Report on the Executive’s Draft Budget 2008-2011

Report on Draft Budget 2008-2011.pdf (4.41 mb)

HTML Source EditorWord Wrap

Session 2007/2008

Third Report

COMMITTEE FOR FINANCE AND PERSONNEL

Report on the Executive’s Draft Budget 2008-2011

TOGETHER WITH THE MINUTES OF PROCEEDINGS OF THE COMMITTEE RELATING TO THE REPORT, WRITTEN SUBMISSIONS, MEMORANDA AND THE MINUTES OF EVIDENCE

Ordered by The Committee for Finance and Personnel to be printed 12 December 2007

Report: 12/07/08R (Committee for Finance and Personnel)

Committee for Finance and Personnel Membership and Powers

Powers

The Committee for Finance and Personnel is a Statutory Departmental Committee established in accordance with paragraphs 8 and 9 of the Belfast Agreement, Section 29 of the Northern Ireland Act 1998 and under Assembly Standing Order 46. The Committee has a scrutiny, policy development and consultation role with respect to the Department of Finance and Personnel and has a role in the initiation of legislation.

The Committee has the power to:

- consider and advise on Departmental budgets and annual plans in the context of the overall budget allocation;

- approve relevant secondary legislation and take the Committee Stage of primary legislation;

- call for persons and papers;

- initiate inquires and make reports; and

- consider and advise on matters brought to the Committee by the Minister of Finance and Personnel.

Membership

The Committee has eleven members, including a Chairperson and Deputy Chairperson, with a quorum of five members.

The membership of the Committee since its establishment on 9 May 2007 has been as follows:

- Mr Mitchel McLaughlin (Chairperson)

- Mr Mervyn Storey (Deputy Chairperson)

- Mr Roy Beggs

- Dr Stephen Farry

- Mr Simon Hamilton

- Mr Fra McCann

- Ms Jennifer McCann

- Mr Adrian McQuillan

- Mr Declan O’Loan

- Ms Dawn Purvis

- Mr Peter Weir

Table of Contents

Executive Summary

Key Conclusions and Recommendations

Introduction

Background

The Committee’s Approach

Plenary Debate, 27 November 2007

Consideration of the Issues

Consideration of Draft Departmental Budgets

Submissions from the Assembly Statutory Committees

Introduction

Theme 1 – Spending Priorities

Theme 2 – Budget Allocations

Theme 3 – Budget Reductions and Efficiencies

Theme 4 – Budget Information and Process

Consideration of Strategic and Cross-cutting Issues

Efficiency Savings

The Reform Agenda

Performance and Efficiency Delivery Unit (PEDU)

Management of Public Finances

Funding for Cross-cutting Programmes

Rating Reform

Capital Realisation Taskforce (CRT)

Borrowing and Private Finance Initiative (PFI)

Barnett Formula versus Needs Assessment

Appendix 1 – Ministerial Statement and Assembly Debate

Official Report of Minister of Finance and Personnel’s Statement on the Draft Budget 2008-2011 — 25 October 2007

Official Report of Assembly Debate on Draft Budget 2008-2011 — 27 November 2007

Appendix 2 – Statutory Committee Submissions

Letter to Statutory Committees inviting input to the report on the Draft Budget 2008-2011

Committee for Agriculture and Rural Development

Committee for Culture, Arts and Leisure

Committee for Education

Committee for Employment and Learning

Committee for Enterprise, Trade and Investment

Committee for the Environment

Committee for Finance and Personnel

Committee for Health, Social Services and Public Safety

Committee for the Office of the First Minister and Deputy First Minister

Committee for Regional Development

Committee for Social Development

Appendix 3 – Minutes of Proceedings (extracts)

19 September 2007

26 September 2007

07 November 2007

14 November 2007

21 November 2007

28 November 2007

05 December 2007

12 December 2007

Appendix 4 – Minutes of Evidence

Department of Finance and Personnel – Civil Service Reform — 7 November 2007

Department of Finance and Personnel – Ministerial Briefing on the Draft Budget 2008-2011 — 14 November 2007

Department of Finance and Personnel – Strategic Budget Issues — 21 November 2007

Department of Finance and Personnel – Performance and Efficiency Delivery Unit;

Capital Realisation Taskforce; and Public Procurement — 28 November 2007

Appendix 5 – Memoranda and Papers from Department of Finance and Personnel

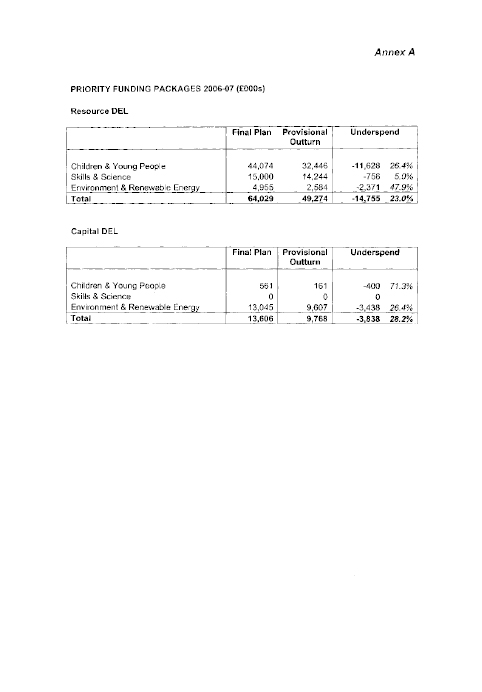

Priority Funding Packages and Capital Underspend

Comprehensive Spending Review 2007 – Value for Money Reviews

Civil Service Reform

Handout Provided to Committee during Ministerial Briefing 21/11/07

Strategic Budget Briefing

Strategic Budget Issues – Questions to the Department of Finance and Personnel

Strategic Budget Issues – Response to Committee Questions

Capital Realisation Taskforce

Performance and Efficiency Delivery Unit

DFP Response on Fit For Purpose Headcount Reductions

Appendix 6 – Northern Ireland Assembly Research Paper

Comparative Analysis of Draft Budget 2008-2011

List of Abbreviations used in the Report

|

AFBI |

Agri-Food Biosciences Institute |

|

AOCC |

Assembly Ombudsman Commissioner for Complaints |

|

ASSI |

Areas of Special Scientific Interest |

|

AWPU |

Age Weighted Pupil Unit |

|

CRT |

Capital Realisation Taskforce |

|

CSR |

Comprehensive Spending Review |

|

CYP |

Children and Young People |

|

DARD |

Department of Agriculture and Rural Development |

|

DCAL |

Department of Culture, Arts and Leisure |

|

DCSF |

Department for Children Schools and Families |

|

DE |

Department of Education |

|

DEL |

Department Expenditure Limit |

|

DEL |

Department for Employment and Learning |

|

DETI |

Department of Enterprise Trade and Investment |

|

DFP |

Department of Finance and Personnel |

|

DHSSPS |

Department of Health, Social Services and Public Safety |

|

DOE |

Department of the Environment |

|

DoH |

Department of Health |

|

DRD |

Department for Regional Development |

|

DSD |

Department for Social Development |

|

EDP |

Efficiency Delivery Plan |

|

EDRM |

Electronic Documents and Records Management |

|

EHS |

Environment and Heritage Service |

|

ERINI |

Economic Research Institute of Northern Ireland |

|

EU |

European Union |

|

EYF |

End Year Flexibility |

|

FDI |

Foreign Direct Investment |

|

FNMS |

Farm Nutrient Management Scheme |

|

FSA |

Food Standards Agency |

|

GB |

Great Britain |

|

GDP |

Gross Domestic Product |

|

GNP |

Gross National Product |

|

GoCO |

Government Owned Contractor Operated |

|

GVA |

Gross Value Added |

|

HMT |

Her Majesty’s Treasury |

|

HR |

Human Resources |

|

HSENI |

Health and Safety Executive Northern Ireland |

|

ICT |

Information and Communications Technology |

|

IDF |

Integrated Development Fund |

|

IDG |

Industrial Development Guarantee |

|

ISNI |

Investment Strategy for Northern Ireland |

|

IT |

Information Technology |

|

LGRU |

Local Government Reform Unit |

|

LMS |

Local Management Scheme |

|

LPS |

Land and Property Services |

|

MLA |

Member of Legislative Assembly |

|

NDPB |

Non Departmental Public Body |

|

NI |

Northern Ireland |

|

NIAER |

Northern Ireland Authority for Energy Regulation |

|

NIAO |

Northern Ireland Audit Office |

|

NICS |

Northern Ireland Civil Service |

|

NILGOS |

Northern Ireland Local Government Officers’ Superannuation scheme |

|

NIO |

Northern Ireland Office |

|

NISRA |

Northern Ireland Statistics and Research Agency |

|

NITB |

Northern Ireland Tourist Board |

|

OFMDFM |

Office of the First Minister and Deputy First Minister |

|

PAC |

Public Accounts Committee |

|

PDSU |

Programme Delivery Support Unit |

|

PEDU |

Performance and Efficiency Delivery Unit |

|

PfG |

Programme for Government |

|

PFI |

Private Finance Initiative |

|

PhD |

Doctor of Philosophy |

|

PKF |

Pannell Kerr Forster |

|

PMDU |

Prime Minister’s Delivery Unit |

|

PPA |

Planning, Preparation and Assessment |

|

PRONI |

Public Record Office of Northern Ireland |

|

PSA |

Public Service Agreement |

|

R&D |

Research and Development |

|

RoI |

Republic of Ireland |

|

RPA |

Review of Public Administration |

|

RRI |

Reinvestment and Reform Initiative |

|

RTP |

Regional Tourism Partnership |

|

SEN |

Special Education Needs |

|

SMFP |

Structural Maintenance Funding Plan |

|

STEM |

Science, Technology, Engineering and Mathematics |

|

TB |

Tuberculosis |

|

TIL |

Tourist Ireland Limited |

|

UK |

United Kingdom |

|

VFM |

Value for Money |

Executive Summary

The Committee for Finance and Personnel fulfils a role in co-ordinating budget scrutiny by the Assembly and this report represents the outcome of that work in respect of the Executive’s Draft Budget 2008 – 2011, which was published on 25 October 2007. The report will be considered by the Executive, as part of a wider public consultation, before a revised Budget is presented to the Assembly for debate and approval in late January 2008.

