Report on the Committee's Inquiry into Developing the Northern Ireland Economy through Innovation, Research & Development

Session: 2011/2012

Date: 24 May 2012

Reference: NIA 42/11-15

Mandate Number: Mandate 2011/15 First Report

nia_report_42_11-15.pdf (19.66 mb)

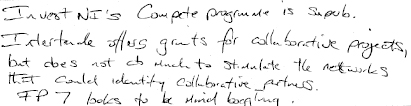

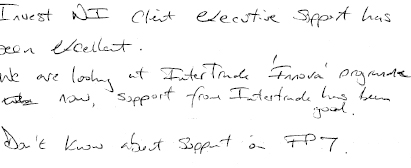

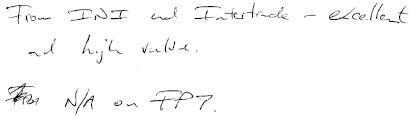

Committee for Enterprise, Trade & Investment

Report on the Committee's Inquiry into Developing the Northern Ireland Economy through Innovation, Research & Development

Together with the Minutes of Proceedings of the Committee Relating to the Report,

Written Submissions, Memoranda and the Minutes of Evidence

Ordered by the Committee for Enterprise, Trade & Investment

to be printed on 24 May 2012

Report: NIA 42/11-15

Mandate 2011/15 First Report

Membership

The Committee has 11 members, including a Chairperson and Deputy Chairperson, and a quorum of five members.

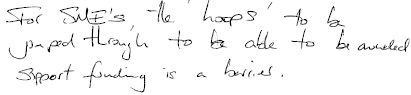

The membership of the Committee is as follows:

Democratic Unionist Party

Gordon Dunne

Stephen Moutray

Paul Frew 1

Robin Newton 4, 6

Green Party

Steven Agnew

Sinn Féin

Daithí McKay (Deputy Chairperson)

Phil Flanagan

Jennifer McCann 2

Social Democratic and Labour Party

Alban Maginness (Chairperson)

Patsy McGlone 5

Ulster Unionist Party

Sandra Overend 3

1 With effect from 24 October 2011 Mr Paul Frew replaced Mr David McIlveen

2 With effect from 23 January 2012 Ms Jennifer McCann replaced Ms Sue Ramsey

3 With effect from 06 February 2012 Mrs Sandra Overend replaced Mr Mike Nesbitt

4 With effect from 27 February 2012 Mr Paul Givan replaced Mr Robin Newton

5 With effect from 23 April 2012 Mr Patsy McGlone replaced Mr Alasdair McDonnell

6 With effect from 21 May 2012 Mr Robin Newton replaced Mr Paul Givan

Table of Contents

List of Abbreviations and Acronyms used in the Report

Appendices

4. Written Submissions to the Committee

List of Abbreviations and Acronyms used in the Report

ADS - Aerospace Defence Security

AFBI - Agri Food Biosciences Institute

BERD - Business Expenditure on Research and Development

BMC - Belfast Metropolitan College

CBI - Confederation of British Industry

CEO - Chief Executive Officer

CIIF - Creative Industries Innovation Fund

CIP - Competitiveness and Innovation Framework Programme

DARD - Department of Agriculture and Rural Development

DEL - Department of Employment and Learning

DETI - Department of Enterprise, Trade and Investment

ECF - Enterprise Capital Funds

EIPs - European Initiative Platforms

EIT - European Institute of Innovation and Technology

ERA - European Research Area

ERRIN - European Regions Research and Innovation Network

EU - European Union

HMRC - Her Majesty's Revenue and Customs

FE - Further Education

FP7 - Framework Programme 7

GB - Great Britain

GVA - Gross Value Added

HE - Higher Education

HEIF - Higher Education Innovation Fund

HIE - Highland and Islands Enterprise

INI - Invest Northern Ireland

INTERREG - Interregional co-operation programme

IP - Intellectual Property

IRDG - Industry Research and Development Group

IREP - Independent Review of Economic Policy

KTP - Knowledge Transfer Partnership

LEAs - Local Enterprise Agencies

MEP - Member of the European Parliament

MNI - Manufacturing Northern Ireland

MoU - Memorandum of Understanding

NDPB - Non Departmental Public Body

NI - Northern Ireland

NIACE - Northern Ireland Advanced Composites & Engineering

NILGA - Northern Ireland Local Government Agency

NISP - Northern Ireland Science Park

NRC - Northern Regional College

PFG - Programme for Government

QUB - Queen's University Belfast

R&D - Research and Development

RAE - Research Assessment Exercise

RDAs - Regional Development Agencies

RISAP - Regional Innovation Strategic Action Plan

RoI - Republic of Ireland

SBRI - Small Business Research Initiative

SE - Scottish Enterprise

SEK - Swedish Krone

SERC - South Eastern Regional College

SFA - Selective Financial Assistance

SFC - Scottish Funding Council

SME - Small & Medium Sized Enterprises

SSAC - Scottish Science Advisory Council

SWC - South West College

TSB - Technology Strategy Board

UCD - University College Dublin

UK - United Kingdom

USA - United States of America

UU - University of Ulster

VINNOVA - Swedish Research Council and the Agency for Innovation Systems

ZIM - Central Innovation Programme for SMEs

Executive Summary

Background and Purpose of the Inquiry

1. The Committee became aware early in the current mandate, of evidence that levels of innovation and research and development (R&D) in Northern Ireland were not as high as would have been expected given the opportunities and programmes that are currently available. Additional evidence had come from the report on the Independent Review of Economic Policy (IREP) calling for improved structures and increased levels of support for innovation and R&D.

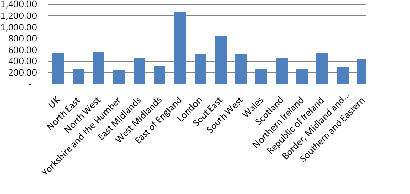

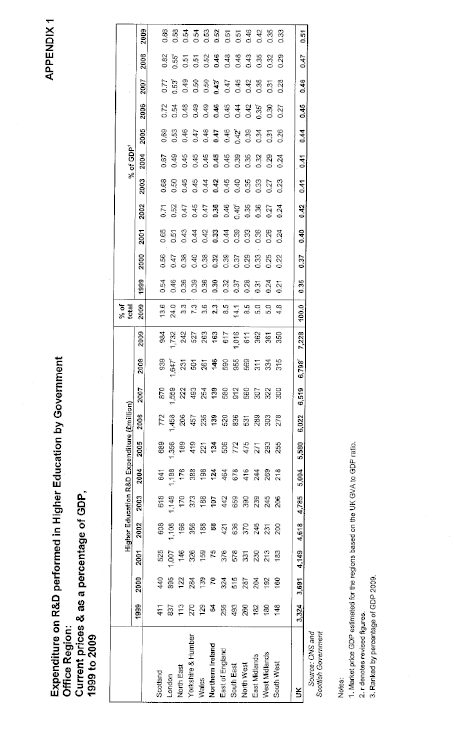

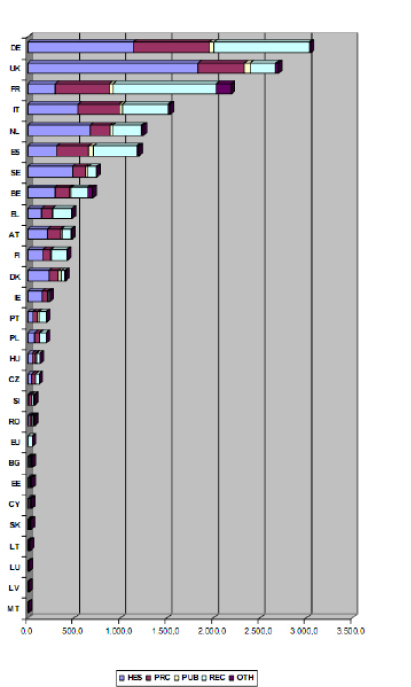

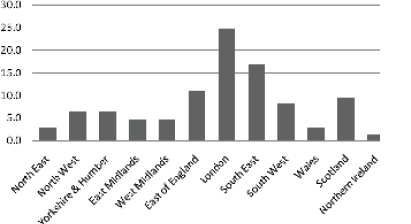

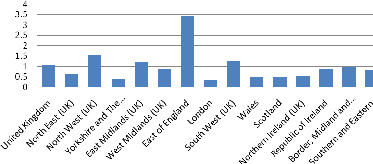

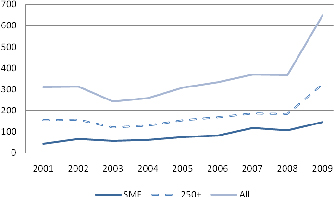

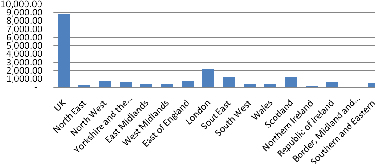

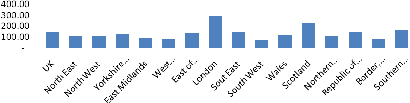

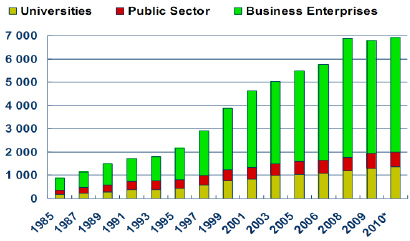

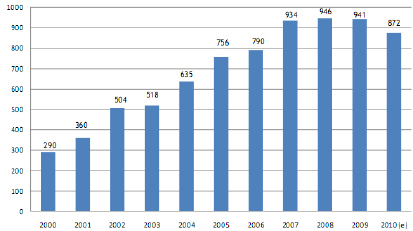

2. The Treasury consultation on rebalancing the Northern Ireland economy noted the particularly low level of business expenditure on R&D. It further noted that R&D and innovation are particularly low when compared to successful small economies in Europe several of which are in more peripheral locations than Northern Ireland. Over the past five years business expenditure on R&D in Northern Ireland has averaged 0.69% of Gross Value Added (GVA) compared to 1.23% for the UK as a whole. Business expenditure on R&D in Northern Ireland is heavily focused on a small number of companies, with just 10 companies accounting for around 57% of all business R&D investment in 2009.[1]

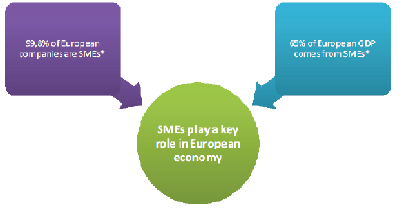

3. In the current economic climate, and with decreasing levels of Selective Financial Assistance available to companies in Northern Ireland, the Committee considers it essential that the opportunities to invest in R&D are fully exploited. There are perceived difficulties in attracting high levels to Northern Ireland due to issues such as the large number of small businesses here compared to other parts of the UK, the small number of universities and difficulties in attracting high levels of R&D to Northern Ireland.

