Committee for Enterprise, Trade and Investment

Committee Motion - Effects of Economic Downturn on Business

Effects of Economic Downturn Paper.pdf (740.63 kb)

Committee’s Scrutiny of the Effects of Economic Downturn on Business

Table of Contents

Introduction and Background

Evidence from Businesses and Business Representative Bodies

Evidence From Other Statutory Committees

Suggestions from the Business Sector on how Government can Assist

Existing Government Initiatives to Support Business

Appendix

- Assembly Research Background Paper

- DETI Matrix of Business Support

- Statistics on Payment of Government Invoices within 10-day Target

- Invest NI Client Performance Bulleting

Introduction and Background

Background

- Since the autumn of 2008, the Committee for Enterprise, Trade & Investment has closely followed of impact of the downturn on Northern Ireland businesses. The Committee received requests from a number business representative bodies to brief the Committee on the impact of the downturn on their sector. In November last year the Committee started taking evidence from businesses and business representative bodies on the impact of the downturn. This scrutiny was formalised when the Committee agreed last autumn, to seek oral briefings from a number of representative organisations, to undertake visits to businesses and to seek briefings from Small and Medium-sized Enterprises (SMEs) at its meeting in North West Marketing in March this year. The purpose of the scrutiny was to provide the Committee with a clear understanding of the impacts of the downturn on businesses in Northern Ireland and to capture information from business on what they believed Government should be doing to assist businesses during these difficult times.

- The Committee agreed that, in order to share the information to the widest possible audience it was appropriate to draw together this paper to share with MLAs and to debate in Plenary in a ‘Take Note’ debate.

- The background paper from Assembly Research at Appendix 1 outlines the origins of the economic downturn, the current picture and forecasts for recovery.

Introduction

- The purpose of this paper is to collate the issues raised by businesses and organisations representing business interests during the Committee’s scrutiny of the impact of the economic downturn on Northern Ireland’s businesses. Also included is a summary of evidence taken by other statutory committees on the impact of the downturn on business (Section 3), suggestions from business organisations, provided in written and/or oral briefings, for steps which Government could take to assist businesses at this time (Section 4) and a summary of existing, mostly Government, initiatives to support business (Section 5).

- In the course of its scrutiny, the Committee took either written or oral evidence from the following business representative bodies:

- Institute of Directors (IoD);

- Confederation of British Industry (CBI);

- Construction Employers’ Federation;

- Enterprise Northern Ireland;

- Federation of Small Businesses (FSB);

- North West Marketing;

- Northern Ireland Manufacturing;

- Northern Ireland Council for Voluntary Action (NICVA);

- Northern Ireland Independent Retail Trade Association (NIIRTA);

- Ortus Business Development Agency; and

- Ulster Community Investment Trust (UCIT);

- The Committee also requested a written and oral briefing from the Irish Congress of Trades Unions but they were unable to provide this.

- At its meeting in North West Marketing, the Committee heard from SMEs. Those attending were ABC Fire Protection, Fern Software and Joe Gallagher Entertainments.

- The Committee also conducted visits to Irwin’s Bakery, Craigavon and Almac, Craigavon to discuss the impact of the downturn on major Northern Ireland exporting organisations.

- The Committee engaged with relevant organisations within Government including the Department for Enterprise, Trade & Investment(DETI) and Invest NI. The Committee received papers from the Department for Finance & Personnel in relation to the 10-day target for the payment of Government invoices. Tourism is a vital aspect of the Northern Ireland economy and, with this in mind, the Committee was briefed by both the Northern Ireland Tourist Board (NITB) and Tourism Ireland Ltd (TIL).

- In order to seek clarification on some of the issues raised during its scrutiny, the Committee met with the British Bankers’ Association and representatives of the four main Northern Ireland banks, namely the Bank of Ireland, the First Trust Bank, the Northern Bank and the Ulster Bank. To further clarify issues raised by the banking sector, the Committee wrote to Lord Mandelson, Secretary of State for Business, Enterprise and Regulatory Reform (BERR).

Evidence from Businesses and Business Representative Bodies

Upward Pressure on Raw Materials

- Irwin’s Bakery told the Committee that the price of raw ingredients is increasing. The Consumer Council also state that food prices have increased by 8% from this time last year. With the current exchange rate with the Euro, it has been predicted that imported raw materials will increase in price.

Downward pressure on prices from multiples

- Some stakeholders state that for some businesses volumes are holding but that generally, supermarkets are being pressurised during the downturn and are having to impose price reductions on suppliers. NIIRTA support this view, stating that independents cannot drive prices down in the same way as multiples can. They state that multiples are putting pressure on suppliers and insisting on lower prices. They also state that cross border trade is mostly with multiples with no reinvestment in the economy here.

Cashflow

- NIIRTA states that there is a stronger push from suppliers for payment within 30 days. FSB state that cashflow is the single biggest problem for small businesses. Ken Nelson told the Committee at the NW Marketing meeting that 70% of SME time is spent chasing debt from other businesses, leading to problems with cashflow and liquidity.

Banking Issues

- At the visit to Irwin’s Bakery, Committee members were informed that, although interest rates are down, banking costs are not. There is a feeling that banks are targeting companies who they know can pay with extra charges. The FSB support this, stating that 33% of their members said that their banks are imposing a change in their financial arrangements which has made them less well off. Changes include new lending conditions with increased charges and rates, reduced overdraft facilities and banks requesting more security for loans. The IoD also told the Committee that banks are rearranging rates and charging arrangement fees to customers.

- NI Manufacturing state that credit insurers are refusing to cover, forcing otherwise good business to go back to banks because they cannot get credit. They state that the current top-up scheme is inadequate in terms of timing and level of support, giving banks even more opportunity to take advantage of SMEs. When further information was requested by the Committee NI Manufacturing responded as follows:

- “The starting position used to be bank base rate plus 120 to 275 basis points (ie. 1.7% to 3.25%). The banks have unilaterally adjusted the starting position at 3 months LIBOR (London Inter-Bank Lending Rate) which effectively increases interest by circa 75 basis points (ie to 1.25% which is 50 basis points plus 75 basis points). The margins are now 200 to 450 basis points (ie 3.25% to 5.75%) and I am aware other local banks are looking at margins of 500 to 750 basis points (ie. 6.25% to 8.75%).”

- the IoD states that the banking crisis has compounded the problems for businesses attempting to find funding for investment and working capital. The FSB believes that Government should put pressure on local banks to ensure that they offer a ‘fair deal’ to local SMEs.

- The Ulster Community Investment Trust (UCIT) provides loan finance to social enterprises that often experience difficulties in accessing finance from elsewhere because of the perceived credit risk associated with their business model. UCIT state that social enterprises are experiencing difficulties in accessing finance from the banking sector. To test this theory, UCIT contacted 36 (52%) of their existing loan-holders and new applicant organisations at the beginning of June 2009.

- Of the 36 social enterprises contacted 39% (14) indicated that they had come directly to UCIT for loan finance. Of the remaining 22 respondent organisations that approached the banks for loan finance before opting to take a loan out with UCIT, 82% (18) indicated that they had experienced difficulties accessing bank finance. Of these respondent organisations:

- 7 had been refused a loan or overdraft facility;

- 10 felt that the banks had applied excessive interest rates and fees to new loan facilities;

- 5 indicated that their bank had increased interest rates on existing loans and overdrafts; and

- 5 indicated that their assets were unacceptable as security for the banks.

- Where a respondent organisation specified which bank they had approached, one of the four main local banks was highlighted.

Differences in the way banks operate here compared to GB

- NI Manufacturing state that there are differences in the approach taken by banks here compared to GB in relation to lending. They state that credit is easing in GB and excessive margins are not being charged by the main banks. They state that their counterparts in GB are surprised to hear stories on Northern Ireland banking. They believe this should be investigated. They also feel that local banks do not take the Lending Panel seriously and that it needs to have a stronger, more active interface in Northern Ireland.

Finance Schemes

- The CBI stated that there is difficulty in understanding the various finance schemes throughout the UK. They state that there is a feeling that more services are announced than are available. The IoD state that when they have sent their people into banks to check on the availability of schemes, many bank staff do not know about some of the schemes which businesses have been told are available. The FSB support this, stating that small business are often unaware of the support and assistance that is available to them. They state that the ‘Solutions for Business – funded by government’ document published by BERR should be replicated by DETI, providing a one-stop comprehensive guide to available financial and technical assistance programme. DETI has recently published its matrix of available support to business (Appendix 2).

- The FSB state that less than 3% of small businesses say their banks are making the Enterprise Finance Guarantee (EFG) scheme available to them. They say that one third of small businesses say their bank is less helpful now than it had been before the credit crunch began.

- NI Manufacturing state that there have been job losses through lack of finance to fulfil orders. They also state that the Hardship Relief Scheme seems to be difficult to access and, if a company applied to it, alarm bells would be raised in that industry.

- In a response to a request for information issued by the Committee on 29 th January 2009 on the provision of the EFG, Lord Mandelson, Secretary of State for Business Enterprise & Regulatory Reform, replied to the Committee on 27 th May 2009 stating that the Northern Bank was one of the eight original EFG lenders to launch on 14 January, the Bank of Ireland and Ulster Bank migrated to EFG when they were ready to do so and that the First Trust Bank were also invited to migrate and that they anticipate making progress towards getting First Trust Bank active as an EFG lender shortly. He further stated that, UK-wide, as of 13 th May 2009, lenders have logged over 3340 eligible cases with a value of over £375 million. No specific information was provided in relation to Northern Ireland.

Rising electricity prices

- NIIRTA state that rising electricity prices are having an adverse effect on business. NI Manufacturing agrees, stating that non-domestic electricity prices in Northern Ireland are significantly higher than UK/European competition, placing NI Manufacturers at a competitive disadvantage.

Legislation adding cost to business

- At visits to Irwin’s Bakery and Almac Committee members were informed that legislation is adding cost to business. Issues raised included:

- Belief that social agenda type legislation means that agency workers have the same rights as full-time staff.

- Working week coming down to 48 hours is impacting on business.

- Road transport hours legislation is costing businesses more than the relief from the cap on industrial rates. The cap on industrial rates was essential, it saved manufacturing and cost Government £20 million. However business in general paid £23 million in additional water charges over the same period.

- It is a business unfriendly environment in relation to employment legislation. Settling disputes is too expensive and the process is overly lengthy compared to GB.