The draft Budget 2008 – 2011 aims to support the strategic priorities in the draft Programme for Government, which include economic growth, investment in infrastructure, modernising public services, environmental protection and promoting tolerance, inclusion, health and well being. Since the commencement of the consultation a lively public debate has ensued over the comparative spending allocations in the draft Budget for these and for other priorities. The Committee welcomes this debate and the deliberations on the competing priorities are reflected in this report – through both the outcome of an Assembly debate, held on 27 November 2007, and in the submissions from the Assembly statutory committees, which examine the draft budgets for the respective departments.

In terms of headline figures, the draft Budget provides for total current expenditure of £8.28 billion in 2008/09; £8.55 billion in 2009/10 and £8.93 billion in 2010/11; with the total for capital investment being £1.64 billion, £1.5 billion and £1.83 billion over the same three years. Whilst these headline figures appear reassuring, the Committee is mindful that the Executive is constrained in terms of available resources. In particular, the outcome of the Comprehensive Spending Review 2007 means that, at the UK level, public expenditure is set to grow at the slowest rate since the spending review process was introduced in 1998. The consequence for Northern Ireland is that real terms growth in expenditure over the next three years will average 1.2% per year. The Committee also recognises that the Executive has had to address a range of legacy issues inherited from the Direct Rule period, including water reform and domestic rating reform, which were the cause of mounting public concern.

As a consequence of the constrained public expenditure environment, the draft Budget places a strong emphasis on efficiency and value for money. The Committee has responded to this positively by examining a range of strategic and cross-cutting budgetary issues with a view to identifying ways of maximising the impact from available resources. For example, included in the Committee’s key findings and recommendations are measures aimed at supporting the efficiency drive, eradicating the culture of underspend and raising the performance of departments in managing public money for the delivery of frontline services.

The Committee notes the invaluable and substantive contributions from the other Assembly statutory committees, which raise a wide range of issues regarding the resource and capital allocations for their respective departments.

This report, including the submissions by the other Assembly statutory committees and the contributions made by Members in the plenary debate on 27 November 2007, represents the Assembly’s key contribution to influencing the Executive in finalising the Budget for 2008 – 2011.

Key Conclusions and Recommendations

General

1. Given the pressing need to raise productivity and living standards in NI, the Committee welcomes the increased focus on economic growth, evident in the draft Programme for Government (PfG) and draft Budget, whilst also being mindful of the importance of the Executive’s other priorities, including investment in infrastructure, promotion of health, tolerance and inclusion, modernisation of public services and protection of the environment. (Paragraph 7)

2. The Committee considers that the new emphasis on the economy necessitates the early publication of a new Regional Economic Strategy which sets out how the Executive’s high level goals will be realised. This should include a cross-cutting implementation plan for taking forward the four productivity drivers of Skills, Enterprise, Innovation and Infrastructure. In addition, it should include challenging and measurable targets and milestones for rebalancing the economy and closing the productivity and income gaps between NI and GB. (Paragraph 8)

Information and Process

3. The Committee echoes the call, made by a number of the Assembly statutory committees, for a closer alignment between the revised Budget and the revised PfG than exists in the draft documents; in particular a more visible linkage is required between PfG priorities and goals, Public Service Agreement objectives and the allocations, departmental objectives and spending areas in the Budget. The Committee also considers that there would be benefit, in terms of transparency and scrutiny, from fuller and more standardised information on departments’ bids and their outcomes being published as part of the draft Budget process. (Paragraph 152)

4. The Committee considers that the future budget process and timetable needs to be settled early in 2008 to enable the Assembly statutory committees to schedule the necessary scrutiny into their work programmes and thereby provide departments with notice in terms of the future information and briefing requirements of committees. (Paragraph 153)

Departmental Budget Allocations

5. In terms of the draft budget allocations for individual departments, the Committee recommends that, in finalising the Budget 2008 – 11, the Minister of Finance and Personnel and the wider Executive take on board the conclusions and recommendations contained in the substantive submissions from each of the Assembly statutory committees, which have been included as appendices to this report. (Paragraph 154)

Strategic and Cross-cutting Issues

6. The Committee believes that the 3% across-the-board efficiency target could present a greater challenge for some departments than for others. The nature and structure of a department’s budget, and the particular demands thereon, will have a bearing in this regard. The Committee also considers that some departments may, conversely, be in a position to achieve efficiencies higher than the 3% target and, therefore, calls on the Department of Finance and Personnel (DFP) to keep under review the comparative impact which the efficiency target is having on individual departments in delivering public services. (Paragraph 160)

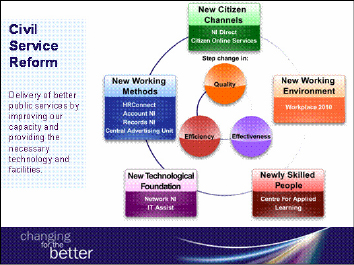

7. Given that the targeted efficiency savings on resource spend have already been removed from departmental starting baselines, the Committee is concerned that there will be a risk to spending on frontline services, from any slippage in achieving the planned efficiencies. The Committee understands that it is planned to publish the final departmental Efficiency Delivery Plans alongside the Final Budget. The Assembly statutory committees will therefore have a vital role to play in scrutinising and monitoring the progress by their respective departments in achieving the planned efficiencies. (Paragraph 161)

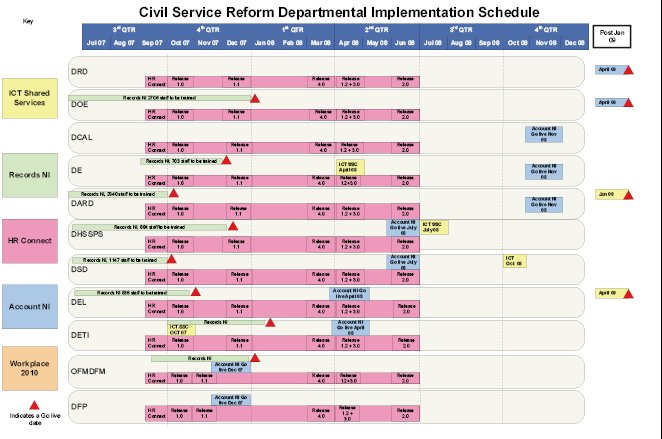

8. The Committee recognises the importance to the Budget of the efficiency drive underpinning the programme of Civil Service reform and has been advised that the benefits will be measured using a series of key performance indicators, which will be integrated within departmental business planning. There will be an important role, therefore, for Assembly statutory committees in monitoring the progress on the various reform projects in their respective departments. (Paragraph 164)

9. The Committee considers that there would be a benefit, in terms of monitoring and accountability, from having the projected value-for-money savings from each of the Civil Service reform projects quantified and disaggregated from the overall 3% cumulative efficiency target. (Paragraph 165)

10. The Committee sees scope for widening the customer base of the shared service centres beyond the Northern Ireland Civil Service (NICS) to cover Non Departmental Public Bodies and other public bodies. Whilst the Committee accepts that the current focus is on establishing the shared service centres to offer an NICS-wide service, it nonetheless believes that the wider potential should be pursued with a view to maximising efficiencies across the public sector. Moreover, the Committee considers that the contractual arrangements with the providers of the shared service centres should include provision to ensure that NICS shares in the benefits from any future expansion in the customer base of the centres. (Paragraph 166)

11. The Committee recognises the importance of the capital receipt from Workplace 2010 to the allocations in the draft Budget but is concerned that the projected capital receipt has varied considerably in recent months. As such, it is necessary to reiterate the call, made in the Committee’s First Report on Workplace 2010 and Location of Public Sector Jobs, for the Department to obtain an accurate and up-to-date market valuation of the properties to be transferred to the Private Sector Partner, thereby maximising the capital receipt. (Paragraph 168)

12. Whilst commending the progress in achieving the target of £250m in savings on public procurement in the three years up to 31 March 2008, the Committee calls for a new target to be included in the revised Budget, which should include a monetary value for savings to be achieved by the end of March 2011. (Paragraph 170)

