Response to the Consultation on the Revision of the Industrial Development Act 1982

Committee Membership

Mr Alban Maginness (Chairperson)

Mr Daithí McKay (Deputy Chairperson)

Mr Steven Agnew

Mr Gordon Dunne

Mr Phil Flanagan

Mr Paul Frew

Dr Alasdair McDonnell

Mr Stephen Moutray

Mr Mike Nesbitt

Mr Robin Newton

Ms Sue Ramsey

The key proposal in the Consultation Document relating to the work of the Committee for Enterprise, Trade & Investment is Proposal 8.1, Assisted Area Map. This consultation response deals only with issues relating to that proposal.

Question: Should Northern Ireland’s automatic inclusion as an assisted area in the UK be removed?

- Before dealing with the main issue of assisted Area status, it is important that the Committee registers its concerns with the consultation process and the lack of information provided to potential respondents.

- The consultation document is quite short. It provides no information for respondents on what has changed since 2007 when the current Assisted Area Map was drawn up. It does not include figures for GDP per capita for Northern Ireland currently or in 2007 or any comparison with a UK wide figure or a breakdown of UK regions to act as a comparison. The information on which respondents are expected to reach a conclusion is very limited. The available information is also out of date. The most recent figures go up to 2008 and in some cases 2009. More up to date figures will not be available until February 2012. It is therefore difficult to make any accurate assessment of the current situation on the basis of out of date figures. Indications are that the Northern Ireland economy has deteriorated significantly since 2008 but in the absence of up to date figures for Gross Domestic Product, Gross Value Added or Gross Domestic Household Income, important decisions such as this, which will impact on the economic future of Northern Ireland, should not be taken.

- The Impact Assessment presents options however, in relation to Assisted Area status, it provides only the proposed option and a ‘do nothing’ option. No other options have been considered.

- The Impact assessment states that, for the main affected groups, “No monetised costs are associated with revising the IDA.” This suggests that the main affected group is considered the UK rather than Northern Ireland. No attempt has been made to assess or outline the impact on Northern Ireland of the proposal.

- Under ‘Key assumptions/sensitivities/risks’, the Impact Assessment states that the revision provides the option to reduce the level of coverage in Northern Ireland, but states that the future level of coverage here cannot yet be assessed as it depends on the revision of Regional Aid Guidelines. Respondents are being asked to make a response with no clear indication of what the impact of removal of Assisted Area status would be.

- The Consultation Document states that, following implementation of the revised Assisted Areas Map, all areas of Northern Ireland would still be eligible for other forms of aid such as Research & Development and training aid. Northern Ireland is however currently eligible for these forms of aid on the same basis as other regions therefore implementation of the proposed revised map would not change this. The statement is misleading as it may suggest that Northern Ireland is getting something in return for the removal of automatic Assisted Area status.

- The final point in the consultation document in relation to Assisted Area status states that an Equality Impact Assessment (EIA) will be conducted on the implications of the proposals for Northern Ireland when the new Regional Aid Guidelines are implemented to draw up the post 2013 Assisted Area Map. This may suggest that the legislation will be put in place prior to the EIA being undertaken. This would mean that the implications of the proposals for Northern Ireland will only be known after the changes are made. The Committee does not consider this approach to be acceptable.

- Moving to the main issue of whether Northern Ireland’s automatic Assisted Area status should be removed, the Committee is in unanimous agreement that this is a highly inappropriate way forward for the Northern Ireland economy at the present time.

- The proposals in the Consultation Document are completely at odds with Treasury views on rebalancing the Northern Ireland Economy. The Treasury consultation recognised the challenges faced by Northern Ireland both now and in the future. It highlighted the low levels of productivity here coupled with high rates of economic inactivity. It highlighted that Northern Ireland is over-represented, compared to the UK average, in low productivity sectors and stated that low productivity is due to under-representation of high productivity sectors in Northern Ireland, including finance and business services. Any move to remove automatic Assisted Area status can only result in significantly harming efforts to attract business from high productivity sectors to Northern Ireland.

- In 2010, within Northern Ireland, aid for Regional Development accounted for 60% of the total State Aid assistance. In its consultation on rebalancing the Northern Ireland economy, the Treasury recognised that Northern Ireland has particularly low levels of business expenditure on R&D even when compared to other small economies in Europe, several of which are in more peripheral locations than Northern Ireland.

- The Treasury consultation went on to state that Northern Ireland’s rate of attraction of Foreign Direct Investment (FDI) has been less than one third of that in the Republic of Ireland. FDI in the Republic of Ireland also tends to be of a higher quality. The Treasury states that “A priority for Northern Ireland is to expand these levels of foreign investment in high wage sectors.” The Republic of Ireland is Northern Ireland’s closest neighbour and greatest competitor for FDI. It also benefits from a corporation tax rate of 12.5%. The Republic of Ireland also has significant linkages to Northern Ireland in terms of exports and accounts for 28.4% of Northern Ireland’s manufacturing exports. The impact of the economic downturn on the economy in the Republic of Ireland is having a significant impact on Northern Ireland both in terms of reduced demand for goods and services impacting on exports and on jobs, especially in the construction sector where many people have traditionally commuted across the border for work. Treasury has recognised the need for the Republic of Ireland to focus in the future on external sources of economic growth and realises that the degree of competition for both inward investment and in the tourist market will be much more intense. Removal of Northern Ireland’s automatic Assisted Area status, when companies seeking to invest already have ample reasons to invest with our closest competitor, would remove a key tool from Invest NI and would undoubtedly cause significant damage to efforts to attract FDI to Northern Ireland.

