussion paper on which views will be sought from all relevant stakeholders. While the general principle behind Review Recommendation 12, in terms of formalising the budget process, was welcomed by a number of the other committees who responded to the discussion paper, the majority have indicated that they wish to await the outcome of the Committee's work in this regard before making any final decisions.

Review Recommendation 13: In due course, consideration should be given to streamlining the end stage of the Budget process by introducing the Main Estimates and the final stage of the Budget process in December/January.Review Recommendation 14: In due course, in light of involvement of the Assembly in the early strategic stage of the Budget and throughout its development, an amendment of Standing Orders to facilitate a truncated passage of Budget Bills through the Assembly should be considered. |

68. The DFP discussion paper considers that "currently the Budget process followed by the Estimates and legislative stage is convoluted and repetitive." The final Budget is debated and approved by the Assembly in December or January. However, the Vote on Account must be taken in February to enable departments to ensure that public services continue during the early part of the new financial year, until the Main Estimates are presented in June. In addition, the first in-year monitoring round is presented around the same time as the Main Estimates, "amending the very plans that have not yet completed formal Assembly approval through the Estimates and Budget Bill." The discussion paper therefore proposes that the Main Estimates and the related Budget Bill are presented as the Final Stage of the Budget in January, which would negate the need for a Vote on Account. In this respect, it would be necessary to ensure that the Budget Bill would receive Royal Assent before the start of the new financial year. It is therefore proposed that, given the involvement of the Assembly and its committees at the earlier stages in the Budget process, consideration could be given to reducing the time taken for passage of Budget Bills by, for example, removing the Further Consideration Stage and the 10 day rule.

69. The discussion paper points out that the streamlining of the end stages of the Budget process in this way could present considerable difficulties for departments. The requirement to produce Main Estimates, January monitoring round and the Spring Supplementary Estimates at the same time, together with related legislation "could prove to be an intolerable burden and a risk that needs to be weighted up carefully." These changes should therefore not be considered until Budgets and Estimates have been aligned and the new Budget process has been successfully implemented.

70. There was general support from other committees for this recommendation, though it is noted that the Committee for Education welcomed proposals to streamline the process in this way provided that the opportunities to consider and debate budgets and financial issues were not reduced. In terms of Review Recommendations 13 and 14, the Committee agrees with the DFP position that the latter stages of the current budget process are convoluted and repetitive. The potential to streamline the process exists, but only in the context of a reformed budget process which provides unequivocally for a formal pre-draft budget phase, affording the Assembly and its committees an opportunity to influence budgetary matters at an early stage. The Committee will therefore wish to consider this matter further once a reformed process has been developed and trialled. In the meantime, and given the caveat included at Recommendation 10, as currently drafted, that a strategic stage will be included in a budget timetable "where circumstances and time permits", the Committee cautions against any amendment to Standing Orders to facilitate a truncated passage of a budget bill.

Review Recommendation 15: The Rates Order should be debated alongside the expenditure plans for the next financial year, as set out in the Budget Bill. |

71. The discussion paper points out that, despite the fact that the Budget and the Estimates take rates income into consideration, the Rates Order is currently debated separately from the Budget Bill and in advance of the new financial year. It argues that "this public income strand of the rates should…be part of the entire financial process in order to minimise any risk that it may be treated as a separate emotive issue by the Assembly, divorced from expenditure plans." As primary legislation would need to be amended to combine the two into one piece of legislation, it is therefore proposed that the Rates Order and Budget Bill are co-ordinated to "positively link the two strands of public finances."

72. The Committee for Education advised that it understands that good practice would be to consider all revenue issues alongside the Budget. The Committee for Regional Development also agreed there should be closer alignment, "particularly as greater responsibilities, but not necessarily budgets, are being delegated to local authorities."

73. Assembly research noted that the current budget process focuses principally on expenditure, with less consideration afforded to the revenue side. In that respect, the proposal to link the Regional Rates Order more closely to the Budget is to be welcomed. In addition, Assembly research pointed out that deliberations in respect of the devolution of Air Passenger Duty and corporation tax powers means that greater attention will need to be paid to revenue forecasts.

74. The Committee supports Review Recommendation 15, that the Rates Order should be debated alongside the expenditure plans for the next financial year, as set out in the Budget Bill, and believes that an integrated approach to considering revenue and spending plans will further underpin Assembly scrutiny.

[1] Review of Financial Process in NI discussion paper, Annex A – Terms of Reference, Appendix 3.

[2] A copy of the presentation is provided at Appendix 3.

[3]http://archive.niassembly.gov.uk/finance/2007mandate/reports/Report_44_09_10R_vol1.html

[4]http://archive.niassembly.gov.uk/finance/2007mandate/reports/report_61_10_11R.htm

[5] Research and Information Service briefing paper, DFP's Review of Financial Process: considerations for improving the budget process, List of Recommendations, Page 214, Appendix 5.