13. The Committee sees considerable potential in the proposal to establish the Performance and Efficiency Delivery Unit (PEDU), as this could provide the Executive with a tool for driving out additional efficiencies and provide individual Ministers with a means for raising performance and delivery within their departments. However, the Committee recommends that, before launching the initiative formally, DFP should resolve the issues which the Committee has identified to date. These include: the terms of reference within which PEDU will operate, which should ensure that the Unit does not contradict or cut across the work of DFP Supply or the Northern Ireland Audit Office; the protocols to provide for consensus-based engagement and positive relationships between PEDU and departments; approaches to offering incentives to gain commitment from departments; clear accountability arrangements and robust reporting mechanisms and targets that will enable the Unit’s performance to be measured and assessed. (Paragraph 177)

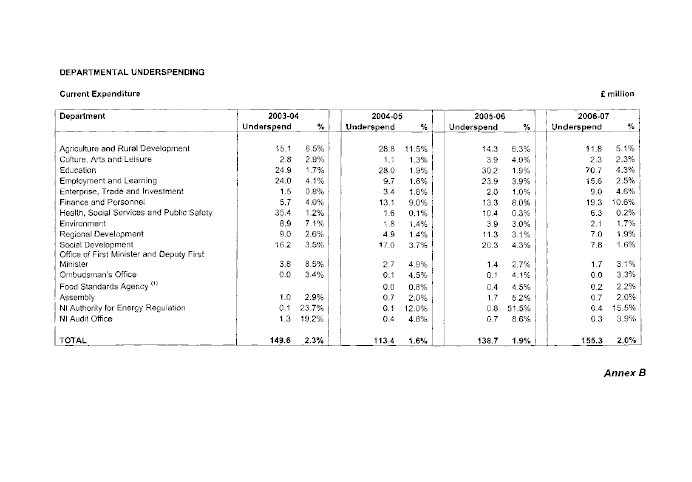

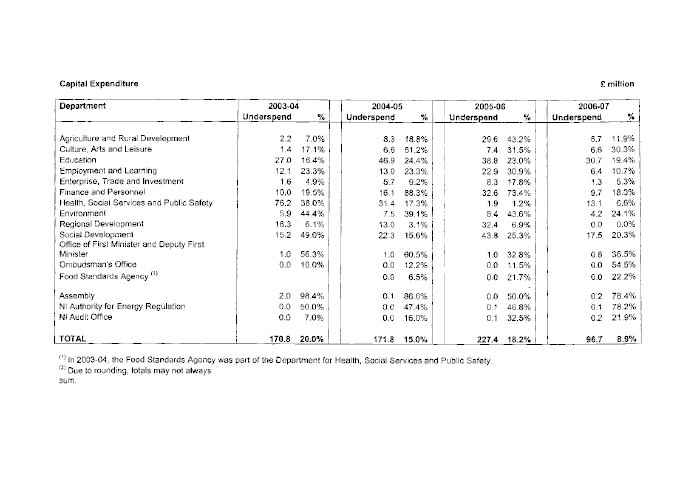

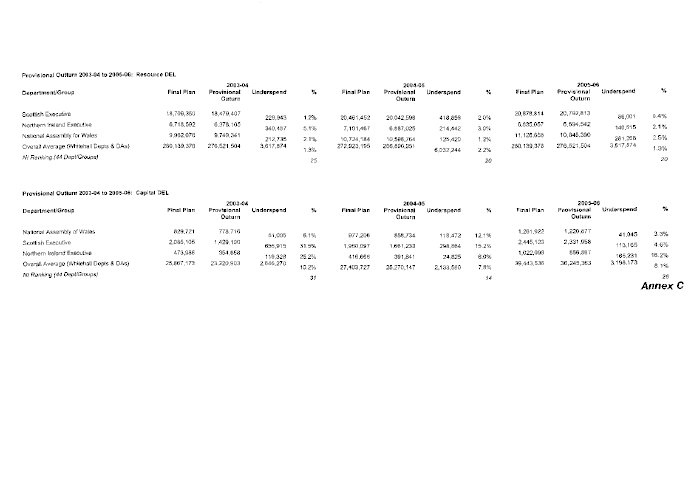

14. The Committee deems that, in terms of current/resource underspend, the average figure of 2% across departments in 2006/07 is unacceptable and recommends that a target is set for reducing current underspend to an average of not more than 1.5% across departments in 2008/09 and to not more than 1% thereafter. On capital underspend, the Committee accepts that this can fluctuate due to unforeseen delays and matters which can be outside the control of departments. Nonetheless, the Committee would point out that delays in capital projects can add significantly, both directly and indirectly, to overall costs and calls for steps to be taken to ensure the effective planning and management of capital projects, with a view to minimising delays and resultant underspend in this area. (Paragraph 184)

15. The Committee accepts the need to reduce overcommitment to provide greater in-year flexibility and capacity to respond to in-year unforeseen pressures. However, the Committee has concerns with the requirement, which applies from 2007/08, for DFP to agree access to the NI stock of current and capital End Year Flexibility (EYF) in each financial year with Treasury. The Committee considers that this restriction on access to EYF attaches uncertainty and risk to monies received originally as an NI entitlement under the Barnett formula. This, combined with the decision to reduce overcommitment, means that there is now an even greater onus on departments to manage public finances in a way which achieves the highest possible level of spend within authorised limits and maximises the impact from available resources. In the view of the Committee, this will require the eradication of the culture of underspend within departments, which has been evident in recent years. (Paragraph 185)

16. The Committee believes that DFP should give a high priority to driving forward the financial management agenda across NICS, including implementing the recommendations in the PKF Report, to raise the priority given to financial forecasting and monitoring within departments. The Committee recommends that the Assembly statutory committees should include budget and financial scrutiny as an integral part of their work programmes. In particular, the ongoing scrutiny of the in-year quarterly monitoring rounds – both before the returns are made to DFP and once the results are announced – will, inter alia, enable the committees to gauge the standard of financial management within their respective departments. To facilitate this process departments should provide their committees with the necessary financial information on a timely basis and in an accessible format. (Paragraph 187)

17. Given the level of concern that has arisen regarding the future funding for cross-cutting programmes, such as Children & Young People, the Committee calls for further assurance in the revised Budget that these important spending areas will not lose priority and that any new funding arrangements do not hinder access by the voluntary and community sector. (Paragraph 190)

18. The Committee recommends that DFP considers further the scope for modifying the industrial derating scheme in the longer term to encourage increased business activity in areas which lead to higher productivity (e.g. research & development, export marketing). In the event that the scheme cannot be modified directly without contravening EC state aid rules, the Committee would support the approach, suggested in the Economic Research Institute of Northern Ireland (ERINI) report, of the Executive taking the opportunity of the review of industrial derating to build a new concordat between industry and government, which will specify what each can expect from the other in obligation and support. (Paragraph 194)

19. The Committee welcomes the assurance from DFP that the focus of Capital Realisation Taskforce will be as much on improving the use of the existing asset base – through, for example, identifying public land for social housing – as it will be on identifying assets for disposal. The Committee calls for consideration to be given to the scope for permitting departments to retain a share of the proceeds from disposals of their excess assets. Such an approach would act as an incentive for proactive engagement by departments whilst also ensuring that the Executive’s priorities are addressed. The Committee also calls for appropriate engagement with local communities, both in terms of the social impact of the sale of individual sites and also on the identification of under-utilised sites for alternative public use. (Paragraph 201)

20. The Committee considers that there is insufficient detail in the draft Budget document (and in the Investment Strategy) on the financing of the planned capital investment. The Committee recommends that, in the interests of transparency, the revised document should include information on the extent to which overall capital investment will be based on anticipated PFI, the extent to which the capital allocations for individual departments will draw on Reinvestment and Reform Initiative (RRI) borrowing, together with details of accumulated debt under RRI and the projected level of loan charges during 2008 – 11. (Paragraph 203)

21. The Committee believes that the ongoing debate on the options for funding devolution in Scotland also has the potential to open up the issue of the future of the Barnett formula for NI. As such, the Committee considers that the Executive should assess the implications of this scenario and prepare accordingly. (Paragraph 205)

Introduction

Background

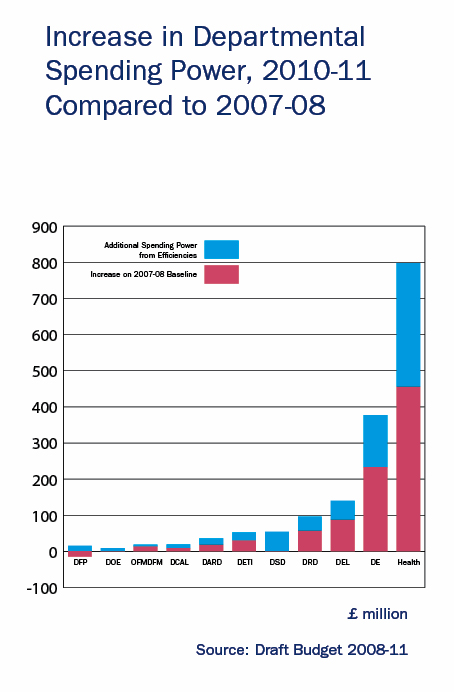

1. The Executive’s Draft Budget 2008 – 11 has been developed in the context of the UK-wide Comprehensive Spending Review (CSR) 2007. The Chancellor of the Exchequer announced the findings from the CSR and Pre-Budget Report on 9 October 2007. The CSR determines the Northern Ireland (NI) Department Expenditure Limit (DEL) over the period 2008 – 11 from the outworking, through the Barnett formula, of the NI share of the settlements for Whitehall Departments. The NI total DEL (i.e. resource plus capital) will increase by £368m/£736m/£1,175m over 2008/09, 2009/10, and 2010/11 respectively to reach £9.6 billion.

