Report on the Transfer of Former Military and Security Sites to the Northern Ireland Executive and Ilex Accounts 2010 - 2011

Session: 2011/2012

Date: 04 July 2012

Reference: NIA 58/11-15

ISBN: 978-0-339-60435-3

Mandate Number: 2011/15

Military_sites.pdf (6.99 mb)

Public Accounts Committee

Together with the Minutes of Proceedings of the Committee

Relating to the Report and the Minutes of Evidence

Ordered by The Public Accounts Committee to be printed 6 June 2012

Report: NIA 58/11-15 Public Accounts Committee

Mandate 2011/15 Ninth Report

Table of Contents

List of abbreviations used in the Report iv

Report

The Sale of the Malone Road Site

Benefits from the Sale of the Sites to the Northern Ireland Block

Retention of Papers and Audit Access

Progress on Regenerating the Sites

Report on Ilex Accounts 2010 - 2011

Appendix 1

Minutes of Proceedings

Appendix 2

Minutes of Evidence

Appendix 3

Correspondence

Appendix 4

List of Witnesses

List of Abbreviations used in the Report

C&AG Comptroller and Auditor General

The Committee Public Accounts Committee

DFP Department of Finance and Personnel

DSD Department for Social Development

HMRC Her Majesty's Revenue and Customs

LPS Land and Property Services

NIHE Northern Ireland Housing Executive

SSA Social Security Agency

Executive Summary

Introduction

1. As part of the Reinvestment and Reform Initiative (May 2002), six[1] former Military and Security sites were transferred free of charge to the Office of the First Minister and Deputy First Minister (the Department). These sites offered the opportunity for economic and social regeneration either through using the proceeds from their disposal (Malone and Magherafelt) or through developing Masterplans and the establishment of appropriate bodies to deliver these. Up to 31 March 2012, £62 million has been spent, mainly in relation to the Maze/Long Kesh, Crumlin Road Gaol and Ebrington sites.

2. Regeneration is a long term process. However, progress has been slow. Masterplans have gone through a number of iterations and have yet to be finalised as agreement has been difficult to reach. There also needs to be an improvement in the standards and quality of performance reporting on their regeneration through clear and transparent targets which are measureable (SMART) and linked to expected outcomes for the sites.

3. Effective governance arrangements also help drive forward the regeneration process and ensure that sound financial and administrative procedures are in place and adhered to. The Department's recent actions to put in place strategic oversight arrangements covering all sites sold or transferred to it are welcome. There are however, significant and serious issues in relation to oversight and governance arrangements in Ilex which, amongst other projects, is taking forward the redevelopment of the Ebrington site.

4. One of the conditions attached to the transfer of the sites was that the Executive would bear the cost of making them ready for use. As detailed checks were not completed prior to their transfer the potential cost of remediation and maintaining and making the sites safe and secure was unknown. Furthermore, Councils and the Environment Agency do not have the same legislative powers as bodies in England and Wales, meaning that they have been unable to effectively regulate the decontamination on former military sites and enforce the "polluter pays" principle.

5. Two of the sites have been sold – Malone and Magherafelt Barracks. Although the Malone site was sold for £3.8 million, the Department could and should have got more for it had it been better advised by Land and Property Services (LPS) who appear to have been driven by expediency rather than a desire to achieve maximum value. It is also worrying that neither the Department nor LPS were aware, until the Audit Office and Committee's investigations, that the purchaser was acting on behalf of another developer who provided the finance and to whom the site was immediately transferred on the day it was sold.

6. While this case is now nine years old, the lessons emerging from it are important and highly relevant.

7. It is a matter of concern that the Department could not make use of the £870,000 achieved from the sale of the Magherafelt site to the North Eastern Education and Library Board (NEELB). In addition the Department told the Committee that cash available and not immediately required must go back to the Consolidated Fund. The Committee is alarmed that the Department is unable to definitively state that the £870,000 has not been lost to the Northern Ireland Block.

Summary of Recommendations

Recommendation 1

1. The Committee recommends that, unless there are compelling reasons not to, sales of land and buildings should be conducted through sealed bids opened in the presence of public sector officials representing the Department or public body disposing of the asset. No matter what method of sale is used the process must be transparent and documented.

Recommendation 2

2. The Committee recommends that public bodies disposing of land and buildings must present clear instructions to LPS on the objectives of the sale and be fully engaged throughout the sale process. The Committee further recommends that LPS examines the format of its submissions to public bodies, with a view to documenting more clearly the basis of its valuations and/or advice on disposals. It is important that advice from LPS is in a format that enables public bodies to critically consider and challenge the advice.

Recommendation 3

3. The Committee is concerned that current guidance on disposal of properties is ambiguous and open to interpretation. The Committee welcomes the LPS statement that the guidance is currently being reviewed. The Committee recommends that this review should be undertaken as a matter of urgency to ensure that the most appropriate approach is taken to disposal of sites; that the proceeds for the public sector are maximised; and that systems are established to ensure the consistent application of that guidance. The Committee is further concerned that its previous recommendation regarding the independence of valuations when disposing of land does not appear to have been acted upon in this case.

Recommendation 4

4. It is important that departments can clearly track and report on how funding is spent. The Committee recommends that, before making commitments to ringfence funding, departments consult with DFP to clarify the process to ensure that it is transparent to the Assembly.

Recommendation 5

5. The Committee recommends that DFP remind departments of the importance of retaining all documentation relevant to ongoing NIAO investigations. It is the responsibility of individual departmental Accounting Officers to ensure that documentation pertinent to an audit is made available, in a timely manner, for examination. This will include where it is retained by another public body or agents appointed by the department.

Recommendation 6

6. The Committee recommends that strategies for engaging with local communities and their representatives are developed for the former military and security sites, and realistic and publicly agreed targets are set for putting them in place.

Recommendation 7

7. The Committee has identified a worrying gap in legislation that means that Councils and the Environment Agency are unable to fully regulate contamination of land and enforce the "polluter pays" principle. The Committee recommends that the Department of the Environment, in consultation with Councils, fully assesses the financial, environmental and health risks associated with having a regulatory regime that falls short of that in place in other regions.

Recommendation 8

8. The Committee recommends that targets for the Department and the delivery bodies responsible for the regeneration of the sites are measureable (SMART) and linked to expected outcomes for the individual sites such as achieving outcomes in private sector investment, employment, business growth, skills development and tackling poverty. This is essential to demonstrate the value for money of the substantial investment of public funds in the sites.

Recommendation 9

9. The Committee welcomes the commitment to streamline sponsorship control of Ilex. The Committee recommends that the new sponsorship arrangements are put in place as soon as possible.

Recommendation 10

10. The Committee recommends that departments re-examine current arrangements to ensure that arms-length bodies, such as Ilex, are given a clear mandate in respect of their responsibilities, including ensuring value for money. As departments remain ultimately accountable, their Accounting Officers need to ensure that oversight arrangements are effective in managing and monitoring financial delegations. In addition they must also ensure that there is adequate information to provide assurance that value for money is being secured for public spending, wherever that spending takes place.

Recommendation 11

11. The Committee recommends that non-executive Board members should have details of who is responsible for paying any tax liabilities formally agreed before appointment and included in the contract of employment. In addition the Committee recommends that DFP issues guidance clarifying the tax position of travel expenses paid to other non-executive Board members throughout the public sector.

Introduction

1. The Public Accounts Committee met on 25th April 2012 to consider the Comptroller and Auditor General's (C&AG's) report: "The transfer of Former Military and Security Sites to the Executive". The Committee also considered Comptroller and Auditor General's (C&AG's) report on Ilex Accounts for 2010-11.

2. The Witnesses were:

- Noel Lavery, Director of Resources, Regeneration International Relations and Institutional Review Directorate and Accounting Officer, Office of the First Minister and Deputy First Minister;

- Kyle Alexander, Programme Director, Maze Long Kesh Programme Delivery Unit;

- Tim Losty, Director of Strategic Investment, Regeneration and International Relations Division, Office of the First Minister and Deputy First Minister;

- David Ross; District Valuer, Land and Property Services, Department of Finance and Personnel;

- Will Haire, Permanent Secretary and Accounting Officer, Department for Social Development;

- Dr Aideen McGinley, Chief Executive and Accounting Officer of ILEX.

3. As part of the Reinvestment and Reform Initiative (May 2002), six[2] former Military and Security sites were transferred free of charge to the Executive – at that time the sites were valued at £24.7 million. The sites offered the opportunity for economic and social regeneration either through using the proceeds from their disposal (Malone Road and Magherafelt) or through the development of Masterplans and the establishment of appropriate bodies to deliver these.

4. The regeneration of the sites at Maze/Long Kesh, Ebrington and Crumlin Road Gaol are long-term projects that require significant public sector investment to deliver the economic and social outcomes for the local communities where they are located. Up to 31 March 2012, almost £60 million has been spent on these sites. However, progress has, been slow. Masterplans have gone through a number of iterations and have yet to be finalised as agreement has been difficult to reach. The absence to date of measurable targets that demonstrate social or economic outcomes for the sites makes it difficult to judge what tangible return has been achieved from this initial investment.