[6] DFP discussion paper, paragraph 14(b)' Appendix 3.

[7]http://archive.niassembly.gov.uk/finance/2007mandate/reports/Report_66_09_10R.html

[8] Committee for Regional Development, Appendix 4.

[9] The Review discussion paper explains that "Currently advisory NDPBs and tribunals are aligned in Budget, Estimates and Accounts", paragraph 24.

[10]http://archive.niassembly.gov.uk/finance/2007mandate/execreport.htm

[11]http://archive.niassembly.gov.uk/finance/2007mandate/reports/dfp_response.htm

[12] See Appendix 4

[13] Research and Information Service Research Paper, The Executive's Review of the Financial Process in Northern Ireland: a critical analysis of DFP's discussion paper, Appendix 5.

[14] Research and Information Service Research Paper, The Executive's Review of the Financial Process in Northern Ireland: a critical analysis of DFP's discussion paper, Appendix 5.

[15] DFP discussion paper, paragraph 49, Appendix 3.

[16] Research and Information Service briefing note, Presenting fiscal data: gross or net?, Appendix 5.

[17] Official Report, 21 September 2011, Appendix 2.

[18] See NIAO letter of 6 January 2012, Appendix 4.

[19] DFP discussion document, paragraph 59, Appendix 3.

[20] DFP discussion document, paragraph 62, Appendix 3.

[21]http://archive.niassembly.gov.uk/finance/2007mandate/reports/Report_66_09_10R.html

[22]http://www.niassembly.gov.uk/Assembly-Business/Official-Report/Reports-11-12/17-January-2012/

[23]http://archive.niassembly.gov.uk/finance/2007mandate/reports/report_61_10_11R.htm, para 108.

[24] An example of the redesigned Estimate is provided at Annex D to the DFP discussion paper, Appendix 3.

[25] A brief synopsis of the proposed Main Estimate Structure is provided at Part 2.8 of the Research and Information Service Paper, The Executive's Review of the Financial Process in Northern Ireland: a critical analysis of DFP's Discussion Paper, Appendix 5.

[26] An example of the redesigned Resource Accounts is provided at Annex E to the DFP discussion paper, Appendix 3.

[27] DFP discussion paper, paragraph 86, Appendix 3.

[28] DFP discussion paper, Executive Summary - Initial recommendations for discussion, Appendix 3.

[29]http://archive.niassembly.gov.uk/finance/2007mandate/reports/Report_66_09_10R.html

[30] DFP discussion paper, Paragraph 92, Appendix 3.

[31] DFP discussion paper, Paragraph 89, Appendix 3.

[32] ibid

[33]http://archive.niassembly.gov.uk/finance/2007mandate/reports/Report_66_09_10R.html , paragraphs 56-59

[34]http://archive.niassembly.gov.uk/finance/2007mandate/reports/report_61_10_11R.htm

[35] See CLG letter of 7 November 2011, Appendix 4.

[36] See CLG letter of 21 November 2011, Appendix 4.

[37] Research and Information Service Briefing Paper, DFP's Review of Financial Process: considerations for improving the budget process, Appendix 5.

Appendix 1

Minutes of Proceedings

Wednesday, 25 May 2011

Room 30, Parliament Buildings

Present: Mr Conor Murphy MP MLA (Chairperson)

Mr Dominic Bradley MLA (Deputy Chairperson)

Mrs Judith Cochrane MLA

Mr Leslie Cree MBE MLA

Mr Paul Girvan MLA

Mr Ross Hussey MLA

Mr Mitchel McLaughlin MLA

Mr Adrian McQuillan MLA

Ms Caitríona Ruane MLA

In Attendance: Mr Shane McAteer (Assembly Clerk)

Mrs Kathy O'Hanlon (Assistant Assembly Clerk)

Mr Jim Nulty (Clerical Supervisor)

Mr Dominic O'Farrell (Clerical Officer)

Apologies: Mr David Hilditch MLA

Mr William Humphrey MLA

10.09am The meeting opened in public session.

10. Overview of Public Expenditure System

Members received an overview briefing on the public expenditure system from Michael Brennan, Head of Central Expenditure Division, DFP; Agnes Lennon, Central Expenditure Division, DFP; and Joanne McBurney, Central Expenditure Division, DFP.

Agreed: the DFP officials will provide the Committee with the timetable for the Review of the Financial Process.

[EXTRACT]

Wednesday, 1 June 2011

Room 30, Parliament Buildings

Present: Mr Conor Murphy MP MLA (Chairperson)

Mr Dominic Bradley MLA (Deputy Chairperson)

Mrs Judith Cochrane MLA

Mr Leslie Cree MBE MLA

Mr Paul Girvan MLA