Invest NI bureaucracy

- Many organisations and individuals who engaged with the Committee were concerned by what they perceived as unnecessary bureaucracy within the Invest NI system. Irwin’s Bakery, Almac, Eamon Scullen from Fern Software, Eddie Boyle from ABC Fire Protection and John McGowan from NW Marketing informed the Committee of difficulties with Invest NI. Comments included from various stakeholders are summarised here:

- Although there are good people in Invest NI, the organisation can be frustrating to deal with as these people are fighting against a system which is very formulaic and process driven and not equipped to take advantage of opportunities now.

- Invest NI need to do some risk-taking but get taken to task by government when they get it wrong.

- The rules should be changed so that Invest NI are content to lose a certain percentage of aid.

- There is a good working relationship with Invest NI but when an application gets into the system, it grinds to a halt.

- Long time periods involved in getting applications through the system can be very frustrating.

- The length of time it takes to get viable and good projects through the system does not help innovation.

- There is a lot of ‘red tape’/‘jumping through hoops’ with Invest NI.

- There can be difficulties meeting all of the criteria for support. If one criterion is not met, then support is not offered.

- Many companies are not engaging with Invest NI due to bureaucracy, red tape and lack of local accountability.

- There are difficulties in understanding who to talk to in order to get support.

- One company, with 10 staff, has four contact points in Invest NI on four issues.

- Invest NI was compared less favourably to the IDA (Industrial Development Agency in RoI) where assistance is available with planning and regulatory requirements.

Perceived Invest NI bias towards large organisations

- Many organisations felt that the issue of support for SMEs needs to be addressed. The matter of who will speak for small business post RPA was considered a key issue by Ken Nelson from NW Marketing. The FSB believe that Invest NI should increase its programme of assistance for non-member SMEs. The CBI suggested that there should be more support for companies which are not Invest NI clients. Eddie Boyle, from ABC Fire Protection felt that, in the economic downturn, there should be more flexibility, better recognition of SMEs with programmes identifying new or potential opportunities for business. NIIRTA believe that DETI and Invest NI could give more practical support, taking the retail trade sector’s views into consideration. They feel that the views of small businesses are often swept aside, for example, in planning.

- CBI stated that there is no active support for SMEs. The only support being the www.nibusinessinfo.com website.

Perceived Invest NI bias towards Belfast region

- At its meeting in NW Marketing, the Committee heard the perception that Invest NI does not function widely outside Belfast. Members were told of the perception that officials in Invest NI concentrate on Belfast.

Planning issues

- NIIRTA feel that the views of small businesses are often swept aside, for example, in planning. It was also felt that more assistance with planning is offered by the IDA than is available from Invest NI. Almac felt that there is a need for change in planning policy to ensure that the needs of business are considered. This did not relate directly to planning applications but to the compatibility of neighbouring applications with existing businesses.

Public procurement

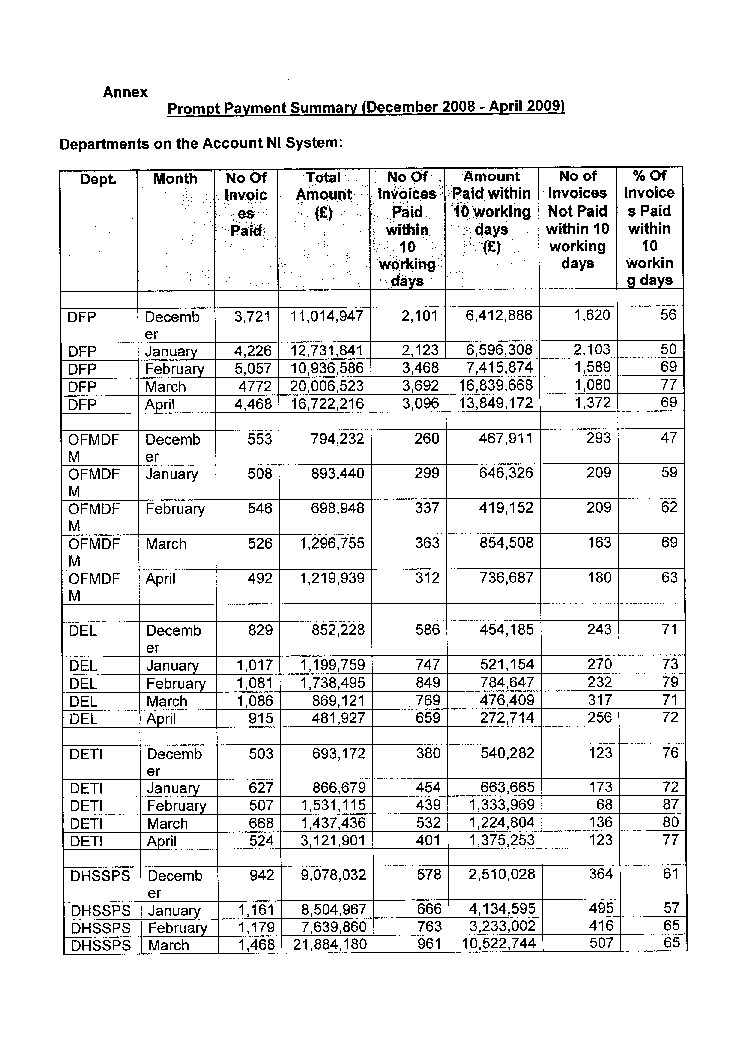

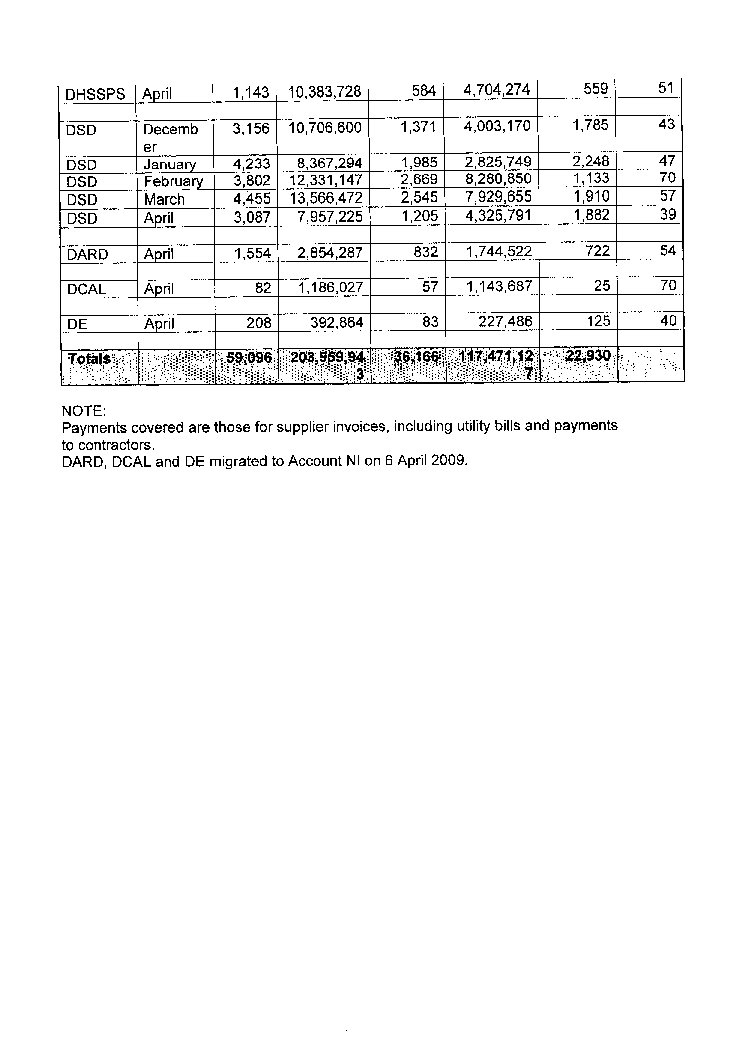

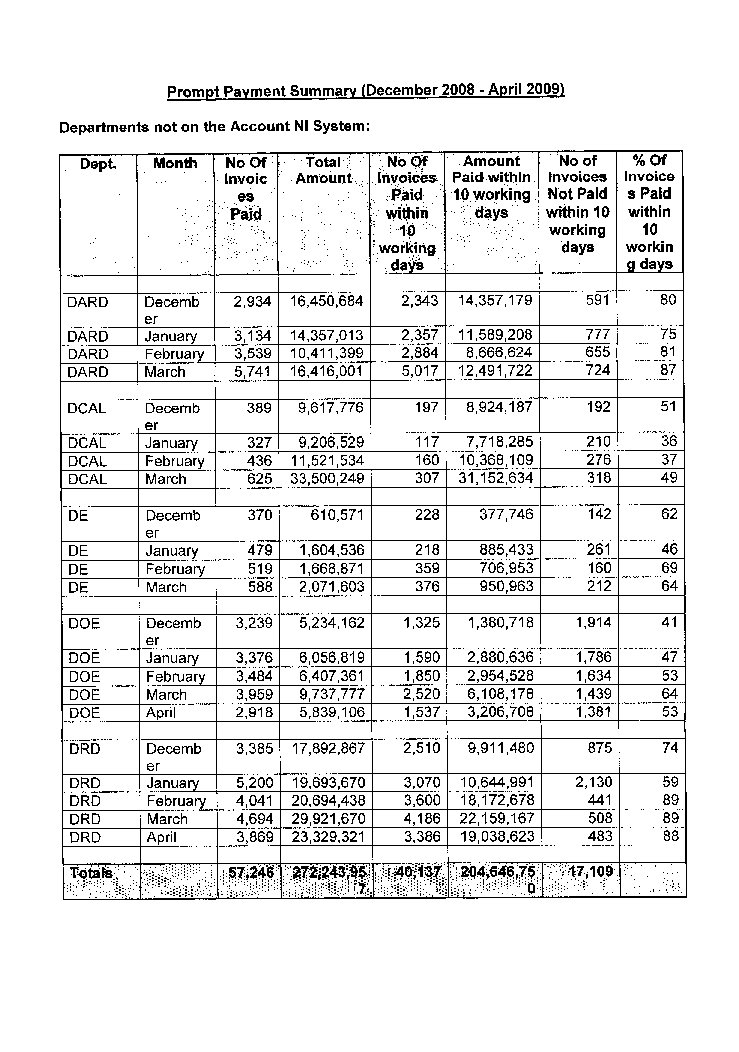

- The IoD state that, following the announcement that public sector invoices would be paid within 10 days of receipt, there is no indication of whether this target is being met. They asked the Committee for Enterprise, Trade & Investment to seek confirmation that public sector payment was being made more quickly. In response to this, the Committee obtained figures from all Government departments. This is at Appendix 3. The FSB believes that there should be a full (but swift) review of the public procurement system, including a relaxation of framework agreements where feasible to enable access to government contracts by small firms.