5. A number of independent reviews have identified issues around the oversight and governance arrangements of Ilex. The audit of its 2009-2010 financial statements identified concerns regarding the procurement, management and approval of projects, indicating a breakdown within Ilex of important controls over spending. This resulted in the C&AG reporting to the Assembly and qualifying his opinion on the regularity of expenditure for 2010-11.

6. Proceeds from the sale of Malone and Magherafelt Barracks sites, totalling £4.7 million, were to be ringfenced specifically for projects which would represent a tangible benefit to the peace process. However, proceeds from the sales may not been used for the intended purpose. Furthermore, the Department is unable to definitively confirm that the £870,000 proceeds from the sale of the Magherafelt site have not been lost to the Northern Ireland Block.

7. The Malone site was a prime development site in Belfast. It was sold to a private developer in 2003, in a rising market, for £3.8million, despite valuations provided by Land and Property Services (LPS) that the site could make up to £5 million. The Committee strongly believes that the department could and should have realised more from this sale.

8. The Committee is deeply concerned that papers supporting many of the key decisions made on the sites were either not available or only made available to the Audit Office late in the day. In the case of the Malone site the Department was unable to provide the Committee with detailed instructions given to the agents appointed to handle the sale of the site or evidence of the marketing and bid evaluation process. The Committee also has serious concerns about the use of an informal unconditional bidding process.

9. In taking evidence on the Comptroller and Auditor General's report, the Committee focused on the following issues:

- The transfer of six sites as part of the Reinvestment and Reform Initiative and the pace of progress in regenerating the sites;

- The sale of two of the sites at Malone and Magherafelt - the marketing and sale of Malone Road Barracks and maximising the sale proceeds and whether the £4.7 million proceeds from the sale of the Malone and Magherafelt sites were applied as intended;

- The transfer of the sites resulting in significant costs to the Executive – investment by the private sector; checks on the level of contamination on the sites; the gap in environmental legislation on the regulation, inspection and remediation of contaminated land; and

- Driving the regeneration of the former military and security sites – particularly the need for measurable, outcome based targets; community involvement in the projects; the internal controls operating within the Department and its strategic oversight of the sites; and the systemic breakdown within Ilex in the application of important spending controls.

The public sector did not seek to maximise the proceeds from the sale of the Malone Road site

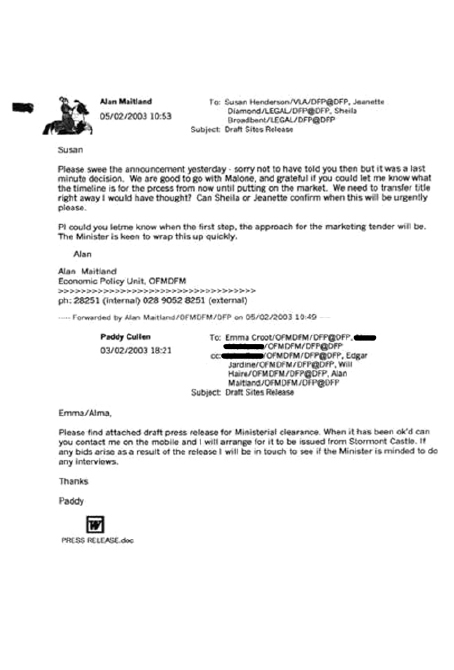

10. The Malone Barracks was a prime development site in South Belfast. It was transferred to the Department in March 2003 and put on the market the following month. The Department was advised on the sale by the Department of Finance and Personnel's Land and Property Services (LPS) who also engaged and appointed a selling agent. Figure 1 provides a timeline summarising the events leading up to the final transfer of the site in December 2003.

Figure 1

Timeline of Events in the sale of the Malone site

| Date | Event |

| February 2003 | OFMDFM decide to sell the site on the open market, and on the advice of LPs, without planning permission; and to instruct LPS to place the site on the market. LPS confirm valuation between £4.3 million and £4.6 million with a maximum of £5 million. |

| March 2003 | Site transferred to OFMDFM from Ministry of Defence Site marketed by LPS appointed agents at an asking price of £3.4 million and seeking unconditional bids |

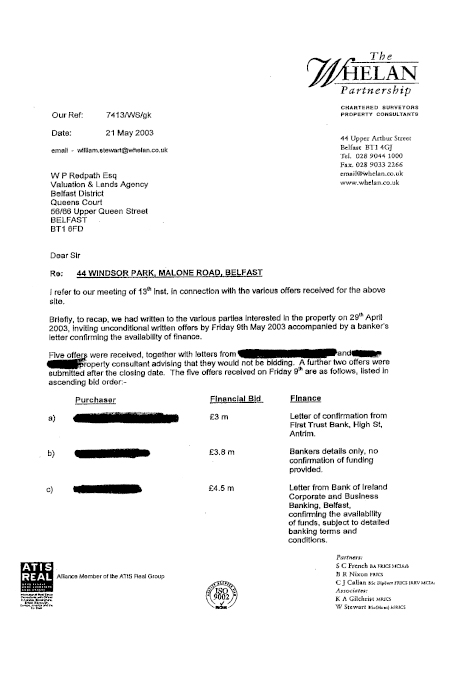

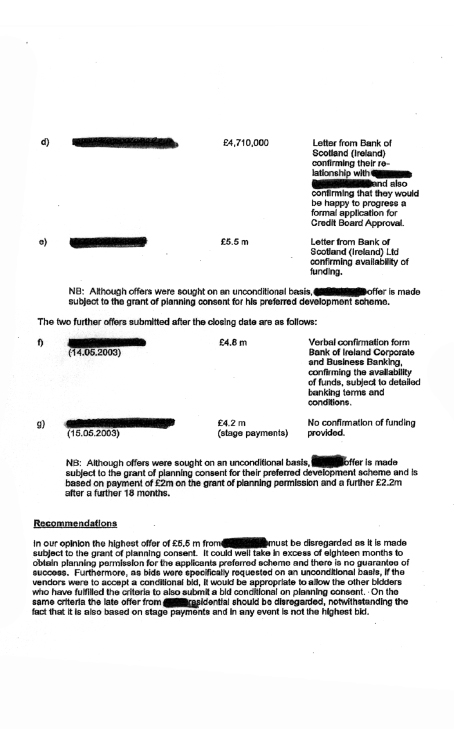

| May 2003 | Five offers received by deadline date of 9th May. Highest bid of £5.5 million rejected as conditional on planning permission for developer's scheme. Two late bids also rejected Agents recommend accepting unconditional bid of £4.7 million |

| June 2003 | Highest remaining bid accepted for £4.7 million |

| July 2003 | Highest bidder withdraws offer |

| August 2003 | Site re-advertised |

| October 2003 | Unconditional bid of £3.8 million accepted from different developer |

| December 2003 | Site transferred from OFMDFM to the developer Developer transfers the site to another developer on the same day, using a "bare trustee" arrangement |

11. An initial attempt to sell the site fell through in August 2003 when the bidder withdrew an offer of £4.7 million. The site was re-marketed and subsequently sold to a private developer in October 2003 for £3.8 million and immediately transferred to another developer. The sale was considered by the Department and LPS to have been a success as it achieved, in their eyes, market value (best price) and was unfettered with no further legal interest, such as clawback, to be monitored. This is despite LPS valuing the site at up to £5 million months earlier.

12. The Committee accepts that each and every disposal or sale of a site is unique, and all risk factors for each site need to be considered. LPS guidance sets out mechanisms to mitigate such risks and obtain best value. These include whether to go to the market with or without conditions; whether to seek outline or full planning permission; and whether to impose some form of clawback to protect the public purse against future enhancement in value. The Committee notes that the Department placed considerable reliance on the professional advice of LPS in relation to the marketing and sale of the site.

13. The Committee has concerns about the advice provided by LPS. In the Committee's view LPS did not give adequate consideration to the various mechanisms available to protect the taxpayer that were set out in its own guidance. It also failed to provide the Department with advice and its rationale in a clear format that enabled the Department to critically consider and challenge this. Whilst the Committee welcomes the Accounting Officer's acknowledgement that the Department should have pressed harder for the inclusion of clawback, the Department must also accept responsibility for what went wrong. It did not clearly articulate the objectives of the sale and through its lack of engagement, it accepted, uncritically, the advice and actions of LPS and the agent. In doing so the Department did not properly protect the taxpayers' interest.

14. The Committee's concerns about the Department's lack of engagement are heightened by the absence of documentation supporting the process. In the Committee's view the sale of the site, with no apparent oversight by officials in opening offers or consideration of bids, was unacceptable.