- It is important to put into context the scale of the competition Northern Ireland faces from the Republic of Ireland. Despite the economic downturn faced by the Republic of Ireland levels of optimism are rising as recovery is witnessed and growth is being seen. At the recent Northern Ireland Economic Conference, attended by the Committee Chair, delegates were informed of the current economic situation in the Republic of Ireland. Gross Domestic Product (GDP) started to increase towards the end of 2010 and continues to grow both in terms of volume and value. Consumer spending started to grow in the early part of 2011 also in terms of volume and value. Labour costs have decreased by over 8.5% since 2008 compared to an average increase of almost 5% across the EU. Exports in the Republic of Ireland contribute 6% of GDP compared with an average of less than 3% across the EU and just under 2.5% for the UK as a whole. Almost 60% of exports are in the high-value pharmaceutical and medical sector. It is this economy which will be Northern Ireland’s main competitor during the coming years.

- In its consultation, the Treasury recognises that the small scale nature of most firms in Northern Ireland means that there will need to be a significant reliance on inward investment projects to deliver the quantity and quality of employment opportunities needed over the next 25 years to rebalance the economy. It also recognises that the private sector here remains weak, especially following the recent economic recession. Northern Ireland has experienced the biggest increase in unemployment during the course of 2010 of any UK region and unemployment continues to rise. The economy here relies heavily on the public sector for jobs. Over 30% of all Northern Ireland jobs are in the public sector compared to a UK average of around 21%. Treasury has recognised the very urgent need to address this through rebalancing the Northern Ireland economy. Removal of automatic Assisted Area status will significantly harm Treasury moves to rebalance the Northern Ireland economy through growing the private sector.

- Latest figures show that the Northern Ireland figure for GDP per inhabitant is approximately 80% of the overall UK figure. Although there is variation within the region, the figure demonstrates low levels of GDP within Northern Ireland. This compares to our nearest neighbours and closest competitor, the Republic of Ireland where GDP has been around 20% to 30% higher than the UK over the five years up to 2008 and around 40% to 55% higher than Northern Ireland over the same period. Northern Ireland is a distinct economic area with people commuting to work to and from all parts of the region. To treat Northern Ireland otherwise at this time will significantly decrease the flexibility that the Assembly and Executive and will ultimately harm efforts to rebalance the Northern Ireland economy.

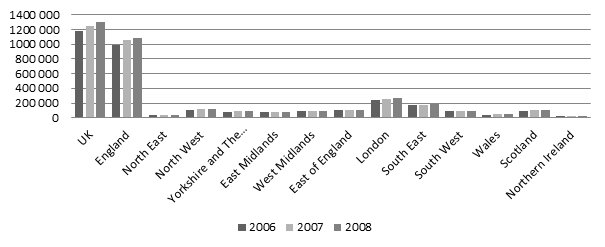

- Figure 1 compares total sub-regional Gross Value Added (GVA) (current prices) for 2006, 2007 and 2008. Throughout the period Northern Ireland had the lowest level of total GVA of all the UK regions. The Northern Ireland total was approximately 2.25% of the UK total in each of these years.

Figure 1: Total sub-regional GVA (current prices) 2006 -2008 (£m)

Source: ONS

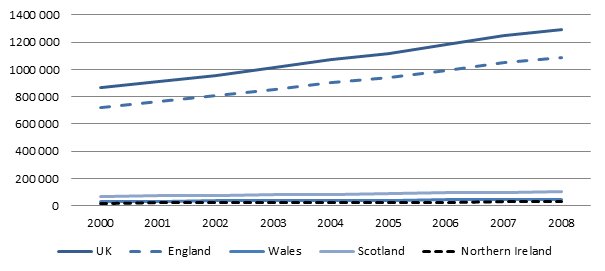

- Figure 2 plots trends in total GVA for the UK and its four regions between 2000 and 2008. It shows that Northern Ireland’s total GVA had been consistently the lowest of all regions. It all shows a marked difference between UK and England’s total GVA compared to the three devolved regions. Although GVA in Belfast is better than the average, the figure does not take into account the travel to work data. Many people travel to work in Belfast from all over Northern Ireland and the region should therefore be considered as a single economic region in this regard. Indeed, 12 of the top most deprived wards in Northern Ireland are in Belfast.