2. The Committee recognises that the outcome of the CSR 2007 means that, at the UK level, public expenditure is set to grow at the slowest rate since the spending review process was introduced in 1998. Whilst the Chancellor’s CSR announcement indicated that the NI DEL would increase in real terms by an average of 1.7% per annum over the next three years, the Minister of Finance and Personnel explained in his statement to the Assembly on 25 October 2007, that, following necessary adjustments, a more accurate figure for real terms growth in NI expenditure over the CSR period is an average of 1.2% per year.

3. When presenting the Executive’s Draft Budget to the Assembly on 25 October, the Minister emphasised that the primary focus is on economic growth and that this provides a clear indication of the Executive’s long-term commitment to build a better future for the people of NI. (A copy of the Minister’s statement of 25 October is included at Appendix 1).

4. The Committee notes that the overall focus in the draft Budget relates to the priorities identified in the Executive’s Draft Programme for Government (PfG), namely to:

- grow a dynamic, innovative economy;

- promote tolerance, inclusion, health and well being;

- invest to build in infrastructure;

- deliver modern, high quality and efficient Public Services; and

- protect and enhance our environmental and natural resources.

5. The draft Budget provides details of the proposed expenditure allocations to Departments for the next three financial years. These resources will be used to deliver the priorities and targets that are highlighted in the draft PfG. In this regard, however, the Committee considers that there is scope for more direct readacross between the draft PfG document and the draft Budget document, which would demonstrate the importance of the Budget as a delivery mechanism (this issue is examined later in the report).

6. In terms of the economic imperative, the Committee is cognisant of the fact that NI has one of the UK’s least prosperous economies and that living standards are now also lower than in the Republic of Ireland (RoI). Evidence to this effect was established through the work of the Committee on the Preparation for Government, prior to the restoration of devolution. This demonstrated that low productivity and low incomes and living standards are the key economic problems facing NI. The statistics show that in terms of Gross Value Added (GVA) per person, which is one of the most common measures of affluence, NI remains at around 20% below the UK average and lies around 25% below the level of Gross National Product (GNP) per person in RoI.1. Moreover, the average earnings in the private sector in NI are around 25% below the UK average and average household incomes are the lowest of any UK region at 14% below the UK average.2.

7. Given the pressing need to raise productivity and living standards in NI, the Committee welcomes the increased focus on economic growth, evident in the draft PfG and draft Budget, whilst also being mindful of the importance of the Executive’s other priorities, including investment in infrastructure, promotion of health, tolerance and inclusion, modernisation of public services and protection of the environment.

8. The Committee considers that the new emphasis on the economy necessitates the early publication of a new Regional Economic Strategy which sets out how the Executive’s high level goals will be realised. This should include a cross-cutting implementation plan for taking forward the four productivity drivers of Skills, Enterprise, Innovation and Infrastructure. In addition, it should include challenging and measurable targets and milestones for rebalancing the economy and closing the productivity and income gaps between NI and GB.

The Committee’s Approach

9. Whilst the Committee has taken evidence from DFP on budgetary matters on an ongoing basis since restoration in May 2007, it agreed its approach to the scrutiny of the draft Budget 2008 – 11 in September 2007. This involved the following steps:

a. hosting an information seminar for all MLAs and relevant Assembly officials on the ‘Assembly’s Role in the Annual Budget Process’ on 17 September 2007;

b. commissioning the views of the other Assembly statutory committees on the draft budget allocations for their respective departments on 24 October 2007;

c. receiving a high-level briefing on the draft Budget by the Minister of Finance and Personnel on 14 November 2007;

d. taking evidence from DFP officials on strategic and cross-cutting budgetary issues, in addition to the Department’s own draft budget allocation;

e. tabling a motion for a ‘take note’ debate in plenary on the Executive’s Draft Budget 2008 – 2011, which took place on Tuesday 27 November 2007; and

f. publishing a co-ordinated report on the draft Budget on behalf of all the Assembly statutory committees.

10. This approach is in line with that taken by the predecessor Committee for Finance and Personnel in the first mandate, and enables the Committee to fulfil a role in co-ordinating budget scrutiny by the Assembly. In commissioning the views of the other statutory committees, the Committee took a new approach of offering suggested themes and issues, which though neither prescriptive nor exhaustive, aimed to assist the committees in gathering evidence from their respective departments and in structuring their submissions (Appendix 2). These included each committee’s views on its Department’s spending priorities in the context of the draft Budget allocation. Also, any evidence-based arguments for additions to the allocations in the Department’s draft budget, any risks from existing efficiency plans and any scope for achieving additional cash-releasing efficiencies or further disposals of excess assets to support frontline services and strategic spending priorities were to be considered. In addition, views were sought on the format and content of the draft Budget document and on the future budget process.

11. The Committee has received substantive submissions from the other statutory committees and these have been summarised separately in the ‘Consideration of the Issues’ section of this report. A complete copy of each of the submissions has also been included at Appendix 2.

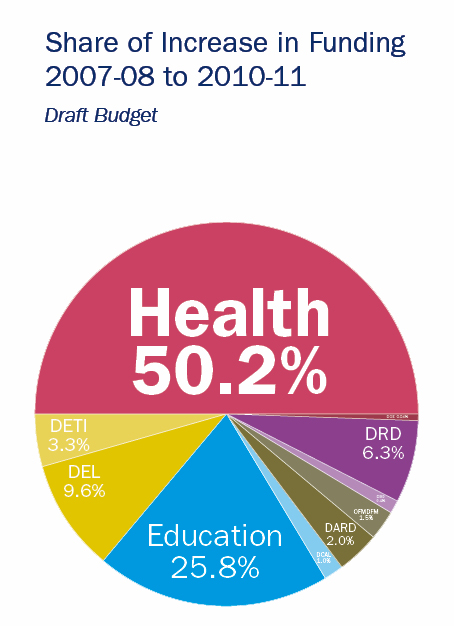

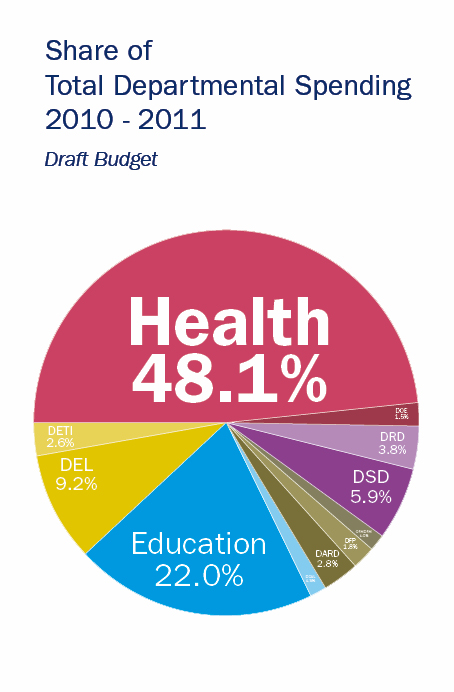

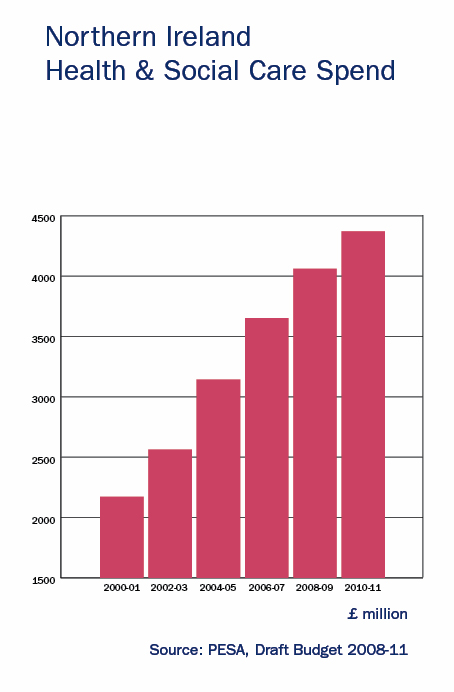

12. During the briefing by the Minister on 14 November, the Committee was informed that, overall, the Executive will receive an additional £1·1 billion in resource and capital funds from the Treasury by 2010-11, compared with 2007-08. The Minister explained that, in early summer, DFP received a total of approximately 270 bids from departments for resource spending, which accumulated to £2·6 billion. As this was considerably greater than the additional money available, decisions and choices had to be made to develop an initial set of indicative Budget allocations for each department. The Minister also pointed out that the Budget allocations to departments were constrained because of the decisions that the Executive had to take on water and sewerage services. The Committee heard that, as a result of the various pressures, there is little room for any additional funding on the resource side, though it is anticipated that the initial work of the Capital Realisation Taskforce will result in some additional capital funding being identified before the Budget is finalised.