Tourism

- The Northern Ireland Tourist Board (NITB) report that hotels, guesthouses and B&Bs expect a broadly negative impact as a result of the economic downturn. Some self-catering establishments expect an improvement. Car hire and coach operators expect a decline. However, attraction operators are more positive as the outlook for closer to home markets remains strong. It is expected that Northern Ireland tourism will be impacted by a decline in visitors to the RoI. There are indications of an expected increase in revenue from the domestic market, with fewer people from Northern Ireland expected to take a foreign holiday. During 2008-09 NITB invested heavily in marketing Northern Ireland within the RoI. The RoI is the only main market area to record growth in visitors in 2008. NITB will focus it efforts targeting holiday visitors domestically and in the RoI during 2009. NITB reports that it is maximising the advantage of current exchange rates with the Euro.

- Both NITB and TIL state that the expected 13% reduction in direct access to Northern Ireland from GB presents a real challenge to growth in tourism. The business travel sector is estimated to have declined by 7% during 2008. Evidence from the GB market suggests that when holidaying at home, people from GB do not consider Northern Ireland because of the lack of awareness around Northern Ireland as being in the Sterling zone. NITB further state that:

“The current positioning of Northern Ireland in the context of the island of Ireland appears to be preventing Northern Ireland from capitalising on any potential value because awareness is now so low in the market.”

- Tourism Ireland predicts that, in 2009 visitor numbers to Northern Ireland are expected to decline by between 3% and 8% and revenue is expected to decline by between 4% and 14%. Northern Ireland is expected to benefit as a tourism economy however it is stated that the 13% decline in access to Northern Ireland from GB may dampen the benefit.

- In relation to exchange rates, it is stated that sterling has deterioriated by 19% against the Euro since November 2008 and that this is expected to have a significant effect on travel and should encourage holiday makers to either holiday domestically or in non-Eurozone destinations.

- In relation to competition, it is stated that non-Eurozone destinations are engaging in significant tactical advertising.

- Tourism Ireland intends to spend 66% of its marketing budget during the first half of the year.

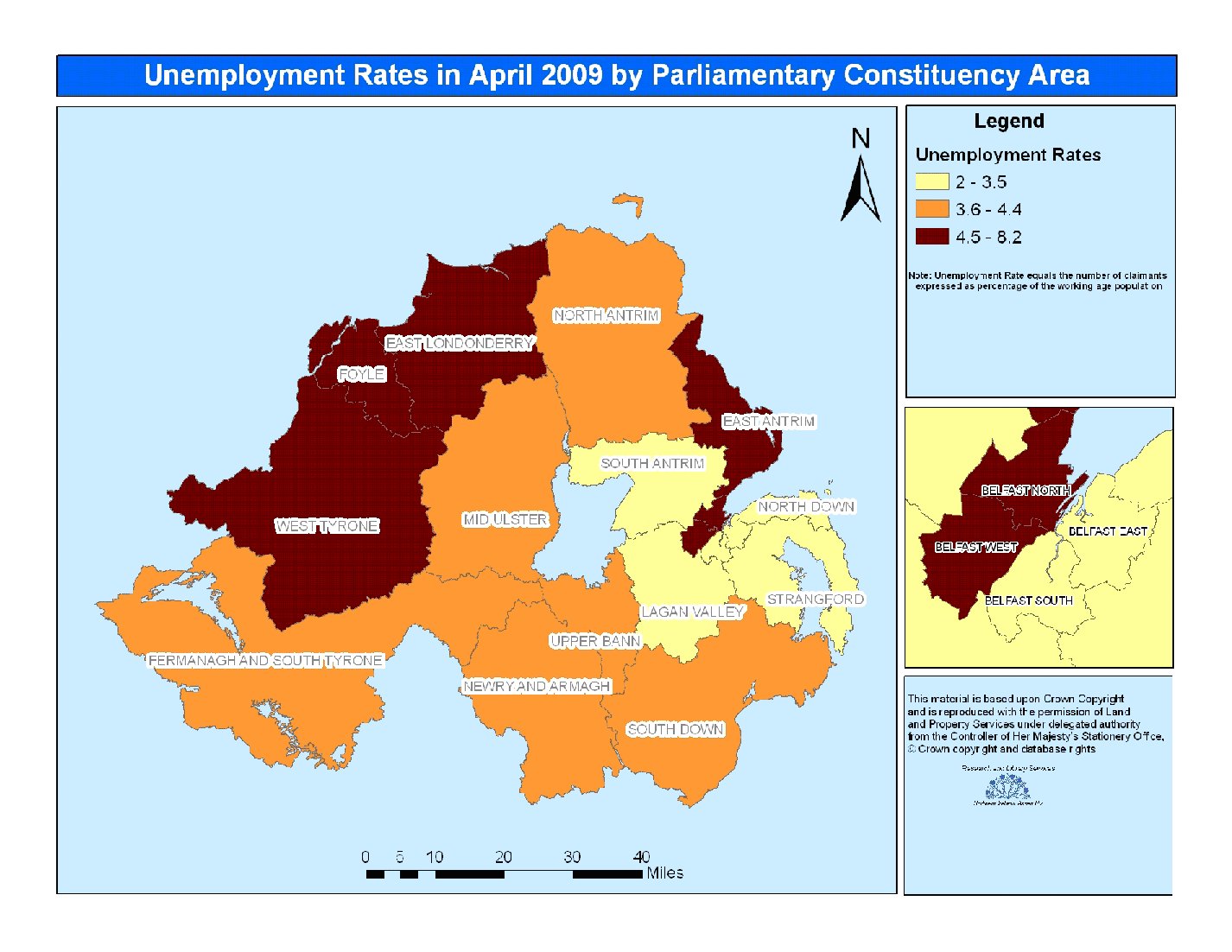

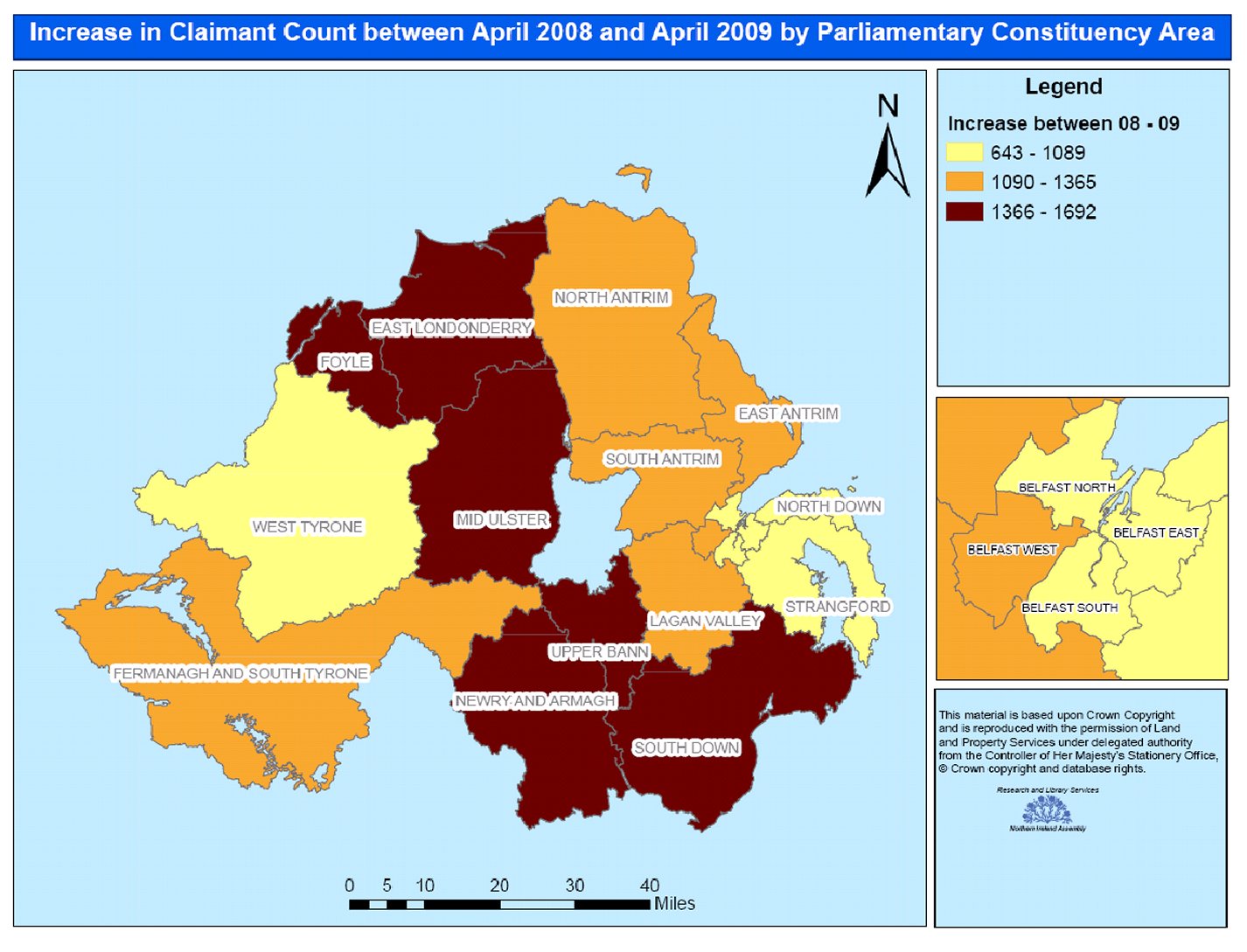

Latest Labour Market Figures

- Figures released on 17 th June 2009 recorded a third successive quarterly fall in the number of Northern Ireland jobs and a further rise in unemployment levels.

- The Northern Ireland seasonally adjusted unemployment rate, as measured by the Labour Force Survey, was estimated at 6.2% for the period February to April 2009. This represented an increase from the rate of 5.7% recorded in the previous quarter and was also up from the rate of 4.0% recorded in the same period one year ago. However, the Northern Ireland unemployment rate remained below the UK average (7.2%) and was also lower than the European Union (8.3%) and Republic of Ireland (10.6%) rates for March 2009.