4. The purpose of the inquiry was to identify barriers faced by organisations in availing of opportunities for support for innovation, research & development and to bring forward recommendations on how these barriers can be overcome to maximise support for innovation, research & development opportunities for the benefit of the Northern Ireland economy.

The Current Position

5. There is a wide range of opportunities available for business and academia to become involved in innovation and R&D. This ranges from international R&D programmes and large EU programmes such as Framework Programme 7 and others to opportunities provided by individual local councils. In between are UK-wide programmes, programmes specific to Northern Ireland, for which Invest NI has responsibility and programmes which are run on a cross-border basis, mainly through InterTradeIreland.

6. The Committee was impressed with the numerous positive comments from respondents regarding the support they received from Invest NI representatives and from InterTradeIreland. It is evident that the work being done on the ground to support organisations involved in R&D is undertaken in a positive and professional manner and is very much appreciated by those who benefit from the support.

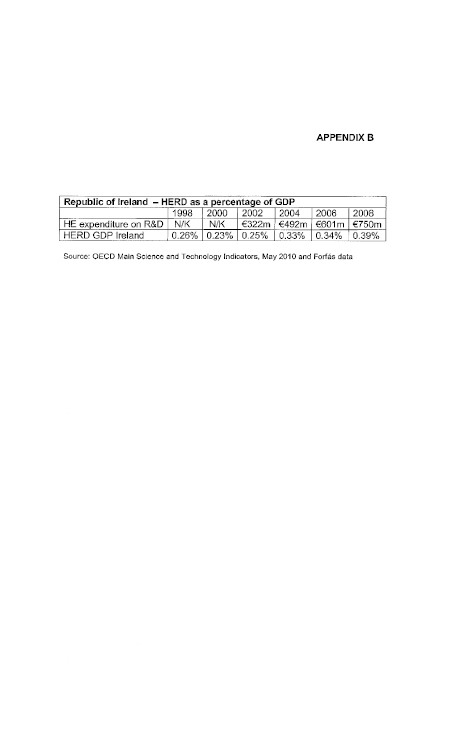

7. Other UK regions have their own specific programmes to provide support for R&D. The Republic of Ireland has a high level of success in R&D, as do countries such as Finland, Sweden and Germany. The Committee considered the mechanisms used by these countries as appropriate benchmarks for the direction in which Northern Ireland should move in the future.

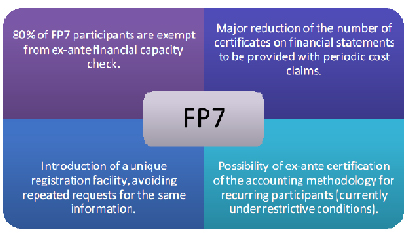

8. Evidence to the inquiry is largely supportive of the currently available programmes to support R&D. Their content is considered mostly appropriate to the needs of those organisations becoming involved in R&D. However there were concerns expressed regarding how these programmes are integrated, managed, communicated and administered. One notable example is the low level of venture capital available in Northern Ireland given the high demand. Another is the lack of involvement of the Executive in the Small Business Research Initiative (SBRI), especially given the high level of success of Northern Ireland companies participating in the programme in GB. Concern was widely expressed regarding lower than expected levels of uptake of funding under Framework Programme 7 (FP7). Many respondents also commented on the need for Northern Ireland to be in a better position to avail of opportunities under Horizon 2020, the successor to FP7, which commences in 2014.

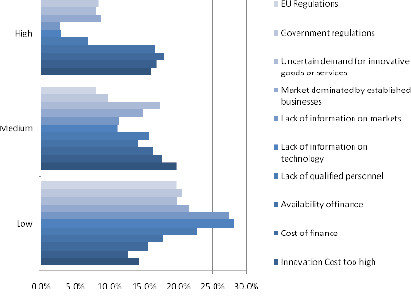

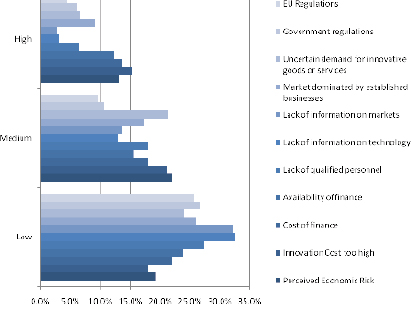

Barriers faced by Organisations

9. During the course of the Inquiry barriers to organisations becoming involved in R&D have been identified by organisations from all sectors and of all sizes. Barriers range from simple issues such as lack of awareness of opportunities and lack of knowledge and skills required to become involved to issues relating to funding, risk, difficulties in commercialising R&D and the complexities involved in the funding processes.

10. There is an evident lack of awareness of the opportunities and support available for innovation and R&D. This is especially the case for, but not solely confined to, Small and Medium Sized Enterprises (SMEs). Many organisations may be aware that opportunities may exist but have no awareness of their own eligibility to avail of those opportunities. In some cases this may extend to companies not realising that the work they are doing actually constitutes R&D. Sometimes the key barrier may be that an organisation does not know how to access the support that may be available.

11. Where there is some knowledge and understanding of available opportunities and support there are still many cases where that support is not sufficient to overcome the lack of capacity and capability within the organisation to avail of those opportunities. Many companies do not have the resources available in terms of people, time and finances to avail of opportunities and the available support is insufficient to help them in overcoming these barriers. Even if resources were to be made available to support organisations, many would still lack the knowledge and skills necessary to go through the application process and to engage in R&D projects. There have been suggestions that the FE and HE sector is well placed to provide support in this regard.

12. Issues were raised regarding the nature and level of funding that is available to support R&D. These included problems with access to finance, low levels of funding and the limited sources of finance that respondents believe are available. Some respondents raised concerns regarding the absence of specialist resources, lack of up-front support and the need for more consistency in research and development funding.

13. A number of respondents from both the private and public sectors raised concerns about the limited availability of opportunities for business-led R&D and for support for the commercialisation of R&D. There was general agreement across Government, business and academia that commercialisation of research is where the long-term benefits of increased innovation and R&D will be realised. It was felt that more opportunities for business-led R&D will lead to a greater focus on commercialisation.

14. In acknowledging that there will always be risks associated with participation in R&D respondents believe more could be done to assist businesses to become aware of those risks and to manage them. Perceptions of risk may often be enough to deter a company from getting involved in R&D, especially if there is the perception that the business itself may be at risk if limited resources have to be allocated with no certainty of success. Intellectual Property (IP) risks were cited as a key barrier to collaboration between businesses. Collaboration is considered to be essential to R&D success. Examples of successful collaboration in leading R&D economies such as Sweden, Finland and Israel were cited as examples of how concerns between companies can be overcome and risks relating to issues such as IP can be managed.

15. The most common risk cited by respondents as a barrier to participation in R&D is the high level of, what is considered, unnecessary and repetitive bureaucracy involved in the programmes and in the administrative processes that are required. This was a major concern regarding EU funded programmes. The Committee recognises that there is little that can be done at implementation level to change this, however there may be opportunities to influence in relation to Horizon 2020. There were also concerns regarding the level of bureaucracy associated with programmes administered at a more local level. The Committee recognises and supports the need for accountability in all funded programmes. The Committee also appreciates that Invest NI has been working to improve the administration of programmes and that much work has been done to eliminate some of the unnecessary bureaucracy. There may be opportunities in this regard to further review processes and streamline programmes to identify and eliminate duplication and unnecessary bureaucracy.

16. Many of the barriers highlighted in the report impact on organisations of all types and sizes from all sectors. These barriers are however magnified for many SMEs and micro-businesses. Small businesses do not have the flexibility and resource to become fully focused on innovation and R&D and still concentrate on the day-to-day running of the business and planning for the future. These businesses need greater levels of hands-on support to enable them to participate in the often complex processes involved in many of the support programmes for R&D. This support may involve every aspect of the process, including support to increase knowledge and skills, support navigating the range of opportunities to determine the most appropriate route to innovation and R&D, help with identifying and managing risks and support through the complexities involved in the process from application to evaluation.

Strategic Approach to Innovation and R&D

17. According to the EU Commission representative in Belfast, Europe's average growth rate has been structurally lower than that of its main economic partners. This is largely as a result of a productivity gap that has widened over the last decade due to differences in business structures combined with lower levels of investment in R&D and innovation, insufficient use of information and communications technologies, reluctance in some parts of society to embrace innovation, barriers to market access and a less dynamic business environment.[2] The United Kingdom just makes it into the top ten countries for innovation according to the Global Innovation Index[3] and is ranked 6th in Europe behind Switzerland, Sweden, Finland, Denmark and the Netherlands. As stated above, levels of innovation and R&D in Northern Ireland are particularly low when compared to successful small economies in Europe and other regions of the UK. Therefore, much work is needed if Northern Ireland is to achieve its potential and achieve the appropriate levels of innovation and R&D as a region.