13. Also during his evidence session, the Minister placed a particular focus on the debate over the funding for health services. The analysis put forward by the Minister on this issue and on a range of other areas pertinent to the draft Budget is set out in the Official Report (Hansard transcript) of the evidence session at Appendix 4.

14. In addition to the briefing by the Minister on 14 November, the Committee held a range of evidence sessions with DFP officials on a number of key strategic and cross-cutting issues for which the Department has lead responsibility. These include:

- planned efficiency savings;

- various aspects of the reform agenda, including the Civil Service reform programme, value-for-money gains from public procurement, and the management of absenteeism;

- the proposed establishment of a Performance and Efficiency Delivery Unit (PEDU);

- the management of public finances, including the issues of overcommitment, End Year Flexibility (EYF), underspend and forecasting and monitoring;

- approaches towards the funding of cross-cutting programmes;

- Rating Reform, including industrial derating;

- the work of the new Capital Realisation Taskforce;

- borrowing and Public Finance Initiative; and

- the future use of the Barnett formula.

15. The outcome of the Committee’s deliberations on these matters is set out separately in the ‘Consideration of Strategic and Cross-cutting Issues’ section of this report. In addition, the related Official Reports of the evidence sessions are included at Appendix 4.

Plenary Debate, 27 November 2007

16. The plenary debate, which took place on 27 November 2007, gave Members, both as representatives of the statutory committees and individually, an opportunity to set out the significant budget issues facing each of the departments in maintaining and improving the delivery of frontline public services. Whilst the Official Report of the debate is included at Appendix 1, it is worth noting at this point that a number of broad themes emerging from the debate have influenced the consideration of issues in this report. In particular, the Committee noted the following:

- the economic focus of the draft Budget is generally welcomed by Members, whilst underlying concerns have been highlighted regarding the economic challenges ahead for NI, including the need to close the productivity and income gaps with GB;

- the debate over the draft Budget allocation for health, including mental health, remains a key issue of contention, with the core argument resting on the extent to which the issue for the Health sector is one of additional funding or improved performance;

- the deliberations around the relative prioritisation of available resources both within and across departments and on the range of needs that need to be addressed in the revised Budget allocations. Amongst the issues cited as deserving higher priority and/or increased funding allocations were social housing, fuel poverty, energy efficiency, sustainable development, the Rape Crisis Centre, children and young people, and senior citizens;

- the need to strike a balance between ensuring that core public services are sufficiently funded and maximising the performance and value for money of those services;

- the potential impact which the efficiency drive could have on lower-priority services and the risk to frontline services from any slippage in achieving the planned efficiencies; and

- the need for some flexibility in considering evidence-based arguments for revisions to the draft Budget, given the potential for additional efficiencies and asset sales resulting from the work of the Performance and Efficiency Delivery Unit and the Capital Realisation Taskforce.

17. In addition to the above issues, Members representing the various Assembly statutory committees made wide-ranging contributions to the debate and these are reflected in the detailed submissions from their committees, which are summarised in the next section of the report and also included in full in the appendices (Appendix 2).

18. The outcome of the debate on 27 November, together with the conclusions and recommendations from this co-ordinated report, represent the Assembly’s key contribution to influencing the Executive in finalising the Budget for 2008 – 2011.

Consideration of the Issues

Consideration of Draft Departmental Budgets

Submissions from the Assembly Statutory Committees

Introduction

19. The Committee for Finance and Personnel wrote to the chairpersons of the other Assembly statutory committees on 24 October 2007, requesting that committees forward their views on the draft Budget allocations for their respective departments by 28 November 2007. The Committee also suggested broad themes and issues around which evidence could be taken and the responses could be framed (Appendix 2). The responses received are substantive and a detailed summary of these has been included below under the following four themes:

1. Spending Priorities;

2. Budget Allocations;

3. Budget Reductions and Efficiencies; and

4. Budget Information and Process.

20. The full submissions have also been included at Appendix 2 and can be referred to for further detail. The response from the Committee for Health, Social Services and Public Safety was not received in time to be included in the summary below. However, the full response has been included at Appendix 2. In this regard, the Committee is mindful of the ongoing debate on the draft Budget allocation for the Department of Health, Social Services and Public Safety (DHSSPS). The Committee is aware that, in recognising that health and social services account for by far the largest portion of spending in NI (47% of total current expenditure in 2007/08), the Committee for Health, Social Services and Public Safety has undertaken as extensive a scrutiny as possible in the time available. This has involved a number of evidence sessions with the DHSSPS and others.

21. The Committee considers that the tight timetable for statutory committees to scrutinise the budget allocations of their respective departments was unfortunate. However, the Committee recognises that, on this occasion, there were particular circumstances which contributed to this situation.

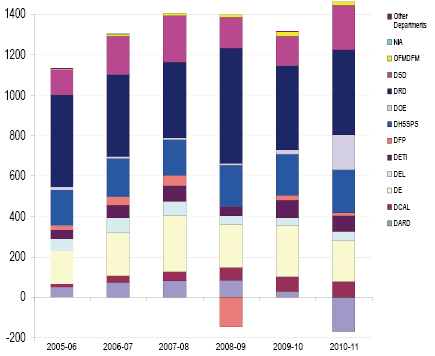

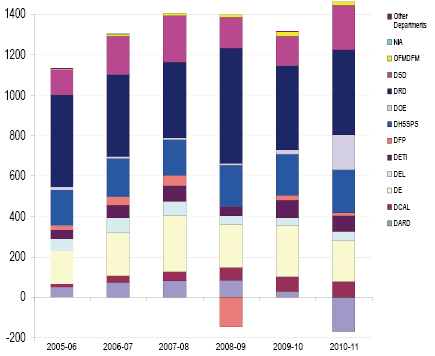

22. In scrutinising the draft Budget allocations of their respective departments, the Assembly statutory committees will have focused on the DEL and, in particular, the greater part of DEL known as ‘Assigned DEL’. This represents the resources subject to allocation at the discretion of the Executive, in accordance with local needs and priorities. Tables 1 and 2 overleaf provide details of the DEL allocations in the draft Budget, broken down by department over the Budget period, with the current expenditure set out in Table 1 and capital investment detailed in Table 2.

Table 1 – Current Expenditure

| Outturn | Plans | |||||||

|---|---|---|---|---|---|---|---|---|

| 2006-07 | 2007-08 | 2008-09 | 2009-10 | 2010-11 | ||||

|

|

£m | £m | % | £m | % | £m | £m | % |

|

Agriculture & Rural Development |

221.7 |

226.4 |

235.7 |

4.1 |

237.8 |

0.9 |

244.7 |

2.9 |

|

Culture, Arts & Leisure |

98.7 |

108.3 |

107.3 |

-1.0 |

109.4 |

2.0 |

117.5 |

7.4 |

|

Education |

1,586.3 |

1,719.2 |

1,770.5 |

3.0 |

1,870.5 |

5.6 |

1,952.3 |

4.4 |

|

Employment & Learning |

617.6 |

731.5 |

734.4 |

0.4 |

771.2 |

5.0 |

818.8 |

6.2 |

|

Enterprise, Trade & Investment |

190.0 |

199.6 |

214.2 |

7.3 |

223.9 |

4.6 |

229.8 |

2.6 |

|

Finance & Personnel |

178.9 |

175.4 |

179.5 |

2.4 |

162.4 |

-9.5 |

160.5 |

-1.2 |

|

Health, Social Services & Public Safety |

3,585.7 |

3,804.8 |

3,938.8 |

3.5 |

4,064.1 |

3.2 |

4,259.2 |

4.8 |

|

Environment |

116.2 |

134.7 |

137.2 |

1.8 |

136.2 |

-0.7 |

135.1 |

-0.8 |

|

Regional Development |

368.7 |

278.0 |

287.6 |

3.5 |

309.2 |

7.5 |

335.2 |

8.4 |

|

Social Development |

472.0 |

521.0 |

529.5 |

1.6 |

522.6 |

-1.3 |

522.3 |

-0.0 |

|

Office of the First Minister & Deputy First Minister |

55.6 |

70.9 |

73.9 |

4.1 |

79.4 |

7.5 |

84.3 |

6.1 |

|

Northern Ireland Assembly |

33.9 |

47.6 |

47.6 |

- |

47.6 |

- |

47.6 |

- |

|

Other Departments |

21.2 |

19.6 |

18.9 |

-3.4 |

19.4 |

2.3 |

19.8 |

2.4 |

|

Total Planned Spend |

7,546.4 |

8,036.9 |

8,275.1 |

3.0 |

8,553.7 |

3.4 |

8,927.2 |

4.4 |

Table 2 – Capital Investment (Net of Receipts)