15. The Committee is alarmed that the Department was not aware that the purchaser was in fact acting on behalf of another development company who funded the purchase of the site. This only became apparent through the work of the Audit Office and evidence presented to this Committee which brought to light that the site had been transferred on the day of sale and that the parties were in fact connected. This exposed the Department to potential conflicts of interest and risks of impropriety.

16. In the Committee's view it is important that public bodies and their selling agents have appropriate procedures in place to mitigate these risks. This should include carrying out checks on the credit worthiness of bidders before accepting offers, and knowing the identity of all parties involved.

17. The Committee believes that the Department and LPS missed potential opportunities to maximise the proceeds from the sale. As part of the initial sales process interested parties were invited to submit unconditional offers by a deadline date. This resulted in the submission of five bids within the deadline and two late bids (see Figure 2). The two late bids and the bid from Bidder E (which was subject to the grant of planning permission) were disregarded.

Figure 2

Details of Initial bids received for Malone Site

| Bid Received | Comments | |

| Bidder A | £3.0 million | |

| Bidder B | £3.8 million | |

| Bidder C | £4.5 million | Bidder C, approached as under-bidder when Bidder D withdrew, Bidder C reduced this offer to £3.6 million |

| Bidder D | £4.7 million | Successful bid |

| Bidder E | £5.5 million | Bid disregarded as the offer made subject to grant of planning consent for bidder's preferred scheme. |

| Bids submitted after closing date for bids | ||

| Bidder F | £4.8 million | Disregarded as late bid |

| Bidder G | £4.2 million | Disregarded as late bid. Offer made subject to grant of planning consent for bidder's preferred scheme and based on stage payments. |

18. LPS guidance does not preclude late or conditional bids from being assessed if they are authentic, offer a better return and are received before a sale becomes legally binding. The Committee acknowledges that conditional bids do carry risks. However, these need to be weighed up against the potential gain. In this case the £800,000 difference between the initial winning bid from Bidder D of £4.7 million and Bidder E's rejected conditional bid of £5.5 million, was, in the Committee's view, worthy of serious consideration, particularly since obtaining planning permission for high density housing was not an issue and the cost of securing this would have, according to LPS, been around £150,000.

19. In the Committee's view it is evident that adequate consideration was not given to the late and conditional bids during the evaluation process, indeed it would appear that they were rejected out of hand. In addition, when the accepted bidder withdrew his offer in July 2003, LPS and the agent continued to seek only unconditional bids; no attempt was made to re-engage with all previous bidders or further explore other options such as conditional bids.

20. In the Committee's view the sale of the site was driven by expediency rather than a desire to achieve maximum value.

Recommendation 1

21. The Committee recommends that, unless there are compelling reasons not to, sales of land and buildings should be conducted through sealed bids opened in the presence of public sector officials representing the Department or public body disposing of the asset. No matter what method of sale is used the process must be transparent and documented.

Recommendation 2

22. The Committee recommends that public bodies disposing of land and buildings must present clear instructions to LPS on the objectives of the sale and be fully engaged throughout the sale process. The Committee further recommends that LPS examines the format of its submissions to public bodies, with a view to documenting more clearly the basis of its valuations and/or advice on disposals. It is important that advice from LPS is in a format that enables public bodies to critically consider and challenge the advice.

Recommendation 3

23. The Committee is concerned that current guidance on disposal of properties is ambiguous and open to interpretation. The Committee welcomes the LPS statement that the guidance is currently being reviewed. The Committee recommends that this review should be undertaken as a matter of urgency to ensure that the most appropriate approach is taken to disposal of sites; that the proceeds for the public sector are maximised; and that systems are established to ensure the consistent application of that guidance. The Committee is further concerned that its previous recommendation regarding the independence of valuations when disposing of land does not appear to have been acted upon in this case.[3]

The NI Block did not get the full Benefit from the Sale of the sites

24. Proceeds from the sale of Malone and Magherafelt Barracks sites, totalling £4.7 million, were to be ringfenced specifically for projects which would represent a tangible benefit to the peace process.

25. It is not clear to the Committee if the proceeds from the sale of the Malone Barracks site have been used for the intended purpose; correspondence from DFP indicates that they were made available for use elsewhere in the NI Block.

26. The Committee acknowledges that the provision of education facilities on the Magherafelt site should provide long term benefits to the local community. However, the Committee is concerned that OFMDFM, to whom the site was gifted, required the NEELB to pay £870,000 for the site. The Department told the Committee that cash available and not immediately required must go back to the Consolidated Fund. However, it could not give a clear answer if the £870,000 has been lost to the Northern Ireland Block; but from the evidence provided this seems to be a strong possibility.

Recommendation 4

27. It is important that departments can clearly track and report on how funding is spent. The Committee recommends that, before making commitments to ringfence funding, departments consult with DFP to clarify the process to ensure that it is transparent to the Assembly.

Retention of papers and Audit Access needs to be improved

28. The Committee is disturbed that papers supporting many of the key decisions made on the sites were either not available or only made available to the Audit Office late in the day. The Committee is frustrated with evidence not being made available for inspection. The establishment and maintenance of a complete and proper public record, apart from being a legal requirement, is a key aspect of open and transparent accountability and one of the principles at the heart of good administration.

29. Documents must also be preserved while an investigation is ongoing. One particular example relates to the sale of the Malone Barracks where the Department was unable to provide the Committee with details of the instructions given to the agents appointed to handle the sale of the site or evidence of the marketing and bid evaluation process. This is unacceptable. This example serves to reinforce the Committee's recommendation made in its recent report on Use of External Consultants by Northern Ireland Departments, that a formal review of the quality and standards of document management and record-keeping should be undertaken.

Recommendation 5

30. The Committee recommends that DFP remind departments of the importance of retaining all documentation relevant to ongoing NIAO investigations. It is the responsibility of individual departmental Accounting Officers to ensure that documentation pertinent to an audit is made available, in a timely manner, for examination. This will include where it is retained by another public body or agents appointed by the department.

Progress on Regenerating the Sites has been too Slow

31. When these sites were transferred nine years ago they offered an opportunity to regenerate local areas and deliver social and economic benefits to local communities. The Committee acknowledges that the regeneration of such sites is a long-term process; as demonstrated in the Laganside experience where, over a 20 year period, an investment of some £150 million, led to inward investment of around £850 million in the waterfront area. However, progress on the regeneration of the former military and security sites has been too slow. Masterplans have yet to be finalised which is reflected in the Department only spending £59 million of the £101 million made available to it for redevelopment since 2003-04.

32. The Committee considers that it is important that communities start to see tangible benefits from the considerable investment that has been made. The Committee welcomes the recent progress being made on the Ebrington and Crumlin Road Gaol sites that has resulted in the Department making full use of the funding made available in 2011-12 for these sites. The Committee also welcomes recent steps now being taken to establish a Development Corporation to drive forward regeneration at Maze/Long Kesh. It is important that there are no further delays in its establishment.

33. One of the key factors in successfully developing the sites is maximising investment from the private sector. The Committee expects to see over the coming years a significant return on the public investment on infrastructure and capital works at the sites. The Committee is encouraged by oral evidence presented that the investment in the sites is expected to generate substantial private sector investment and jobs. For example, the Committee was told of the potential for £250 million investment in the Maze Long Kesh site and a potential to create 5,000 jobs. The leasing of "A" wing and the re-opening of Crumlin Road Gaol is also forecasted to create 55 to 60 jobs.

34. It is important that the substantial investment transforming these former military and security sites becomes a long-term asset for local communities. Continued participation from communities and/or their representatives is essential in taking forward regeneration efforts on the sites. There must also be systems for reporting back to communities on what has been done. The Committee is encouraged by the new strategic oversight arrangements that have been put in place by the Department which should improve communications between the various departments and public bodies responsible for taking forward the regeneration of the sites. However, the Committee expects to see an improvement in the standards and quality of performance reporting on the regeneration of the sites through clear and transparent targets.

35. The importance of completing detailed checks on ground conditions and the costs of security and maintenance is highlighted in the case of Maze/Long Kesh where the cost of decontaminating the site alone is expected to be over £8 million. Although the remediation work at the site is now virtually completed, it is important that lessons are learnt from the experience. The Committee expects departments to fully consider those lessons in managing any future major regeneration projects or when dealing with remediation on the sites transferred more recently, such as Shackleton.

36. The Environment Agency and Councils do not have the same legislative powers as bodies in England and Wales. As a result, they cannot fully exercise their inspection powers on contaminated land such as that found on former military sites. The Committee has considered the written brief presented by the Department of the Environment, setting out current arrangements for dealing with historic contamination, new contamination and pollution through the planning control process as sites are undergoing redevelopment. However, the Committee is concerned that without the commencement of Part 3 of the Waste and Contaminated Land (Northern Ireland) Order 1997, the gap in legislation is a major obstacle to applying the "polluter pays" principle in dealing with contaminated land.