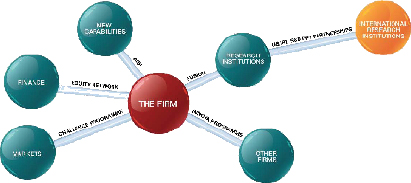

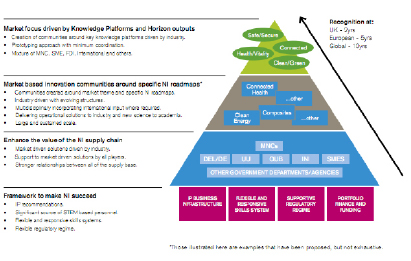

18. Much positive work is being done to develop and grow the capability within Northern Ireland to become involved in innovation and R&D. It is recognised within DETI that R&D can play a significant role in attracting Foreign Direct Investment (FDI) and economic growth. There have been calls from respondents for the prioritisation of sectors and DETI has done this through the Programme for Government and the Economic Strategy. While much is being done at a strategic level there is also evidence that there is considerable disconnection between programmes, between Government, business and academia and within each of the three sectors. The work DETI is doing at a macro level to develop the R&D agenda from an international perspective is essential to grow the economy through Foreign Direct Investment. It is also important to drive innovation and R&D within Northern Ireland and support indigenous business of all sizes and academia to engage now and with any new opportunities which may arise in the future. Many respondents have informed the Committee of the need for a more holistic, better coordinated and planned approach across all sectors and at all levels.

19. The infrastructure that is currently in place to support R&D has largely evolved from established support mechanisms as the role of R&D has rapidly developed over the past number of years. Considering the expected future impact of R&D as a key economic driver, a clear vision for innovation and R&D must be developed and implemented, including policies, strategies, structures, systems and processes which are custom-designed specifically to meet the long-term challenge of maximising the potential for Northern Ireland businesses and academia at all levels to take advantage of the existing and future opportunities for innovation, research and development (Recommendation 1).

20. There is considerable evidence that the appropriate structures are not in place to fully support innovation and R&D in a holistic and coordinated manner. Despite the best efforts of DETI and Invest NI, the absence of an appropriate structure is a major barrier to Government developing a more holistic and coordinated approach. Many respondents have suggested the establishment of a single organisation or single point of contact with direct links to business and academia, tasked with supporting all types of organisations. There would be a role for this organisation or unit in gathering market intelligence on R&D from all available sources including benchmarking against regions considered leaders in the field. It would also be the appropriate location for developing, streamlining and improving programmes and processes for innovation and R&D and for ensuring these programmes and processes meet the needs of businesses of all sizes, universities, FE colleges and research institutions. In the first instance, there is a need for a high-level steering group to oversee and set the strategic direction for all R&D activity. A high-level steering group should be established comprising Government, business and academia to advise on policy and oversee the integration and coordination of all R&D activity across all three sectors at all levels (Recommendation 2). The steering group should be involved in setting the vision for innovation and R&D.

21. Below this level a completely new structure is required in the form of a single unit to integrate and coordinate all innovation and R&D activity. It should have four key responsibilities:

i. Improving Government knowledge and information on innovation and R&D by gathering knowledge and information through, research, networking and collaboration to identify and learn from good practices; and to identify the contribution that can be made at all levels by Government, business and academia.

ii. Developing programmes systems and processes to meet the needs of business and academia by providing programmes of assistance for innovation and R&D; providing support to understand and navigate programmes; and providing support for administering programmes from application to evaluation.

iii. Implementing support for innovation and R&D through promotion of opportunities, educating and mentoring, practical support through projects, awareness programmes for support available and for specific programmes (such as Horizon 2020 and the Small Business Research Initiative).

iv. Developing and supporting a culture of innovation and R&D across Government, business and academia at all levels in Northern Ireland (Recommendation 3).

Integration and Coordination of Innovation and R&D

22. It is not considered necessary to wait until the establishment of a new structure in order to progress the four key responsibilities outlined above. Innovation and R&D are key priorities for Government and work should commence now to integrate and coordinate the approach. This should be done in a manner that will enable these responsibilities to be integrated into the new structure as it is developed.

23. It is essential that there is understanding of the contribution that can be made by Government, business and academia at all levels in order to develop programmes, systems and process that can take advantage of the opportunities that exist both now and in the future. Information and knowledge of good practice in other regions needs to be gathered and applied to the Northern Ireland situation. Northern Ireland must become more connected in Europe. The required knowledge and understanding must be gained and shared in order to enable business and academia to work with EU programmes for R&D including FP7 and Horizon 2020. Other sources of support for R&D coming from outside Northern Ireland also need to be developed. This includes developing the venture capital opportunities to help meet growing demand and involvement in the Small Business Research Initiative. It is also important to look inwardly to understand the capabilities, the weaknesses and the potential that exist inside Northern Ireland. There must be a comprehensive knowledge and understanding of what Government, business and academia can contribute to increasing the level and quality of innovation and R&D. Learning from good practices in other countries, developing the ability for Northern Ireland to engage in Europe and understanding the capabilities, the gaps and the potential that exist inside Northern Ireland are the three critical elements to provide the knowledge and understanding required to assist in developing the appropriate infrastructure for innovation and R&D. Therefore, a mechanism should be put in place and resource allocated to undertake the following functions:

i. To identify and learn from good practices in innovation and R&D in other countries and regions.

ii. To engage regularly with other sources of support such as EU institutions, venture capital firms and the Technology Strategy Board to gain a comprehensive understanding of and influence the initiatives and support programmes that are available for R&D.

iii. To gain a comprehensive understanding of the strengths, weaknesses, and potential that exists in Government, business and academia in Northern Ireland to contribute to innovation and R&D.

iv. To use the knowledge and understanding gained to inform the development of appropriate systems and processes, to support and improve the capacity and capability of organisations at all levels to participate in innovation and R&D (Recommendation 4).

24. For Northern Ireland to make the most of the opportunities available for innovation and R&D, the programmes, systems and processes that are put in place to implement and support those opportunities must be appropriate to the needs of the wide variety of businesses which may wish to avail of them. They must also meet the needs of universities, FE colleges and research institutions. This must be done efficiently and effectively. Given the large number of respondents from all sectors and of all sizes who are experiencing difficulties in accessing and availing of opportunities, there is much still be done to align programmes, systems and processes to the needs of those who seek to use them. Programmes for innovation and R&D meet the needs of users. Therefore, Government, business and academia should work together to review and, where necessary, improve programmes developed within Northern Ireland and influence programmes being developed elsewhere, so as to balance the needs of business and academia with those of the Executive (Recommendation 5). In order to ensure that the processes in place to support those programmes are appropriate to the users' needs, Government, business and academia should work together to review and improve existing support processes and, where appropriate, develop new practical measures of support for all innovation and R&D programmes (Recommendation 6). In order to ensure that the level of bureaucracy associated with the administrative processes for innovation and R&D are sufficient to meet accountability requirements without being overly complex or unnecessary, Government, business and academia should work together to review and, where necessary, improve the administrative processes for R&D programmes developed within Northern Ireland so as to balance the needs and capabilities of business and academia with the needs of the Executive (Recommendation 7).

25. The level of awareness and understanding of innovation and R&D needs to be increased. Programmes of education and mentoring are required and awareness sessions will be required for new programmes such as Horizon 2020 and the Small Business Research Initiative and practical support measures will be required to assist business and academia throughout programmes. A long-term strategy and implementation plan should be developed with appropriate resources provided for promotion of opportunities for R&D, educating and mentoring, practical support through projects and awareness programmes for support available for specific schemes (Recommendation 8).

26. Recommendations have been made for a vision and strategic approach to innovation and R&D. New structures have been recommended from the top down to support innovation and R&D, to develop and implement new and improved programmes and support mechanisms and to raise awareness, knowledge and understanding of innovation and R&D at all levels across Government, business and academia. However, for Northern Ireland to achieve long-term success in R&D as a region and for R&D to make the contribution needed to drive and develop the economy, there must be a culture of R&D across all sectors at all levels. A clear and consistent message and approach must be continuously promoted by Government, business and academia across Northern Ireland to the effect that innovation, and R&D are key drivers for economic growth and will be supported at all levels (Recommendation 9).

Short-Term Measures to Improve Uptake of R&D

27. Throughout the course of the inquiry there were a number of issues raised which the Committee believes can and should be addressed individually. These are largely 'quick fixes' which can be implemented without undue delay. By addressing these issues the message will be sent out that Northern Ireland is serious about addressing the barriers to organisations becoming involved in innovation and R&D.

28. The need for mentoring has been established for all programmes including Framework Programme 7. Mentoring would be particularly welcomed by SMEs and micro-businesses to assist in identifying the type of support best suited to individual companies and to support companies throughout the process. Invest NI should explore ways to open up innovation and R&D mentoring schemes to all businesses which need it. This should include consideration of the contribution that could be made by third parties such as local councils, FE colleges and Local Enterprise Agencies (Recommendation 10).

29. The Committee recognises the high levels of expenditure that businesses undergo to become involved in R&D and the impact this high expenditure can have on cash-flow. Government also recognises this as a problem and, in recognition, has cut the target period for payment of invoices by Government departments from 30 days to 10 days. In the same spirit, the target time period for payment of grants, following receipt of an accurate record of expenditure should be reduced immediately to 30 days with consideration given to how this can be reduced further in the future (Recommendation 11).

30. The Committee was impressed with the high level of success of Northern Ireland companies tendering under the Small Business Research Initiative. The Committee was however disappointed to learn that opportunities do not exist for these progressive companies and others to tender under the SBRI for contracts within Northern Ireland. This constitutes a significant gap in both the innovation and R&D infrastructure here and in the procedures for procurement. The Department of Finance & Personnel must take steps to introduce and promote the Small Business Research Initiative across Government departments, agencies and NDPBs (Recommendation 12).