| Outturn | Plans | |||||||

|---|---|---|---|---|---|---|---|---|

|

|

2006-07 £m | 2007-08 £m | 2008-09 £m | 2009-10 £m | 2010-11 £m | |||

|

Agriculture & Rural Development |

42.2 |

83.0 |

83.6 |

28.6 |

-171.1 |

|||

|

Culture, Arts & Leisure |

15.3 |

43.0 |

64.5 |

74.1 |

79.9 |

|||

|

Education |

128.0 |

279.8 |

213.6 |

252.3 |

200.1 |

|||

|

Employment & Learning |

53.8 |

68.9 |

40.7 |

38.7 |

44.6 |

|||

|

Enterprise, Trade & Investment |

24.2 |

77.5 |

48.0 |

87.9 |

78.2 |

|||

|

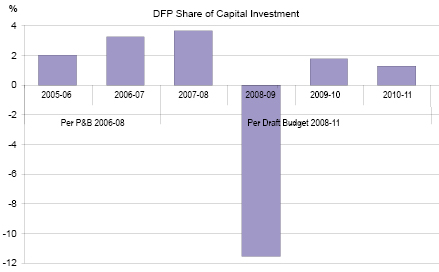

Finance & Personnel |

43.2 |

51.1 |

-145.0 |

22.7 |

16.0 |

|||

|

Health, Social Services & Public Safety |

185.1 |

177.8 |

202.6 |

203.7 |

213.2 |

|||

|

Environment |

13.3 |

9.8 |

10.7 |

22.5 |

171.2 |

|||

|

Regional Development |

421.0 |

373.1 |

568.7 |

416.0 |

419.9 |

|||

|

Social Development |

69.5 |

231.3 |

153.7 |

145.3 |

223.4 |

|||

|

Office of the First Minister & Deputy First Minister |

1.5 |

11.7 |

12.4 |

23.2 |

17.3 |

|||

|

Northern Ireland Assembly |

0.1 |

2.0 |

0.3 |

0.3 |

0.3 |

|||

|

Other Departments |

0.8 |

0.4 |

0.4 |

0.4 |

0.4 |

|||

|

Total Allocations |

997.9 |

1,409.4 |

1,254.2 |

1,315.6 |

1,293.4 |

|||

Theme 1 – Spending Priorities

Committee for Agriculture and Rural Development

23. The Committee referred to a recent report from the Red Meat Taskforce which presented a very bleak outlook for NI’s suckler herd farmers and which, the Committee believes, provides sufficient evidence to merit an additional and substantive tranche of monies. The Committee also believes that a broader and more strategic approach is needed for the red meat sector, which could include direct support to suckler herd farmers and a combined producer/process/retail approach to the agricultural sector. The Committee was broadly content with the resource allocations but has concerns around the Department of Agriculture and Rural Development’s (DARD) intention to remove frontline staff from markets and abattoirs. The Committee believes that this will result in service costs passing to the farming industry and will also create difficulties during the transition from manned to unmanned posts. It recommends the retention of at least one official until the new technology and processes have bedded in, and believes that the cost of this will be minimal and will be offset by the efficient processing of animals at these venues. The Committee also indicated that is was opposed to the proposed Efficiency Delivery Plans relating to animal health and cost-sharing, wildlife intervention, the reduction, rather than the eradication, of Tuberculosis (TB) and Brucellosis and the reduction in funding to the Agri-Food and Biosciences Institute.

Committee for Culture, Arts and Leisure

24. In overall terms, the Committee views the draft Budget allocation to the Department of Culture, Arts and Leisure (DCAL) as small and inadequate. DCAL is suffering from a legacy of the past in which government has consistently undervalued the contribution that culture, arts and leisure make to all sectors of society. The Committee would therefore advocate an uplift across all areas of DCAL’s draft Budget.

25. In terms of the balance in the DCAL resource allocation, the Committee notes that almost half of the departmental budget will be spent on libraries and museums (£53m), which is more than twice the amount that will be spent on sport and the arts combined (£23m). The Committee does not accept the argument that arts and sports organisations can rely on a large amount of volunteers, whereas libraries and museums require paid staff. This is not a valid argument for under-funding sport and art. The fact that there are so many volunteers in arts and sports should lead Government to ensure that they have the best support mechanisms available to encourage them to continue in their volunteering and to ensure that their work is of the highest calibre. This includes the provision of better local facilities. In previous Assembly debates, Members have referred to the huge benefits that sport brings to communities and to the population, and to the cross-community aspects of sport. The Committee would advocate that arts and sports are brought more to the fore and additional monies allocated to them.

Committee for Education

26. The Committee scrutinised in some detail the Minister’s prioritised bids during the period leading up to the finalisation of the draft Budget and followed this up by scrutinising a scenario prepared by the Department of Education (DE) of how its draft Budget resource allocation increase might be utilised to meet inescapable bids and some highly desirable bids. This involved not only a considerable prioritisation of, but also a scaling back of original bids and in some areas only meeting bids in part in the final year of the Budget period. The Committee found this a highly useful and informative exercise, but would highlight that, since the Minister had yet to make decisions on her priorities on how available draft Budget resource allocations might be used, the Committee found it difficult to make firm judgements and recommendations on the implications of the draft Budget for education. The Committee has reflected some of its specific concerns/priorities, but in most instances has simply noted and highlighted possible/probable draft Budget implications and the associated concerns of the Department/Minister. These are included under the next theme on Budget Allocations.

27. DE’s strategic objectives and therefore its key top priorities for allocation of resources must be maintaining core education services at 2007-08 levels in real terms after taking account of demography and pay and price pressures; and meeting contractual, statutory and other inescapable pressures. However, it is also clear that to maintain education core services over the next three years and beyond, it is essential to invest in the short-term to deliver existing and planned education reforms.

28. The Committee examined in some detail one of the Department’s substantial inescapable bids to maintain educational services through the Aggregated School Budgets. It was found that these were adjusted to be net of demography changes, and were based on approximately 2.5% inflation. The latter contrasted to English School Budgets with guaranteed per pupil uplift of 5.5%.

Committee for Employment and Learning

29. The Committee considers that the role of the Department for Employment and Learning (DEL) in delivering both an innovative approach to economic development and working towards reducing social disadvantage and poverty is critical. The Committee assesses that DEL achieved a ‘mid-ranking’ result on bid outcomes and considers that the allocation for achieving cross-cutting themes, while strong in places, will not be sufficient to meet the significant priorities and goals laid out in the PfG for economic development. In particular, whilst welcoming the emphasis on initiatives to be delivered by the Department of Enterprise, Trade and Investment (DETI), the Committee is concerned that the monies allocated to deliver on skills requirement could fall short of achieving the necessary synergy between business growth and skills development.

Committee for Enterprise, Trade and Investment

30. The Committee particularly welcomes the fact that Growing the Economy will be the top priority over the lifetime of the PfG. Whilst recognising that this is not a new priority and has been included in previous PfGs, the Committee welcomes that this priority is repeated and restated and is accompanied by cross-cutting Public Service Agreements (PSAs).

31. DETI resource and capital allocations in the draft Budget, align with what the Committee generally considers should be DETI’s key spending priorities in contributing to the PfG role of ‘growing a dynamic, innovative economy.’ However the Committee has noted that no specific identifiable resources or support plans have been allocated so far to local enterprise and the social economy and regional tourism partnerships and recommends that further consideration is given to ensuring adequate resources and support plans are put in place.

32. DETI bids mostly focus on growing a dynamic, innovative economy, and on the cross-cutting sustainability theme. Energy bids focus on protecting and enhancing the environment and natural resources and the cross-cutting sustainability theme. Business regulation, Consumer Council issues and Health and Safety Executive Northern Ireland (HSENI) bids focus on promoting tolerance, inclusion and the health and well being cross-cutting theme. The productivity bids focus on the cross-cutting skills theme.

33. The Committee welcomes the new arrangements for Invest NI funding but would seek assurances that should the need to resort to the Industrial Development Guarantee arise, that it is not at the expense of other budget commitments relating to DETI and the wider economy.

34. It is unclear to the Committee where innovation funding provided by Treasury and the Irish Government is reflected in the draft Budget and the Committee hopes that further work on this issue is more visible and positive in the revised Budget.

35. Due to unmet high discretionary bids, the Committee is concerned that DETI will not be able to fulfil its contractual obligations as an EU Managing Authority and its obligations under the Energy-End Use and Energy Services. It recommends that this shortfall is urgently addressed as a budget priority for the Executive.

Committee for the Environment

36. The Committee notes that the draft Budget allocations largely meet the following bids:

- Road safety services: road casualty reductions; road transport compliance and enforcement; reduction in vehicle-related crime and reduced emissions.

- Enforcement and better regulation: establishment of a dedicated environmental crime team to combat the illegal dumping of waste and the establishment of a new strategic development and delivery support team to co-ordinate cross-cutting regulation activities; implementation of the air quality strategy.

- Programme Delivery Support Unit (PDSU): support for district councils and the three waste management groups in implementing major waste procurement plans.

37. The Committee notes that the following bids were not met, and has particular concerns regarding the shortfalls in the spending proposals for the costs of implementing the Review of Public Administration (RPA). Figures refer to the 2008 – 2011 period covered by the draft Budget.

- Planning Reform (£0.55m other resources and £2.5m administration).

- RPA (covering the costs incurred by Planning Service and Local Government Reform Unit (LGRU) in taking forward the RPA agenda - £13.55m other resources and £4.55m administration. LGRU requiring £13m other resources and £1.7m administration.

- Local Government Division (£2.4m other resources).

- Waste and Contaminated Land (£3.7m other resources and £0.83m administration).