- The more recent claimant count measure of unemployment stood at 48,000 in May 2009, with the number of claimants having increased by 1,900 over the month. While this is the smallest rise in the last seven months, the increase in the previous month was broadly similar (2,000). Over the year to May 2009, the number of unemployed claimants in Northern Ireland has increased by 23,100 (92.8%), which is slightly higher than the equivalent UK increase (88.7%). Just over half of the annual increase (58% or 13,300) in Northern Ireland has occurred in the last 6 months.

- Seasonal adjusted estimates from the Quarterly Employment Survey showed that there were 715,050 employee jobs filled in March 2009. This represented an estimated net decrease of 6,220 over the quarter and a fall of 19,030 over the year. The decrease over the quarter was driven by falls in Service sector (-2,770), Manufacturing sector (-1,790) and Construction sector jobs (-1,520). This was the third successive quarterly decrease in the seasonally adjusted employee jobs (employee jobs decreased by 6,500 over the previous quarterly period).

- The seasonally adjusted number of working age persons that were economically inactive increased by an estimated 14,000 over the quarter and the corresponding working age economic inactivity rate increased to 29.0% (in February – April 2009). The Northern Ireland inactivity rate remained considerably higher than the UK average rate (20.8%) and was the highest of the UK regions.

- The Department was notified of 321 confirmed redundancies6-8 which took place in May 2009. This compares to 545 in April 2009 and 155 in May 2008. There has been a 156% increase in the number of confirmed redundancies over the last year to 31st May 2009 – 4,433 compared to 1,735 in the previous year.

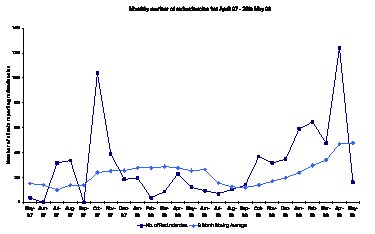

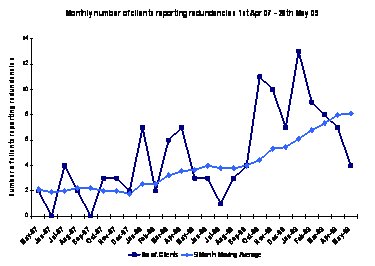

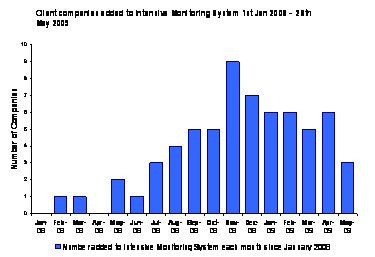

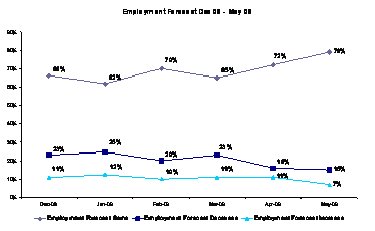

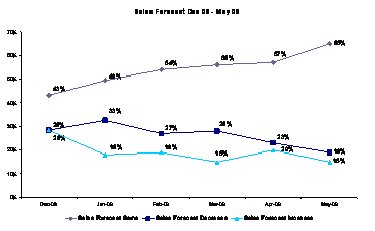

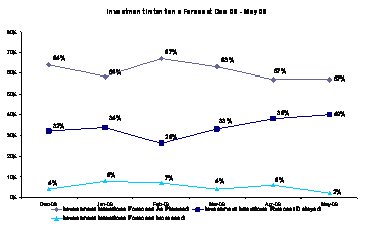

Invest NI Client Performance

- The Invest NI Client Performance Bulletin – May 2009 is at Appendix 4. The bulletin provides an overview of the impact of the downturn on Invest NI clients. It deals with redundancies, client monitoring, employment forecasts, sales forecasts and investment intentions of client companies.

Evidence From Other Statutory Committees

Committee for Agriculture & Rural Development

- The Committee for Agriculture and Rural Development has had a number of discussions with regards to this matter and would emphasis the negative impact the economic downturn is having in respect of the agricultural industry, in particular the following matters:

Dairy Sector

- The economic downturn has contributed to extreme conditions being faced by the dairy sector. This has culminated in the cost of producing a litre of milk being some 6p per litre more than the price being received at auction. The Committee has been successful in lobbying the European Commission to intervene in the form of re-introduction of export refunds. However, this is a short-term solution and longer term action is required to support this vital industry.

Marketing and Processing

- The Northern Ireland Rural Development Programme (NIRDP) has a number of measures aimed at Marketing and Processing and has committed upwards of £20 million towards these. However, the economic downturn has resulted in farm and other agricultural businesses being reluctant to invest monies into these areas, focussing on keeping their core businesses profitable. This is evident in other schemes on offer in the NIRDP such as the Woodland Grants Schemes. The Committee for Agriculture and Rural Development has called on the Department to reallocate monies from within these areas to the Farm Modernisation Programme.

Committee of the Environment

- The Committee for the Environment was briefed by on the economic downturn in the construction industry by representatives of the Construction Industry Group NI (CIGNI) at its meeting on 22 January.

- The main points of the briefing were:

- At the end of November 2008 there were 8,200 construction workers claiming unemployment benefits. This is an increase of 90% since November 2007.

- Since the start of 2008 alone, an additional 3000 construction workers are claiming Jobseekers Allowance.

- During October CIGNI had projected that the number of construction workers claiming unemployment benefit would rise to over 10,000 by the summer of 2009. Following the significant acceleration in the number claiming benefits in November they now anticipate that the 10,000 mark will be reached by the end of February or sooner.

- The figures for Jobseekers claims do not reveal the true extent of unemployment within the industry – some are self employed and have taken on other jobs whilst some are foreign nationals and have returned home.

- The industry estimates there may be 2000 construction jobs being lost each month.

- NHBC (National House-Building Council) registrations of housing starts are down 61% over the past 12 months

- The Construction Employers Federation (CEF) published ‘Review of Planning Processes in Northern Ireland” and has lobbied intensively for fundamental reform to the planning system for many years.

- The industry welcomes recent commitments to bring forward a number of measures to improve the system. It is now essential that these commitments are implemented on the ground as Government intervention is crucial.

- CIGNI is continuing to work with the Northern Ireland Environment Agency on implementation of the Better Regulation programme with particular emphasis on waste and recycling issues which could help the industry. Of particular note is the work on developing quality protocols for topsoil, asphalt planning and recovered oil.

- The Committee has also recently asked the Department of the Environment to reconsider their plans to introduce legislation and schemes which would raise or introduce fees. These include:

- Amended draft determination of fees for entertainments licences

- Waste Management Charging Scheme

- Introduction of application fees and annual subsistence charges for abstraction and impoundment licensing

- SL1 – European Whole Vehicle Type Approval – Individual Vehicle Approval Fees Legislation

- Increase to annual charge in respect of Water Order consents to discharge that are subject to monitoring

- Proposed increases in charges under the Pollution Prevention and Control (PPC) and Radioactive Substances (RAS) charging schemes

- The Planning (Fees) (Amendment) Regulations (NI) 2009

- The Committee is particularly concerned about the Department’s proposals to increase planning fees by 20% and has asked the Minister to reconsider all the proposals in light of the current economic climate.

Committee for Regional Development

- On a number of occasions in the past year, the Committee for Regional Development received written and oral briefing from organisations such as the Quarry Products Association. Specifically, on 12 November 2008, Members heard from the Construction Industry Group on the impact of the economic downturn on the construction and roads maintenance sector in Northern Ireland, and in January 2009, considered proposals from the Quarry Products Association to bring forward planned work from 2009/10 into 2008/09 to support the industry, and the barrier to these proposals posed by the current accounting rules. In response, the Committee wrote to the Minister for Regional Development and the Committee for Finance and Personnel, seeking a solution to the accounting rules problem and expressing its support for Ministers in working together creatively to find budgetary and other solutions to bring forward roads maintenance work.

- The Committee for Regional Development also held a concurrent meeting with the Committee for Finance and Personnel, on 18 February 2009, to hear an oral pre-briefing on a research paper produced by the Economic Research Institute for Northern Ireland entitled Mitigating the Recession: Options for the Northern Ireland Executive. Among other issues, this report looked at ways of freeing up or accelerating spend to maintain employment in the construction sector. A copy of this report is available on www.erini.ac.uk/dsp_publications.cfm/publication_key/2203/ .

Committee for the Office of the First Minister & deputy First Minister

- The Committee have concerns regarding the impact that the economic downturn will have in relation to meeting targets in tackling child poverty, specifically one of the action areas is getting lone parents and other parents into the workplace which is made more difficult as a result of the economic downturn.

- In relation to the Investment Strategy, the Committee for the Office of the First Minister and deputy First Minister have taken evidence from the Federation of Small Businesses who raised concerns regarding the problems small businesses are having in accessing procurement contracts particularly in the current economic climate.

- Also in relation to the Investment Strategy, the Committee for the Office of the First Minister and deputy First Minister consider that getting big projects up and running for example Maze/Long Kesh would help to reinvigorate the economy.

Committee for Health, Social Services & Public Safety

- On Thursday 29 January 2009 the Committee met informally with the Construction Industry Group Northern Ireland, an umbrella group incorporating groups covering all aspects of the Construction Industry. The Construction Industry Group outlined proposals in the health sector that could help to alleviate the unprecedented levels of unemployment in the construction industry. These were:

- New Healthcare Projects – Representatives from CIG explained that while £3 billion may have been set aside for healthcare facilities, the size and complexity of the projects alongside long lead-in times means that a large proportion of this sum can be used up on just a few projects.

- Land Sale – The CIG discussed the current position regarding the sale of land and in particular the site at the Belvoir Park Hospital. It was stated that originally it had been envisaged that the revenue from the sale of this land would be part of the block budget but due to the current economic climate this was unlikely to happen leaving a potential deficit in funding for capital projects.

- Health Estate Projects – The CIG hold the view that many health facilities in ‘dire need of repair’ could quickly be brought up to minimum standards if revenue funds can be allocated.

- The Committee subsequently raised these concerns with the Minister for Health Social Services & Public Safety and with the Office of the First and deputy First Ministers.