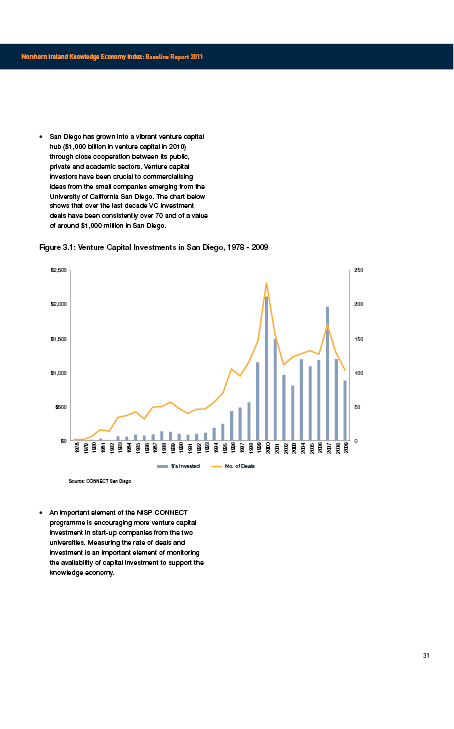

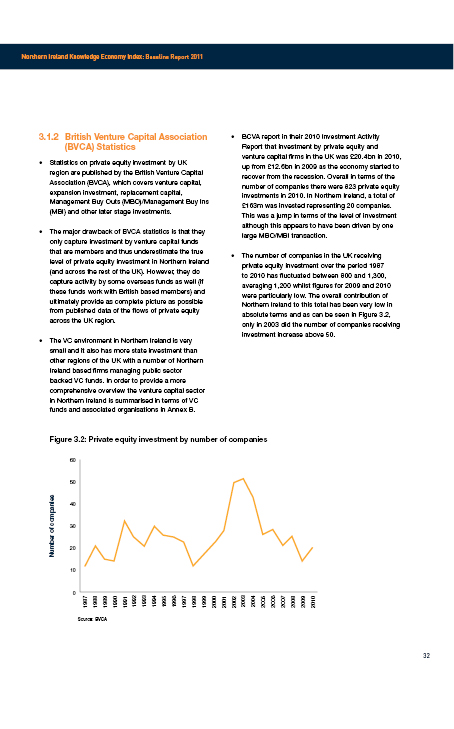

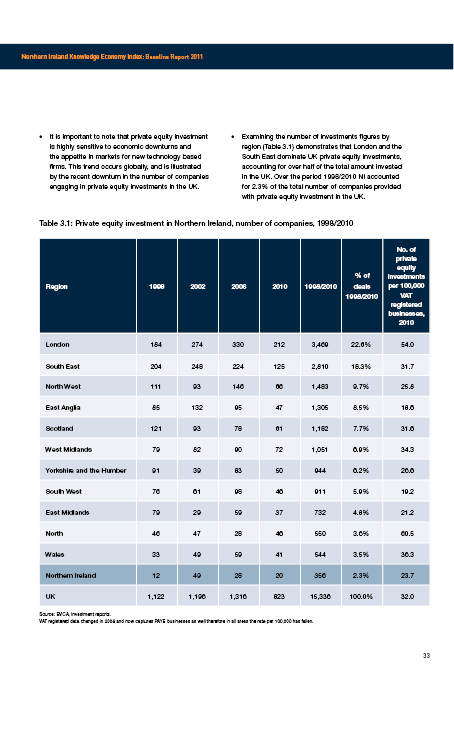

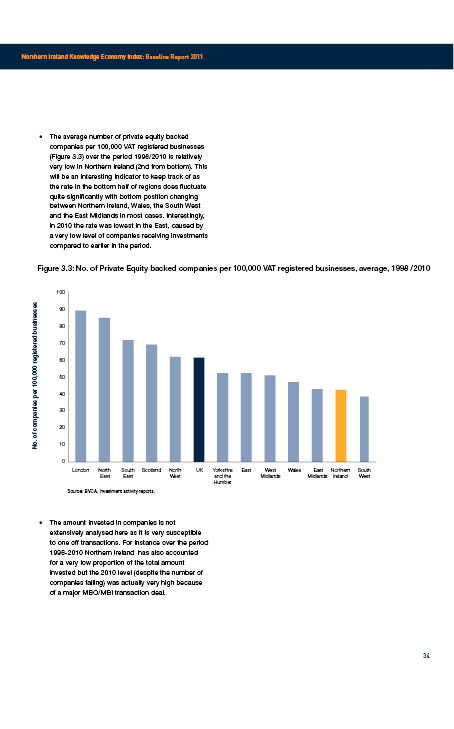

31. Given the importance of venture capital to small, early-stage, high-technology, knowledge-based companies, there seems to be little resolve to deal with the issue as a priority. DETI recognises that venture capital is critical and has informed the Committee that it is committed to growing a flourishing venture capital environment. The Department of Enterprise, Trade & Investment must work with others including the universities, NISP, AFBI and venture capital companies to develop a strategy and plan to increase the level of venture capital available in Northern Ireland (Recommendation13).

32. Some respondents have indicated the need to take advantage, at the earliest stage, of the opportunities available in Horizon 2020. This should involve a process of matching Northern Ireland's research base to the funding priorities of Horizon 2020. Focus should be on the knowledge and experience achieved and business networks created through EU participation. Therefore, preparation for Horizon 2020 should commence immediately, including an assessment of what Northern Ireland can offer, in business and academia, in relation to the funding opportunities available through Horizon 2020 (Recommendation 14).

33. A number of respondents, including Invest NI have suggested that there would be benefits in appointing a Chief Scientific Officer to advise on policy and to lobby on behalf of the Northern Ireland research base and maximise its strengths. There have been calls for a high level science steering committee to lead a science strategy for Northern Ireland. The Executive should explore the benefits of establishing high level structures for science including the appointment of a Northern Ireland Chief Scientific Officer and a science steering committee (Recommendation 15).

Summary of Recommendations

Vision for Innovation and R&D

1. A clear vision for innovation and R&D must be developed and implemented, including policies, strategies, structures, systems and processes which are custom-designed specifically to meet the long-term challenge of maximising the potential for Northern Ireland businesses and academia at all levels to take advantage of the existing and future opportunities for innovation, research and development.

Structures to Support Innovation and R&D

2. A high-level steering group should be established comprising Government, business and academia to advise on policy and oversee the integration and coordination of all R&D activity across all three sectors at all levels.

3. A completely new structure is required in the form of a single unit to integrate and coordinate all innovation and R&D activity. It should have four key responsibilities:

i. Improving Government knowledge and information on innovation and R&D by gathering knowledge and information through, research, networking and collaboration to identify and learn from good practices; and to identify the contribution that can be made at all levels by Government, business and academia.

ii. Developing programmes systems and processes to meet the needs of business and academia by providing programmes of assistance for innovation and R&D; providing support to understand and navigate programmes; and providing support for administering programmes from application to evaluation.

iii. Implementing support for innovation and R&D through promotion of opportunities, educating and mentoring, practical support through projects, awareness programmes for support available and for specific programmes (such as Horizon 2020 and the Small Business Research Initiative).

iv. Developing and supporting a culture of innovation and R&D across Government, business and academia at all levels in Northern Ireland.

Improving Government Knowledge and Information

4. A mechanism should be put in place and resource allocated to undertake the following functions:

i. To identify and learn from good practices in innovation and R&D in other countries and regions.

ii. To engage regularly with other sources of support such as EU institutions, venture capital firms and the Technology Strategy Board to gain a comprehensive understanding of and influence the initiatives and support programmes that are available for R&D.

iii. To gain a comprehensive understanding of the strengths, weaknesses, and potential that exists in Government, business and academia in Northern Ireland to contribute to innovation and R&D.

iv. To use the knowledge and understanding gained to inform the development of appropriate systems and processes, to support and improve the capacity and capability of organisations at all levels to participate in innovation and R&D.

Improving Programmes, Systems and Processes

5. Government, business and academia should work together to review and, where necessary, improve programmes developed within Northern Ireland and influence programmes being developed elsewhere, so as to balance the needs of business and academia with those of the Executive.

6. Government, business and academia should work together to review and improve existing support processes and, where appropriate, develop new practical measures of support for all innovation and R&D programmes.

7. Government, business and academia should work together to review and, where necessary, improve the administrative processes for R&D programmes developed within Northern Ireland so as to balance the needs and capabilities of business and academia with the needs of the Executive.

Implementing Support

8. A long-term strategy and implementation plan should be developed with appropriate resources provided for promotion of opportunities for R&D, educating and mentoring, practical support through projects and awareness programmes for support available for specific schemes.

Developing and Implementing a Culture of Innovation and R&D

9. A clear and consistent message and approach must be continuously promoted by Government, business and academia across Northern Ireland to the effect that innovation, and R&D are key drivers for economic growth and will be supported at all levels.

Additional Short-Term Measures to Improve Uptake of R&D

10. Invest NI should explore ways to open up innovation and R&D mentoring schemes to all businesses which need it. This should include consideration of the contribution that could be made by third parties such as local councils, FE colleges and Local Enterprise Agencies.

11. The target time period for payment of grants, following receipt of an accurate record of expenditure should be reduced immediately to 30 days with consideration given to how this can be reduced further in the future.

12. The Department of Finance & Personnel must take steps to introduce and promote the Small Business Research Initiative across Government departments, agencies and NDPBs.

13. The Department of Enterprise, Trade & Investment must work with others including the universities, NISP, AFBI and venture capital companies to develop a strategy and plan increase the level of venture capital available in Northern Ireland.

14. Preparation for Horizon 2020 should commence immediately, including an assessment of what Northern Ireland can offer, in business and academia, in relation to the funding opportunities available through Horizon 2020.

15. The Executive should explore the benefits of establishing high level structures for science including the appointment of a Northern Ireland Chief Scientific Officer and a science steering committee.

Introduction

Background

16. The Independent Review of Economic Policy (IREP), which reported in September 2009 noted,

"The promotion of innovation and R&D – including business sophistication and, at the regional level, technology transfer – is the most important long term driver of productivity. This is essential for NI to move up the value chain."

17. The report recognised the time-limited availability of Selective Financial Assistance due to changes in EU State Aid rules. It highlighted the need to incentivise innovation and R&D and to produce business-led, commercially relevant results. The report recommended that most assistance, currently delivered through SFA should be redirected to provide greater levels of support to innovation and R&D.[4]

18. Following a briefing from Assembly Research and Information Services in June 2011, the Committee agreed to commission research into Research and Development (R&D) activity in Northern Ireland and the level of R&D in Northern Ireland within a UK/European/global context. Following consideration of Research Reports the Committee agreed that it would be appropriate to conduct an inquiry into the future role innovation, research and development can play in developing the Northern Ireland economy.