Committee for the Office of the First Minister and Deputy First Minister

38. The Committee discussed the proposed bids for additional resources and the proposed efficiency plans for the Office of the First Minister and Deputy First Minister (OFMDFM). The priorities were:

- additional financial resources to allow the Planning Appeals Commission to recruit and deploy additional Commissioners to address the backlog in planning appeals in NI;

- additional resources for the programme for Good Relations;

- additional funding to support the needs of victims and survivors;

- additional funding to develop a play policy for NI;

- additional funding to take forward sustainable development in NI; and

- additional funding to take forward the anti-poverty strategy.

39. The Committee is generally content with the additional resources allocated but has concerns about a number of areas, which are covered under the next theme on Budget Allocations. The Committee welcomes the allocation of resources for taking forward the Older People’s agenda from 2009/10. The Committee considers that, if managed and delivered well, the majority of departmental functions and corresponding spending priorities will directly help to deliver on the Executive’s strategic and cross-cutting priorities. Several of the key functions are within the Equality and Strategy and Regeneration directorates which have clear relationships with promoting tolerance, inclusion, health and well-being, investing to build our infrastructure and protecting and enhancing our environment and natural resources.

40. The Committee recommends that the Executive recognises the importance of the findings in the “Cost of Division Report” to its strategic, cross-cutting and spending priorities.

Committee for Regional Development

41. The Committee considers that the allocations for the Department for Regional Development (DRD) are insufficient to meet the infrastructure, economic, social and environmental needs of NI and illustrates this by highlighting the following:

- spending per capita on transport in NI was £65 below that in England in 2005-06;

- structural maintenance funding is £125m below the level identified in the Structural Funding Maintenance Plan; and

- the legacy of under-investment in water and sewerage services in NI has been demonstrated in the Strand One report by the Independent Water Review Panel (October 2007).

Committee for Social Development

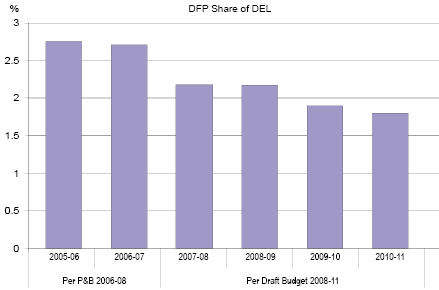

42. The Committee highlighted that the Department for Social Development (DSD) contributes, either at key goal level or at PSA Outcome level, to all of the Executive’s strategic and cross-cutting priorities. The Committee is of the view that the spending priorities agreed by the Department for the 2008-2011 budget period support the Executive’s strategic priorities and key plans.

Committee for Finance and Personnel

43. For the Department of Finance and Personnel (DFP) the draft Budget document for 2008-11 highlights the importance of the Department leading reform, delivering value and promoting sustainability in the public sector. The key issues for DFP in the draft PfG are the implementation of the NI Direct programme, which will see a single telephone number point of contact being taken forward over the PfG period, and delivering the wider Northern Ireland Civil Service (NICS) reform programme. In addition, the Workplace 2010 programme is expected to contribute an estimated £175m to the Investment Strategy for NI (ISNI).

44. The Committee is generally content that the Department’s spending priorities align with the priorities and key goals in the draft PfG and with the related PSA objectives. In particular, the Committee considers that DFP’s role in leading and co-ordinating both the reform agenda and the financial management agenda will be critical to realising the aspirations of the PfG and the efficiency and value-for-money drive which underpins the Budget. These areas are examined in greater detail later in the report.

Theme 2 – Budget Allocations

Committee for Agriculture and Rural Development

45. The Committee has grave concerns around the sale of the entire Crossnacreevy site to fund the Farm Nutrient Management Scheme (FNMS) and considers that, unless an EU derogation is achieved to extend the deadline for the scheme beyond December 2008, the £50m budget (with access to an additional £29m) is too high. This is due to the inability to gain planning permission for in excess of 2500 applications and to access a competent builder to undertake the works within the deadline. The Committee believes that it is unnecessary to sell the entire Crossnacreevy site, especially as no business case has been developed, and that DARD has not considered alternative options, including the sale of part of the site, sufficient to cover the requirements of the FNMS. Given DARD’s current intention to sell the entire site, the Committee has previously suggested that some, or all, of the additional receipts could have been used to fund additional programmes such as farm modernisation, or in relation to the findings of the Red Meat Taskforce report.

46. The Committee recommends that DARD reprioritises its budget allocation from the reduction of TB and Brucellosis to the eradication of these diseases and is concerned at the high levels of annual compensation. The Committee has also raised with DARD the issue of the purchase of the ex-army base at Forkhill and, whilst totally supportive of the ventures planned for this site, believes that responsibility for these ventures lies with other departments and that DARD should not be taking the lead, financially or otherwise. The Committee believes that this should not be prioritised as an inescapable bid. The Committee is concerned that DARD has not addressed the issue of appropriate salary levels to recruit and retain qualified professional staff in the Rivers Agency and calls on DARD to revisit salary levels for these grades and reprioritise the Agency’s resource budget accordingly.

Committee for Culture, Arts and Leisure

47. The Committee is disappointed with the level of resource funding which has been allocated to the arts. With over 35,000 people bringing £30m into the local economy, the arts industries are major contributors. The potential exists for greater expansion of these industries but this cannot be done without adequate funding. One of the key targets within the draft PfG for the economy is to grow the creative industries by 15% by 2011. However, if the funding is not increased to support local artists the Committee believes it is unlikely that this target will be met. Similarly, the draft PfG contains a goal for increasing the proportion of the population attending arts events by 2% by 2011. The Committee would question how this will be possible with the limited funding available to the arts under the draft Budget. In addition to the economic benefits, the Committee would also point out the contribution which the arts make to health and education, particularly in aiding recovery from illness.

48. The arts sector in NI has endured standstill funding for the past three years and the Committee had hoped that the draft Budget would go some way to bridging the gap between NI and the rest of the UK and Ireland in relation to per capita funding. However, this has not been the case. The 2007/2008 baseline for NI is £6.13 per head, substantially less than the figures for England (£8.27), Scotland (£11.93) and RoI (£12.61). The draft Budget for arts does nothing to bridge these gaps and NI remains significantly behind. The Committee is of the view that the people of NI should have the same cultural entitlement as their neighbours on these islands.

49. The draft allocation for arts will make life very difficult for the Arts Council of NI in terms of distributing its limited funding. The Arts Council has raised concerns that the current draft Budget settlement for the arts will put at risk as many as 200 full-time and part-time jobs, and over 25,000 participants from across NI may be denied access to outreach activities and engagement in the arts.

50. In relation to the resource allocation for sport, the Committee is concerned that DCAL will not be able to deliver its targets for increasing participation among young people with the current level of funding set aside in the draft Budget. DCAL has informed the Committee that within the capital allocation, there is no provision for spend on community-based infrastructure and yet it is at a local level that young people participate in sport. The Committee is disappointed that more emphasis has not been put on community sport and assisting local sports clubs in the ongoing work they do with young people. The Committee is concerned that unless the resource budget for sport is uplifted, resulting redundancies will occur in organisations such as the Gaelic Athletic Association and Ulster Rugby who are doing excellent work with young people.

51. The Committee notes that, in Scotland, money was taken directly from the Health budget and allocated to sport, in recognition that savings can be made in the longer term on health if more people are encouraged to engage in physical recreation. For every £1 here that goes into sport, £900 is spent on health. A moderate increase in our sports budget could generate considerable improvement in health and well-being. This is something that the Committee would wish the Executive to consider in the future. The Committee would also point out the economic benefits of investment in sport. In 2007, 2% of NI’s Gross Domestic Product (GDP) was related to sport, 7,000 full-time equivalent jobs were sport-related and for every £1 of public investment in sport there was an £8 return.

52. In relation to the funding allocated for museums, the Committee is of the view that this too should be uplifted. Recognition needs to be given to the role which museums, culture and the arts have in attracting tourists to NI, thus contributing to the economy. Museums attract almost one million visitors per year.

53. The Committee noted that only one figure is provided for the ‘North/South Body Languages’. However, there are two bodies in question – the Ulster Scots Agency and Foras na Gaeilge. The Committee is of the view that separate figures should be provided for each of the bodies.

54. The Committee is concerned about the manner in which DCAL is intending to spend its capital allocation for sport. DCAL’s priorities are elite facilities such as a 50m swimming pool and the multi-sports stadium, with the intention that they will be used in connection with the 2012 Olympics. The Committee has concerns about the lasting legacy that the Olympic Games will bring to NI, and what it will mean in real, measurable terms. The Committee also believes there is a high level of uncertainty about whether NI will have a multi-sports stadium by 2012, and around how much it might cost and whether there is adequate funding to pay for it. There is also uncertainty around the funding for elite facilities. The Secretary of State previously gave a commitment of £53 million for elite sports facilities, yet £18 million has been taken off that budget. The Committee is disappointed that promises previously made by the Secretary of State may not materialise.

55. The Committee welcomes the £21 million that is to be allocated to the building of the new Public Record Office of Northern Ireland (PRONI). Given the new location at the Titanic Quarter, there is a significant tourist market for PRONI to tap into. There is great potential for PRONI to benefit from people coming to NI to investigate their family roots and this spend will contribute to the wider economy in that respect. If additional funding could be found to enhance the visitor experience at PRONI this would be most welcome.