Committee for Education

- The capital allocation for the Education Sector this year amounts to over £250 million which will be used to help progress around 100 approved major works projects as identified in the department’s Investment Delivery Plan plus support a number of minor works projects across the sector. This will represent a significant flow of work for the construction industry in the coming year.

- Also, an additional £5 million will be made available, in year, to supplement existing levels of planned investment for maintenance of the education estate.

- In addition to the above, the Minister has also provided funding to extend the current Clothing Allowances Scheme to cover primary school children as well as those in post‑primary schools (see paragraph 5 (v) above for further details). These resources have been provided in recognition of the hardship facing parents at this time and will help those in the community with young families who struggle to meet the cost of basic everyday needs, such as the cost of school uniforms.

- Schools Maintenance (£14.8 million) – due to other pressures, such as increased energy and utility costs, Education and Library Boardss have been unable to set aside adequate funding to make a significant impact on the level of backlog maintenance in each Board area. The extent of maintenance backlog in schools is significant and failure to address this will compound the problem through further deterioration of the education estate. Any resources secured, would be additional to the £5 million set aside in the recent budget process and would provide a small measure to address immediate maintenance works. Funding for maintenance would align with the overall objective of supporting the economy in this period of economic downturn by providing additional support for the construction industry.

Committee for Employment & Learning

- From the beginning of this Assembly session I September 2008, it has been apparent to the Committee that what started as an ‘economic downturn’ was turning into something rather more. In September/October 2008, the Committee took evidence from stakeholders on the downturn in the in the construction industry. The Committee understands that this industry tends to be a harbinger of the future of the economy generally. By the third quarter of 2008, the construction industry was clearly in trouble with housing building grinding to a house and many other building projects being moth-balled. The Committee realised that a significant way to stimulate the economy would be pushing ahead with public capital investment projects. To that end the Committee wrote to all Executive Ministers in the final quarter of 2008 asking them to outline what capital investment projects their departments were due to undertake in the next year to 18 months. The Committee advocated that Ministers assess which of these projects could be brought forward and that these should be started as soon as possible. Other Committees supported this initiative, with the OFMdFM Committee writing a similar letter to Executive Ministers a few weeks later.

- A further consequence of the downturn in the construction industry has been the redundancy of hundreds of apprentices in this sector. The downturn’s movement into a recession precipitated the redundancy of dozens of apprentices across a number of industries. The Committee’s actions prompted the Employment and Learning Minister to announce contingencies to help apprentices in the construction, automotive and engineering manufacturing industries in October 2008. This prompted the Committee to undertake an Inquiry into the way forward for apprenticeships, with a particular focus on how to give apprenticeships greater ‘recession proofing’. The debate on the report is scheduled for 22nd June. The Committee’s lobbying in this area caused the Minister to announce a training allowance scheme aimed at the engineering manufacturing sector in May 2009. This ‘Skillsafe’ scheme is aimed at helping employers to fund training for apprentices or other workers that have been put on short-time.

- The Inquiry has been a part of the Committee’s wider strategy of using every platform to emphasise to employers that the downturn is a key time to continue investing in skills and training so that they are in a position to benefit when the upturn comes and new industries emerge in a restructured global economy. During this Assembly session the Committee has also lobbied the Department of Finance and Personnel to ensure that funding for upskilling and reskilling programmes managed by DEL are prioritised in any budget exercises as a way of building the local economy skillbase for the upturn when it comes.

Committee for Culture, Arts & Leisure

- In January 2009, the Culture, Arts and Leisure Committee began its inquiry into funding of the arts in Northern Ireland. The Committee took and is still taking evidence from a range of stakeholders including the Arts Council, professional arts organisations and community/voluntary based arts organisations.

- During the evidence sessions, witnesses highlighted the impact of the economic downturn on the funding available to the arts, from both the public and private sectors. For example, it is becoming increasingly challenging to attract private sponsorship for arts events as businesses are cutting back on this kind of expenditure at present. Similarly, the economic climate puts greater demands on the public purse, and there is the perception that funding for the arts may suffer because of this.

Committee for Finance & Personnel

- On 24 September 2009, the Committee heard evidence from the Construction Industry Forum for Northern Ireland, on the Forum’s role to alleviate the slowdown in the construction industry.

- The Committee’s ongoing inquiry into public procurement policy and practice in Northern Ireland is focusing on the options for maximising the involvement of local Small and Medium Enterprises and Social Economy Enterprises in public contracts, with the ultimate aim of realising additional economic and social benefits from the public procurement process in NI. To date, the Committee has received 35 written submissions and is in the process of taking oral evidence from a wide range of stakeholders.

- The Committee has taken evidence from DFP officials on progress in 2008/09 on the Department’s Investment Delivery Plan and, on 1 April 2009, took evidence from both DFP officials and the Chief Executive of the Strategic Investment Board on the various options available for financing the Investment Strategy for NI (ISNI) which will have a major impact on the local construction industry.

- The Committee has continued to monitor the development of a Regional Economic Strategy for NI and the implications for local businesses from the recommendations in the Varney Review of NI’s competitiveness.

- Representatives from the British Bankers’ Association and from the main local banks gave evidence to the Committee on 14 January 2009 on the role of their organisations in alleviating the downturn. A further session with these banks has been arranged for 17 June 2009, together with evidence from a number of Northern Ireland’s other mortgage lenders. Prior to this , on 10 June 2009, the Committee will take evidence from the Institute of Directors on its recent survey of NI businesses’ experience of accessing finance from the local banks.

- The Committee held a concurrent meeting with the Committee for Regional Development on 18 February 2009, to take evidence from the Economic Research Institute of Northern Ireland on Mitigating the Recession.

- The Committee has previously offered its support for DFP’s proposal to introduce a Small Business Rate Relief scheme and a briefing on the outcome of the public consultation on the integrated impact assessment for the proposal, has been provisionally arranged prior to summer recess.

- The Official Report of these evidence sessions is available on the Committee’s web pages.

Committee for Social Development

- The Committee received a briefing from the Construction Employers Federation on 11 December 2008 in relation to the economic downturn and considered the following points:

- Unemployment in the construction industry (which was at that time estimated at around 8,000) was accelerating and was possibly being masked by factors including emigration and reduced working hours;

- The downturn was adversely affecting apprenticeships in the construction industry;

- Total workload in the construction industry was low owing to a decline in new housing starts;

- Construction costs – energy, transport and raw materials – were reportedly increasing;

- The construction industry was calling for capital projects to be brought forward by the Executive;

- Under-spending and discontinuity of funding was exacerbating the difficulties facing the construction industry; and

- Unsold housing stock was slowing the recovery of the domestic housing marke

- The Committee supported the view that targeted, affordable efforts should be made to stimulate the construction industry during the downturn. The Committee indicated that the social housing programme together with housing refurbishment and maintenance programmes represent a good investment for the Executive both in respect of the immediate economic and employment benefits and the longer term gains for individuals, families and communities of more and better social housing. Nonetheless, the Committee recognised the difficult budgetary position that the Executive is experiencing and called on stakeholders to work together constructively to explore alternative financing solutions for social housing and new ways in which to ease other difficulties relating to the downturn.

Suggestions from the Business Sector on how Government can Assist

Additional ideas and suggestions

- Many of the organisations which engaged with the Committee presented ideas and made suggestions for steps which could be taken by Government to assist business during the economic downturn. This section provides details of those ideas and suggestions.

Institute of Directors

- Key messages from the Institute of Directors to the Committee are:

- The IoD commends the recommendations of the Economic Development Forum’s priority actions report to the Committee.

- The focus for the Assembly must be on maintaining employment.

- During this time of economic downturn, all organisations, whether in the public, private or voluntary sectors must be encouraged to invest in skills, R&D, innovation and making themselves more efficient to enable them to come out of the recession in as strong a position as possible.

- Our politicians need to show their understanding of the impact of the economy on all other aspects of the community and to ensure that their decisions are ‘economy proofed’.

- Decisions should be taken to bring forward public investment projects to support the construction sector and thereby secure jobs in other sectors.

- The IoD also recommends a number of specific actions to assist the economy during the downturn. These are outlined below.

- Planning: Evidence shows that while some planning applications are being processed more quickly, the Planning Service itself does not acknowledge the part it has to play in supporting the central economic priority of the Programme for Government. The Committee should urge the Environment Minister to do more to change the culture within Planning Service and to speed up the decision making process on projects that have the potential to create substantial construction jobs with private sector investment.

- Faster public sector payment: The Committee should seek evidence that this is actually happening.

- Capital spend: The Committee should call for capital projects to be brought to market as soon as possible to create jobs and infrastructure (Departmental core capital expenditure projects – schools, roads, etc – and Olympic facilities, regeneration sites, etc) even if these fall outwith the responsibility of DETI. The impact of the state of the construction sector on the whole economy requires the ETI Committee to urge the relevant Ministers to prioritise maintenance spending on roads, schools, hospitals, etc before the year end and to increase maintenance budgets into 2009-10.

- Assembly decisions: With current financial constraints and continuing pressure on the Northern Ireland budget from Treasury, politicians need to make sure that their decisions are ‘economy proofed’ – for example, free prescriptions for all rather than to those in real need, and the fuel poverty package that provides financial assistance rather than increasing grants to make homes more fuel efficient or working with the energy suppliers to organise credits at a better rate. Economy proofing also applies to legislation that might add to the bureaucratic and cost burden of firms including such proposals as the extension of holiday entitlement.

- Executive: The Committee should demand of the Executive a weekly update on what actions it is taking to address the economic situation. We would like to see the economy as an Executive agenda item at every meeting. IoD has called for a champion for the economy to ensure that all parts of government take their role in support the economy seriously.

- Tourism: The Northern Ireland Tourist Board should be supported and encouraged to market itself more aggressively while sterling exchange rates make Northern Ireland a more affordable tourism destination. This will require co-ordinated action across DETI, DRD and DEL,

- Energy: Capital support for investment in energy efficiency and cost effective renewables would be valuable in helping to leverage private investment. The public sector can lead by example in energy efficiency.

- Research & Development: The Committee should support the provision of funding to take forward the MATRIX recommendations and, in particular, to exploit the potential of the renewables sector.

- Skills: Again this is outside the Department’s remit but this is a god time to make investment in re-skilling and up-skilling the current workforce and the wider labour-force including those in leadership and management positions and to communicate what support is available. The Committee could encourage the Minister to support internship schemes for graduates.