19. In agreeing the Terms of Reference for the Inquiry, the Committee agreed to include provision for the use of a Rapporteur to lead the collection and analysis of evidence and to oversee the drafting of the Inquiry report. The Rapporteur role included taking evidence at informal meetings with key stakeholders. This approach enabled the Committee to widen the range of stakeholders from whom evidence was taken without increasing the duration of the Inquiry.

20. "Europe's average growth rate has been structurally lower than that of our main economic partners, largely due to a productivity gap that has widened over the last decade. Much of this is due to differences in business structures combined with lower levels of investment in R&D and innovation, insufficient use of information and communications technologies, reluctance in some parts of our societies to embrace innovation, barriers to market access and a less dynamic business environment".[5]

Terms of Reference

21. The Committee critically examined the mechanisms in place in government for providing assistance to micro businesses, small and medium sized enterprises, large businesses and academia to avail of opportunities for innovation, research and development at international, EU, UK, cross-border, Northern Ireland and local government levels. The Inquiry identified barriers faced by organisations here in availing of opportunities for support for innovation, research & development and makes recommendations on how policies, procedures and practices can be improved in order to maximise opportunities to support innovation, research and development for the benefit of the Northern Ireland economy.

22. Specifically, the Committee:

- Examined the current policies, programmes and opportunities available to support innovation, research and development at international, EU, UK, cross-border, Northern Ireland and local government levels;

- Examined the current policies, procedures and practices being deployed to assist organisations to avail of those opportunities;

- Compared the assistance provided in Northern Ireland with that provided at regional level in England, in the other devolved administrations, in the Republic of Ireland and in other EU member states;

- Assessed the appropriateness of current policies, procedures and practices in assisting organisations to avail of opportunities for innovation, research and development; and

- Identified actions to be taken by the UK Government, Northern Ireland Executive, DETI, other NI departments, IntertradeIreland, universities, businesses and business support organisations and local councils.

Approach to the Inquiry

23. The Committee made a specific call for evidence from identified key stakeholders and a general call for evidence through the Assembly website. On the basis of written evidence submitted, the Committee decided which organisations and individuals to invite to provide oral evidence to the Committee.

24. The Committee undertook visits, as appropriate, to gain a practical understanding of the issues involved and the problems faced by key stakeholders.

25. The Assembly Research and Library Services undertook research into the following areas to inform the Committee:

- Research & Development strategy, expenditure and constraints in Northern Ireland;

- Assistance provided to support organisations to avail of research and development opportunities at regional level in England, in the other devolved administrations, in the Republic of Ireland and in other selected EU member states;

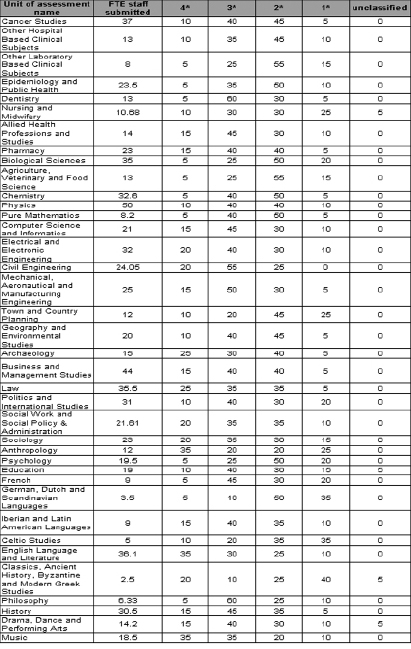

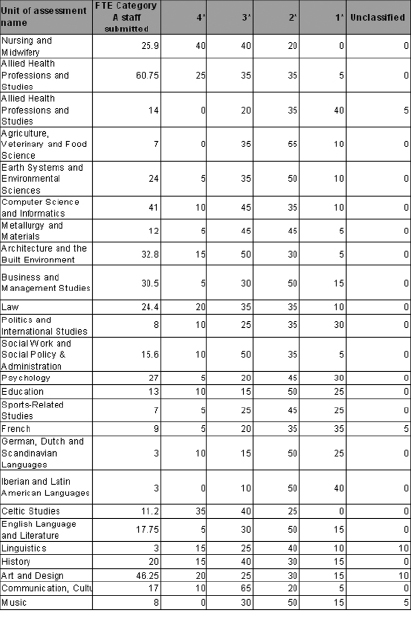

- Identification of the best performing universities in the UK and RoI for Research and development.

- Identification of international best practice in research and development.

- Identification of both regional and sector-specific initiatives in the UK.

26. The Committee used the services of a Rapporteur in conducting the inquiry. However the Committee harnessed the knowledge and experience of all its members in collecting, and analysing the evidence for the inquiry and in determining conclusions and recommendations.

27. Those providing written evidence to the Committee were asked to respond by 16th December 2011. Oral evidence was taken between 9th February 2012 and 29th March 2012.

Key Issues and Findings

Current Policies, Programmes and Opportunities for R&D

Local Government

28. Local authorities have implemented a number of schemes under the various European Structural Funds aimed at providing early stage R&D support to micro-businesses.[6] This type of support is principally aimed at encouraging businesses to engage in R&D for the first time and provides direct mentoring support for the participant businesses.[7]

29. According to the Northern Ireland Local Government Association (NILGA) councils are involved in the process by signposting local businesses to opportunities which they otherwise would not be aware of. Their experience of dealing on a one-to-one basis with their local business community allows them to identify opportunities which can be harnessed and developed through appropriate programmes and contacts which can be essential to the development of innovative concepts and turn them into exploitable products.[8]

30. Lisburn City Council's Innovation Networks Programme aims to place innovation and research at the core of local business development activity and to develop strategic innovation partnerships between businesses located in the Lisburn City Council area and third level education and research centres. Local companies will be encouraged to increase levels of R&D by identifying and developing appropriate new technologies, new processes, new systems and new products that will add value, and improve overall business competitiveness and profitability. In the 2009-2010, the Innovation Networks Programme assisted sixteen local companies to grow their business through increased levels of investment in R&D. The project also enabled businesses to have access to the world class research and new technologies developed by the University of Ulster staff which will provide opportunities to launch new commercially viable products and enter new markets. In the past year, the programme has resulted in one business achieving an Energy & Environment Innovation Award at the 2010 Sustainable Ireland Awards. In addition, another business reported an expected turnover of £60k generated directly from the project over the next five years. Moreover, cumulative collaborative R&D funding secured over next 5 years is anticipated to be £317k.[9]

31. Castlereagh Borough Council offers an Economic Development Services Function to local businesses. For local businesses this offers:

- Grants advice and support; Business development programmes and mentoring;

- Links to partner programmes offering support and development; and

- Tourism development and collaborative support and marketing projects.

32. In September 2011, Castlereagh Borough Council launched the 'Evolution Project'. The project maximises the support available through www.nibusinessinfo.co.uk by the facilitation of an audit benchmarking process. It also puts in place an itinerary of support built around the specific needs of business participants/applicants. All stakeholders have signed up to a memorandum of understanding with a lead consultant managing a pool of 'specialist associates on behalf of the Council.

33. Belfast City Council's Stepping Stone program is principally aimed at encouraging businesses to engage in R&D for the first time and provides direct mentoring support for the participant businesses The Stepping Stone to Success Program helps companies, in particular micro-businesses working in technologically isolated environments, to bridge the technology competency gap and facilitate innovation. It provides face-to-face contact with experienced professionals who can advise on routes to innovative solutions which are specifically tailored to the needs of the individual company. Immediate advice is available on industry best practice, equipment specification, process improvement and on general technical problem solving. The program identifies areas which are blocking growth or disadvantaging companies relative to their competitors.[10]

34. Craigavon Borough Council's 'You Can Develop It' programme works to encourage and support Craigavon companies to implement significant improvements that will help accelerate their growth; and develop their capacity in an increasingly competitive marketplace. Companies are guided on how to think strategically and behave innovatively to take their product/service forward. This will mean the concurrent development of new products and the development of management resulting in the accelerated growth.[11] The programme provides mentoring and coaching to assist companies in innovation strategy, assist local companies in the research and development lifecycle and encourages local business to develop their capacity.

35. Newry and Mourne District Council has an active role in economic development. Its Economic Development Unit is involved in sourcing all aspects of funding and this includes, EU (INTERREG, Rural Development). Furthermore, the Council is actively on board with all relevant Government Departments. Newry and Mourne District Council has dedicated officials to advise, signpost, apply for funding and implement projects.

36. These projects have been framed with the aim of establishing sustainable relationships between the local research communities within universities and colleges and business base.

Northern Ireland

37. Up until 2011, Northern Ireland's key R&D strategy document wass the Regional Innovation Strategic Action Plan 2008-2011. The plan sought to meet Public Service Agreement 1 – 'promote higher-value added activity through innovation and the commercial exploitation of R&D'.[12] Delivery on this agreement was measured through average annual growth in business expenditure on R&D (BERD). There were two central targets related to this:

- Increase SME annual growth in BERD by 8%; and

- Increase larger company growth in BERD by 5%.[13]

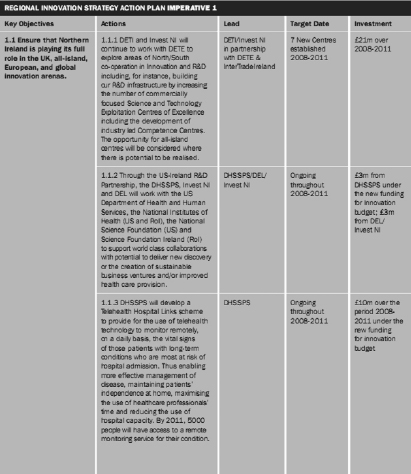

38. The Action Plan's strategic objectives are at Table 1 in Assembly Research paper NIAR 281-11 at Appendix 5. The range of objectives presented combines a multi-sectorial approach covering the private, public, and education sectors, with a multi-level outlook that is regional, national and international.[14] The financial contribution committed in the Action Plan is £360m over a three-year period; this includes £170m from Invest Northern Ireland and £90m from the innovation fund.