Recommendation 6

37. The Committee recommends that strategies for engaging with local communities and their representatives are developed for the former military and security sites, and realistic and publicly agreed targets are set for putting them in place.

Recommendation 7

38. The Committee has identified a worrying gap in legislation that means that Councils and the Environment Agency are unable to fully regulate contamination of land and enforce the "polluter pays" principle. The Committee recommends that the Department of the Environment, in consultation with Councils, fully assesses the financial, environmental and health risks associated with having a regulatory regime that falls short of that in place in other regions.

Recommendation 8

39. The Committee recommends that targets for the Department and the delivery bodies responsible for the regeneration of the sites are measureable (SMART) and linked to expected outcomes for the individual sites such as achieving outcomes in private sector investment, employment, business growth, skills development and tackling poverty. This is essential to demonstrate the value for money of the substantial investment of public funds in the sites.

Report on Ilex Accounts 2010-11

40. Ilex is a company established in 2003 with the aim of promoting the regeneration of Derry~Londonderry. In recent years Ilex has had a number of significant achievements including delivery of the Peace Bridge, helping to secure the UK City of Culture for 2013 and the recent opening of the Ebrington parade ground.

41. However, while the Committee recognises the work of the company in a range of areas, it is very concerned by the systemic breakdown in the application of key spending controls. The Committee welcomes the Chief Executive's candour in recognising that both she and the organisation got things wrong in applying these controls over several years and the assurance that an action plan is now in place to ensure that no new issues will arise in future. However, there a number of important lessons.

Governance Arrangements

42. Ilex is currently funded by two Departments, OFMDFM and DSD. These sponsor departments share accountability for Ilex and the Committee feels that these arrangements, in which Ilex has effectively served two masters, have contributed to the problems that have arisen. The Committee was pleased to note that arrangements are underway to ensure that, in future, one Department would be established as having a clear lead responsibility for Ilex.

43. Another contributing factor to the problems that arose was the poor quality of financial information provided to the Ilex Board.

Spending without proper approval

44. The Committee is very concerned at the extent of expenditure that had been incurred by Ilex without proper approvals from sponsor departments or, in some cases, without business plans having been prepared prior to the spending taking place. This reflects a lack of regard for well-established rules governing spending on projects. This is particularly surprising given the Chief Executive's previous experience as an Accounting Officer in two major departments. In the Committee's view it is important that the action plan, developed by Ilex to ensure that spending rules are followed, is fully implemented. The Committee would be extremely concerned if new cases of breaches of control were to arise in future.

Procurement

45. The Committee is disappointed by the case where a firm agreed a price of £64,000 for consultancy on the peace bridge but then subsequently had its contract extended for a project resulting in revised costs of £479,000. The fact that the extension of these costs was not approved by sponsor departments is not acceptable. The extension of the contract without going back to the market also means that it is impossible to demonstrate that value for money has been achieved.

46. The Committee is concerned that, because of the failure to apply proper procedures, it is likely that the Northern Ireland Block may have to meet these increased costs.

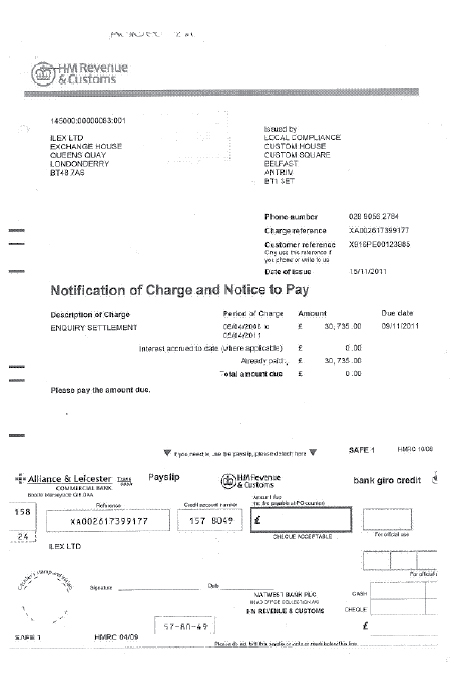

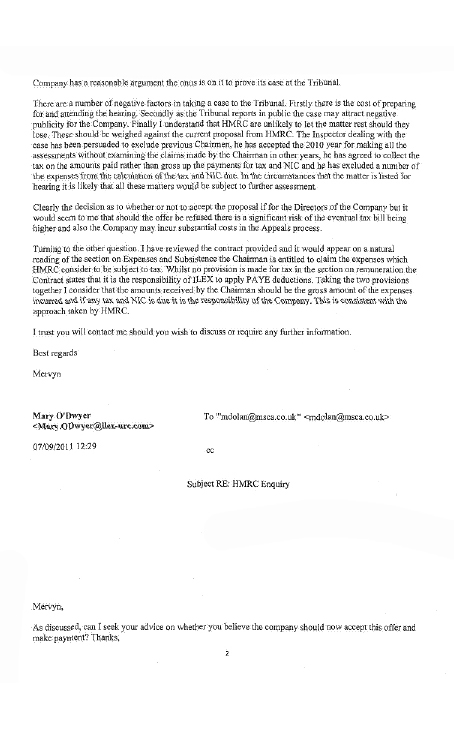

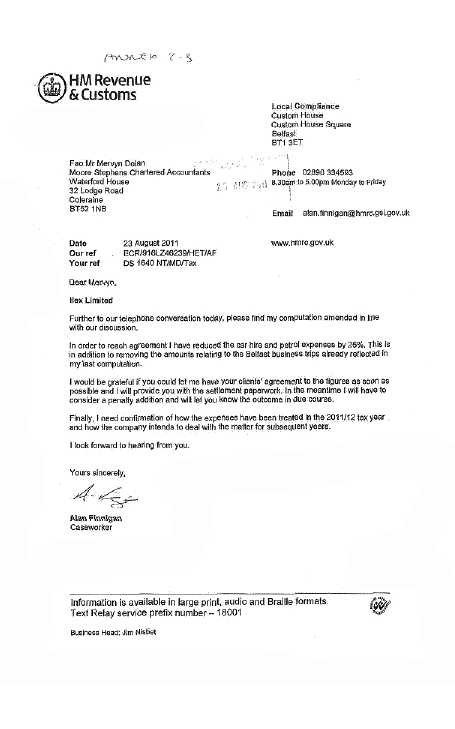

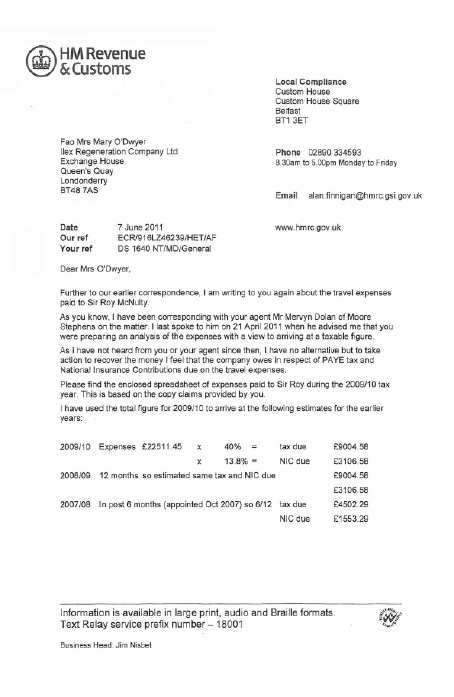

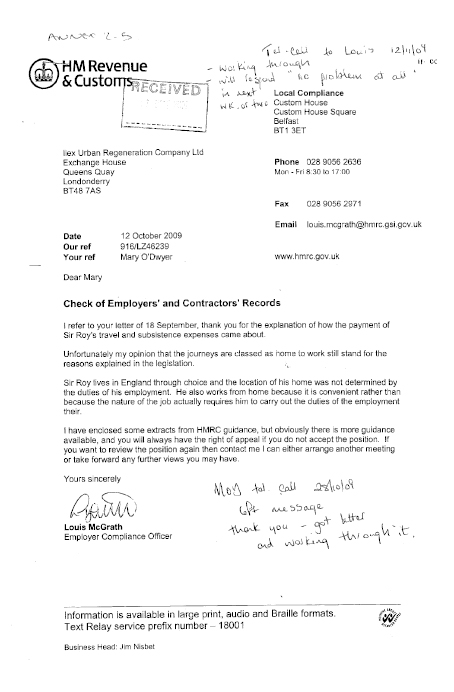

Tax liabilities on travel expenses

47. The Committee notes that Ilex paid tax and national insurance contributions on behalf of the Chairman in relation to travel expenses which had been deemed by HMRC to be taxable. This was despite the fact that the Chairman's contract did not clearly state whose responsibility it was to pay this tax liability. The Committee is disappointed that the payment of this amount was not identified as a novel and contentious issue that should have required approval from the Sponsor Departments. This issue may also have wider implications for the payment of travel expenses to non-executive Board members across the public sector.