- Banks: Local banks should be encouraged to utilise the Enterprise Finance Guarantee Scheme and Working Capital Scheme, which are available to support businesses. Since many banks now have received considerable public funding, the Committee should monitor whether the banks are providing the necessary funding to support viable projects/companies in the private sector. The executive needs to ensure that sufficient funding is available for Northern Ireland SME's and homebuyers. Actions are being taken by the headquarters of the big 4 local banks that will help their economy e.g. AIB and BoI in RoI increase lending capacity to small to medium enterprises by 10% and provide an additional 30% capacity for lending to first time buyers in 2009 as part of their recapitalisation package. We need to ensure that Northern Ireland is not left behind.

- Increased funding: The Executive could consider ways of increasing funding e.g. increased borrowing or creating a Northern Ireland Investment Bond, managed by local banks, to attract local savers by offering a better interest rate than is available commercially and using the income to increase public investment.

- The Institute believes that the Programme for Government and our own 1.7 Challenge still represent a way forward for Northern Ireland in spite of the current economic situation. We would urge the Committee to challenge and monitor progress on the objectives in the Programme for Government.

CBI Presentation

- The CBI suggested that SMEs could benefit from a ‘buddying up’ scheme where top 100 NI companies provide support to about four SMEs each to assist them during this time.

- It was suggested that tourism sector could benefit from the tourism marketing budget being increased or even doubled to ensure that Northern Ireland takes advantage of the current weak sterling rate to attract more tourists to the region.

- It was suggested that Government should take a longer term view. They believe that education should be more focused to ensure that they are in a position to deliver the skills that business need 3-5 years down the line. It was also suggested that there is a need to focus Sector Skills Councils to engage with SMEs.

- Further support for SMEs could be given through the DETI Enterprise Strategy proposal to support SMEs through the 13 Councils.

- The CBI also outlined the need to for Government to invest more in research and development.

North West Marketing Meeting

- It was felt that with a small export drive NI business could weather the storm – this was considered an urgent necessity if business is to survive and succeed during the economic downturn.

- Need to market NI better during the window of opportunity which currently exists with the weak sterling was suggested but it was stated that there is a need for funding in order to support such an initiative.

- It was stated that SMEs need additional support for start-up. This related to the removal of grant support for start-up businesses. It was felt that selective grant support is needed for SMEs.

- It was stated that, with RPA, there currently exists an opportunity for all stakeholders, including those from Government, business and business representative bodies to work together to get a seamless package of support in place to assist business at local and regional level.

- It was felt that the 10-day target for the payment of Government invoices was not being adhered to or enforced by Government. In response to this statement, the Committee requested statistics from DFP on output against targets for each Government Department. This information is at Appendix 3 and has been copied to other statutory committees for information.

- It was also suggested that failed businesses needed support to wind down.

Construction Employers’ Federation Written Briefing

- Open the debate about how all Executive Ministers, both individually and collectively, can make savings in order to allow a redistribution of funds into the building and maintaining of our infrastructure – housing, schools, hospitals, roads and water infrastructure etc.

- Ensure that each Government Construction Client’s budgeted construction spend for 2009/10, both capital and revenue, is published before the start of the next financial year.

- Highlight to all Government Departments that lowest price does not equate to best value for money in the procurement process.

NICVA Written Briefing

- Government should also consider how it can help the voluntary and community sector cope with the recession at least as well as in England. Many voluntary and community organisations will be the innovators in the recession and many organisations will find a huge surge of demand on their services caused by the recession itself. At the very least funding relationships have to be dynamic, decisions delivered early to allow for planning that can make best use of available resources and funding tranches whether contracted or grant supported need a 10 day turn around as in England. It is unlikely the banks, even for a fee, will fund the gap whilst organisations wait on payments.

- There is the need for a modernisation and resilience fund package that helps good organisations prepare for change. Government needs to plan and involve organisations in the key areas that demand is expected to rise: advice services; mental heath; labour market; and housing related issues to highlight a few.

- But most of all we need to move more quickly and strategically while time is still on our side. Inaction or simply waiting to see what will happen is likely to result in more organisational damage than need be the case. A realistic assessment of the situation by Government and the voluntary and community sector can lead to a strategic response and individual actions by organisations to make themselves more resilient to the fallout of the recession.

Northern Ireland Independent Retail Trade Association

- There needs to have ‘economy proofing’ of decisions in all Government departments and a more joined up approach to Government.

- Multiples should be in towns, not out of town as out of town developments result in a decline in business in town centres.

- NITB should work more closely –start a dialogue with the independent retail sector and see where the sector can fit into its plans for tourism in the region.

- There should be a DETI official in charge of each sector. For example, retailing, manufacturing, etc. There should be a single point of contact in DETI for the sector. There is a different way of working with the independent retail sector as it is different to other sectors.

- The Innovation agenda is very important. It is very high in the independent retail sector. It should not be slowed down due to the economic downturn.

Federation of Small Businesses

- A full review of the recently introduced finance schemes, such as the Enterprise Finance Guarantee Scheme, should be carried out. This should include an assessment of the number of loans applied for, the number approved, and of which banks are actually providing them. This review should determine how successful the schemes are, and what measures are needed to improve access for local firms

- Investigate and challenge the issue of trade credit insurance for small businesses. This has so far gone largely unhighlighted but is a significant problem for local SMEs.

- Introduce and promote a targeted support programme for businesses encouraging greater energy efficiency, to include incentives and tailored advice.

- Drive forward the recommendations made in the MATRIX panel report, to make Northern Ireland the Centre of Excellence for green technologies, agri-food, IT development, and pharmaceuticals.

- Action on up-skilling the workforce and increasing the supply of suitably qualified young people must be addressed urgently. There have been a variety of reviews and strategies developed, some of which are still ongoing – but practical action must now be taken to initiate real programmes to take these forward.

- Put a freeze on any further regulations being imposed on small businesses for a period of two years.

Northern Ireland Manufacturing

- Need continued focus on the release of Government Capital Projects to benefit construction sector and save jobs.

- Prompt decisions on projects to deal with the disposal of by products in poultry/food industry such as Rose Energy proposal for biomass energy.

- Good examples are One North-East and Scotland where they are tackling renewable energy opportunities to create centres of excellence and incentives for companies to develop in this area.

Almac Visit

- If we can get the three parts working well together (Education, E&L and ETI) it could be a blueprint for how things should be done.

- The role of STEM champion is a full-time job.

Ulster Community Investment Trust

- Over the next 10 years UCIT will require a minimum of £20m in new capital to meet the growing demand for loan finance from the social economy in Northern Ireland. This level of investment is needed to improve the availability of finance for commercially viable social enterprises that are well placed to expand their operations, create and retain jobs, deliver more public services, and ultimately reduce poverty and promote community cohesion.

Proposal – Banks Lend to UCIT to Support Social Economy

- UCIT is seeking the support of the four main local banks, including: Ulster Bank; Northern Bank; Bank of Ireland; and First Trust Bank to lend UCIT £2 million per annum over 10 years to help increase the availability of loan finance to the social economy. The key features of our proposal are set out below:

- No risk to banks as UCIT would accept all liability for borrowed funds, which would be used to on-lend to the social economy. UCIT has nearly ten years experience in social lending and investing public funds, a strong balance sheet and more than £15 million in assets.

- A portion of the £2 million invested annually by the banks into UCIT for on-lending into the social economy would qualify for tax relief up to 5% per annum over 5 years.

- To ensure that this capital remains affordable for borrowers in the social economy, a subsidised rate would have to be applied to the banks’ loan to UCIT. This is critical, because charging the full cost of funds would result in an unacceptable price for social enterprises borrowing from UCIT.

- We estimate that if each of the four local banks invests £500,000 per annum, they would incur a small cost which is likely to be off-set by tax relief provided to the banks under the Community Investment Tax Relief scheme.

- UCIT would on-lend funds to social enterprises at BoE base rate + up to 2% (or a minimum base rate of 3% + up to 2% when the BoE is lower)

- UCIT would agree to repay the original capital and interest on a monthly basis over a term of 10 years with no risk of default. Any defaults by social enterprises are a matter for UCIT.

- By applying a subsidised rate, UCIT is trying to strike a balance between the needs of:

- UCIT – which needs to make funds available at affordable rates and generate income to cover incremental costs and bad debts

- Banks – who can provide funds to discharge their Corporate Social Responsibility at a subsidised but reasonable rate

- Social Enterprise Borrowers – who require access to finance at affordable rates

Benefits to Local Banking Sector

- By lending to UCIT to support the social economy, local banks would:

- Support the Northern Ireland Executive’s work with UCIT to help grow the social economy – generating goodwill

- Make social finance more readily available to borrowers without the need for banks to take on any risk

- Enhance their Corporate Social Responsibility. As part of UCIT’s communications strategy we would brand bank funds to demonstrate their support for social enterprises in local communities across Northern Ireland

- Mitigate further calls for ‘gift’ funding from the sector

Evidence of Similar Schemes

Republic of Ireland

- In February 2007, the Irish Government announced the establishment of an independent Social Finance Foundation (SFF) with €25m in seed funding secured from the Irish banking sector. SFF acts as a wholesale supplier of investment finance for on-lending by 5 accredited social finance providers, including UCIT ( Ireland).

- Launching the initiative, the former Minister for Finance, Brian Cowan acknowledged that social enterprises ‘have the potential to yield significant economic and social returns but often experience difficulties in accessing finance from mainstream financial institutions’.

- In March 2008, the Social Finance Foundation reached agreement with the banking sector to borrow an additional €6 million per annum over the next 12 years at a subsidised rate. As a result, the Irish banking sector will use SFF to invest €97 million (approx. £88 million) into the social economy in the Republic of Ireland over the next 12 years.

United States

- The Community Reinvestment Act (CRA) was introduced in 1977 to compel banks to provide financial services in so-called ‘red-lined’ disadvantaged communities, where they previously refused to lend. The Act has encouraged banks to partner with intermediaries such as Community Development Finance Institutions (CDFIs) who offer financial services in these communities.

- Banks’ support of the US CDFI sector was cemented following a 1995 amendment to the Act which made investing in a CDFI an accredited activity.

Great Britain

- In the UK, it was originally envisaged that the banking sector would be a natural ally of CDFIs in terms of funding, investment and referrals. Much progress has been made and a number of banks work very closely with the sector. However, partnerships can be developed further, building on the concept of the US Community Reinvestment Act.