39. Invest NI's corporate plan (2008-2011) set targets similar to those outlined by the Department above. The plan made a commitment to:

- Secure Research & Development investment commitments of £120m;

- Assist 300 companies to engage in Research & Development for the first time;

- Increase the commercialisation of intellectual property from Northern Ireland's university and company research base; and

- Support MATRIX (the NI Science and Industry Panel), which will advise DETI on policies to better target resources to technology areas of greatest future potential and exploit core niche strengths in the R&D and science base.[15]

40. The Committee considered the final progress report on the RISAP at its meeting on 1st December and wrote to the Minister welcoming the achievement of the Plan's objectives. The Committee is currently awaiting the successor to the RISAP, the Action Plan for R&D, Innovation and Creativity. The Committee suggested to the Minister that, when this plan is developed, it would be appropriate to include objectives which demonstrate clear outcomes and benefits including objectives, with annual targets, directly related to increasing the number of companies, the number of locally owned companies and the number of SMEs investing in R&D as well as objectives for increasing the overall spend on R&D in Northern Ireland.

41. MATRIX is a Northern Ireland business led expert panel which advises government on the commercialisation of R&D and science and technology. MATRIX provides advice across areas such as key R&D and science and technology affecting business innovation and emerging strategic technology issues affecting the Northern Ireland economy. MATRIX also plays a role in promoting a culture of innovation and raising the profile of R&D and science and technology, with particular regard to commercial activities. The panel's key objectives range from increasing the economic return from science and technology to promoting the importance of R&D and science and technology in Northern Ireland.

42. The Programme for Government (PFG) introduced three targets, which impacts on Northern Ireland's R&D landscape. The first is to 'support £300m investment by businesses in R&D, with at least 20% coming from Small and Medium sized Enterprises'. Should the 20% target for small and medium enterprises be reached this would equate to £60m in R&D investment from companies of this size over the three year life span of the PFG.[16]

43. A second business focused target is to 'support 200 projects through the Creative Industries Innovation Fund'. This target is to be brought forward by the Department of Culture, Arts and Leisure. Whilst not exclusively linked to business R&D, the Creative Industries Innovation Fund (CIIF) has assisted in the development of innovation within business in Northern Ireland.[17]

44. The final target focuses on the higher education sector and sets a target of increasing places in courses of economic relevance in the subjects of Science, Technology, Engineering and Mathematics. The increase equates to 1180 additional places staggered over a period of three years.[18] The additional places will be spread across Northern Ireland's universities and further education institutes.

45. R&D is seen as key to rebalancing and rebuilding the Northern Ireland economy, The Department of Enterprise, Trade and Investment's Economic Strategy details how this can be achieved. The Economic Strategy identifies the challenges to R&D and innovation in Northern Ireland such as the need for diversification in target areas and the need to provide greater emphasis on the support of high technology manufacturing industries. The Strategy indicates that R&D and innovation are cross-departmental and presents strategies that reflect this. It also highlights the cross-departmental key actions for further development and contains medium to long-term goals for R&D including:

- The evolution of the NI Science Park into an Open Innovation Centre;

- Ensuring there is an alignment of publically funded research with economic goals to increase potential for knowledge transfer between business and academia;

- Exploration into the commercialisation of publicly funded research and public sector Intellectual Property;

- Nurturing innovation through public procurement; identification of areas of collaboration between the health sector and business; and

- Examining the establishment of an Innovation Council.[19]

46. There is a range of resources available to Northern Ireland businesses wishing to participate in R&D. These include NI specific resources such as Invest NI grants. A summary of funding available for R&D and innovation in Northern Ireland is detailed in Assembly Research Paper NIAR 921-11 at Appendix 5.

Cross-Border

47. InterTradeIreland works on a cross-border basis supporting SMEs in North/South trade and business development. The organisation has a particular focus on R&D and Innovation through the Innova programme, which offers businesses an opportunity to participate in cross-border R&D partnerships. Additionally, FUSION is an all-island technology transfer programme that offers support packages worth up to £29,500 to undertake a 12 month innovation project. It also offers businesses general advice on R&D and innovation whilst offering assistance with some EU funding programmes such as Framework Programme 7. InterTradeIreland has established an All-Island Innovation Programme which plays an important role in the organisation of innovation lectures and workshops. More detail on the support offered by InterTradeIreland is included in the organisation's written submission to the Inquiry at Appendix 4.

48. Although there are no structures in place at regional level to support cross border cooperation on innovation and R&D at a local level an example was provided to the Committee of a cross border partnership between two local councils. A European economic development office has been established in Newry to work with an existing office in Dundalk. A Memorandum of Understanding (MoU) has been agreed between Newry & Mourne District Council and Louth Local Authorities in order to support and promote the economic development and competitiveness of the region.[20] The MoU should provide opportunities for cross border cooperation on innovation and R&D.

United Kingdom

49. R&D and Innovation policy for the UK Government was outlined in the Blueprint for Technology, published in November 2010. The strategy aims at making the UK Government the 'most technology friendly in the world' and seeks to drive economic productivity through 'high-growth, high-tech innovative businesses'.[21] The strategy seeks to remove barriers to and incentivise Innovation and R&D by establishing the right framework for enterprise and investment; maintaining competitive advantage through industries which already possess and have potential to maintain competitive advantage; and reducing the gap between innovation and commerciality.[22] The Strategy outlines measures to ensure delivery of these objectives:

- A consultation on the taxation of intellectual property, R&D Tax Credits, the potential for creating a Patent Box and the Dyson Review recommendations;

- Maintaining the science budget in cash terms of the Spending Review period with resource spending of £4. 6 billion a year;

- A series of regulation simplifications;

- a 'one-in-one-out' rule whereby no regulation is brought in without another regulation being cut by at least the same amount;

- ending the culture of 'tick-box' regulation;

- 'sunset clauses' for regulations and regulators to ensure that the need for each is regularly reviewed;

- Afford the public 'the opportunity to challenge the worst regulations'; and

- Bringing 'new discipline to the implementation of EU rules, so that British businesses are not disadvantaged relative to their European competitors and ensure gold-plating is stopped'.

- The provision, over four years, of £200m to fund the establishment of ' an elite network of Technology and Innovation Centres';

- Creating 'the most competitive environment in the developed world for venture capital and early-stage investment';

- The establishment of the UK Innovation Fund, which comprises of £150m government and £175m of private investment; and

- Introduce a Small Business Research Initiative (SBRI) to provide R&D procurement contracts to businesses to develop new and innovative products and services.[23]

50. Equity gaps in R&D can be addressed using Enterprise Capital Funds (ECF). They are temporary funds, subject to specific deadlines and take the form of public and private money. The ECF has no specific regional or sectorial targets, nor, is it specifically a research and development/ innovation focussed project. Rather it is targeted at encouraging enterprise and productivity growth. The government will contribute up to £25m to a specific fund, or twice the private capital, whichever is lower.[24] Investments from Enterprise Capital Funds must be in UK based SMEs or to fund the UK operations of SMEs.

51. Research and Development Tax Credits is a scheme administered by HMRC which permits businesses to claim corporation tax relief on expenditure on R&D that has been undertaken by the business. Under the SME Scheme (businesses with fewer than 500 employees) 200% corporation tax relief is allowed for. Under the Large Company Scheme, businesses can claim 130% corporation tax relief on qualifying R&D costs.[25]

European Union

52. Programmes and policies at regional, national and European level operate under an umbrella concept called The European Research Area (ERA). The ERA involves all R&D activities in Europe which involve a transnational perspective.[26] The ERA seeks to create a European wide market for research that meets the needs of industry, the scientific community and citizens, and which is characterised by a flow of highly mobile competent researchers. The ERA seeks a research infrastructure that is fully integrated and accessible to research teams from Europe; Research institutions engaging in public-private cooperation and partnerships forming research clusters and networks for knowledge transfer; research programmes and priorities, that emphasise jointly-programmed public research investment; and a research area that is open to the world.[27]

53. Framework Programme 7 (FP7) is the principal delivery mechanism of research policy and funding at a European level. FP7 has a lifespan of seven years between its implementation in 2007 and its completion in 2013. The budget for the programme over its seven year cycle is €50.5bn with an additional €2.7bn made available for its first five years through the Euratom programme.[28] Activities funded through FP7 must have a 'European Added Value'. To meet this objective projects often have a transnational element, incorporating consortia of participants from different member and non-member states.[29]

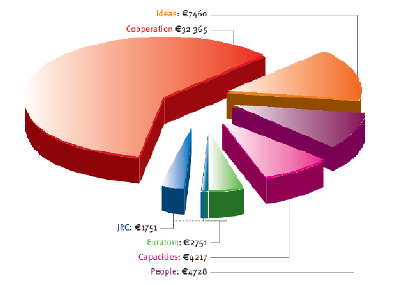

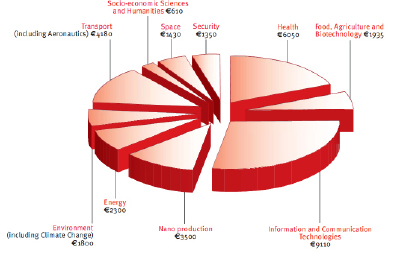

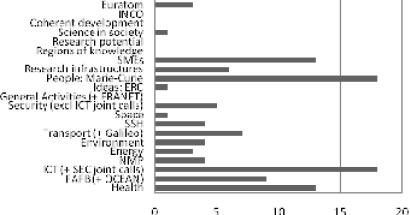

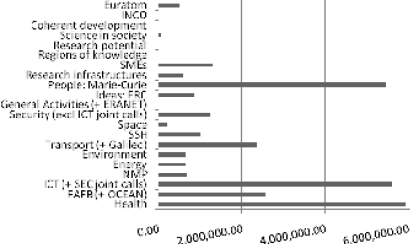

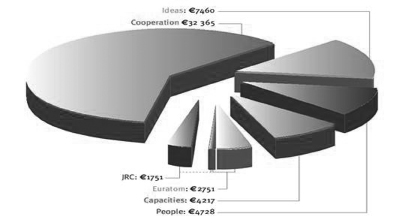

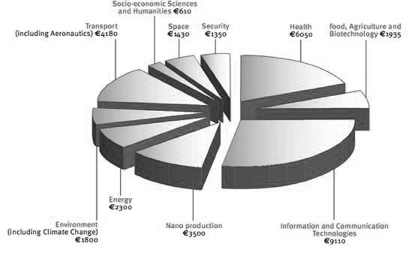

54. FP7 is made up of five programmes: The Cooperation Programme; The Ideas Programme; The People Programme; The Capacities Programme; and The Eurotom Programme. Of these, the greatest proportion of funding is earmarked for the Cooperation Programme - €32,365m. This programme focuses on research into areas such as Health, Energy and Environment.[30]