Recommendation 9

48. The Committee welcomes the commitment to streamline sponsorship control of Ilex. The Committee recommends that the new sponsorship arrangements are put in place as soon as possible.

Recommendation 10

49. The Committee recommends that departments re-examine current arrangements to ensure that arms-length bodies, such as Ilex, are given a clear mandate in respect of their responsibilities, including ensuring value for money. As departments remain ultimately accountable, their Accounting Officers need to ensure that oversight arrangements are effective in managing and monitoring financial delegations. In addition they must also ensure that there is adequate information to provide assurance that value for money is being secured for public spending, wherever that spending takes place.

Recommendation 11

50. The Committee recommends that non-executive Board members should have details of who is responsible for paying any tax liabilities formally agreed before appointment and included in the contract of employment. In addition the Committee recommends that DFP issues guidance clarifying the tax position of travel expenses paid to other non-executive Board members throughout the public sector.

[1] The six sites are at Malone Road; Magherafelt; the former army base and prison at Maze/Long Kesh; Ebrington; and Crumlin Road Goal

[2] The six sites are at Malone Road; Magherafelt; the former army base and prison at Maze/Long Kesh; Ebrington; and Crumlin Road Goal.

[3] Recommendation 3 of the 2008 report, 'Report on the Transfer of Surplus Land in the PFI Education Pathfinder Projects' read as follows:

"The Committee recommends that when considering the disposal of a site, public bodies must adhere to the basic principles of defining the site precisely and valuing it accordingly. Public bodies must also ensure that they engage the Land and Property Service, and where appropriate recognised professional valuers, from the outset and ensure that valuations are updated on a regular basis."

Minutes of Proceedings

of the Committee

Relating to the Report

Wednesday, 18 April 2012

The Senate Chamber, Parliament Buildings

Present: Mr Paul Maskey MP (Chairperson)

Mr Joe Byrne (Deputy Chairperson)

Mr Sydney Anderson

Mr Michael Copeland

Mr John Dallat

Mr Alex Easton

Mr Paul Girvan

Mr Ross Hussey

Mr Mitchel McLaughlin

Mr Conor Murphy MP

In Attendance: Miss Aoibhinn Treanor (Assembly Clerk)

Mr Phil Pateman (Assistant Assembly Clerk)

Mrs Danielle Saunders (Clerical Supervisor)

Mr Darren Weir (Clerical Officer)

Mr Jonathan McMillen (Assembly Legal Services)

Apologies: Mr Adrian McQuillan

2:02 pm The meeting opened in public session.

5. Briefing on the NIAO Report on 'The Transfer of Former Military Sites to the Northern Ireland Executive' and 'Report on ILEX Accounts 2010-11'

Mr Kieran Donnelly, Comptroller and Auditor General; Mr Brandon McMaster, Director; and Mr Sean Beattie, Audit Manager; briefed the Committee on the report.

2:39 pm The meeting went into closed session after the C&AG's initial remarks.

2:39 pm Mr Murphy left the meeting.

3:10 pm Mr Copeland left the meeting.

3:14 pm Mr Copeland entered the meeting.

3:15 pm Mr Dallat left the meeting.

3:26 pm Mr Girvan left the meeting.

3:40 pm Mr Dallat entered the meeting.

3:41 pm Mr Girvan entered the meeting.

The witnesses answered a number of questions put by members.

3:46 pm Mr Hussey left the meeting.

[EXTRACT]

Wednesday, 25 April 2012

The Senate Chamber, Parliament Buildings

Present: Mr Paul Maskey MP (Chairperson)

Mr Sydney Anderson

Mr Michael Copeland

Mr John Dallat

Mr Mitchel McLaughlin

Mr Adrian McQuillan

Mr Conor Murphy MP

In Attendance: Miss Aoibhinn Treanor (Assembly Clerk)

Mr Phil Pateman (Assistant Assembly Clerk)

Mrs Danielle Saunders (Clerical Supervisor)

Mr Darren Weir (Clerical Officer)

Apologies: Mr Joe Byrne (Deputy Chairperson)

Mr Alex Easton

Mr Paul Girvan

Mr Ross Hussey

2:01 pm The meeting opened in public session.

4. Evidence on the Northern Ireland Audit Office Report 'Transfer of Former Military Sites to the Northern Ireland Executive'.

The Committee took oral evidence on the above report from:

- Mr Noel Lavery, Accounting Officer, Office of the First Minister and deputy First Minister (OFMDFM);

- Mr Kyle Alexander, Programme Director, Maze Long Kesh Programme Delivery Unit, Strategic Investment Board (SIB);

- Mr Tim Losty, Director of Strategic Development, Regeneration and International Relations Division, Office of the First Minister and deputy First Minister (OFMDFM);

- Mr David Ross, District Valuer, Land and Property Services (LPS).

3:34 pm Mr Copeland left the meeting.

3:36 pm Mr Copeland entered the meeting.

3:45 pm Mr Dallat left the meeting.

3:46 pm Mr McQuillan entered the meeting.

3:50 pm Mr Dallat left the meeting.

3:58 pm Mr Copeland left the meeting.

4:08 pm Mr Anderson left the meeting.

4:09 pm Mr Copeland entered the meeting.

4:11 pm Mr Murphy left the meeting.

4:16 pm Mr Murphy entered the meeting.

4:18 pm Mr Anderson entered the meeting.

The witnesses answered a number of questions put by the Committee.

Agreed: The Committee agreed to request further information from the witnesses.

4:37 pm The meeting was suspended.

4;45 pm The meeting recommenced in public session.

Evidence on the Northern Ireland Audit Office Report 'Ilex Accounts 2010 - 2011'.

The Committee took oral evidence on the above report from:

- Mr Will Haire, Accounting Officer, Department for Social Development (DSD);

- Mr Noel Lavery, Accounting Officer, Office of the First Minister and deputy First Minister (OFMDFM);

- Dr Aideen McGinley, Accounting Officer, Ilex.

5:03 pm Mr Copeland left the meeting.

5:05 pm Mr Copeland entered the meeting.

The witnesses answered a number of questions put by the Committee.

Agreed: The Committee agreed to request further information from the witnesses.

[EXTRACT]

Wednesday, 2 May 2012

The Senate Chamber, Parliament Buildings

Present: Mr Paul Maskey MP (Chairperson)

Mr Joe Byrne (Deputy Chairperson)

Mr Sydney Anderson

Mr Michael Copeland

Mr John Dallat

Mr Alex Easton

Mr Paul Girvan

Mr Ross Hussey

Mr Mitchel McLaughlin

Mr Adrian McQuillan

Mr Conor Murphy MP

In Attendance: Miss Aoibhinn Treanor (Assembly Clerk)

Mr Phil Pateman (Assistant Assembly Clerk)

Mr Gavin Ervine (Clerical Supervisor)

Mr Darren Weir (Clerical Officer)

2:02 pm The meeting opened in public session.

2:20 pm The meeting went into closed session.

5. Issues Arising from the Oral Evidence Session on 'The Transfer of Former Military Sites to the Northern Ireland Executive' and 'Report on ILEX Accounts 2010-11'

The Committee considered an issues paper relating to the previous week's evidence session.

2:46 pm Mr Girvan left the meeting.

3:02 pm Mr Girvan entered the meeting.

3:09 pm Mr Dallat left the meeting.

3:15 pm Mr Dallat entered the meeting.

Agreed: The Committee agreed to proceed with the drafting of the report on the basis of its discussion and the issues paper.

Agreed: The Committee further agreed to refer to the Audit Office a whistleblower allegation in relation to Ilex and to factor the findings into its report if material.

[EXTRACT]

Wednesday, 30 May 2012

Room 29, Parliament Buildings

Present: Mr Paul Maskey MP (Chairperson)

Mr Joe Byrne (Deputy Chairperson)

Mr Michael Copeland

Mr John Dallat

Mr Alex Easton

Mr Paul Girvan

Mr Ross Hussey

Mr Mitchel McLaughlin

Mr Adrian McQuillan

Mr Conor Murphy MP

In Attendance: Miss Aoibhinn Treanor (Assembly Clerk)

Mr Phil Pateman (Assistant Assembly Clerk)

Mrs Danielle Saunders (Clerical Supervisor)

Mr Darren Weir (Clerical Officer)

Apologies: Mr Sydney Anderson

2:00 pm The meeting recommenced in public session.

2:12 pm The meeting went into closed session.

6. Draft Committee Report on 'The Transfer of Former Military Sites to the Northern Ireland Executive' and 'Report on ILEX Accounts 2010-11'

Correspondence from OFMDFM.

The Committee noted correspondence from Mr Noel Lavery, Accounting Officer, OFMDFM providing the information sought by the Committee following its evidence session on 25 April 2012.

4:17 pm Mr Copeland declared an interest stating that a solicitor named in the response from the Department has previously represented him.

4:18 pm Mr Dallat entered the meeting.

4:23 pm Mr Byrne left the meeting.