- UCIT fully supports the Community Development Finance Association (CDFA) intention to work with representatives from the banking sector, the Department of Business, Enterprise and Regulatory Reform and the Treasury to form a ‘Partnership Group’ that will formally agree a ‘Community Finance Charter’ by the end of 2009 to ensure greater cooperation in the provision of finances to under-served communities.

Next Steps

- There is an urgency to reach agreement with the four main local banks to ensure that a minimum of £20m in new capital is made available to meet the demand for loan finance from the social economy in Northern Ireland over the next 10 years.

- UCIT has written to the four main local banks to request an opportunity to meet and discuss our proposal

- If the banks agree to our proposal, we will need to get a common loan agreement signed off by all of the banks

- UCIT would be keen to begin drawing down on funds in January 2010 at the latest

Existing Government Initiatives to Support Business

DETI Matrix of Financial Support Available to Business

- In May this year DETI made available a matrix of the types of financial support that have been made available to SMEs in order to help them through difficulties in relation to the economic downturn (Appendix 2). The matrix provides an overview of the main European, UK and NI schemes which have been introduced as a direct response to the economic downturn. Schemes listed in the matrix are:

- Working Capital Scheme, announced by BERR on 14 th January 2009 to provide working capital guarantees to banks;

- Enterprise Finance Guarantee Scheme, announced by BERR on 14 th January 2009 to provide guarantees of term loans (one to ten years) from banks to SMEs;

- Capital for Enterprise Fund, announced by BERR on 14 th January 2009 to provide support for the conversion of business debt to equity;

- Accelerated Support Fund, announced by Invest NI on 9 th December 2009 to provide grant support for projects against eligible vouched and approved expenditure;

- Trade Credit Insurance To-up Scheme, announced by BERR on 22 nd April to enable eligible businesses to purchase ‘top-up’ credit insurance cover;

- European Investment Bank Fund (EIB), announced by EU/European Investment Bank on 16 th December 2008 to provide EIB funding for term bank loans to SMEs;

- Business Payment Support Service, announced by HM Revenue and Customs in 2008 with further expansion announced on 22 nd April 2009 to enable business facing temporary financial difficulties to spread tax payments over a timetable they can afford and to offset tax payments where appropriate; and

- The Ulster Bank regional Fund for SMEs, announced by the Ulster Bank on 5 th February 2009 as a bank scheme to provide debt finance and provide business with access to other options to help manage their capital and cashflow.

Short Term Aid Scheme

- Announced by the Minister for Enterprise, Trade & Investment on 26th May 2009, the Short Term Aid Scheme is a £15 million scheme by Invest NI to help businesses during the current economic climate. The scheme commenced on 1st June 2009. The scheme will allow qualifying businesses in the manufacturing and tradable services sectors to receive support of up to approximately £450,000 at current exchange rates, to retain key staff while they plan and restructure for the future.

Skillsafe Scheme

- Announced by the Minister for Employment & Learning, the Skillsafe Scheme Skillsafe Scheme will make up to £6 million available for the training of apprentices who are on short-time working. The scheme commenced on 8th June 2009. Money for the scheme comes from DEL’s budget and from the European Social Fund. DEL will work with employers who have placed apprentices on short-time working and with the relevant training organisation to help to fill the apprentices’ downtime with accredited training that will contribute to their apprenticeship.

- The scheme will pay the apprentice a training allowance to offset the reduction in their pay caused by their being placed on short-time working. The scheme will also contribute to the additional training costs. The programme began with the manufacturing/engineering sector, but eligibility for the scheme will be kept under review with the aim of expanding it to other key sectors, subject to demand.

Appendix 1

Assembly Research and Library Service

Overview of the Recession

1 Introduction

The following paper traces the origins of the current recession from the sup-prime mortgage crisis in the US to the global freezing of money markets. The latter part of the paper looks at current global conditions and forecasts, as well as looking specifically at the current conditions in the Northern Ireland and the UK as a whole.

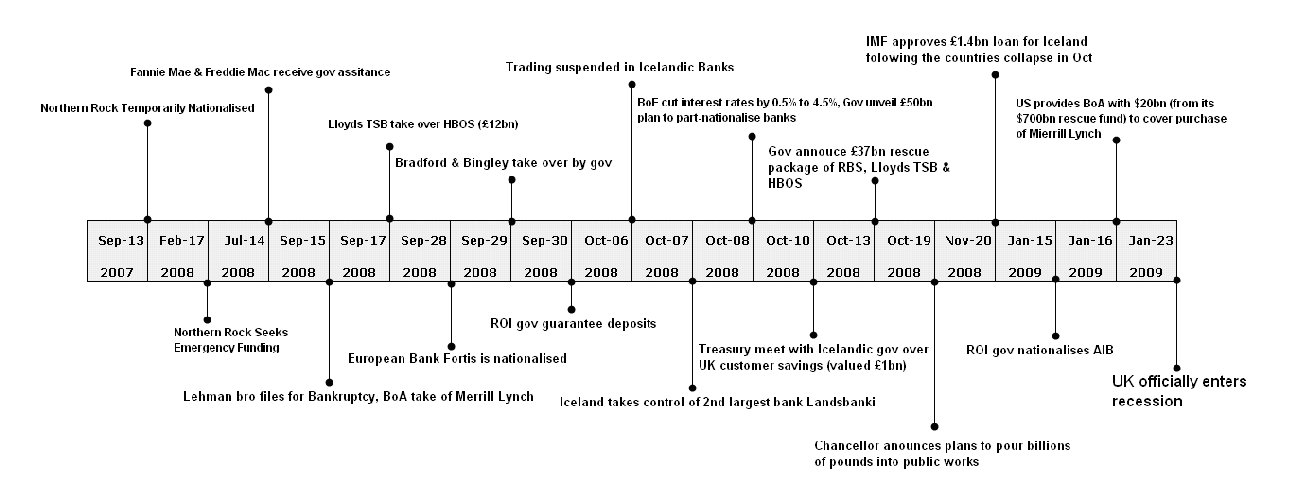

Further useful information is contained in the Annexes to the document, namely: Annex 1, which provides a timeline of events leading up to the UK’s announcement of recession; and Annexes 2-4 which present certain economic variables geographically for Northern Ireland.

2 Origins

Contemporary economic conditions, it is argued, have their foundation in the financial concept “originate and distribute”. Over the past two years global finance has witnessed a domino effect, which began with the sub-prime mortgage crisis and which led, ultimately, to a rapid drying up of money markets and recessionary conditions.1 As the Economist pointed out in January 2009:

“Over the past 22 months the shock has spread from American housing, sector by sector, economy by economy. Some markets have seized up; others are being pounded by volatility”.2

The US sup-prime mortgage crisis broke in August 20073, although some commentators argue the warnings signs were visible as early as December 2006.4 Sub-prime mortgages were typically sold to customers with poor credit histories and low incomes. The products sold were predominately adjustable rate mortgages (ARMs), linked to the federal interest rate.5 The sub-prime market grew substantially from 1997 to 2006, by which stage the total market was worth approximately $700 billion.6 ARMs were often sold at a two year fixed rate, which when it expired led to higher payments at a time when federal interest rates were also rising. The consequence was a spate of repossessions spreading through the US, exceeding 1.3m in 2008.7

Whilst bad in itself, had the sub-prime mortgage crisis occurred under traditional the model of mortgage lending it would have at least been localised. The reason the crisis had such a widespread impact on global economics lies in the “originate and distribute” model of mortgage lending.8 In the traditional mortgage model banks were required to finance their mortgage lending through customer deposits, this limited the amount they could lend.9 It also increased risk, as an IPPR example illustrates:

“In the old days, a bank might hold lots of mortgages from people living in a particular town. That would be quite risky, because if, for example, the local industry failed, the bank would be under pressure.”10

The adoption of the “originate and distribute” model was designed to spread this risk.11Within this model mortgages were sold initially as mortgage bonds, then repackaged as Collateralised Mortgage backed Obligations (CMOs) and Collateralised Debt Obligations (CDOs) and sold to investors. The idea was that everyone would be taking small bets, as numerous investors would own small parts of thousands of mortgages, and therefore the overall risk would be reduced.12

When the rate of defaults on sub-prime mortgages began to soar, investors in CMOs and CDOs realised they would not get the money back on their investments and would find it difficult to resell (despite the products been rated investment grade and therefore unlikely to default), this caused the CDO and CMO markets to implode. Investors in CMOs and CDOs had insured their investments against default, through Credit Default Swaps. As defaults increased, however, the amount of money owed in default insurance became so great that insurers worried about the ability to pay out.13 This had a further knock on as:

“At this stage, international wholesale money markets began to dry up rapidly as lenders became fearful of lending to one another as the scale of their exposure to toxic debt was unclear.”14

In other words, the global economy entered the credit crunch. There were further knock-on effects from the evaporation of credit. Concern over tightening credit conditions and losses from bad assets led to a questioning of the stability of major financial institutions. This ultimately led to the financial crisis of September 2008, the default of Lehman Brothers and numerous government interventions and bailouts in banks throughout the US and Europe. 15

According to the International Monetary Fund (IMF):

“Although a global meltdown was averted by determined fire-fighting efforts, this sharp escalation of financial stress battered the global economy through a range of channels”.16

The fallout from the banking crisis has been felt across the board. The credit crunch and the “breakdown of securitisation technology” hit borrowers and investors. The protracted deflation of the housing bubble and the decline of equity markets, whilst to an extent “inevitable” corrections, led to greatly reduced personal wealth. The scale of the crisis was so large that its impacts passed quickly to all sectors and all economies. Moreover, the crisis hit business and consumer confidence hard, with the latter’s reservations significantly evident in the decline of industrial production and consumer spending. Confidence, according to commentators, is returning to an extent, but job losses continue apace. 17

It is generally accepted that turmoil in housing and financial markets triggered the economic recession, through a series of inter-related crises. Some commentators, most notably those from the OECD and the Economist, are of the opinion that these declines were symptomatic of a much broader set of trends. In a paper presented to the G20, the OECD state for example:

“… the rapid process of globalisation over the past two decades can explain some of these features and has played a main role in both the run-up to and the propagation of the current crisis”.18

Globalisation or more specifically the globalisation of de-regulated free market capitalism, it is argued, created the context within which “freewheeling areas of modern finance” could prosper. The logical consequence of such an argument is that the financial markets must, to a greater or lesser degree, be re-regulated.19

A counter argument maintains that is was not de-regulation but mis-regulation (particularly of sub-prime mortgages in the US) which facilitated the crises.20 Economist Robin Blackburn further maintains that “financialization was born in a quite heavily regulated world” and asks whether “more and better regulation”, whilst necessary will be enough to counter the current problems. It should be added that Blackburn’s account of events still places emphasis upon the unregulated world of shadow finance.21

Irrespective of one’s position on the heavily political deregulation/regulation debate it is still possible to see the hand of globalisation in propagating the crisis. This is particularly evident in the manner in which the decline in world trade acted as a line of transmission “from countries directly affected by the financial crisis towards others, including emerging economies”.22

3 Current Picture

3.1 Global Conditions & Forecasts

The Ulster Bank’s Northern Ireland Economic Review (May 2009), which surveys a number of economic forecasts, predicts a -2.1% global contraction for 2009, with major regional contractions predicted to be as follows – US -2.7%, UK -3.3% and the EU 12 -3.4%.