56. The Committee would underline the importance of ensuring that the total capital allocation is used for the best advantage of culture, arts and leisure activities and that the potential for underspends is minimised. To conclude, the Committee recommends that the capital budget for DCAL is uplifted, particularly in relation to sports and arts, in recognition of the vital role they play in our society and in building a better future.

Committee for Education

Resource Budget

57. The Committee has scrutinised two main interlocking value-for-money reforms being progressed by DE (i.e. the RPA Education Reform and the Modernising of the School Estate with the move to strategic area planning). Although the Committee currently has some reservations on how these reforms will be achieved, it is important that the efficiency outcomes are delivered. In welcoming the proposed allocation to DE of non-recurrent, largely ‘Invest to Save’ money of £10m, £25m and £10m, the Committee notes that these allocations are immediately absorbed to take forward the reforms highlighted above. Also included are £10m and £5m to continue the Children and Young Peoples’ Funding Package (CYP) and Integrated Development Fund (IDF) long-term essential services now in place, addressing both youth and school provision in disadvantaged areas. Some of these services give clear priority to improving core skills of literacy and numeracy.

58. The Committee’s analysis to date shows that DE would have particular difficulties in finding funding to maintain the CYP and IDF projects/activities in Years 1 & 2 of the Budget period at 2007/08 levels. The Committee would therefore share concerns that this is removing key services targeting disadvantaged school children and other initiatives now established such as the Extended School, Renewing Communities Programmes, and work engaging parents in the life and work of schools. The Committee noted that one particular cost pressure arising regarding DE support for the reforms is Departmental administration of £2.1m, £2.5m and £2.6m over the Budget period and the Committee noted it is essential that these resources are secured under the classification of administration.

59. Another key area for funding is Curriculum Reform. The Committee has some reservations on aspects of this, but it clearly has to be advanced and indeed the Department has a statutory responsibility to do so. The Committee noted that resource budget pressures under the proposed draft Budget may well result in scaling back of funding and delays in implementing Curriculum reforms. The Committee was informed that an important part of the reforms is to ensure that young people leave school having had the opportunity to follow a range of subject options that include skills and subject areas identified as being most relevant to the local and wider economy and to the need of local business – in line with the draft PfG priority of Growing a Dynamic Economy.

60. Although the Committee has yet to be appraised of the potential benefits and outcomes of the Special Education Needs (SEN) and Inclusion Review and the Early Years Strategy, the Committee noted the general concerns that budget resource pressures could well delay improvements and efficiencies in these areas. The Committee noted the particular concerns that School Improvement Fund work and measures to promote Literacy and Numeracy may well be scaled back significantly. Some of this bid was specific to the current Literacy and Numeracy Strategy, while the bulk of it would have been devoted to Literacy and Numeracy enhancement. Not finding the funding for this bid runs counter to the draft PfG PSAs 10 and 19 and is at odds with commitments given following the Westminster Public Accounts Committee Report criticisms.

61. The Committee noted that a specific bid to enhance Science, Technology, Engineering and Mathematics (STEM) skills may not be met at all. This bid would have enhanced the equipment used in STEM and the professional development of STEM teachers, the recruitment of STEM graduates into teaching and the uptake of STEM subjects by pupils. This again runs counter to the draft PfG priority of Growing a Dynamic Economy, specifically PSA 2. The Committee recommends that DE proactively pursues funding from the Innovation Fund for elements of STEM and other appropriate areas.

62. The Committee would question why the bid for Maintenance of the School Estate might not be met – again a spend-to-save issue. Also, the Committee noted with concern that a specific bid to enhance the Youth Service may not be met.

63. The Committee has taken a particular interest in the need to reduce the differential in funding levels between primary and post-primary schools. The Committee noted the Common Funding Scheme (LMS) consultation with schools, launched in mid-November 2007. This seeks views on the proposal to raise the Age Weighted Pupil Unit (AWPU) for primary pupils from 1.02 to either 1.03 or 1.04. The Committee sees the higher weighting (1.04), which generates only an average annual uplift of £24 per pupil, as a minimum uplift and understand that to have no negative effect on post-primary pupil funding would cost some £6m per annum over the next 3 years. The Committee considers it essential that this money is found. It also welcomes the commitments in the draft Budget to fund the second day of Teaching Principals’ Planning, Preparation and Assessment (PPA). Again the Committee considers this to be essential funding as this would mainly benefit Primary School Principals where the evidence for PPA is clear. This is only a fraction of the PPA/Leadership and Management time measures emanating from the Curran Inquiry which would cost £44m per year, with the total package of recommendations at over £80m a year. Associated with this, the Committee enquired about the costs of employing Newly Qualified Teachers to cover part of teachers’ productive time and introducing a guaranteed induction year. The Committee was informed that this would cost approximately £19m per year. This was not on the original list of DE bids and the Committee considers it should be given active consideration, along with the issue of using Newly Qualified Teachers (approx. £24.5k) as opposed to experienced teachers (approx. £42k) for substitution teachers.

Capital Funding

64. In relation to draft Budget proposals for capital funding for DE under the draft ISNI, the Committee welcomes the recognition in the draft Budget that it is important to deliver a modern and sustainable school (and youth) estate to support the development of a well-educated populace with the skills to engage fully and positively in society and the economy. The draft PfG proposed PSA 16 ‘investing to provide a modern fit-for-purpose education estate in line with best practice and VFM’ sets out DE’s specific actions and targets in this area. The Committee sees it important to replace deficient school buildings, but alongside this an area-based planning approach must be delivered and implemented as soon as possible. A total of £714.5m is proposed for allocation to Schools and Youth Services over the 3-year Budget period, with an indicative allocation of £2,792m over the remaining 7 years (£3,506m in total). This will enable over 100 major schools projects (previously announced) to be taken forward over the period, including 8 special needs schools, as well as continued investment in the school estate.

65. The Committee noted that this will include both conventionally funded and Private Finance Initiative (PFI) projects and that the Department is currently analysing anticipated profiles of project capital spend to determine how best to manage the delivery of the projects within the budget allocations. The Committee will carefully scrutinise the Department’s Investment Delivery Plans under the new procurement framework when published in early 2008, as the Committee has concerns about delays in school capital projects and the £30m capital underspend reported in 2006-07. In particular, the Committee will be asking for feedback from DE on what additional resources for investment can be found from the disposal of DE assets under the new Capital Realisation Taskforce set up by OFMDFM and DFP. In this respect the Committee notes the assumption that DE capital receipts from the disposal of surplus assets over the three year budget period is £48.5m.

Committee for Employment and Learning

66. The Committee has no major concerns with the budget relative to previous Departmental budgets, or on the arguments and evidence put forward by DEL in terms of the rationale for priorities and needs. The Committee also endorses DEL’s main spending priorities. The Committee’s main concerns relate to DEL’s ability to deliver key programmes and initiatives relative to the allocations that it has achieved. In particular, the Committee is concerned that unless the skills base is there to ‘pre-empt’ and meet the opportunities, investors could be frustrated and opportunities could be missed. From this general point, there are a number of specific issues of concern:

- an apparent disconnect between the ambitious PfG goals relating to Research and Development (R&D) and innovation and the apparent lack of resources, or at least clarity on resources. The funding available for innovation appears to be inadequate to take forward the leading edge research in the universities and within the private sector, that the Executive considers is required to bring about a transformation from a traditional to a knowledge-based economy. The Committee is aware of opportunities available (e.g. via the Science Foundation Ireland) which only exist as narrow windows of opportunity and urges that the Executive is creative in ensuring that R&D investment is prioritised in the short and medium-term, to secure longer-term economic gains.

- the commitment on PhDs laid out in the draft PfG is an unfunded bid. The Committee has heard that a proportion of the funding for innovation will be utilised to meet this goal, but is concerned that this would be spreading an already relatively small amount of money even more thinly. DEL has indicated that there is a small amount of unallocated money from bids, that could be utilised on PhDs and the Committee would welcome any movement in this direction.

- since devolution, much has been made of the need for re-skilling the population currently in the workforce. The recent Leitch Review sets the context for this and establishes challenging targets. However, a DEL bid for Foreign Direct Investment (FDI)/ Employer Support Programme for Further Education has not been funded and the Committee is concerned that this could lead to a serious general gap with regard to adult training and apprenticeships.

- in addition, the critical sector initiatives (a programme designed specifically to pre-empt and prepare for FDI) have only received £9 m over 3 years (and no money in the first year) against DEL’s original bid of £24 m.

- a major part of the Leitch Review focuses on Essential Skills and the Committee has serious concerns on the budget allocation to deliver on this vital component. DEL has indicated that, to an extent, the bid may have been speculative on this particular issue and has stated that it believes it has sufficient funding to initiate relevant programmes. The Committee will be ensuring that this issue remains on its future work programme to assess if that is indeed the case.

- linked to this, the Committee is fully supportive of DEL’s bid to include ICT as a third essential skill. However, the Department has received only £5m from an £11.4m bid (44%) over the next three years. The Committee is particularly concerned that there is no baseline budget being dedicated to this issue at present and no money has been secured for the first year and therefore that DEL will struggle to deliver on this important programme.