Figure 2: Total regional GVA regions 2000-2008 (£m)

Source: Eurostat

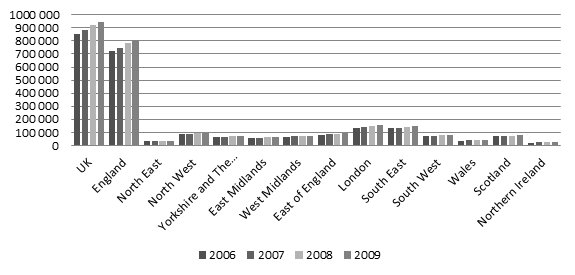

- Annual figures for Gross Domestic Household Income (GDHI) in Northern Ireland from 2006 to 2009 show that the region has consistently had the lowest GDHI of any UK region (Figure 3). GDHI is the amount of money households have available for expenditure once expenses such as taxes, social contributions, property ownership and pension provisions are deducted.

Figure 3: Total GDHI UK Regions 2006-2009 (£m)

Source: ONS

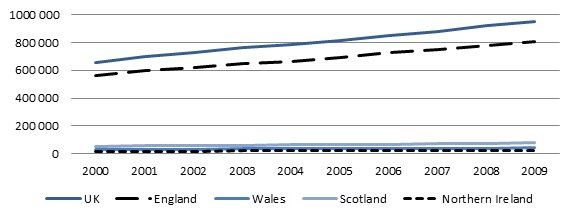

- Figure 4 shows trends in total GDHI between 2000 and 2009 for the UK and its four main regions. The figure demonstrates that Northern Ireland has had consistently the lowest level of GDHI in this period.

Figure 4: Total GDHI 2000-2009 UK and regions (£m)

Source: ONS

- In 2006, the EU proposed that Northern Ireland should continue to have Exceptional Region status due to its unique set of circumstances. Since 2006 the situation in Northern Ireland has deteriorated significantly due to the economic downturn. In the absence of any direction to the contrary from the EU, the Committee considers it inappropriate that the UK Government would unilaterally seek to change this status. On the contrary, the Committee believes that the UK Government should support Northern Ireland’s case to continue to hold Exceptional Region status.

- Northern Ireland has many unique characteristics both in terms of its position within the UK and its geographical position bordering another EU member state. Northern Ireland is located on the periphery of Europe and on the periphery of the UK. This creates its own difficulties in attracting investment from companies internationally, from the EU and from other parts of the UK. As stated previously, it borders the Republic of Ireland which remains a prosperous state within the EU and there are also difficulties in removing the perceptions of Northern Ireland abroad. This was highlighted only last week when the Committee hosted a lunch with the UK Ambassadors from the Association of South East Asian Nations. These ambassadors were pleasantly surprised at the welcome they received and at the advances that have been made here but they stated that they would still have a considerable amount of work to do to convince businesses from their respective nations to invest in Northern Ireland, mainly due to the perceptions that still exist in relation to our past.

- In answer to a question in the House of Commons on what plans he had to make Northern Ireland an Enterprise Zone, Secretary of State, Owen Paterson stated:

“We have been saying for three years now that an economy that depends for 77.6% of its GDP on state spending is wholly unsustainable. It will need rebalancing. That will take time. To do nothing is irresponsible; to move too fast is irresponsible, and I estimate that it will take, probably, 25 years. This week, we will be sending a paper to the Executive for discussion, looking at ways of turning the whole of Northern Ireland into an enterprise zone.” - For Northern Ireland to become an enterprise zone, would require 100% Assisted Area status. Removal of automatic Assisted Area status would preclude this policy option from being taken forward. At a time when Northern Ireland’s economic future is being considered and when important decisions have yet to be taken it is important that different areas of government work together to ensure that the right tools are provided to help in rebalancing the economy here. It is therefore premature, in the absence of a decision on whether Northern Ireland should be an enterprise zone, to take decisions that will remove this important option. It is clear from this and from the other evidence presented that Northern Ireland as a whole has economic issues which have to be addressed. It is not possible to divorce the issue of rebalancing the Northern Ireland economy from the issue of Assisted Area status. Northern Ireland must retain the flexibility of this policy tool and the Assembly and the Executive must have full accessibility to the full suite of policy tools at this time to help move Northern Ireland towards being a vibrant, private sector led economy.

- In conclusion, Northern Ireland is economically very different to other regions across Britain. There are low levels of productivity coupled with high rates of economic inactivity. Current and future competition from the Republic of Ireland for inward investment and tourism is intense and will become increasingly intense. There is a significant reliance in Northern Ireland on inward investment projects to deliver the quantity and quality of employment opportunities needed in the coming decades to rebalance the economy and this is recognised by Treasury. Northern Ireland has seen the biggest increase in unemployment during the last year of any UK region and unemployment levels continue to rise. GDP per inhabitant is only around 80% lower than the UK average and up to 55% lower than the Republic of Ireland. Northern Ireland has the lowest GVA and GDHI of any UK region. Removal of automatic Assisted Area status will significantly harm efforts to attract business to Northern Ireland, especially business from high productivity sectors; remove a key tool from Invest NI and cause significant damage to efforts to attract FDI and to compete with the Republic of Ireland; and cause major damage to efforts to rebalance the Northern Ireland economy through growing the private sector.