The report also notes that Economic surveys show tentative signs of recovery. Manufacturing output in the US and China, for example, is considered to have “bottomed out” in December 2008, with both economies experiencing output growth in the sector since then.

Oxford Economics’ (OE) latest World Economic Prospects publication carries the headline “recovery still some way off, despite ‘green shoots’”. The report states that world GDP for 2008 was 1.8% growth and predicts a -2.5% reduction in 2009, with growth retuning in 2010 with a 1.7% increase. In 2011 a return to growth levels in the region of those pre-recession (2006) is expected, with upward trends to continue the years to follow.23

In qualitative reading of the future prospect, the OE report notes that:

- although manufacturing performance has improved this is largely due to a cycle of de-stocking, in which output growth was cut to bellow the growth of demand;

- consumer spending will remain low, on account of unemployment and falls in houses price, depressing demand into 2010; and

- although government stimulus efforts will provide some support, there remains a risk that a continued “retrenchment in the private sector will drag growth down again” resulting in a “W-shaped growth scenario”.24

The National Institute Economic Review (NIER) concurs with the general view that modest growth of 2.1% will return in 2010. However, they add that they expect GDP growth to remain below recent trend rates in most of the major economies in 2011 and in some cases in 2012”. According to NIER “from 2013, growth should rise above trend rates towards a new, lower, equilibrium”, although the recession will leave permanent scars on the major economies, with lenders likely to continue to act cautiously and maintain a perception of higher risk. Despite this, the same report notes that lending to the private sector, which slowed considerably in 2008, is showing signs of relaxation if not recovery. They note that while there was a continued tightening of loan conditions in the first half of 2009 the rate of this tightening has eased.25

The IMFs outlook deems short-term prospects to be “precarious”. They estimate a global contraction of -1.3% in 2009, noting that output is projected to decline in countries representing three-quarters of the global economy and that growth in all countries will decelerate sharply from “normal” trends. Like other forecasts the IMF also predict modest growth in 2010, although, at 1.9% their estimates are more conservative. For the IMF, the key factor in returning to pre-recession growth patterns is the speed with which the financial sector can be stabilised. They argue, however, that this process will take longer than they and others had previously predicted given the “complexities involved in dealing with bad assets and restoring confidence in bank balance sheets, especially against the backdrop of a deepening downturn in activity that continues to expand losses on a wide range of banking assets”.26

3.2 Current UK Conditions 27

- The Budget 2009 predicted a 1% contraction in the UK economy, followed by growth of 1.75% in 2010. The current consensus is less favourable – a 3.3% contraction in 2009 followed by a modest growth of 0.3% in 2010.

- Q1 2009 saw a 1.9% contraction in UK GDP, Q4 2008 had shown a 1.6% contraction.

- 2007/08 Public Sector Net Borrowing stood at 2.5% of GDP; estimates predict this will increase to 6.3% in 2008/09 and 12.4% in 2009/10.

- Public Sector Net Debt is expected to rise to 76% (80% when financial interventions in the banking industry are included). Higher taxes and lower public sector expenditure are expected as a consequence.

- UK public finance problems are expected to spill over to the Northern Ireland economy. NI will shoulder some of the £9bn/yr of efficiencies savings from 2011. Calculated using the Barnett formula this translates to approximately £200m – £250m per year from 2011.

- Purchasing Managers Indexes (PMI) show some sign of improvement, the pace of contraction, for example, was seen to slow in April’s composite PMI for the UK. Mortgage approvals in March 2009 where 44% higher than their November 2008 low.

- In September 2008 annual CPI inflation hit 5.2%. In March 2009 the corresponding figure was 2.9%, a lesser decrease than expected on account of sterling prices inflating imports.

- In March 2009 interest rates were decreased to a record low of 0.5%;

- An increase in secured credit availability is anticipated in Q2. While, in the corporate sector, credit availability improved during Q1, with further improvements expected in Q2 results.

3.3 Current Conditions - Northern Ireland28

The latest Ulster Bank Northern Ireland Quarterly Economic Review (May 2009), makes the following observations on the Northern Ireland Economy:

- In Q4 2008 private sector output decreased by 3.9% compared to the same quarter the previous year. In 2009, a total contraction of 5% is anticipated.

- Q1 2009, Northern Ireland wholesale and retail distribution output fell by 1.9% on the previous quarter (corresponding UK figure was 2.4%) bringing the year on year decrease to 7% (4.9% in the UK).

- Between September 2007 and December 2008 the Business Service and Finance sector incurred 3,300 job losses (from a 2007 peak of 96,500 employees), further losses are expected in 2009.

- Northern Ireland Tourist Board note that the hotel industry experienced a 10% fall in sales in Q4 2008, compared to the previous year.

- In Q4 2008 manufacturing output fell by 4.8% ( UK=4.5%) compared to the previous quarter and 5.2% ( UK=7.5%), the steepest decline since 2001.

- The Food & Drink sector has been the exception to the above - Q4 figures show an 8.9% year on year increase.

- 3,100 jobs were lost in the manufacturing sector in 2008. A decline of 10% is expected in 2009.

- Q4 2008 saw a 0.9% quarterly increase in construction output, although year on year this represents a decrease of 4.3%. Housing output (new houses) declined by 19% in 2008. Infrastructure construction increased 24% in 2008.

- 5,090 jobs were lost in the construction sector in 2008, equivalent to -4.2% ( UK = +0.5%).

In addition the Ulster Bank report, commenting on the Northern Ireland housing market, notes:

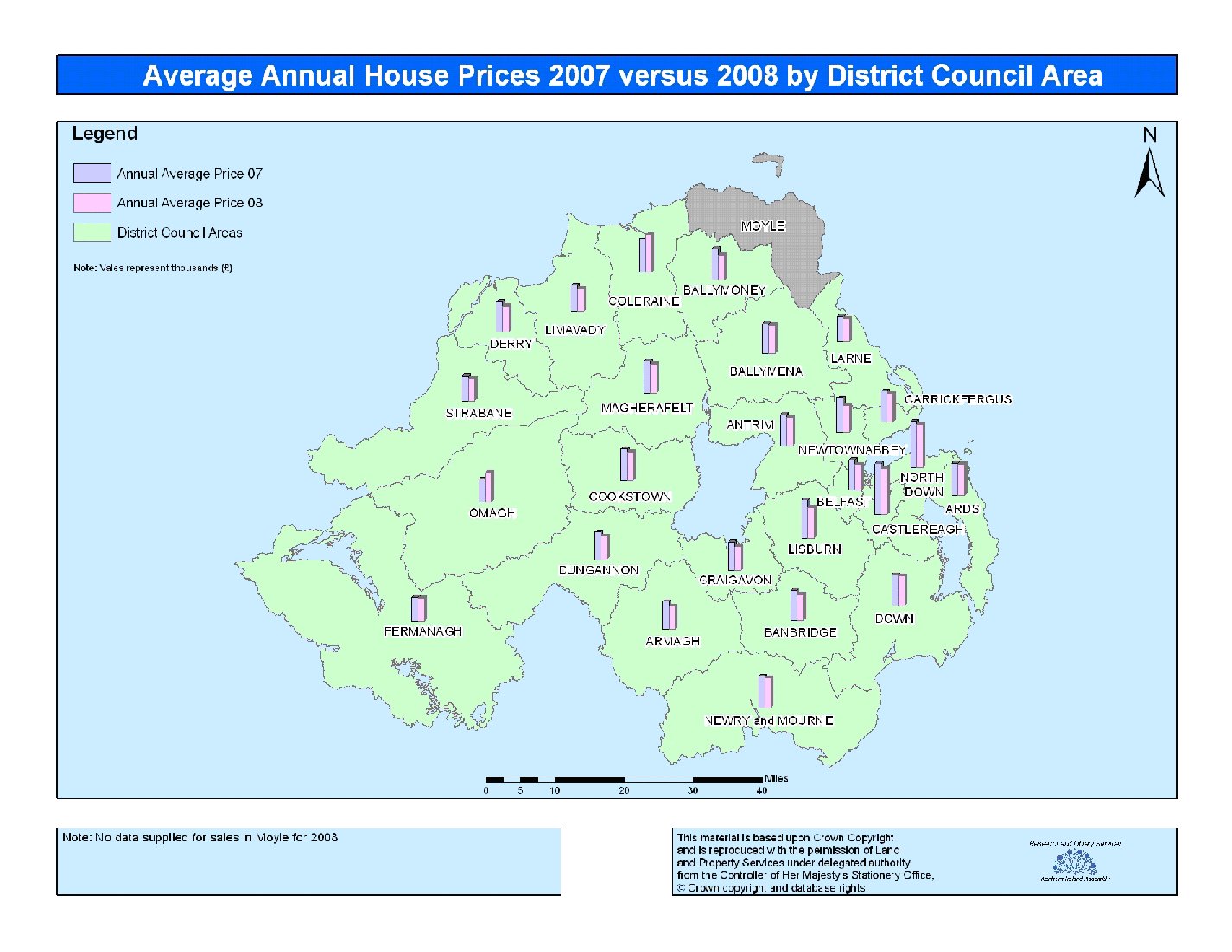

- NI average house prices were estimated in the DCLG survey to be £182k in February 2009, a 19% decrease on the previous year ( UK = -12%). An alternative Nationwide survey found Q1 prices to be 38% below their Q3 2007 peak. Prices are expected to fall to £135k during 2009 (45% below Q3 2007), stabilizing at £125k in 2010 (50% lower than Q3 2007).