4:26 pm Mr McQuillan left the meeting.

Correspondence from Ilex

The Committee noted correspondence from Dr Aideen McGinley, Accounting Officer, Ilex pursuant to the Ilex evidence session on 25 April 2012.

4:27 pm Mr McQuillan entered the meeting.

4:30 pm Mr Dallat left the meeting.

[EXTRACT]

Wednesday, 6 June 2012

Room 29, Parliament Buildings

Present: Mr Paul Maskey MP (Chairperson)

Mr Sydney Anderson

Mr Michael Copeland

Mr John Dallat

Mr Alex Easton

Mr Paul Girvan

Mr Ross Hussey

Mr Mitchel McLaughlin

Mr Conor Murphy MP

In Attendance: Miss Aoibhinn Treanor (Assembly Clerk)

Mr Phil Pateman (Assistant Assembly Clerk)

Mrs Danielle Saunders (Clerical Supervisor)

Mr Darren Weir (Clerical Officer)

Apologies: Mr Joe Byrne (Deputy Chairperson)

Mr Adrian McQuillan

2:00 pm The meeting opened in public session.

6. Consideration of Draft Committee Report on 'The Transfer of Former Military and Security Sites to the NI Executive and Ilex Report and Accounts'

The Committee considered the first draft of its report on 'The Transfer of Former Military and Security Sites to the NI Executive and Ilex Report and Accounts'

Paragraphs 1 - 7 read and agreed.

Paragraph 8 read, amended and agreed.

4:12 pm Mr Girvan left the meeting.

Paragraph 9 read and agreed.

Paragraph 10 read, amended and agreed.

Paragraphs 11 -22 read and agreed.

Paragraph 23 read, amended and agreed.

Paragraphs 24 – 27 read and agreed.

Paragraphs 29 – 30 read and agreed.

4:20 pm Mr Girvan entered the meeting.

Paragraphs 31 - 37 read and agreed.

Paragraph 38 read, amended and agreed.

Paragraphs 39 – 50 read and agreed.

4:28 pm Mr Copeland left the meeting.

4:30 pm Mr Copeland entered the meeting.

Consideration of the Executive Summary

Paragraph 1 – 7 read and agreed.

Agreed: The Committee agreed the correspondence to be included within the report.

Agreed: The Committee ordered the report to be printed.

[EXTRACT]

Minutes of Evidence

25 April 2012

Members present for all or part of the proceedings:

Mr Paul Maskey (Chairperson)

Mr Sydney Anderson

Mr Michael Copeland

Mr John Dallat

Mr Mitchel McLaughlin

Mr Adrian McQuillan

Mr Conor Murphy

Witnesses:

|

Mr David Ross |

Land and Property Services |

|

|

Mr Noel Lavery |

Office of the First Minister and deputy First Minister |

|

|

Mr Kyle Alexander |

Strategic Investment Board |

Also in attendance:

|

Mr Kieran Donnelly |

Comptroller and Auditor General |

|

|

Ms Fiona Hamill |

Treasury Officer of Accounts |

1. The Chairperson: We are joined today by Mr Noel Lavery, who is not the permanent secretary but who is nonetheless the accounting officer for the Office of the First Minister and deputy First Minister (OFMDFM). You are very welcome, Mr Lavery. Would you like to introduce your colleagues?

2. Mr Noel Lavery (Office of the First Minister and deputy First Minister): On my right is Kyle Alexander, former chief executive of Laganside and the Strategic Investment Board's (SIB) chief expert on regeneration; he heads up the programme delivery unit at the Maze/Long Kesh site. On my left is Tim Losty, who heads up the regeneration sites team in the Department; on the far left is David Ross from Land and Property Services (LPS).

3. The Chairperson: Thank you. The usual procedure is that I ask some questions to set the scene, and other members ask their questions.

4. My first question, Noel, is with regard to figure 2 on page 4. You have given an update of that table to the Committee that shows that expenditure on the military sites to March 2012 now totals almost £62 million. Can you explain briefly to the Committee what tangible benefits have been delivered on that substantial investment of public funds for the delivery of economic benefit and regeneration to local communities and areas?

5. Mr Lavery: Your question is what we have achieved and what benefits the £62 million have brought. Ten years ago, we had military and prison sites designed for that purpose; those sites have now been prepared for development, and we are beginning to see tangible results. However, the strategic investment value of the sites will be considered in an holistic way and in the context of the whole economy in the long term.

6. If I may reference Laganside — and Kyle will probably do that a few times during this evidence session — it took 10 years to create the correct investment environment there and a further 10 for private-sector delivery and full community benefit. Therefore we should not lose sight of the fact that, in overall regeneration terms, this initiative will, in our view, be hugely beneficial.

7. As to its achievements, the Audit Office report and press release refer to "quick-win projects" at Crumlin Road Gaol and Ebrington. Since then, the Royal Ulster Agricultural Society (RUAS) and Peace Centre projects have been secured at Maze/Long Kesh. An income of about £35 million from the peace programme and from the disposal of the sites has been secured, and the RUAS investment will, we believe, bring about £60 million of development value to the Maze/Long Kesh site.

8. The RUAS and Peace Centre projects are forecast to generate between 370 and 450 jobs. Crumlin Road Gaol, the leasing of A wing and the re-opening is forecast to create 55 to 60 jobs. As to the infrastructure investment element of the £62 million, which is about £33 million, the SIB estimates that it has provided about 670 employment years.

9. I have a couple of things to say about the sites themselves. At Ilex, some 150 buildings of the former military site have been cleared, and Ebrington Square was opened in February 2012. The parade ground was transformed into a multi-purpose culture, leisure and performance space, the largest on the island of Ireland, and it facilitates City of Culture events. The Peace Bridge and the parade ground are two completely new and very significant shared spaces. I am sure that the Committee will get into that later. At Maze/Long Kesh, the programme of remediation works is complete, and the site has been transformed. The two projects that we discussed and the Balmoral Show will go there in 2013. At the gaol, there has been a £5·3 million restoration programme, and we will shortly complete the commercial leasing of A wing.

10. The Chairperson: Thank you for that update, Noel. What do you estimate the total projected expenditure of public funds to be?

11. Mr Lavery: I am not sure that I can give you a firm estimate of that. However, I can tell you that £36 million has been set aside by the Executive over the rest of this CSR (comprehensive spending review) period. The remediation works at Maze/Long Kesh are virtually complete; they will complete the infrastructure and capital works.

12. Market conditions will be a significant factor in the amount of public expenditure required for the full development of the site. Colliers International made an assessment of the Maze site and found that it may require an investment of about £60 million to generate external investment of about £250 million. Ilex has given a broad estimate of another £30 million to generate investment of £150 million. Let me repeat that market conditions will be a big factor. Kyle, do you want to add to that from your perspective?

13. Mr Kyle Alexander (Strategic Investment Board): You referred to the expenditure to date, and Noel has mentioned what the long-term return on that might be. The investment in Laganside was some £150 million, which in time led to investment of some £850 million in the waterfront area, but that was on a 20-year timescale. The first 10 years was to get the site infrastructure in place, and there was significant expenditure on that. For example, it took seven years after the plans came out for Laganside to complete the weir and 10 years before the Waterfront Hall was completed. Only in the 10 years since that date has the real level of investment in the site come about. The sums spent to date add up to £62 million, but you need to see that within a 20-year timescale on those sites. The expectation of the work that we are doing is that we will start to see significant return on that expenditure. That is the judgement that needs to be made as to where we are now.

14. The Chairperson: To return to the projected expenditure, Noel, you mentioned £60 million and then £30 million for Ilex. Do you have a time brief? You said that there is £36 million for this term; would that leave —

15. Mr Lavery: The £36 million would take us to 2014-15. We are probably looking to 2015-2020 for Maze/Long Kesh, and I think that it would be similar at Ebrington; however, a great deal depends on the private sector and the private-sector market in the development of the sites and in getting private-sector investment. That is the aim, and one of the key questions is how the market moves and how we can attract private sector investment.

16. If you bear with me, Chairman, the Royal Ulster Agricultural Society investment is an encouraging start; we are getting £60 million of investment there. It is not as if we have not achieved anything at the sites, and Ebrington is now moving towards that stage too.

17. The Chairperson: Thank you. Paragraph 4 states that an agreement was reached with the Ministry of Defence as far back as 2004 in relation to some of the sites with significant development potential. How formal were those arrangements and what lessons did your Department learn, Noel? How were those applied to the management of more recent transfers of sites after the 2010 Hillsborough agreement?

18. Mr Lavery: The report mentions the cost of decontamination. We think that the final cost of decontamination at the Maze will be about £8 million, but some necessary demolition means that it will end up at £9·5 million. It is fair to say that that was unknown. The land quality assessments were known at the time, as the report states. I think that we have learned our lesson on the Hillsborough sites in taking them on and getting an estimate of what the cost of decontamination of the sites would be. That is one of the significant lessons.