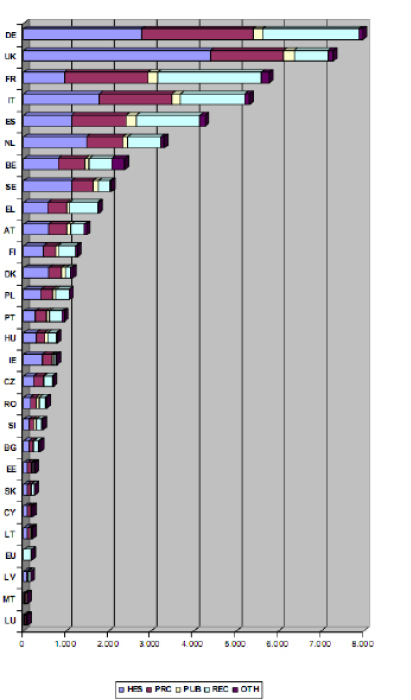

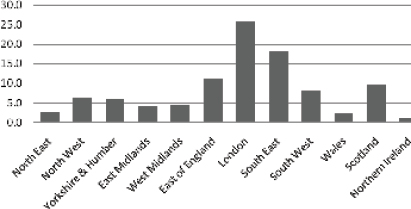

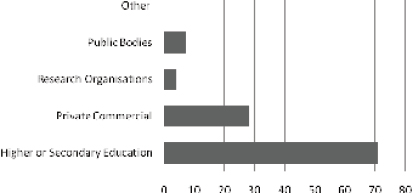

55. As of 1 April 2011, Northern Ireland organisations have participated in 110 projects, with a requested financial contribution of €30m. Northern Ireland Participation in FP7 has been highest in the Higher Education sector which makes up 65% of total participation.[31]

56. A detailed analysis of Framework Programme 7 can be found in Assembly Research paper NIAR 636-11 at Appendix 5.

57. Horizon 2020 will be the successor to FP7 running from 2014 to 2020. It will bring together all existing EU research and innovation funding currently provided through FP7, the Competitiveness and Innovation Framework Programme (CIP) and the European Institute of Innovation and Technology (EIT). The different types of funding provided by the existing programmes will be brought together into a single coherent, flexible framework. It will provide funding for every stage of the innovation process from basic research to market uptake, in line with the EU's commitments under the "Innovation Union".[32] Horizon 2020 will have three strategic objectives:

- Strengthening the EU's position as a world leader in science;

- Ensuring Europe is an attractive location to invest in research and innovation; and

- Tackling the major societal issues affecting the lives of European citizens.

International

58. The US Ireland R&D Partnership is highlighted in the written submission from InterTradeIreland at Appendix 4. It is considered a unique alliance between the three jurisdictions to address common research challenges in nanotechnology, sensor technology, telecommunications, energy & sustainability and a range of health areas. In oral evidence, InterTradeIreland representatives stated that although the process has been slow to get established, it is now at the stage that participants in the programme are branded as being world-class in whatever area they are working.[33]

Summary of Assistance Provided for R&D in Other Regions

England

59. In England local areas are offered the opportunity to take control of their future economic development. Local Enterprise Partnerships are locally-owned partnerships between local authorities and businesses and play a central role in determining local economic priorities and undertaking activities to drive economic growth and the creation of local jobs. They are also a key vehicle in delivering Government objectives for economic growth and decentralization, whilst also providing a means for local authorities to work together with business in order to quicken the economic recovery. As Local Enterprise Partnerships are based on more meaningful economic areas, they will be better placed to determine the needs of the local economy along with a greater ability to identify barriers to local economic growth[34] The UK Government's coalition programme supports the creation of Local Enterprise Partnerships as replacement of the Regional Development Agencies (RDAs).

60. There have been 39 partnerships announced thus far. Priorities relating to innovation and R&D include:

- Greater Manchester Local Enterprise Partnership: Capitalizing on the area's world class research, science and innovation capability;

- Cumbria Local Enterprise Partnership: Driving enterprise, innovation and growth in the Cumbrian economy, delivering real long-term growth in the most efficient and effective ways possible through both our rural and urban based businesses; and

- North Eastern Local Enterprise Partnership: Promoting productivity, enterprise and business growth through developing innovation and exploiting research and development capabilities.[35]

61. A Local Enterprise Partnership Network has been established to enable Local Enterprise Partnerships to come together to discuss shared issues, engage with Government and share knowledge and best practice. It is also intended to be a gateway to news and information of importance to Local Enterprise Partnerships.

Scotland

62. The Scottish Economic Strategy places R&D and innovation amongst a number of broader strategic objectives. It seeks to:

- Support the development of innovation and its commercialisation;

- Invest in universities and the creative industries, and tailor Scottish life sciences to assist in the development of key sectors – creative industries; energy (including renewables); financial and business services; food and drink (including agriculture, and fisheries); life sciences; sustainable tourism; and universities;

- Develop a skills base that is responsive to the needs of business; and

- Support innovative low carbon technology to assist transition to a low-carbon economy.

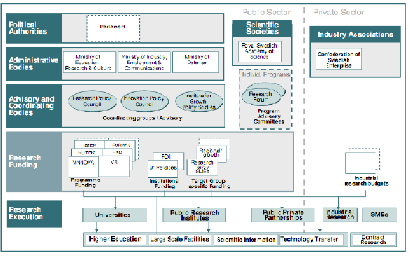

63. R&D and innovation policy is driven by a number of agencies. The first is the Scottish Science Advisory council (SSAC). The SSAC advises the Scottish Government's Chief Scientific Officer on specific issue and science related policy with a view to promoting economic growth and ensures that it has a diverse membership across a range of stakeholders. Scottish Enterprise (SE) is a development agency that facilitates R&D and innovation policy. SE offers a range of grants and supports including SMART Scotland, R&D Grants, Seven Framework Programme, R&D Tax Credits and access to the Winning through Innovation Programme. The Highlands and Islands Enterprise (HIE) is a development agency that focuses specifically on these regions in Scotland. The HIE offers finance and support through funding schemes, Small Business Research Initiatives and grants aimed at supporting collaboration between businesses and academia. The Scottish Funding Council (SFC) is the final agency. The SFC is the main funding body for Scottish universities and colleges. Funding from the SFC supports strategic initiatives in universities including research activities and general funding for teaching activities.[36]

Wales

64. The 2011 policy document 'Economic Renewal: A new direction' outlines the Welsh Government's current policy on R&D and Innovation. Welsh policy includes a range of measures intended to encourage innovation and R&D. It contains commitments to:

- Address under-used business incubation capacity; and

- Adopt a more focused approach, talking barriers to investment in R&D and innovation.

65. Funding for R&D in Wales supports industrial research, experimental development, and exploitation. This funding is labelled as repayable finance, it is however, not repayable. Funding is also available at a local level through the Local Investment Fund, tailored toward SMEs. Private investment is facilitated through Finance Wales. Early stage finance is focussed upon technology businesses. Funding for the Higher Education Sector is delivered by The Higher Education Funding Council for Wales. Funding is broken down into teaching, research and postgraduate research.[37]

Republic of Ireland

66. There are a number of actors involved in the delivery of R&D and innovation policy in RoI. The Department of Jobs, Trade and Innovation published the key strategy document, Science for Technology and Innovation (2006), containing measures they seek to promote:

- Academic research;

- Graduate schools;

- Commercialisation;

- Industrial research;

- Public sector research;

- Public awareness; and

- Cross-border and international cooperation.

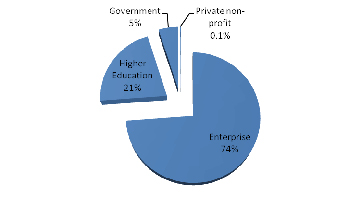

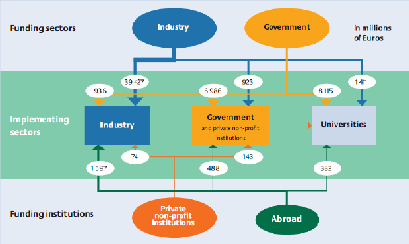

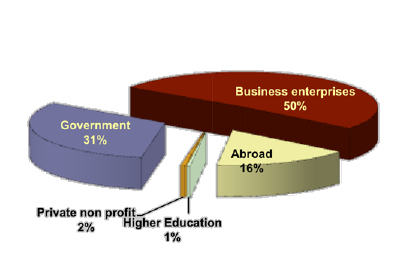

67. In the RoI 50% of R&D funding is drawn from business enterprises, with the government providing 31% of funding. The largest share of Government funding is allocated to the higher education sector through the Higher Education Authority. Funding and support for R&D and innovation in business is offered through Enterprise Ireland. This includes:

- R&D Stimulation Grant;

- R&D Fund: Small Projects;

- R&D Fund: Large Projects;

- Innovative High Potential Start Up support;

- Funding for collaborate on Research and Development Projects with Colleges and/or Companies;

- Innovation Vouchers;

- R&D Advocates Scheme;

- Innovation Partnership Programme;

- Applied Research Enhancement;

- Technology Centres; and

- Support accessing FP7 funding and other EU streams.[38]

68. IDA Ireland and InterTradeIreland both offer support and funding opportunities through grant aid. However, InterTradeIreland offer programmes such as the FUSION programme - offering companies the opportunity to employ graduates – and The Innova programme which offers business grants for carrying out an innovation programme in partnership with a company from Northern Ireland.

69. Enterprise Ireland is the government organisation responsible for the development and growth of Irish enterprises in world markets. They provide supports for both companies and researchers in Higher Education Institutes to develop new technologies and processes that will lead to job creation and increased exports. Services provided by Enterprise Ireland include:

- Incentives to stimulate in-company R&D – new product, service and process development to ensure sustainability, and growth through the evolution of products and services.