19. Perhaps I should have said earlier that OFMDFM accepts the recommendations in the report absolutely.

20. Mr Copeland: I just want to gauge whether it was believed that the sites had a net value at the time of transfer. In other words, there was a figure of £24 million, if I remember rightly, that seemed to have its roots in the House of Commons as an answer from the Ministry of Defence. Were the liabilities in connection with this £24 million in excess of £24 million? In other words, were they a net asset or a net liability, notwithstanding the fact that they undoubtedly had potential? The numbers do not seem to gel.

21. Mr Lavery: The sites are definitely an asset; they were gifted. I am just trying to get to the core of your point, Mr Copeland. Figure 6 in my letter to the Committee shows that total remediation costs were £5·8 million. That figure will end up at £8 million or £9 million.

22. Mr Copeland: Is that for all of the sites?

23. Mr Lavery: Yes. The rest of the costs that we have used are the running costs that you would expect to incur in developing a major site, apart from the decontamination.

24. Mr Tim Losty (Office of the First Minister and deputy First Minister): We are looking at these sites. They were military sites and prison sites used specifically for those purposes. When the sites were gifted to us, a value, according to market forces, was put on them.

25. Mr Copeland: How much was that?

26. Mr Losty: I will find that figure for you, Mr Copeland.

27. Mr Lavery: The Hillsborough site —

28. Mr Losty: I was going to put the answer in relation to our investment in the sites to make them a long-term asset for the community. We are investing in those sites to change them from being military sites to community assets that will be used for economic and social benefits. We are already starting to see some of the benefits coming to fruition in some of the sites. We are looking at them in respect of their short, medium and long-term benefits. We are starting to get to the short-term benefits now, and we are looking at the long-term benefits, which is when the value to the taxpayer will be greatly increased.

29. Mr Alexander: I will make a more general point. I suggest that you do not judge the success of these sites on the value of what they can be disposed for. The sites are a tool; they are a means to an end. You judge what you spend on them on what their eventual output will be. We expect that the output for these sites will be significant investment and significant job creation. In the report you will see that we have spent £25 million to date on Maze/Long Kesh, but the work that we have done in the past two or three months suggests that there is potential for £250 million investment in the site and a potential to create 5,000 jobs. You need to judge the success of the sites in those terms and not simply on what the land value will be.

30. Mr Dallat: I had not intended coming in at this stage, but I picked up on a couple of things. We are here to learn from what happened in the past and to make sure that it does not happen in the future. Did I hear you right when you said that you had learned from the contamination and the cost of decontamination?

31. Mr Lavery: Yes.

32. Mr Dallat: I also picked up that when acquiring these sites it would have been useful to have had a vision for their future use or, in the simplest terms, a master plan. Am I right in that?

33. Mr Lavery: There are two questions there, Mr Dallat. The Department has learned lessons regarding the potential extent of decontamination. It has also learned lessons about the time it takes to discover the extent of decontamination and the works required; it takes a very substantial period, as has been shown at Maze/Long Kesh. As for plans and timescales, you will see in the report that there was a significant consultation on each site, and the report acknowledges that that is extremely important, given the nature of the sites and the fact that the reinvestment and reform initiative (RRI) said that they should be to the benefit of the community.

34. Mr Dallat: There is a reason why I am asking the question, although it is not strictly part of our remit today. Last September, Shackleton Barracks was acquired. Decontamination costs were not known, and there was no master plan or vision for the future. You just told me that you learned lessons from those sites; which of those lessons were applied to the former Shackleton barracks at Ballykelly? It is sitting with no master plan and no vision, and nobody has a clue what the decontamination costs are.

35. Mr Lavery: I will answer that and then bring in my colleague Tim, if you are OK with that. You made two points; one was about the extent of the decontamination and the other was about the plan. The sites were gifted under the Hillsborough agreement. We got the Central Procurement Directorate (CPD) to get hold of the land quality assessments that were provided by the MoD. The CPD had the experience of dealing with the Maze/Long Kesh site, and we came up with an estimate of what the remediation costs would be. The report talks about a ministerial direction. That was one of the issues involved.

36. We took receipt of the site only in November 2011, and we have been working with the Strategic Investment Board (SIB) asset management unit to look at the plans for it.

37. Mr Losty: The purpose of our taking on the site was to sell it and use the proceeds. The market is not great at present, so we were not getting the offers that we wanted for the site.

38. Mr Dallat: But you were getting offers.

39. Mr Losty: There were offers when the Ministry of Defence first put it on the market, but we are looking at how we can maximise the economic and social benefits of the site. We received the site late last year, and we are looking at the short-, medium- and long-term uses. Hopefully, the market will change. We are also looking at lessons that were learned from dealing with the decontamination issue. The costs of decontamination will depend on the eventual uses of the site. We are working with the Central Procurement Directorate and the asset management unit on the costs of potential uses for the site. One of the lessons that was learned is that we will look for support from third-party organisations by way of advice on decontamination.

40. It is a very large site. We need to look at whether we should try to dispose of it in one lot or whether we can subdivide it into smaller lots and target different market groups. We have been talking to local stakeholders over the past few months. In fact, we are at an advanced stage of commercial negotiations about the use of one part of the site. We will also talk to the local council and community organisations in the coming weeks to get an idea of what local communities would like to see on the site.

41. Mr Dallat: I asked the question only because I do not want another Public Accounts Committee sitting in five years' time to hear a sad story about lessons having been learnt from the past. As you know, we will be watching very carefully to make sure that lessons have been learnt from the sites, that the criticism that is already flowing in the newspapers is eventually not justified and that Ballykelly does not become another albatross. The term "gifted" does not really convey the term.

42. It was all part of the Hillsborough agreement. Was there any discussion of the MoD making a contribution towards the mess that was left over the past 100 years?

43. Mr Lavery: Are you referring to the Hillsborough sites?

44. Mr Dallat: Those sites and whatever.

45. Mr Lavery: There was discussion at official and ministerial level. The final agreement was that the sites were gifted as is.

46. Mr Dallat: The MoD got a quare deal.

47. Mr Lavery: Again, as we said, the future value will tell the story.

48. Mr Copeland: There are two parts to this. You threw in the phrase "ministerial direction" in reference to, I think, the Hillsborough agreement sites. What is the context of a ministerial direction in that setting? Have ministerial directions been issued in connection with any of the others?

49. Mr Lavery: Shackleton was the only site for which ministerial direction was sought. I sought a ministerial direction on foot of the MoD sales process. The general principle is that accounting officers seek ministerial direction when they do not believe that a course of action represents best value for money. I am sure that the Treasury Officer of Accounts could give a longer explanation. [Interruption.]

50. The Chairperson: If you do not mind, I am chairing the meeting. We might bring the Treasury Officer of Accounts in in a moment. Is there a second part to your question?

51. Mr Copeland: No. I think that that covered it.

52. Ms Fiona Hamill (Treasury Officer of Accounts): Do you want me to say something on ministerial directions?

53. The Chairperson: If you can be brief.

54. Ms Hamill: An accounting officer seeks a ministerial direction if a Minister is seeking to move something forward, but the accounting officer is not confident that they can clearly demonstrate that it is value for money. That is their purpose. Therefore, when the decision needed to be taken in that situation, Noel, as accounting officer, was not able to demonstrate fully to his satisfaction value for money. Therefore, he sought a direction from the Minister to proceed. That is standard protocol under managing public money.

55. Mr McQuillan: To come back to John's question on Shackleton barracks, I was encouraged to hear Tim saying that he was going to have a conversation with the local community. Shackleton barracks is part of my constituency, and I know that the local community is keen to know what will happen to it and to acquire a piece of it for a community hub. Therefore, you need to have a conversation with the local community about that sooner rather than later before any draft plan or anything else is done. When do you intend to consult with the community?

56. Mr Losty: Over the last number of months, we have been looking at the site and looking at some of the issues in relation to maintenance. We have been talking to neighbours and local farmers who have been approached by some organisations that want to use the site in the short term. We have been dealing with those issues.

57. In relation to the consultation process, I believe that we are meeting the council early next week, and that will start the engagement process. Through the council, we will reach out to local community organisations.

58. Mr McLaughlin: My question arises from the information that Fiona gave us. Where a ministerial direction is involved, is it based on a specific concern expressed by the accounting officer on points on which he or she would seek ministerial direction, or are we talking about a Minister who simply says "Get on with it"? If we want to look at the issues that emerge subsequently and want to be clear about where responsibility in those particular circumstances resides, will we always find that the accounting officer sets out the areas of concern and then seeks ministerial direction on those specific points?

59. Mr Lavery: In this particular instance, my concern was that there was an MoD sales process that gave a market value. I took the advice of the LPS and the asset management unit. The MoD put a timescale on it, and, looking at the offer that was on the table, the potential decontamination and running costs, those were the issues of concern. Therefore, my advice recognised the market uncertainties at the time. It is an unusual site to take on. If I understood your question correctly, will you be questioning me again on what happened on those sites? Was that your question?