- Assistance with R&D collaboration - with research institutions, to develop and bring to market new technologies, products or processes.

70. Companies in RoI can also claim for 25% R&D tax credit.

Finland

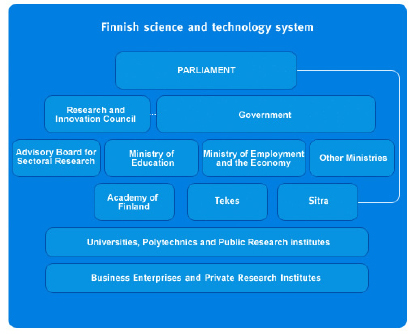

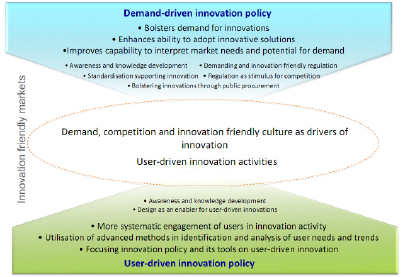

71. The Ministry of Employment and the Economy and Ministry of Education and Science are responsible for the Finnish innovation system at departmental level. VEKKES is the main funding agency proving grants of €600m annually. Finland performs well across a number of indicators: The region's human resource performance is strong; the region is marked by high business investments; and Finnish SME cooperation in innovation has been growing at a faster rate than the EU average. The National Innovation Strategy (2008) outlines the current research and innovation policy. It is based on ten principles:

- reinforcing the competence base;

- broad-based innovation activity;

- internationalisation of the innovation environment and operating in a world without borders;

- strong and networked innovation centres;

- internationally competitive system of training and higher education;

- developing the Finnish environment to support growth businesses;

- strengthening demand and user orientation;

- central government's corporate steering and a systemic approach;

- resources for innovation activity; and

- International review of the innovation system.[39]

Sweden

72. The Ministry of Enterprise, Energy and Communications and the Ministry of Education are both responsible for innovation and research policy. The Swedish Research Council and the Agency for Innovation Systems (VINNOVA) are the agencies responsible for delivery of innovation and research policy. VINNOVA has a range of responsibilities in the delivery of innovation policy:

- Investing in research and innovation;

- Improving the innovation capacity of SMEs – which includes coaching and facilitating their promotion in international partnerships;

- Promoting global links – through bilateral linkages and through participating in EU R&D programmes;

- Policy development; and

- Utilising the Country's innovation infrastructure – which includes a strong research and innovation environment, testing and demonstration sites, incubation facilities, and the relationship that exist amongst the 'triple helix'.[40]

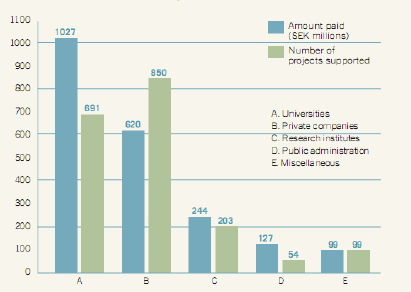

73. The country's research and innovation system has a number of strengths:

- High-levels of investment in R&D – in 2009 total Swedish R&D investment amounted to 112bn Swedish Krone (SEK);

- A concentration of large global corporations with a culture of R&D investment;

- An internationally linked economy (although with some distance to market);

- An export orientated market that is fuelled by innovation; and

- A long tradition of cooperation within a 'triple helix' – Academia, Government and Industry.[41]

74. Sweden's research and innovation focus is on health, biotechnology and transport with a focus on promoting excellence in Universities and linking academia to business.

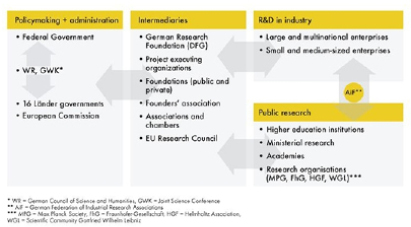

Germany

75. In Germany, the federal government and the 16 L?nder each has roles and responsibilities in the delivery of innovation policy. At federal level, the Federal Ministry of Education and Research and the Federal Ministry of Economics and Technology are responsible for research and innovation. There are more than 20 organisations - across Germany's governance system - responsible for the delivery of policy formulated at federal or state level. Current policy is a response to specific research and innovation challenges:

- Funding innovation - German policy is to offer a range of financial support mechanism to SMEs including venture capital (the High-tech start-up fund), loan programmes and grants. In 2008 the Central Innovation Programme for SMEs (ZIM) was launched. In 2009 and 2010 ZIM had an annual budget of €300m, rising to €500m from 2011.

- Keeping pace with global technology trends – federal government launched a series of 17 'Thematic R&D Programmes', which target policy and funding at specific technological areas.

- Adapting Germany's education system to meet the needs of rapidly evolving requirements of technology and innovation – the Federal Government has have reformed vocational training courses, introducing new, 'modern' courses and improving the supply of further education, including additional financial incentives for employees.

- Continuing the strong tradition of industry-science link ups – A number of policies have been adopted to ensure this tradition continues. The region has also introduced the Research Bonus to strengthen the ability of universities and public research institutions to co-operate with SMEs.[42]

76. Case studies on regional innovation systems – including Baden-Württemberg, Germany - can be found in Assembly Research paper NIAR 850-11 are included at Appendix five.

Academia Involvement with Business in R&D

Further Education Colleges

77. Further Education Colleges engage with business through a range of projects and initiatives. The aim of these is to increase collaboration with business in a knowledge sharing capacity.

78. The Belfast Metropolitan College (BMC) has used the Knowledge Transfer Partnership (KTP) as a vehicle for research engagement between the College and local businesses. The experience gained from the KTP has led to an exploration of Framework Program 7 initiatives. BMC contend that the establishment of networks for sharing information and developing ideas is crucial to supporting R&D. BMC's own knowledge network - Club Met - facilitates business to business engagement and access to a range of resources at the college which provide research and development support.

79. The Northern Regional College (NRC) has outlined an Economic Engagement Strategy. The strategy aims to develop relationships between the college and organisations through value added services. The college's engagement with business is classified into three categories: Strategic Partners; Stakeholders; and Consumers.

80. The South West College (SWC) has provided an on-the-ground practical R&D support presence through its InnoTech Centre. The Centre is assisting business to become more competitive through research and development. An example of the SWC's involvement with business is illustrated in the Kilkeel Development Association, where nine SMEs have partnered to research a sustainable vision, incorporating renewable technologies and sustainable development.

Queen's University Belfast

81. In the written evidence submission, QUB indicated that there are a variety of funding schemes that currently exist to incentivise collaboration between business and academia. QUB have been successful in many of these schemes including the Knowledge Transfer Partnership, which has been beneficial to university collaboration with business.

82. A major factor in QUB's success is QUBIS Ltd which, over the past 25 years, has created more than 50 high technology companies and over 1,000 jobs, and is continuing to make a very significant contribution to the local economy generating an expected turnover of £104m in 2010.[43]

83. In exchange for an entrepreneur's time and initial investment QUBIS Ltd will provide an investment, the use of university facilities and university intellectual property.

84. QUB contends that having a level of expertise closer to academics and businesses linked into academia makes a huge difference.

"It has allowed us, since November 2011, to put forward 11 funding applications to a value of up to £30 million.'"[44]

85. QUB considers it important to engage with business much earlier in the research process and insists collaboration is about;

"understanding what the problems of industry and companies are and ensuring that our research pieces are tuned to those needs and that we work in partnership"[45]

University of Ulster

86. In the oral briefing from the University of Ulster (UU), representatives reported that they have witnessed a higher degree of engagement from business into university research and a higher outflow of research into the economy.[46]

87. Furthermore, UU noted that there is a much higher degree of engagement from academics in business activities. They indicated:

"We reckon that, in 2011, around 37% our academics are working with companies today'[47]

88. As a result of this engagement, academics are seeing the institutional benefits from engaging with industry, both to their teaching and research activities.

89. UU indicate that the criteria have changed in the Research Assessment Exercise (RAE) and Research Excellence Framework to place a higher emphasis on impact. UU explained what the changes meant:

'That is the translation of research outputs into the economy, including providing competitiveness for industry; policy inputs and impacts; and societal inputs and impacts.'[48]

90. The success of UU in collaborating with business is a result of their work with spin-off companies. Innovation Ulster Ltd is a legally constituted vehicle through which the University of Ulster engages commercially with the business community and investors.[49] Profits and surpluses from commercial activity are brought back into the University for distribution to the academic community and associated faculties and schools.

91. Innovation Ulster Ltd is evidence of UU's commitment to play a key role in Northern Ireland's economic and social development.

92. The primary role of the Innovation Services Team within the Office of Innovation is to translate the University's knowledge and technology (Intellectual Property) into marketable products and services in the most effective and timely manner possible. This is achieved primarily through the following mechanisms:

- Spinouts / New Business Ventures

- Technology Licences

- Consultancy

- Collaborative Development Projects[50]

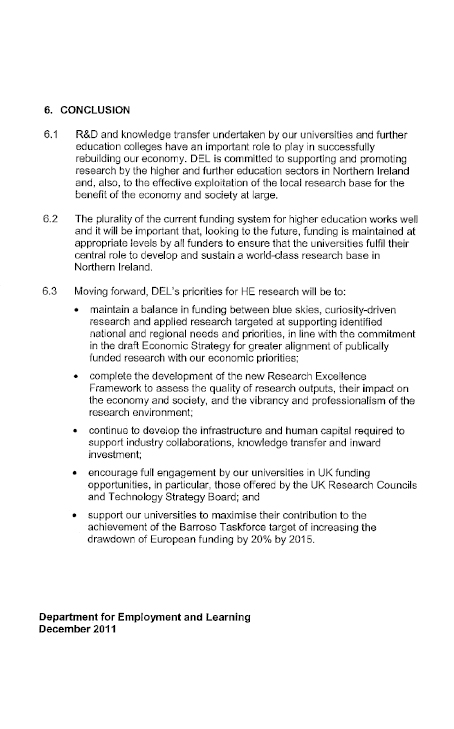

Universities in the Republic of Ireland