60. Mr McLaughlin: I do not know what will emerge. Looking at the report, I am concerned about what might emerge. To narrow this down, is there a general almost pro forma approach that involves the accounting officer setting out the reasons why they are concerned about approving the processing of a particular project and seeking ministerial direction, or is this a unique and specific set of circumstances in which a ministerial direction or intervention was given?

61. Mr Lavery: There is no pro forma. It will be quite different, depending on the nature of the value-for-money decision, and this was very specific to that site.

62. Mr McLaughlin: The paper trail would stand that up, and, if necessary, we could compare that with other examples of ministerial direction?

63. Mr Lavery: Yes.

64. The Chairperson: Paragraph 13, which is on page 7, and paragraph 2.4 refer to record keeping and documentation. There was a delay in giving the information to the Audit Office before completion of its report. That is a bugbear of mine and of the Committee, because we have seen it happen before. In fact, we have made recommendations on that in previous reports. I surmise that you have looked through some of those recommendations and know that it is an issue for us. In light of that, what are you doing about it, and how will you ensure that it does not happen again? It is unacceptable that information comes late in the day, just prior to an agreed report being signed off.

65. Mr Lavery: I absolutely accept that, and I apologise to the Committee for that. I am certainly not happy that records could not be found. Paragraph 13 refers to the generalities in relation to OFMDFM records, and paragraph 2.4 refers to the LPS records. I have written to all staff and told them that this is not acceptable. The Department's record management system changed in 2008, and we certainly learnt lessons from this. I assure the Committee that this should not happen again.

66. The Chairperson: I appreciate that assurance, and, obviously, we will be watching that. In the past, it has been an issue with other Departments, and we cannot find it acceptable. On this occasion, I will take your word for it. I appreciate that assurance, and it is the first time that we have had an assurance from anyone that it will not happen again. There you go, we might hold it against you one day.

67. Mr McQuillan: From figure 4 on page 12, I see that the master plans for the three development plans are still in draft form, some nine years after the sites were transferred to the Executive. Why have those not been finalised, and can you give the Committee an update on why that has happened with each of the sites?

68. Mr Lavery: I will take that site by site, Mr McQuillan. Kyle will speak about where we are with the Maze/Long Kesh site.

69. Mr Alexander: The Maze/Long Kesh (MLK) master plan was prepared in 2006. In 2009, when there was, in a sense, a change in the proposals for the site, Ministers said that we were not going back to start with a clean sheet and that we had to build on the work that was done before. Since April 2009, we have prepared a spatial framework, and that is now in place. I am ready to present that to the board of the development corporation when it is formed. We have prepared a revised plan for the site, which will be for the board of the development corporation to endorse.

70. A lot of master plans can be prepared without numbers against them, and a common criticism of master plans is that they do not have delivery plans linked with them. For the Maze, we have prepared the spatial framework, and we have prepared the delivery plan at the same time. That has a full 25-year financial model, and, on the back of that, we have prepared an outline business case that looks at the options for the overall development of the site. That is now with OFMDFM, so it means that we now have a revised plan in place and that we are looking at the options and what the costs will be. All of those plans are there to enable the corporation, when it is formed, to be able to create momentum and move on.

71. You can spend a lot of time and money working up master plans, and, after the previous scheme failed and as we moved on from April 2009, there was a need to create confidence in the Maze/Long Kesh site. The priority for the team, while we worked up the overall plans, was to get delivery on the site. That is why much of the effort since 2009 went into securing the move of the RUAS to the site and confirming funding for the conflict resolution centre. We now expect the board of the development corporation to be in place by August or September. It will come into play with a revised plan in place, with the RUAS on site and with funding confirmed for the conflict resolution centre. I believe that, for the first time, we have created momentum that will give the corporation the opportunity to start to attract private sector interest to the site.

72. Therefore, to sum up what has been quite a long answer, you need two things when working on any of these sites: a framework for investment decisions to be made, and a focus on getting things done. That was the approach that we took with the Maze/Long Kesh site.

73. Mr McQuillan: When will that be finalised? Will it be August or September?

74. Mr Alexander: The spatial framework is now in place in draft form, and we await the appointment of the chair and board of the development corporation. Obviously, they will want to have an input into the plan, so that it becomes their plan that they will want to promote. However, that has not stopped the work to get the RUAS onto the site. That work was under way at the same time.

75. Mr Lavery: Mr McQuillan, I am conscious that the point behind your question was about the time taken. As I indicated earlier, there were, previously, plans for a multi-sports stadium at the Maze/Long Kesh site, and that previous scheme is one of the reasons why we have only reached this stage now. On a more general point, given the importance of the sites, we have taken time to undertake community consultation. When Sir Roy McNulty became involved in the Ebrington site in 2007 or 2008, he was not convinced that there was consensus on the plans, and that is one of the reasons why it has taken a longer time. We expect the Ebrington master plan within the next six to nine months, but Tim can give you more details on that and on the master plan for the Crumlin Road jail.

76. Mr Losty: I will follow that up with some dates and an understanding of where we are. The Crumlin Road jail/Girdwood master plan was produced in 2007. We had to do an equality impact assessment, which generated substantial comment from the community. We are working closely with the Department for Social Development (DSD), which is taking the lead on that master plan. The Minister for Social Development has progressed the consultation on all aspects of that master plan, and we expect an announcement on it fairly soon.

77. As Noel said, a regeneration plan was produced for the Ebrington site, but it did not receive the required level of community support. Attention then focused on developing the One Plan, and the plan for Ebrington will be fed from that. We expect a master plan from Ilex for the Ebrington site within the next three to four months.

78. Mr McQuillan: You said that the master plan for the Ebrington site did not have the support of the community. Why was that? Was there not enough consultation with the community?

79. Mr Losty: A great deal of community consultation went on during the planning process. However, as I understand it, at the time, a number of organisations in the city were progressing a planning process. Therefore, there were a number of different plans, and it was felt by some sections of the community that those plans did not reflect the various needs of the communities in the city. The decision was taken to stand down many of the plans and to try to harness all the available resources to produce the One Plan, which all the stakeholder groups could support. That approach has been cited as best practice in the Organisation for Economic and Co-operation and Development (OECD) reports.

80. Mr McQuillan: I understand that. I will turn to paragraphs 1.8 and 1.9. Mr Alexander, as a former chief executive of the successful Laganside development corporation and having spent some time at Ilex, you are in a unique position. What do you see as the pros and cons of development corporations and urban regeneration companies, and, based on your experience, what do you see as the three or four key learning points emerging from the handling of the Maze/Long Kesh and Ebrington sites?

81. Mr Alexander: I will first take your comments on the merits of an urban development corporation or an urban regeneration company. The real strength of an urban development corporation is when the task is simply to focus on the regeneration of sites. For example, at Maze/Long Kesh there is a 350-acre site that is in OFMDFM ownership, and a development corporation is well placed to take that on. That was the same with Laganside, where the responsibility was very much only for the cleared sites along the waterfront. I am aware that there was a debate prior to Ilex being formed as to which vehicle was correct. My view at that time — I presented to the panel that was looking at it — was that, if the aim had been simply to regenerate the Fort George and Ebrington sites, there would have been merit in the development corporation approach. However, the role for Ilex was much more than that. It was not only to regenerate those sites but to have a role in the overall regeneration of the city, and it was felt at that time that the urban regeneration company (URC) was the more appropriate vehicle for that.

82. It is interesting, looking back now, that it has come through from the One Plan that the regeneration of Fort George and Ebrington must very much be part of thinking what is right for the city as a whole and about how those sites can be used to benefit the needs of the communities in the city. The approach to form a URC for Ilex was based on that.

83. The simple answer is that the urban development corporation works when you have a very clearly defined site to work within, and the URC approach works when you are working with communities. That explains some of the background.

84. Mr Dallat: Am I right in saying that the original concept for Ilex was the Laganside concept, namely a development plan? Do you know why that was rubbished and the other model was chosen?

85. Mr Lavery: I am not sure of the answer. Direct rule Minister Ian Pearson made the final decision on the urban regeneration company.

86. Mr Losty: If I can follow on —

87. Mr Dallat: I will put it to you another way: that model was chosen. The one that Mr Alexander outlined is probably the better one, and I want it on the record that that model was to happen at Ilex, and somebody else — Pearson or somebody — decided to not have that.

88. Mr Alexander: No, I was saying that, if Ilex had been formed simply to look at Fort George and Ebrington, my advice and thinking at the time was that the urban development corporation would have been correct. However, in order to look at those sites in the city as a whole and work with the communities, the view of the direct rule Minister at that time was that the URC was the preferred approach, and they went for that option.

89. Mr Dallat: I did not come here to praise you, but, on this occasion, you are absolutely right. I am sorry that they did not take your advice.